253

9 Signs You Can't Control Your Money

The fact that you remain broke may not be to blame for a small salary, but the inability to keep your money under control. Many people, earning quite decently, constantly experience financial difficulties and wonder where the earned funds flow. Financial stability begins not with a high income, but with the ability to competently manage what already exists.

According to a study by the National Agency for Financial Research, 63% of Russians admit that they do not keep records of their income and expenses, and 47% have no financial goals for the future. These figures are directly correlated with financial well-being.

Let’s take a look at 9 key signs that point to personal finance management issues and figure out how to fix them.

1. You don’t know exactly how much you spend and earn.

A lack of understanding of your financial flow is the first and most obvious sign of money control problems. If you find it difficult to name the exact amount of monthly expenses or can not say with certainty how much money entered your accounts in the past month – this is a serious bell.

How to fix:

- Start keeping a daily record of all expenses, even the smallest.

- Use special applications for financial tracking (such as Money Manager, CoinKeeper, YNAB).

- Start the practice of a weekly financial review, where you analyze all the movements of funds.

Only by having a complete picture of the movement of your money can you make informed financial decisions. Financial accounting is not an additional burden, but a tool that frees up your resources.

2. You regularly get into debt for everyday expenses.

Using credit cards or loans to pay for ordinary daily expenses, such as groceries, utility bills or transportation, indicates a serious budget imbalance. This creates a dangerous spiral of debt from which it becomes increasingly difficult to escape.

According to Bank of Russia statistics, about 30% of borrowers spend more than 80% of their income on debt servicing, which significantly exceeds the safe norm of 30-40%.

How to fix:

- Create a financial cushion of 3-6 monthly expenses.

- Develop a realistic plan to repay existing debts.

- Implement the 24-hour rule: Wait a day before any unplanned purchase to assess its need.

- Switch to the envelope system: pre-distribute cash by expense category.

3. You have no financial goals or plan to achieve them.

Lacking clear financial goals is like traveling without a card – you can move for a long time, but not get close to the desired result. Financially literate people always know what they want in the short, medium and long term.

Living without financial goals often leads to impulsive spending and a lack of motivation to save and invest. Your finances need direction just as a ship needs a route.

How to fix:

- Formulate specific SMART goals (specific, measurable, achievable, relevant, time-limited).

- Break down big goals into small stages with clear deadlines.

- Regularly monitor progress and adjust the plan if necessary.

- Visualize your goals – it increases motivation.

4. You have no savings or less than one month's income.

A financial safety cushion is not a luxury, but a necessity. If you live from paycheck to paycheck without any financial protection, then any unforeseen circumstance can lead to serious problems.

Research shows that having even a small reserve fund significantly reduces financial stress and improves overall quality of life.

How to fix:

- Start small – save at least 5-10% of each income.

- Automate savings – set up automatic transfer of funds on the day of receipt of salary.

- Use the “pay yourself first” rule – save money before you start spending it.

- Gradually increase the reserve fund to the amount of 3-6 monthly expenses.

5. You don’t know your credit score or loan terms.

Many people ignore their credit history until they need a large loan. However, not knowing the terms of your existing loans and your current credit score can cost you significant money in the long run.

How to fix:

- Request your credit history from the credit bureau (this can be done for free once a year).

- Examine in detail the conditions for all available loans and loans.

- Develop a strategy for improving the credit rating – timely payments, reducing the debt burden, increasing the period of use of credit products.

- Monitor your credit score regularly to track progress.

6. You don’t have a budget or you break it regularly.

The budget is not a restriction of freedom, but a tool to achieve it. The lack of a clear financial plan or its constant violation suggests that you do not control your money, and they control you.

How to fix:

- Start by analyzing the actual spending over the past 3 months.

- Create a realistic 50/30/20 budget (50% for necessary expenses, 30% for desires, 20% for savings and investments).

- Regularly monitor budget performance and make adjustments when necessary.

- Use the method of zero budgeting – distribute all income into categories to the last penny.

7. You make impulsive purchases and often regret them.

Impulsive spending is a surefire way to disrupt even the most thought-out financial plan. If you often succumb to spontaneous desires and buy things that are then unnecessary, this is a sign of poor financial self-control.

Psychologists note that impulsive purchases are often associated with emotional states and attempts to lift the mood through the purchase of new things.

How to fix:

- Implement the 24/72 hour shopping rule: wait 24 hours before buying to 5,000 rubles and 72 hours for more expensive purchases.

- Before every purchase, ask yourself, “How will this thing improve my life?” and “Will I use it in a month?”

- Make a shopping list before going to the store and strictly follow it.

- Remove applications of online stores from your phone and unsubscribe from mailings with advertising.

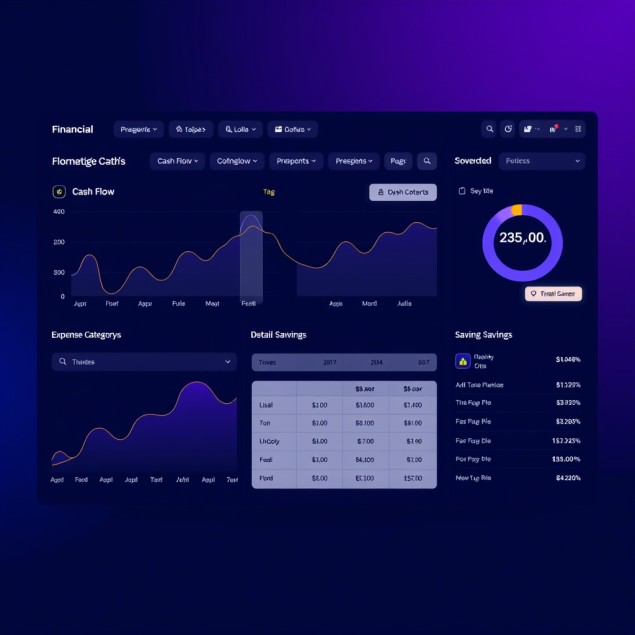

8. You don’t invest or have a retirement plan.

One of the most serious signs of money management problems is the lack of a long-term financial strategy. If you do not invest and do not think about retirement, then you give up the opportunity to create passive income and ensure financial independence in the future.

How to fix:

- Start with education – learn the basics of investing through courses, books, podcasts.

- Open an Individual Investment Account (IIA) for tax benefits.

- Start with small amounts and diversified instruments like ETFs or index funds.

- Develop a pension strategy that includes state pensions and private savings.

- Adhere to the principle of regularity of investments – even small amounts with a systematic approach will lead to significant results.

9. You avoid talking about money and you don't improve financial literacy.

A reluctance to discuss financial issues and a lack of desire to improve your financial literacy is another worrying sign. Money is a tool, and like any tool, you need to learn how to use it.

How to fix:

- Make it a habit to regularly read articles, books, and blogs about personal finance.

- Subscribe to educational podcasts or financial literacy channels.

- Start openly discussing financial matters with a partner, friends, or financial advisor.

- Attend seminars, webinars, or personal finance management courses.

- Set the tradition of a monthly “fiscal day” where you analyze your progress and set new goals.

Take control of money – take control of life

The ability to manage finances is a skill that can and should be developed. Recognizing the problem is the first step to solving it. If you find yourself with a few signs from the list above, do not despair. Start with small steps, gradually introducing new financial habits into your life.

Remember that financial stability is not a matter of income, but the result of competent management of available resources. Even people with high incomes can experience constant financial difficulties if they do not know how to control their expenses and make long-term plans.

Take responsibility for your financial well-being and you will see how not only your bank account will change, but your quality of life as a whole.

Glossary of financial terms

A financial safety cushion is a stock of money sufficient to cover expenses for a certain period (usually 3-6 months) in case of loss of the main source of income.

A credit rating is an assessment of a person’s creditworthiness based on their credit history and current financial obligations.

The 50/30/20 method is a budgeting system in which 50% of income is spent on necessary expenses, 30% on desires and 20% on savings and investments.

Zero budgeting is a method of budget planning in which each ruble of income is allocated to specific categories of expenditure, investment or savings to zero balance.

Financial literacy is a set of knowledge, skills and attitudes in the field of finance that allow you to make informed and effective decisions about money.

Diversification is the allocation of investments between different financial instruments, industries or geographical regions in order to reduce risks.

ETF (Exchange Traded Fund) is an exchange-traded investment fund whose securities are traded on an exchange and track a certain index, sector, commodity or basket of assets.

IIS (Individual Investment Account) is a special brokerage account that provides tax benefits for long-term investment.