963

How to manage personal finances: income and expenses

Well, let's get down to the fun part? Finally, we are counting our income and expenses. There are a lot of approaches here, options for how to do it even more. Therefore, I will tell you one of the options, and you try to see if it will be convenient and understandable for you.

So, we build a plan, a schedule of our income and expenses for the year, broken down by months.

Task 1. Consider Income.

We need to calculate our income on a monthly basis for a year

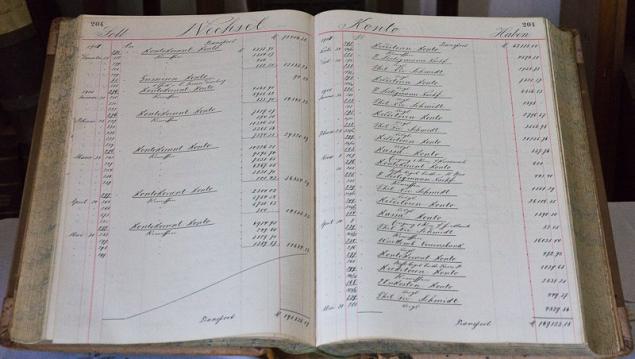

To do this, we will build a table with columns: first column: Name of income, then 12 columns, one for each month - Amount of income per month in January, February, etc. until December in rubles And the final column - Amount of income per year in rubles.

it will look something like this:

1. The salary of the wife per month is 50,000 rubles. per year 600,000 rubles.

2. The husband's salary per month is 100,000 rubles. per year 1,200,000 rubles.

3. The husband's annual bonus in the month of April is 300,000 rubles, a year - 300,000 rubles.

4. The wife's income from the sale of hand-made jewelry is an average of 10,000 rubles per month. per year 120,000 rubles.

We calculate the results - we get our current income for each month and for the year.

Now we multiply the amount of income for the year by the number of years that we expect to work until retirement. A lot, right? This is the amount of money that will pass through your hands during this time. And whether it will go away like sand between your fingers, or will become the foundation of your financial security - depends only on you.

And one more thing for us now is important to do - compare the resulting amount of money that will pass through our hands in the form of income until retirement, with the total value of our financial goals, which we dreamed up for ourselves in Stage 1.

What happened? Lacks? It's all bad. After all, we have not even considered that we need to spend money on our life - eat, drink, dress, etc.

So we are going in two directions - firstly, we are looking for options to increase income, and secondly, we are reviewing the goals and possibly changing them to more realistic ones.

Enough and even something remains? Already good, it means that, purely theoretically, our goals are achievable. And it pleases. But again, we remember the costs of our current life and the fact that we have not even counted them yet ...

So, we will smoothly move on to the next task - we calculate our expenses.

Task 2. We calculate the costs.

The table will be the same in form as the income table, only the income will be expenses.

How to structure expenses within a table? Each will have its own structure, which depends on a lot - your assets, family composition, age of family members, etc., etc.

For example, it might look like this:

Section 1. Maintenance of real estate

1. Utility bills 2. Taxes

Section 2. Expenses for the car

1. Gasoline 2. Car wash and dry cleaning 3. Transport tax

Section 3 Food Expenses

Section 4. Expenses for recreation, hobbies, vacations and entertainment

Section 5. Expenses for clothing and footwear

Section 6. Expenditures on sports, health and beauty.

Section 7. Social expenses (birthdays of relatives, friends and colleagues, other similar expenses)

Section 8. Expenses for children

1. Payment for daughter's kindergarten 2. Summer camp for son 3. Payment for clubs for both children

Section 9. Expenses for mobile communications and the Internet.

Once again - everyone has their own life and therefore everyone will have their own structure of expenses. The main thing is to try not to miss anything.

In general, remember all your expenses and enter them in the table. Then you count the results, see how much expenses you got for the month and for the year. Compare with the income you receive for each month and for the year as a whole and see if there is anything left of your income after living expenses. If there is nothing left, or even a minus has turned out, then this is tough, and we urgently need to look for opportunities to reduce costs and increase income.

Perhaps you will have uneven expenses within the year - in some months they will turn out to be more, and in some less. This means that when planning your budget for the year, these costs need to be redistributed to other months, or you need to accumulate the necessary amount for them in advance.

Or maybe you have enough income to cover all your current expenses, and you even have a free balance? then hurray, hurray, let's go forward !!!

Wait a minute, by the way, but this free residue - do you really have it? Is it on a term deposit in a bank, or on a salary card, or in the form of dollars in a box in a closet? Or has it disappeared somewhere and you cannot understand where?

If you dissolve, then you need to look again at the list of your expenses, perhaps you forgot about something - the annual purchase of a fitness card, for example, or a contribution to the professional community?

Now we return to our goals again. We take the amount of income for the period remaining until the planned retirement, subtract from the non-current expenses for this period, we get the free balance for this entire period. Compare with the cost of our goals.

Enough? excellent, so we are great, and now our task is to fulfill our plans to achieve the goals, and at the same time preserve and increase our capital.

Not enough money to meet your goals and objectives? We all know the solution very well - we are looking for opportunities to increase income and severely reduce our expenses. if there is still something to reduce, Well, or again we revise the goals and make them even more real.

Task 3. Develop your planned budget of income and expenses for the next 12 months. Think over the best timing of certain expenses and the possibility of making them more even.

Task 4. Immediately after receiving your salary, make a certain amount of money for a separate fixed-term deposit to ensure the safety of the planned free balance of money. The deposit must be - urgent, up to a year, with the possibility of replenishment, with a high interest rate. To select a deposit, you can see the analytics of deposits on the Internet. for example. on the site compare.ru and study the offers of banks in your region, since they can be very different from those in Moscow. Remember that deposits up to 1.4 million. rubles are insured by the state, but nevertheless we choose the bank meticulously. we don’t want to run around the banks afterwards for our money.

Task 5. Keep a detailed daily record of all income and expenses for the next three months. Maybe you will like it and you will continue to lead it every day. Or maybe you won't. What I guarantee is that you will definitely better understand the structure and volume of your real income and expenses. Most likely, you will find many unexpected things for yourself. what they didn’t pay attention to before. If you keep such records for scrap, console yourself with the fact that it is only for three months. Imagine this is such a financial quest. published

Author: Marina Kaliseeva

If you want to change your occupation, earn more, master a new profession, the Institute for Professional Retraining will help you realize your desires.

Source: //theageofhappiness.com/posts/kak-upravlyat-lichnymi-finansami-dohody-irashody/ce00hf93bb0

So, we build a plan, a schedule of our income and expenses for the year, broken down by months.

Task 1. Consider Income.

We need to calculate our income on a monthly basis for a year

To do this, we will build a table with columns: first column: Name of income, then 12 columns, one for each month - Amount of income per month in January, February, etc. until December in rubles And the final column - Amount of income per year in rubles.

it will look something like this:

1. The salary of the wife per month is 50,000 rubles. per year 600,000 rubles.

2. The husband's salary per month is 100,000 rubles. per year 1,200,000 rubles.

3. The husband's annual bonus in the month of April is 300,000 rubles, a year - 300,000 rubles.

4. The wife's income from the sale of hand-made jewelry is an average of 10,000 rubles per month. per year 120,000 rubles.

We calculate the results - we get our current income for each month and for the year.

Now we multiply the amount of income for the year by the number of years that we expect to work until retirement. A lot, right? This is the amount of money that will pass through your hands during this time. And whether it will go away like sand between your fingers, or will become the foundation of your financial security - depends only on you.

And one more thing for us now is important to do - compare the resulting amount of money that will pass through our hands in the form of income until retirement, with the total value of our financial goals, which we dreamed up for ourselves in Stage 1.

What happened? Lacks? It's all bad. After all, we have not even considered that we need to spend money on our life - eat, drink, dress, etc.

So we are going in two directions - firstly, we are looking for options to increase income, and secondly, we are reviewing the goals and possibly changing them to more realistic ones.

Enough and even something remains? Already good, it means that, purely theoretically, our goals are achievable. And it pleases. But again, we remember the costs of our current life and the fact that we have not even counted them yet ...

So, we will smoothly move on to the next task - we calculate our expenses.

Task 2. We calculate the costs.

The table will be the same in form as the income table, only the income will be expenses.

How to structure expenses within a table? Each will have its own structure, which depends on a lot - your assets, family composition, age of family members, etc., etc.

For example, it might look like this:

Section 1. Maintenance of real estate

1. Utility bills 2. Taxes

Section 2. Expenses for the car

1. Gasoline 2. Car wash and dry cleaning 3. Transport tax

Section 3 Food Expenses

Section 4. Expenses for recreation, hobbies, vacations and entertainment

Section 5. Expenses for clothing and footwear

Section 6. Expenditures on sports, health and beauty.

Section 7. Social expenses (birthdays of relatives, friends and colleagues, other similar expenses)

Section 8. Expenses for children

1. Payment for daughter's kindergarten 2. Summer camp for son 3. Payment for clubs for both children

Section 9. Expenses for mobile communications and the Internet.

Once again - everyone has their own life and therefore everyone will have their own structure of expenses. The main thing is to try not to miss anything.

In general, remember all your expenses and enter them in the table. Then you count the results, see how much expenses you got for the month and for the year. Compare with the income you receive for each month and for the year as a whole and see if there is anything left of your income after living expenses. If there is nothing left, or even a minus has turned out, then this is tough, and we urgently need to look for opportunities to reduce costs and increase income.

Perhaps you will have uneven expenses within the year - in some months they will turn out to be more, and in some less. This means that when planning your budget for the year, these costs need to be redistributed to other months, or you need to accumulate the necessary amount for them in advance.

Or maybe you have enough income to cover all your current expenses, and you even have a free balance? then hurray, hurray, let's go forward !!!

Wait a minute, by the way, but this free residue - do you really have it? Is it on a term deposit in a bank, or on a salary card, or in the form of dollars in a box in a closet? Or has it disappeared somewhere and you cannot understand where?

If you dissolve, then you need to look again at the list of your expenses, perhaps you forgot about something - the annual purchase of a fitness card, for example, or a contribution to the professional community?

Now we return to our goals again. We take the amount of income for the period remaining until the planned retirement, subtract from the non-current expenses for this period, we get the free balance for this entire period. Compare with the cost of our goals.

Enough? excellent, so we are great, and now our task is to fulfill our plans to achieve the goals, and at the same time preserve and increase our capital.

Not enough money to meet your goals and objectives? We all know the solution very well - we are looking for opportunities to increase income and severely reduce our expenses. if there is still something to reduce, Well, or again we revise the goals and make them even more real.

Task 3. Develop your planned budget of income and expenses for the next 12 months. Think over the best timing of certain expenses and the possibility of making them more even.

Task 4. Immediately after receiving your salary, make a certain amount of money for a separate fixed-term deposit to ensure the safety of the planned free balance of money. The deposit must be - urgent, up to a year, with the possibility of replenishment, with a high interest rate. To select a deposit, you can see the analytics of deposits on the Internet. for example. on the site compare.ru and study the offers of banks in your region, since they can be very different from those in Moscow. Remember that deposits up to 1.4 million. rubles are insured by the state, but nevertheless we choose the bank meticulously. we don’t want to run around the banks afterwards for our money.

Task 5. Keep a detailed daily record of all income and expenses for the next three months. Maybe you will like it and you will continue to lead it every day. Or maybe you won't. What I guarantee is that you will definitely better understand the structure and volume of your real income and expenses. Most likely, you will find many unexpected things for yourself. what they didn’t pay attention to before. If you keep such records for scrap, console yourself with the fact that it is only for three months. Imagine this is such a financial quest. published

Author: Marina Kaliseeva

If you want to change your occupation, earn more, master a new profession, the Institute for Professional Retraining will help you realize your desires.

Source: //theageofhappiness.com/posts/kak-upravlyat-lichnymi-finansami-dohody-irashody/ce00hf93bb0