811

Why major corporations are hoarding trillions of dollars?

Illustration by Andrew Rae i>

There is an economic mystery, they are trying to solve a lot and for a long time. Financial experts often call it a puzzle or paradox. The reason for this paradox are: American companies have cumulatively of $ 1.9 trillion in bank accounts and in treasury bonds, not using this money. This state of affairs has no historical analogues. US corporations have always been borrowers, rather than holders of funds, so to analyze the source information and to compare the current situation with the same periods in the past is not possible, such data do not exist. But there are several hypotheses to explain the cause of the fashion for cash. Answers to the question "why corporations trillions of dollars?" You will find further in the article, translated The New York Times Magazine, prepared specifically for the corporate blog company engaged in the processing of payments on the Internet, PayOnline.

The idea that corporations will keep at such a large part of their profits, it seems absurd for economic reasons, especially now, when the Treasury bonds, which they keep the money, give 2% profit. It is much more profitable it would be to invest it in something else - the products, services or the acquisition of other companies. This would exceed the minimum corporate profitability concepts 2 cents on the dollar. However, they prefer to keep the money.

Take, for example, Google. Its new parent company, Alphabet, worth about 500 billion dollars. It owns the sum of 80 billion dollars, which keeps Google on bank accounts or other short-term investments. Therefore, buying 1 share Alphabet, which recently traded at about $ 700, you actually get in the order of $ 100 in cash. With these $ 80 billion Google might buy Uber and its Indian rival of Ola, and the remaining money - to spend on the Palantir's, a startup working in the field of data analysis and presentation. Or with the help of the money Google could easily buy out Goldman Sachs and American Express, or almost 100% stake in MasterCard. Another option - the purchase of Costco or eBay or the 25% stake in the Amazon. In general, the Google has all opportunities to invest these funds and as a result get a lot more than just 2 cents on the dollar.

Apparently, the beginning of this strange fashion corporations hoarding had at the beginning of 2000. As the brightest example is General Motors, which is holding cash in the amount of nearly half of its value. Apple holds more than a third of its value. Of course, to put up with this state of affairs can not all: if the company rather than to accumulate funds in this way, let them in business, we would immediately saw dramatic growth, and with it, certainly, and increasing the number of high-paying jobs. In 90-x, when the company retained a much smaller portion of their profits, they built new plants and acquiring new buildings. Partly because of this habit start funds in dealing these years were a period of low unemployment and tangible economic growth. It is also noteworthy that this utility model the behavior of corporations has helped the Government to collect such a large amount of tax revenues, it is the first time in the last 160 years has come nearer to the payment of all its debts.

What is the reason for this behavior? The number of articles on this topic in economic journals do not count. Each offers its own theory about why corporations have shifted from borrowing to saving them. Some lead is quite prosaic reason: just like people, companies want to have the money for an emergency or to stay afloat in bad economic times, and the past decade was not quiet because of higher risks. In addition, corporations have been paying much more attention to the so-called tax optimization, which all the others are called "tax avoidance". There are many reasons why the retention of money and careful distribution to affiliated companies, especially foreign, is an excellent method of reducing the amount of taxes paid.

Another reason for the retention of money associated with the ever increasing competition for the best staff and the purchase of promising companies. This is especially true for high-tech companies and the pharmaceutical industry. When Google and Apple enter into talks to buy smaller companies, they may scare off other competitors, because last understand that entering into an unequal battle with the owners of virtually infinite resources. A rather strange situation when withholding money helps companies save even more of them with the ability to pay less for absorption in the absence of competition. The Google, by the way, bought by one company in a week, then as Apple, despite its less regular acquisitions, generally does not lag behind its competitors.

But even if you're satisfied with these explanations, the mystery still remains unsolved. like Google or GM companies hold too much cash. So much that even a reserve fund, tax optimization and scaring competitors taken together can not be an excuse. Georgetown University professor, Li Pinkovitts says that economists recognize the ambiguity of this issue, divided into two different camps.

Representatives of the first camp believe that a large reserve of cash indicates the presence in the company of serious problems. It is also possible that things go wrong in the whole industry, so that its members simply do not invest in anything. Maybe the point is that top managers go about their dark deeds and accumulate such "nest egg" for the achievement of personal goals. For example, they want to hide the consequences of incorrect decisions made in order to preserve their jobs. In this case, they can take advantage of the money supply, at the time of making the company more profitable.

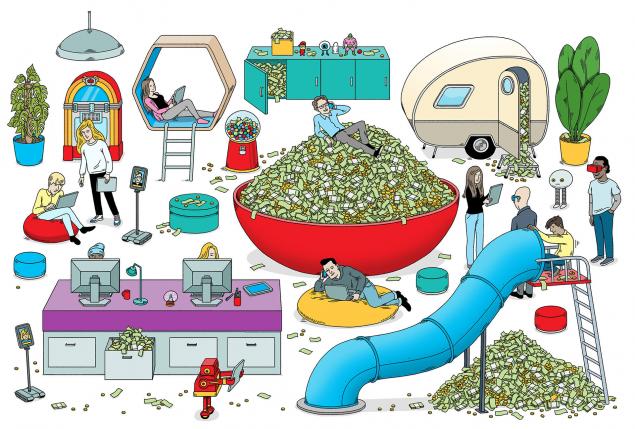

Illustration Andrew Rae i>

Representatives of the other camp have expressed doubt that the free market can create opportunities that would allow managers to keep such large amounts of cash for their own purposes.

Together with his colleague Roan Williamson Pinkovitz established evaluation model, which has allowed to analyze the reaction of investors to the different levels of cash savings for companies. Analysis was applied to data in E-12888 public companies from 43 sectors for the period from 1965 to 2014. The model shows how to estimate the value of the investors 1 dollar invested in a particular company.

His findings show that both theories have grounds. For some sectors of the accumulation of cash it is obviously correlated with negative results. For the publishing business and the entertainment industry attempts to accumulate additional money supply leads to the fact that this money is losing its value in the eyes of investors, dropping in price to 40 cents on the dollar. In defense of the coal industry and the situation is much worse: the value of the invested dollar falls below zero. Perhaps this means that the company executives in these industries are trying to create a safety cushion for yourself or your company as the market apparently reacts negatively to their desire to accumulate money supply.

However, in the case of other sectors of the value of every dollar invested in the result grows. For pharmaceutical companies value a dollar of savings grows to $ 1.50. For software companies, the figure is even higher - $ 2. This attitude of investors means that they trust the managers of companies in these sectors, such as Larry Page, head of Alphabet. In fact, investors believe that the management of such companies can take advantage of the capital even better than they are. Surface study of branches of the second group, which includes, among other auto companies and medical device manufacturers, shows that the number of companies, collecting the most funds, clearly correlates with their belonging to these sectors. It is possible that a decent portion of the above-mentioned sum of 1.9 trillion dollars belongs to the corporations who collect them, so as to receive compensation from the securities market.

As a result, there is only one question: Why do companies do this? The answer probably lies in the fact that both managers and investors believe that their industries big changes are coming, but what a change it will be, nobody knows for sure. Throughout the XX century, as mankind has passed from the driven horses and the sun agrarian to electrified and motorized industrial, and then to the "silicon" information economy, it became clear that investing in innovation has helped to grow and develop the majority of companies that this was done. This is a major investment in the acquisition of buildings, equipment and computer technology. Today, however, the value of companies is growing more due to new ideas and ways of interaction. Ideas emerge and spread much faster than before. Rate their costs at the same time become more complicated. A good example of this trend can result in "dotcom crisis" that occurred in part because of the inability of companies to give a correct estimate of the cost of the Internet market.

Of course, the main economic questions sound very simple to our time: "Do good times gone? Are we waiting for the widening gap between the rich minority and the poorer majority? "Money puzzle gives us little cause for optimism. If corporate executives and investors really believed that the future is bleak, and innovation and economic growth inevitably slows down, they would have little reason to keep at so much money. In fact, this accumulation may be a sign that these innovative transformations is not far off. And if this is indeed the case, then soon we all are waiting for the good news.

Source: geektimes.ru/company/payonline/blog/270650/

From the people to the machines: Robotic Revolution in China

Mars rover Curiosity is exploring dark dunes