475

9 financial mistakes that often allow women

That's how women that respond to the money a little differently than men. We in the Website have noticed a few differences in how to spend money of them, and figured out how to prevent the error.

Shifting all financial issues on the man

Often since childhood we are convinced that the woman is a homemaker, affectionate, kind, care of children, and the man in turn — earner. A wise woman does not forget about all of this, but at the same time creates a "reserve" for the future, engaged in self-education, not to lose yourself as a specialist because the only source of income in the family is risky.

The uncertainty of purpose

Wealth is winning the game but not participate. Men are more successful because they play to the bitter and not comforted only by participation. Set a goal, determine its monetary value and go to the end.

Mistrust your intuition

Important in achieving financial independence is to trust your intuition is something that we have developed better than in men. A smart woman trusts her intuition, listens to her, takes advantage of this benefit.

Indifference to their future and health

While you are young and you have no pain, it's hard to force yourself to protect your health. But our body is the main asset and investing in it is very important. Time to go to the doctor, go to the gym, do not waste your nerves in vain. Just so you do not pay for treatment of some running sores are ten times more than you had in the beginning.

The lack of private savings

Every woman needs to be sure that there will be nothing that ever happened in her life. This provides her a sense of independence and confidence. Keeping the money in the Bank to replenish the Deposit with possibility of partial withdrawal without loss of interest is a great idea. The minimal necessary to stash your regular monthly expenses multiplied by three.

Impulsive buying mood

And this is typical female mistake. Making shopping to alleviate boredom or to lighten the mood, women often go over the credit limit. The easiest way to avoid this is to make a shopping list and set a certain amount of costs before you go to the store and find something to do that would relieve stress.

Waste of money for the sake of saving

Another mistake: buying something just feels right, and in fact goes in the trash. Usually more money is spent on sales, so use them wisely.

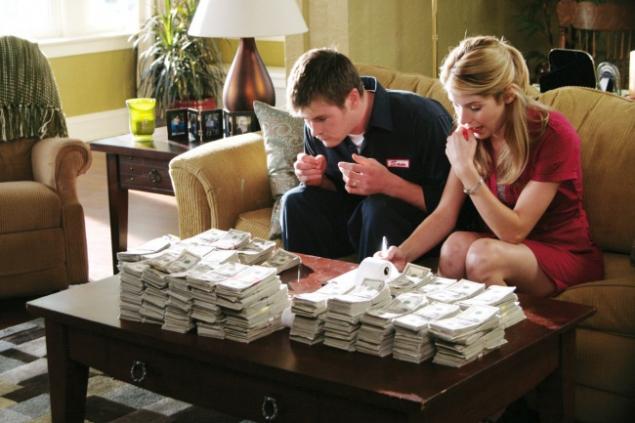

Lack of savings

- A simple example: if at age 25 you save $ 100 at 8% per annum, 55 you will have a balance of $ 146 000,04.

Appeal for help to friends in the financial question

This is one of the most common women's mistakes. Everyone has their own unique situation, so a smart woman will always find financial solutions for themselves and in any case not like girlfriends. Well, if she needs help, she'll turn to a professional in this field, which will help to solve her questions.

Photo preview of 20th Century Fox

Author Natalia Smirnova

According to the materials of the Home

See also

How not to deny yourself and live within your means: a secret from the American financier

How to kill a consumer: the experience of the person with the money

via www.adme.ru/svoboda-psihologiya/kak-ubit-v-sebe-potrebitelya-opyt-cheloveka-s-dengami-758610/