482

Correctly spend money – 8 of the rules used by scientists

фото:www.pbs.org

We've searched the whole Internet and found 8 of the best recommendations on personal Finance management.

Earn money is difficult, and correctly to spend it is even more difficult. Here are techniques that will help you.

1. Keep track of all your purchases

It is not necessary to follow all the time. Enough to do one "preventive" month of the year, during which you'll record all your expenses. You may be surprised at how many actually spend money on chocolate batonchiki or coffee stalls.

A month, during which you'll record all your expenses, as seriously to "sober up" you. He will answer to the eternal question, what happens to the money.

2. Save what you can save

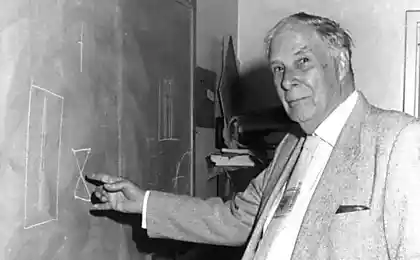

Usually when people try to save money, do it for a great purpose — to raise money for a vacation, a car or an apartment. This is the wrong approach, says Professor of psychology and behavioral Economics at Duke University Dan Ariely.

He proposes to estimate what amount of salary you can defer, without significant damage to the family, and then leave it immediately after receiving income. Got paid — translated "convenient" for her part in a special "savings" account. If banking tools allow, this process can even be automated.

Why does it work? The fact that even the idea of how to spend the money on some trifle can make our brain hard to produce dopamine — a pleasure hormone that encourages us to rash decisions. Usually people rely on willpower, but this is an inefficient way to contain myself. But to make part of his salary we are not "seen" quite, simple. Just pre-refrain from potential temptations and you will not have to make hard for the psyche of the decision within one month.

3. Create an emergency Fund

In this era of unstable economy without the usual income can be sudden. In the event a "black day" is best, of course, have a special stash. Its minimum size — six monthly budgets of the family. In six months you will surely find a way to stabilize the rapidly deteriorating economic situation of the family.

4. You need a financial strategy

Develop a detailed system of their spending. Here is a perfect of its kind for the United States. The cost of the rental of real estate or mortgage: 35-40% of the total budget. Health insurance — 2%. Fun and buying things "for the soul" — 15%. Unexpected expenses — 8%.

The following system is a complex process. But studies show that people who are faced with financial difficulties, it is easier to agree on its use. Moreover, hard times will be left behind, the habit of spending money wisely and consciously will stay with you.

5. Reduce consumption of cosmetic products

This will not only save money, but also help health. If you use too much shampoo, it will weaken your hair. If you got the shower gel, it spoils your skin. Drawing on the body of too much gel makes you the razor in the face more often than necessary and it causes skin irritation. And so on.

6. Review prices

Salaried employees are often asked about the salary increase. But entrepreneurs often forget that you can raise personal income just by reducing costs. Call all the vendors work for more than six months. Ask them to give the discount. Half will Balk and refuse to change anything. Another quarter will try to find you a compromise. The rest will find a way.

7. Resist impulse purchases

Contrary to stereotypes, many of us spend the majority of their money on impulsive expensive purchases, and not on what is really needed. It happens this way: you notice in the market for a new smartphone, the thought of buying it cause the brain to hard dopamine — and here you are already on the hook. To get at it the easier it is, the more tired you feel.

So, firstly, do not go to hypermarkets after a hard day. Second, make it a rule not to make spontaneous purchases worth more than $100. Want a new smartphone? Agree with them that bear at least the weekend. And after the weekend, if you wish to stay, will definitely buy. Studies show that 80% of these "intolerable wishes" in two days disappear.

8. Avoid the stress of shopping

Psychiatrist Lorrin Quran, doctor of medical Sciences from Stanford University, says that all people, even if not conscious, susceptible to therapy. Of course, here we are again talking about dopamine.

Because of this insidious hormone we all love to relieve stress through shopping. But the problem is that "retail therapy" does not work: as soon as the stress passes, the next day, realizing what he'd done unnecessary purchases that will only become even sadder.

So get yourself another habit: every time when experiencing emotional exhaustion, go to the gym. Here it really works.

Source: /users/1077