971

Why Tractor Plant will remain in Canada

Putin asked him to write a note saying why can not stand Rostselmash tractors from Canada to Russia. Compare conditions.

I think this information will be of interest to you.

6 pictures + text

1. The cost of manpower

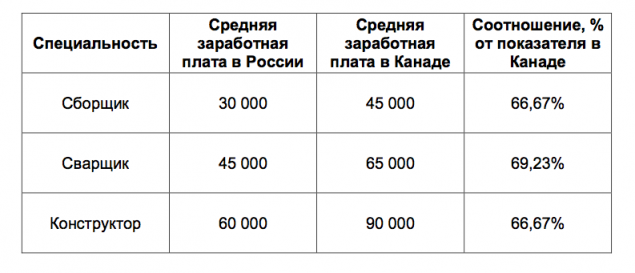

The difference between Russia and Canada in the cost of labor is not so great. In 2012, the average salary of a skilled worker (for example, a welder or a collector) in Rostov-on-Don was 67-69% of the wages of similar workers in Winnipeg (see. Table 1). But in Russia, payroll taxes and value added tax (VAT) above.

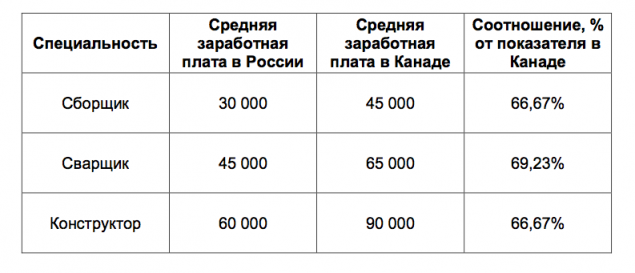

Table 1. Comparison of average net (arms) of wages in Russia and Canada, on the main specialties rubles.

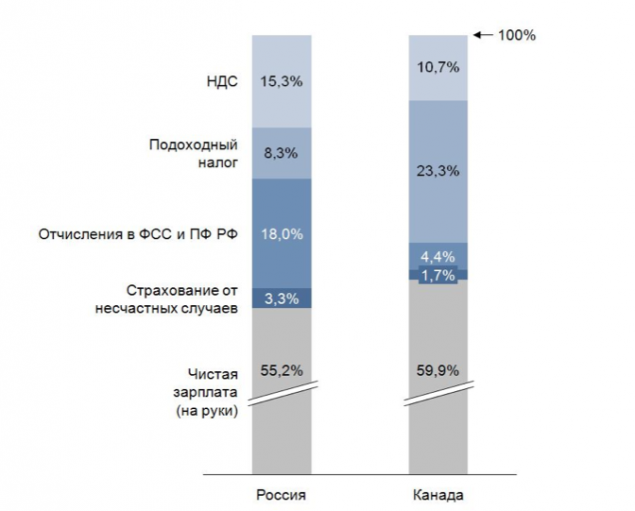

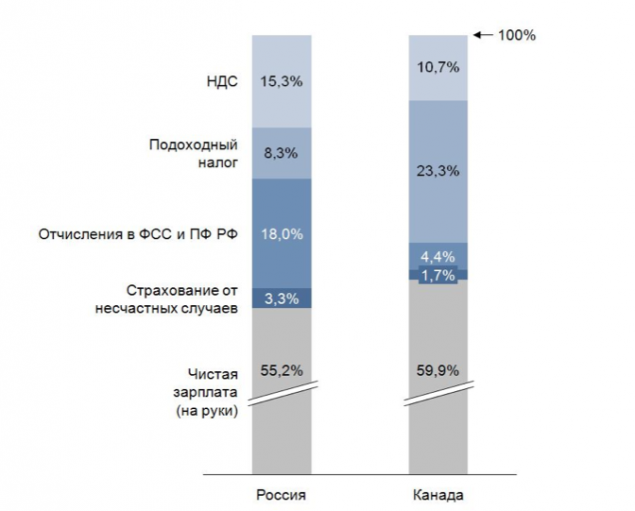

In Canada, 3, 5 times lower pension contributions, 2 times lower charges for insurance against accidents, a third lower than the value added tax (12% versus 18% in Russia), but at 2, 8 times higher than the income tax . As a result, the ruble is handed salaries in Russia must pay taxes and contributions 81 kopecks., And in Canada - 72 kopecks.

Figure 1. Comparison of the cost structure of the enterprise labor skilled worker plant in Russia and in Canada in 2012

Labor costs at a plant in Canada in 2012 amounted to 38, 5 million. US dollars. The cost of labor is at a similar plant in Rostov-on-Don would have amounted to 28, 5 million. US dollars, which is 10, 0 mln. US dollars less.

However, from 2002 to 2012 the average wage in Russia increased by 472% (CAGR: 21, 1%), and in Canada - only 30% (2, 0% per year). With the growth pace in 3-4 years work in Russia it will be more expensive than in Canada.

Posted in [mergetime] 1380813401 [/ mergetime]

2. The cost of loans

The average annual interest rate on loans in Russia in 2012 amounted to 11, 75%. The plant in Canada, the average interest rate in 2012 amounted to 2, 30%.

Interest expense on loans tractor plant in Canada in 2012 amounted to 3, 5 mln. US dollars.

Accordingly, the cost of similar loans in Russia would have been 5, 1 times higher and amounted to 17, 9 mln. US dollars, which is higher than the entire net profit generated in the production in Canada in 2012.

Thus, in Russia the cost of paying interest on loans will be 14, 4 mln. Dollars. Higher than in Canada.

3. The cost of energy and transport

Gas supply. The price of one cubic meter of gas in 2012 in the Southern Federal District averaged 4, 594 rubles. The cost of a cubic meter of gas for the plant in Winnipeg in 2012 was 10, 461 rubles ($ 0, 33) - 2, 28 times higher. When consumed by the 3, 55 million. M3 of natural gas per year (2012) savings when transferring a plant in Russia will be only 0 657 mln. US dollars.

In connection with the annual growth rates for the supply of natural gas set out in the long-term vision and the socio-economic development of the country, as well as related to the objectives of the management of "Gazprom" to enter the equal income prices of the domestic and foreign markets, given a competitive advantage as a year reduced.

Power supply. Tariffs for the supply of electricity in Canada for large industrial enterprises account for an average of 1, 70 rubles per kW ($ 0, 055). In Russia, the rate of 2, 20 times higher - 3, 70 rubles. Thus, the cost of the tractor plant for electricity during transfer to the Russian Federation will grow by 2, 118 mln. US dollars, which is much superior savings on gas supply.

Moving. Due to the high cost of fuel in Russia (an average of 5, 5% higher than in North America), and other factors, the price of carriage of goods freight trawls (Plant Used agricultural machinery) in Russia is much higher than Canadian: an average of 60, $ 0 / km and 39 in Russia, 4 rubles / km ($ 1, 25) in Canada. Increased costs for transportation will be about 4 183 mln. US dollars.

Tariffs for rail freight are growing at significant rates: in 2008, the most beneficial mode of transport for the transport of goods over a distance of 750 kilometers of railway was, in 2013, to railway transport services for freight transportation resorted to a distance of 1 500 kilometers.

Thus, the increase in the costs of using the services of shipping companies and natural monopolies, based on average estimates will be 5 644 million. US dollars a year

Posted in [mergetime] 1380813454 [/ mergetime]

4. Expenditure on plant

In order to protect and prevent violations of the rule of law at the plant in Rostov-on-Don, the company is forced to maintain a large staff of protection (about 150 people). The costs include salaries, uniforms, insurance, maintenance of office premises, associated taxes. State protection for the plant in Canada is 4, and their functions are limited to control access system and, if necessary, communication with law enforcement.

The costs of protection of a similar plant in the Rostov region will be about 1050 thousand. Dollars, that on days 0, 898 million. US dollars more than the current costs for this article in the Canadian company.

5. Excessive bureaucracy and complexity of the accounting and tax accounting

1. Russian companies have to keep records in three directions:

- Accounting records in accordance with the law on accounting;

- Tax accounting in accordance with the requirements of the tax legislation;

- Records in accordance with the rules of International Financial Reporting Standards (the company which, in accordance with the requirement of federal legislation must prepare consolidated financial statements).

The Canadian law provides for a single form of accounting.

2. cumbersome document.

The Russian legislation on accounting and tax accounting, requires the registration of a large number of paper documents that leads to the necessity of drawing up documents on a 2-5 business transaction.

In Canada, the number of documents that are made out economic operations is much less than in Russia.

3. The need for a large number of documents of various regulatory and fiscal authorities.

The bodies of control measures within the framework of field, cameral, counter checks requested by a large number of copies of documents. Over the past year, LLC "Combine Plant" Rostselmash "fiscal authorities in the copies provided about 41 thousand. Documents (number of inspections for the year - 167).

In this regard, Russian enterprises have to contain the advanced state of the accounting and financial services. The staff of these services at the plant in the Rostov region (similar Canadian) is not less than 65 people, which greatly increase the costs of the enterprise.

According to calculations, the average annual rate of the contents of these services will require 1 805 thousand. Dollars, up 1 005 mln. US dollars higher than the current costs at the Canadian plant where these services consist of 14 people.

It is also important to note that the accounting system and the complexity of the document in Russia leads to the fact that managers of commercial divisions of up to 50% of the time have to spend on the collection and documentation. For Canadian businesses working with documents kept to a minimum - no more than 10% of the time.

6. Tax burden

1. Income tax

The income tax rate in Canada is 35, 0%. However, taking into account various deductions and exemptions to encourage research and development and modernization of production effective income tax rate was at a factory in Canada in 2012 - 16, 7%, or 3, 3% lower than in Russia (the income tax rate in the Russian Federation - 20%).

In Canada, the following tax incentives for modernization:

• When you purchase the equipment allowed its accelerated depreciation (higher rate than in Russia) - 30% of the outstanding amount each year.

In Russia, allowed depreciation deduction of 30% in the first year, in the following years - 7% (with a 10-year amortization period).

Thus, 70% of the cost of equipment in Canada can be attributed to the cost (to reduce income tax) for 3 years, in Russia - for 6 years. In this regard, to invest in machinery and equipment in Canada is more profitable.

• In Canada, a program of tax deductions for business investment (Manufacturing Investment Tax Credit).

The tax deduction is aimed at the development and modernization of industrial production in Manitoba is 10% of the amount of capital investments (investments in the purchase of equipment, construction and repair of buildings, etc.). That is, when the construction of a new plant worth 10 million. Dollars the government is subsidizing the plant automatically 1 million. Dollars by reducing this amount of income tax (no tax base, namely the payment of income tax). In Russia there are no such deductions.

• When carrying out R & D *

Any company in Canada may be in the first year just to absorb 100% of the costs incurred, and additionally, for the same amount, reduce the tax base, ie the costs of research and development expenses accounted for in the double size.

For example, if the cost of development of the tractor (including all related costs) was 20 mln. US dollars, the base of the income tax may be reduced by 40 mln. US dollars, that is, the government indirectly subsidizes the producer for 14 mln. US dollars (40 x 0, 35 = 14).

In Russia, for the production of machinery and equipment is not the measure.

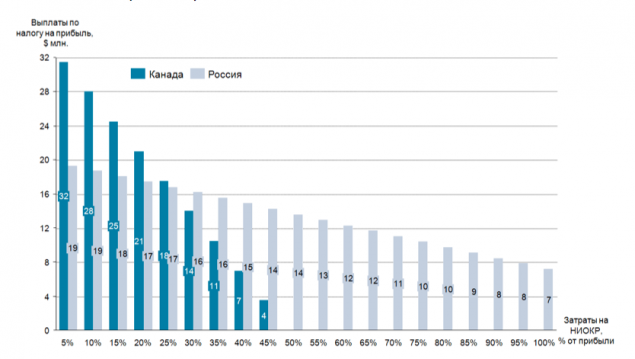

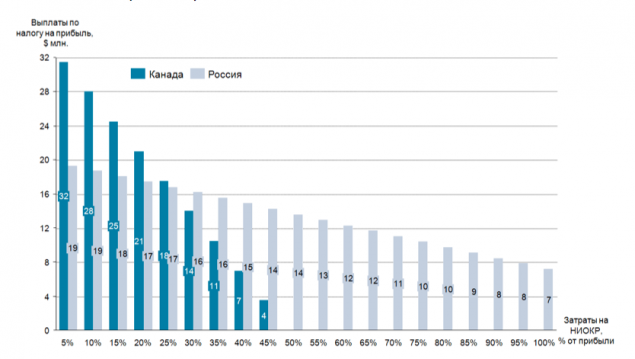

In view of the above programs plotted the value of income tax on the level of R & D expenditures and modernization. As in Figure 2, with an increase in the cost of Canadian companies for research and development, the value of the income tax is reduced faster pace. At the level of R & D costs in the amount of 50% of the income tax on the profit reaches zero. In Russia, the lowest rate stimulates the removal of profits from the business, rather than investment.

* - Research and Development (research and development) - a wider concept than R & D, since they include salaries of engineers, designers and workers of technical centers, the salary of other employees involved in the design, as well as the cost of materials and components staff training, acquisition of industrial, scientific and measuring equipment, testing, prototype wear and so on. Providing research reports for expenditure verification is not required.

Figure 2. Dynamics of the income tax, depending on the proportion of R & D expenditures from the profit in Russia and Canada (gain = 100 mln. US dollars)

2. Current taxes

In Canada, the turnover tax is divided into federal portion - similar VAT (the rate of 5%) and regional - sales tax (rate from 0 to 8%). Average turnover tax in Canada is 10%. The total tax rate in Winnipeg, where the plant is located, is 12% (7% - local, 5% - national).

The rate of value added tax in the Russian Federation - 18%.

3. Other taxes

For the plant in Canada, property taxes in 2012 amounted to 1 176 million. Dollars. USA. This tax is calculated on the basis of actually incurred by the municipality the cost of maintaining the infrastructure and surrounding areas. In Rostov-on-Don property tax rate is 2, 2% of the book value. It is also necessary to pay the land tax in the amount of 95 rubles per m2. However, the Russian company needs to finance the improvement of the surrounding areas and infrastructure.

The company also pays tax in Canada on business in the amount of 221 thousand. Dollars per year. In Russia there is no analogue of this tax.

In accordance with the Russian Federation tax legislation similar to the Canadian company will have to charge the following taxes:

- Income tax - 20% of the profits (if any);

- Property tax - 0, 54 mln. US dollars;

- Value added tax - 73, 50 million. Dollars.

Total - 74, 04 million. US dollars, which is 26, 10 million. US dollars higher than in Canada. 7. State support for the development of production

In addition to the more favorable economic framework conditions in Canada are successfully operating a variety of government programs to support the development of production.

In 2012 in Canada received the following subsidies for the development of production:

- Training of personnel in the amount of 50% of the cost, but no more than 2 000 dollars a year per employee;

- Individual grants for the development of new components in the amount of 100-150 thousand dollars to the project (but not more than 50% of project cost). This program was carried out to develop a new frame to the tractor, the development of new plastic components for tractor (tank), the development of elements of the hood of the new materials;

- On measures to reduce energy consumption. In a program of Manitoba Power Smart: business investment in the energy efficiency (lamp replacement, networks, installation of woofers and other special equipment) are compensated by the state through the local electricity supplier (Manitoba Hydro) in the amount of 50% of the costs. Cost recovery occurs within 1-2 months. For filling out forms and applications do not require additional staff.

8. Ensuring a stable domestic demand for agricultural machinery

Due to low interest rates on loans, Canadian farmers rarely receive direct subsidies for the purchase of equipment. However, indirect support measures that affect the well-being and solvency of Agriculture allocated in amounts significantly higher than the Russian. According to the OECD, in 2011 the level of support for agriculture in Canada amounted to $ 7 billion. US dollars, that is $ 160 per 1 hectare of sown areas (in Russia this figure is less than 40 US dollars).

In the WTO, Canada is entitled to annually subsidize the export of agricultural products in the amount of 659 million. US dollars. Russia in the negotiations refused to support export opportunities.

The Canadian government spends a protectionist policy in relation to agricultural products. Average applied import tariff on food and agricultural raw materials is 18, 02% (in Russia - 14, 29%), including, for example, for dairy products - 246, 78% (in Russia - 17, 68%).

Fuel for agriculture in Canada are not subject to taxes and excise taxes - the so-called "pink fuel", which significantly reduces costs and allows manufacturers to introduce advanced technologies.

Minimizing the risks of agricultural production (including flood, drought, crop failure) is due to the insurance program margin of farmers: in the event of a margin of production, for example, by 60%, the farmer gets 42% in the form of compensation from the government. This mechanism is shown to be effective during the drought of 2006 (payments amounted to more than 1, 3 billion. US dollars) and during the floods this year.

These measures ensure the competitiveness of Canadian farmers in the global market, provide them with a stable high income, it has a positive effect on investment in the renewal of equipment and introduction of resource-saving technologies. Due to this in the first half of 2013 growth in sales of tractors in Canada was 8%, harvesting - 21% (in Russia - a drop of 13% and 26%, respectively), which is contrary to all the assertions about the global crisis in the economy in general and agriculture economy, in particular.

9. The development of exports of agricultural machinery

Canada has a government agency Export Development EDC. In contrast to the Russian analogue (EXIAR), this agency not only insure export transactions, but also provides related loans at preferential rates to foreign buyers. For example, in Kazakhstan market Canadian tractor plant sells 100% of its products through a program of EDC, rate-related credit of 3, 8% per annum. LLC "Combine Plant" Rostselmash "in the market of Kazakhstan has implemented in 2012 only 3% of its products through EXIAR, and the rate on the loan for the buyers was 6%. Programs EXIAR become a real support for exports, but it is impossible to carry out the agency lending limits their use.

Besides the officials of the Canadian government, embassies and various agencies of the first item on the agenda in international negotiations put Canadian exports of industrial products, which had a positive effect on its growth.

10. The atmosphere of doing business in Canada

The absence of congestion in urban areas enables the supply of materials and components to the factory system JIT (Just in Time), so that there is a significant savings in maintenance depots and payment of staff.

The system of airports and airlines abundance allows you to quickly and cheaply to navigate the North American continent, which greatly simplifies doing business.

That's all I wanted to say.

Source:

I think this information will be of interest to you.

6 pictures + text

1. The cost of manpower

The difference between Russia and Canada in the cost of labor is not so great. In 2012, the average salary of a skilled worker (for example, a welder or a collector) in Rostov-on-Don was 67-69% of the wages of similar workers in Winnipeg (see. Table 1). But in Russia, payroll taxes and value added tax (VAT) above.

Table 1. Comparison of average net (arms) of wages in Russia and Canada, on the main specialties rubles.

In Canada, 3, 5 times lower pension contributions, 2 times lower charges for insurance against accidents, a third lower than the value added tax (12% versus 18% in Russia), but at 2, 8 times higher than the income tax . As a result, the ruble is handed salaries in Russia must pay taxes and contributions 81 kopecks., And in Canada - 72 kopecks.

Figure 1. Comparison of the cost structure of the enterprise labor skilled worker plant in Russia and in Canada in 2012

Labor costs at a plant in Canada in 2012 amounted to 38, 5 million. US dollars. The cost of labor is at a similar plant in Rostov-on-Don would have amounted to 28, 5 million. US dollars, which is 10, 0 mln. US dollars less.

However, from 2002 to 2012 the average wage in Russia increased by 472% (CAGR: 21, 1%), and in Canada - only 30% (2, 0% per year). With the growth pace in 3-4 years work in Russia it will be more expensive than in Canada.

Posted in [mergetime] 1380813401 [/ mergetime]

2. The cost of loans

The average annual interest rate on loans in Russia in 2012 amounted to 11, 75%. The plant in Canada, the average interest rate in 2012 amounted to 2, 30%.

Interest expense on loans tractor plant in Canada in 2012 amounted to 3, 5 mln. US dollars.

Accordingly, the cost of similar loans in Russia would have been 5, 1 times higher and amounted to 17, 9 mln. US dollars, which is higher than the entire net profit generated in the production in Canada in 2012.

Thus, in Russia the cost of paying interest on loans will be 14, 4 mln. Dollars. Higher than in Canada.

3. The cost of energy and transport

Gas supply. The price of one cubic meter of gas in 2012 in the Southern Federal District averaged 4, 594 rubles. The cost of a cubic meter of gas for the plant in Winnipeg in 2012 was 10, 461 rubles ($ 0, 33) - 2, 28 times higher. When consumed by the 3, 55 million. M3 of natural gas per year (2012) savings when transferring a plant in Russia will be only 0 657 mln. US dollars.

In connection with the annual growth rates for the supply of natural gas set out in the long-term vision and the socio-economic development of the country, as well as related to the objectives of the management of "Gazprom" to enter the equal income prices of the domestic and foreign markets, given a competitive advantage as a year reduced.

Power supply. Tariffs for the supply of electricity in Canada for large industrial enterprises account for an average of 1, 70 rubles per kW ($ 0, 055). In Russia, the rate of 2, 20 times higher - 3, 70 rubles. Thus, the cost of the tractor plant for electricity during transfer to the Russian Federation will grow by 2, 118 mln. US dollars, which is much superior savings on gas supply.

Moving. Due to the high cost of fuel in Russia (an average of 5, 5% higher than in North America), and other factors, the price of carriage of goods freight trawls (Plant Used agricultural machinery) in Russia is much higher than Canadian: an average of 60, $ 0 / km and 39 in Russia, 4 rubles / km ($ 1, 25) in Canada. Increased costs for transportation will be about 4 183 mln. US dollars.

Tariffs for rail freight are growing at significant rates: in 2008, the most beneficial mode of transport for the transport of goods over a distance of 750 kilometers of railway was, in 2013, to railway transport services for freight transportation resorted to a distance of 1 500 kilometers.

Thus, the increase in the costs of using the services of shipping companies and natural monopolies, based on average estimates will be 5 644 million. US dollars a year

Posted in [mergetime] 1380813454 [/ mergetime]

4. Expenditure on plant

In order to protect and prevent violations of the rule of law at the plant in Rostov-on-Don, the company is forced to maintain a large staff of protection (about 150 people). The costs include salaries, uniforms, insurance, maintenance of office premises, associated taxes. State protection for the plant in Canada is 4, and their functions are limited to control access system and, if necessary, communication with law enforcement.

The costs of protection of a similar plant in the Rostov region will be about 1050 thousand. Dollars, that on days 0, 898 million. US dollars more than the current costs for this article in the Canadian company.

5. Excessive bureaucracy and complexity of the accounting and tax accounting

1. Russian companies have to keep records in three directions:

- Accounting records in accordance with the law on accounting;

- Tax accounting in accordance with the requirements of the tax legislation;

- Records in accordance with the rules of International Financial Reporting Standards (the company which, in accordance with the requirement of federal legislation must prepare consolidated financial statements).

The Canadian law provides for a single form of accounting.

2. cumbersome document.

The Russian legislation on accounting and tax accounting, requires the registration of a large number of paper documents that leads to the necessity of drawing up documents on a 2-5 business transaction.

In Canada, the number of documents that are made out economic operations is much less than in Russia.

3. The need for a large number of documents of various regulatory and fiscal authorities.

The bodies of control measures within the framework of field, cameral, counter checks requested by a large number of copies of documents. Over the past year, LLC "Combine Plant" Rostselmash "fiscal authorities in the copies provided about 41 thousand. Documents (number of inspections for the year - 167).

In this regard, Russian enterprises have to contain the advanced state of the accounting and financial services. The staff of these services at the plant in the Rostov region (similar Canadian) is not less than 65 people, which greatly increase the costs of the enterprise.

According to calculations, the average annual rate of the contents of these services will require 1 805 thousand. Dollars, up 1 005 mln. US dollars higher than the current costs at the Canadian plant where these services consist of 14 people.

It is also important to note that the accounting system and the complexity of the document in Russia leads to the fact that managers of commercial divisions of up to 50% of the time have to spend on the collection and documentation. For Canadian businesses working with documents kept to a minimum - no more than 10% of the time.

6. Tax burden

1. Income tax

The income tax rate in Canada is 35, 0%. However, taking into account various deductions and exemptions to encourage research and development and modernization of production effective income tax rate was at a factory in Canada in 2012 - 16, 7%, or 3, 3% lower than in Russia (the income tax rate in the Russian Federation - 20%).

In Canada, the following tax incentives for modernization:

• When you purchase the equipment allowed its accelerated depreciation (higher rate than in Russia) - 30% of the outstanding amount each year.

In Russia, allowed depreciation deduction of 30% in the first year, in the following years - 7% (with a 10-year amortization period).

Thus, 70% of the cost of equipment in Canada can be attributed to the cost (to reduce income tax) for 3 years, in Russia - for 6 years. In this regard, to invest in machinery and equipment in Canada is more profitable.

• In Canada, a program of tax deductions for business investment (Manufacturing Investment Tax Credit).

The tax deduction is aimed at the development and modernization of industrial production in Manitoba is 10% of the amount of capital investments (investments in the purchase of equipment, construction and repair of buildings, etc.). That is, when the construction of a new plant worth 10 million. Dollars the government is subsidizing the plant automatically 1 million. Dollars by reducing this amount of income tax (no tax base, namely the payment of income tax). In Russia there are no such deductions.

• When carrying out R & D *

Any company in Canada may be in the first year just to absorb 100% of the costs incurred, and additionally, for the same amount, reduce the tax base, ie the costs of research and development expenses accounted for in the double size.

For example, if the cost of development of the tractor (including all related costs) was 20 mln. US dollars, the base of the income tax may be reduced by 40 mln. US dollars, that is, the government indirectly subsidizes the producer for 14 mln. US dollars (40 x 0, 35 = 14).

In Russia, for the production of machinery and equipment is not the measure.

In view of the above programs plotted the value of income tax on the level of R & D expenditures and modernization. As in Figure 2, with an increase in the cost of Canadian companies for research and development, the value of the income tax is reduced faster pace. At the level of R & D costs in the amount of 50% of the income tax on the profit reaches zero. In Russia, the lowest rate stimulates the removal of profits from the business, rather than investment.

* - Research and Development (research and development) - a wider concept than R & D, since they include salaries of engineers, designers and workers of technical centers, the salary of other employees involved in the design, as well as the cost of materials and components staff training, acquisition of industrial, scientific and measuring equipment, testing, prototype wear and so on. Providing research reports for expenditure verification is not required.

Figure 2. Dynamics of the income tax, depending on the proportion of R & D expenditures from the profit in Russia and Canada (gain = 100 mln. US dollars)

2. Current taxes

In Canada, the turnover tax is divided into federal portion - similar VAT (the rate of 5%) and regional - sales tax (rate from 0 to 8%). Average turnover tax in Canada is 10%. The total tax rate in Winnipeg, where the plant is located, is 12% (7% - local, 5% - national).

The rate of value added tax in the Russian Federation - 18%.

3. Other taxes

For the plant in Canada, property taxes in 2012 amounted to 1 176 million. Dollars. USA. This tax is calculated on the basis of actually incurred by the municipality the cost of maintaining the infrastructure and surrounding areas. In Rostov-on-Don property tax rate is 2, 2% of the book value. It is also necessary to pay the land tax in the amount of 95 rubles per m2. However, the Russian company needs to finance the improvement of the surrounding areas and infrastructure.

The company also pays tax in Canada on business in the amount of 221 thousand. Dollars per year. In Russia there is no analogue of this tax.

In accordance with the Russian Federation tax legislation similar to the Canadian company will have to charge the following taxes:

- Income tax - 20% of the profits (if any);

- Property tax - 0, 54 mln. US dollars;

- Value added tax - 73, 50 million. Dollars.

Total - 74, 04 million. US dollars, which is 26, 10 million. US dollars higher than in Canada. 7. State support for the development of production

In addition to the more favorable economic framework conditions in Canada are successfully operating a variety of government programs to support the development of production.

In 2012 in Canada received the following subsidies for the development of production:

- Training of personnel in the amount of 50% of the cost, but no more than 2 000 dollars a year per employee;

- Individual grants for the development of new components in the amount of 100-150 thousand dollars to the project (but not more than 50% of project cost). This program was carried out to develop a new frame to the tractor, the development of new plastic components for tractor (tank), the development of elements of the hood of the new materials;

- On measures to reduce energy consumption. In a program of Manitoba Power Smart: business investment in the energy efficiency (lamp replacement, networks, installation of woofers and other special equipment) are compensated by the state through the local electricity supplier (Manitoba Hydro) in the amount of 50% of the costs. Cost recovery occurs within 1-2 months. For filling out forms and applications do not require additional staff.

8. Ensuring a stable domestic demand for agricultural machinery

Due to low interest rates on loans, Canadian farmers rarely receive direct subsidies for the purchase of equipment. However, indirect support measures that affect the well-being and solvency of Agriculture allocated in amounts significantly higher than the Russian. According to the OECD, in 2011 the level of support for agriculture in Canada amounted to $ 7 billion. US dollars, that is $ 160 per 1 hectare of sown areas (in Russia this figure is less than 40 US dollars).

In the WTO, Canada is entitled to annually subsidize the export of agricultural products in the amount of 659 million. US dollars. Russia in the negotiations refused to support export opportunities.

The Canadian government spends a protectionist policy in relation to agricultural products. Average applied import tariff on food and agricultural raw materials is 18, 02% (in Russia - 14, 29%), including, for example, for dairy products - 246, 78% (in Russia - 17, 68%).

Fuel for agriculture in Canada are not subject to taxes and excise taxes - the so-called "pink fuel", which significantly reduces costs and allows manufacturers to introduce advanced technologies.

Minimizing the risks of agricultural production (including flood, drought, crop failure) is due to the insurance program margin of farmers: in the event of a margin of production, for example, by 60%, the farmer gets 42% in the form of compensation from the government. This mechanism is shown to be effective during the drought of 2006 (payments amounted to more than 1, 3 billion. US dollars) and during the floods this year.

These measures ensure the competitiveness of Canadian farmers in the global market, provide them with a stable high income, it has a positive effect on investment in the renewal of equipment and introduction of resource-saving technologies. Due to this in the first half of 2013 growth in sales of tractors in Canada was 8%, harvesting - 21% (in Russia - a drop of 13% and 26%, respectively), which is contrary to all the assertions about the global crisis in the economy in general and agriculture economy, in particular.

9. The development of exports of agricultural machinery

Canada has a government agency Export Development EDC. In contrast to the Russian analogue (EXIAR), this agency not only insure export transactions, but also provides related loans at preferential rates to foreign buyers. For example, in Kazakhstan market Canadian tractor plant sells 100% of its products through a program of EDC, rate-related credit of 3, 8% per annum. LLC "Combine Plant" Rostselmash "in the market of Kazakhstan has implemented in 2012 only 3% of its products through EXIAR, and the rate on the loan for the buyers was 6%. Programs EXIAR become a real support for exports, but it is impossible to carry out the agency lending limits their use.

Besides the officials of the Canadian government, embassies and various agencies of the first item on the agenda in international negotiations put Canadian exports of industrial products, which had a positive effect on its growth.

10. The atmosphere of doing business in Canada

The absence of congestion in urban areas enables the supply of materials and components to the factory system JIT (Just in Time), so that there is a significant savings in maintenance depots and payment of staff.

The system of airports and airlines abundance allows you to quickly and cheaply to navigate the North American continent, which greatly simplifies doing business.

That's all I wanted to say.

Source: