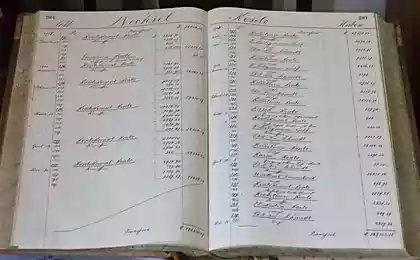

1727

Detailed Budget average American family

Take the budget of an average American family and begin to assume their expenses. Just understand where a mandatory expense, and where not.

I must say that this is not the average family in the country, and the average family among families where both parents work, have a college degree, and already have some experience in their profession. For this category of educated and active population - the average family budget. All the expenses I have divided into 3 categories, depending on whether they are required.

It is mandatory spending - you have to pay every month

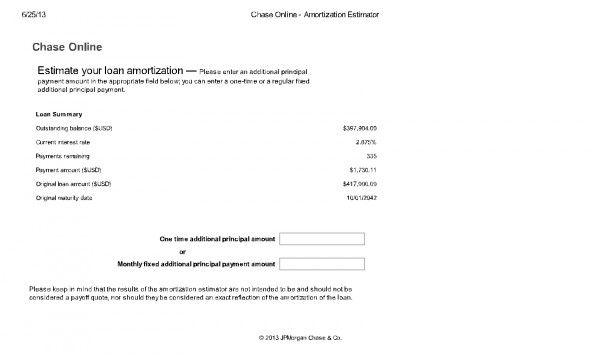

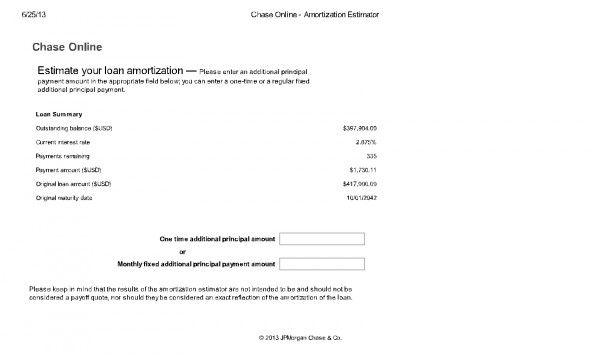

1. Mortgages - $ 1730 per month

Loan amount $ 417, 000 at 2.85% for 30 years. Usually families move every 10 years, and if the house is sold and the mortgage is paid. Mortgage or rent housing is a basic compulsory consumption of American families.

What kind of house they live in these big money? In our area it is usually a house of about 200 square meters, with garage, 3 bedrooms, two san toilets, living room, dining room, kitchen and courtyard.

Front view

Living

Kitchen

Master bedroom

Children's playground in the yard. in the background a garage

Children's bedroom

Another room, we called it Florida Room. The room is open to the sun on all sides.

2. Property taxes - $ 620 per month.

In our area high taxes as a prestigious and expensive place. We live close to work, and these taxes we get police, fire and ambulance to arrive in 2 minutes. Net parks. Well, good free schools.

3. Insurance house fire, theft, and hurricanes - $ 360

Mortgage obliges us to insure the house, and without a mortgage is a good idea. Here we have insurance is expensive, as we are 500 meters from the sea, and there are frequent hurricanes. House, in principle, not one survived the hurricane, and well protected. Built of concrete blocks have metal shutters, a house on a hill, the roof is made anti-hurricane.

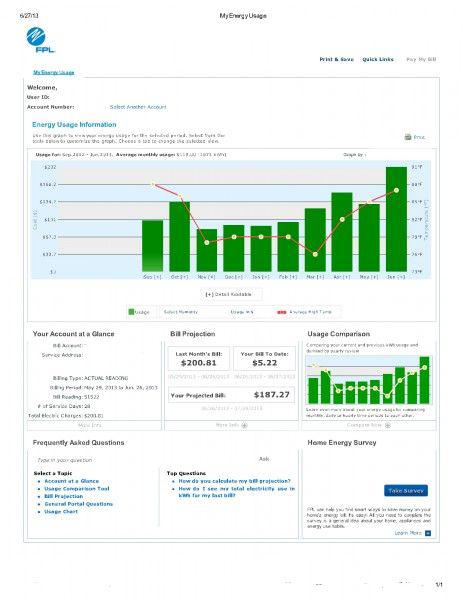

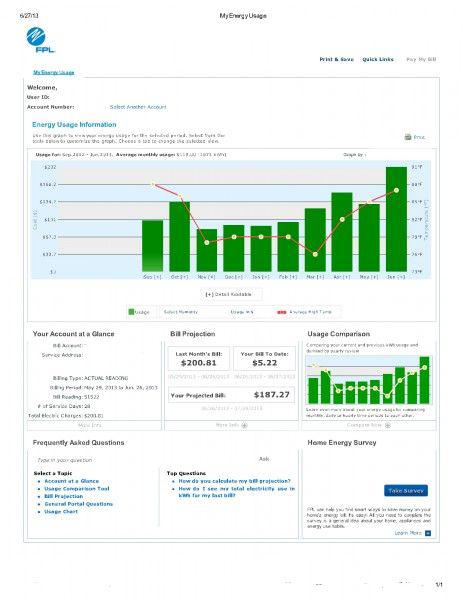

4. Electricity - $ 120 per month

Consumption depends on the time of year, but on average perhaps $ 120. In winter, fall, spring around $ 80. In the summer of $ 200. The main consumption is for air conditioning, heating and water.

5. Water - $ 10 per month

We pay only for cold water get about $ 30 for the quarter.

6. Garbage collection - $ 58 a month.

Rubbish from our house take 4 times a week, and debris should be sorted in the ordinary, something that is recyclable (plastic, metal, glass, paper), and garden waste (branches, leaves, trees).

7. Payments on student loans - $ 100

The debt of about $ 34, 000 at 2.65% for 30 years

Total very mandatory spending a month - $ 2998

Almost mandatory spending, without which it is difficult to live

8. Expenditure on food - $ 400 per month

In principle, nothing does not deny.

9. The cable TV and Internet - $ 85 per month.

It depends on a package of channels and internet speed. We are not the cheapest, but not the most expensive.

10. Gasoline - $ 145 per month for two cars.

Prior to drive about 7 miles one way.

10. Maintenance of machinery - $ 50 a month.

While the new, nothing special is not necessary, except for oil change periodically. Those free service from Toyota first 3 years. In any case, I wrote $ 600 a year.

11. Mobile phones - $ 65.

For one paying job for another $ 65 a virtually unlimited calls, data, SMS.

12. Insurance for the car - $ 200 per month.

There is an opportunity to reduce costs, but we buy insurance with a maximum coverage of civil liability of $ 500, 000 dollars for the insurance case.

13. Medications - about $ 100 a month.

These include contraceptives.

14. Insurance Medical semyu- at $ 500 per month.

15. Disability Insurance - $ 136

If you become disabled, pays a certain amount (such as $ 800 per month) for the rest of his life.

16. Life insurance - $ 60 a month

If a breadwinner dies, the insurance helps to balance the financial problems to remain. 3 insurance policies totaling $ 1.3 million. In addition to work on feature complimentary insurance, about $ 600, 000. However, insurance against work stop action after leaving work.

17 Insurance semyu- eye on the $ 10.

Pays $ 200 per year for each on glasses or lenses kontakntye.

18. Insurance dental family - $ 120

Shipping basic dental expenses.

19. The cost of a garden the child - $ 800.

The training program at a local school for 2 year olds, is worth $ 40 dollars a day. School free.

Total, almost mandatory costs per month - $ 2671

Not quite mandatory spending, without which you can do if you need

20. Mowing the lawn - $ 120

Every two weeks, a person comes and mows the lawn. $ 60 at a time.

21. Delivery of prepared food - $ 428

Wife own food orders delivered to work five days a week. twice daily.

22. Expenses for the dog - around $ 450 per month.

The dog every day a man came to walk it - $ 75 per week or $ 300 a month. About once a month the dog wash and shear - $ 60. Then, the dog has a medical insurance - $ 500 per year. Well, the cost of food, medicines, vaccinations, check-ups, toys, clothes, somewhere another $ 500 a year.

23. Expenses for house cleaning - $ 200 per month

Every two weeks, the housekeeper comes and cleans the house, washing clothes, ironing, and so on. It costs $ 100 a day.

24. Spending on restaurants - about $ 400 a month.

Restaurants that level in which we walk are about $ 100- $ 150 for two people, or $ 200 if the child.

25. Expenditure on entertainment - $ 250 per month on average.

Tickets for the theater, ballet, opera, cinema, sports events and so on.

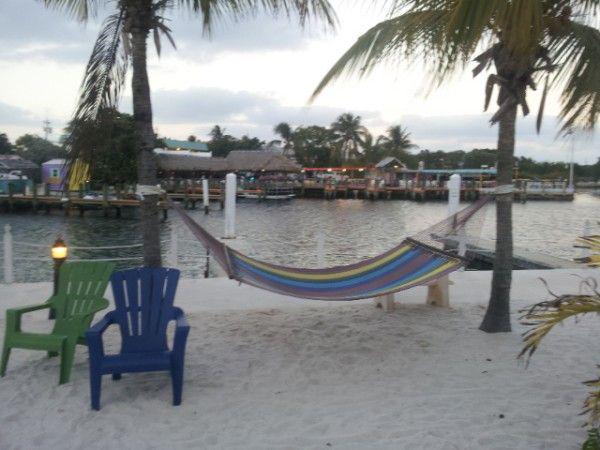

26. travel costs - $ 500 per month, on average.

There is of course difficult to paint, as these costs are very irregular and very different cost. Then, free flights we usually gets for miles, which we have accumulated a lot. But about $ 6,000 a year. For example, a trip of 10 days in Spain, cost about $ 4,000. A trip to New York for a week was worth $ 2,000.

27. Spending on clothes - $ 400 per month

Of course, not every month. When 0, a $ 2,000 when a time at the sale.

28. Gifts to charities and political organizations $ 200

Approximately 2,500 per year, rounded and averaged.

29. Contribution to various savings funds (pension, health and education) - $ 4,000 a month.

Total, it is not mandatory costs per month - $ 7148

Summarize family expenses:

Required - $ 2998

Almost Bound - $ 2671

Not really required - $ 7148

Total: $ 12817

Well, all that remains after the payment of these expenses, you can already spend on life and the loved ones.

Source: skystream7.livejournal.com

I must say that this is not the average family in the country, and the average family among families where both parents work, have a college degree, and already have some experience in their profession. For this category of educated and active population - the average family budget. All the expenses I have divided into 3 categories, depending on whether they are required.

It is mandatory spending - you have to pay every month

1. Mortgages - $ 1730 per month

Loan amount $ 417, 000 at 2.85% for 30 years. Usually families move every 10 years, and if the house is sold and the mortgage is paid. Mortgage or rent housing is a basic compulsory consumption of American families.

What kind of house they live in these big money? In our area it is usually a house of about 200 square meters, with garage, 3 bedrooms, two san toilets, living room, dining room, kitchen and courtyard.

Front view

Living

Kitchen

Master bedroom

Children's playground in the yard. in the background a garage

Children's bedroom

Another room, we called it Florida Room. The room is open to the sun on all sides.

2. Property taxes - $ 620 per month.

In our area high taxes as a prestigious and expensive place. We live close to work, and these taxes we get police, fire and ambulance to arrive in 2 minutes. Net parks. Well, good free schools.

3. Insurance house fire, theft, and hurricanes - $ 360

Mortgage obliges us to insure the house, and without a mortgage is a good idea. Here we have insurance is expensive, as we are 500 meters from the sea, and there are frequent hurricanes. House, in principle, not one survived the hurricane, and well protected. Built of concrete blocks have metal shutters, a house on a hill, the roof is made anti-hurricane.

4. Electricity - $ 120 per month

Consumption depends on the time of year, but on average perhaps $ 120. In winter, fall, spring around $ 80. In the summer of $ 200. The main consumption is for air conditioning, heating and water.

5. Water - $ 10 per month

We pay only for cold water get about $ 30 for the quarter.

6. Garbage collection - $ 58 a month.

Rubbish from our house take 4 times a week, and debris should be sorted in the ordinary, something that is recyclable (plastic, metal, glass, paper), and garden waste (branches, leaves, trees).

7. Payments on student loans - $ 100

The debt of about $ 34, 000 at 2.65% for 30 years

Total very mandatory spending a month - $ 2998

Almost mandatory spending, without which it is difficult to live

8. Expenditure on food - $ 400 per month

In principle, nothing does not deny.

9. The cable TV and Internet - $ 85 per month.

It depends on a package of channels and internet speed. We are not the cheapest, but not the most expensive.

10. Gasoline - $ 145 per month for two cars.

Prior to drive about 7 miles one way.

10. Maintenance of machinery - $ 50 a month.

While the new, nothing special is not necessary, except for oil change periodically. Those free service from Toyota first 3 years. In any case, I wrote $ 600 a year.

11. Mobile phones - $ 65.

For one paying job for another $ 65 a virtually unlimited calls, data, SMS.

12. Insurance for the car - $ 200 per month.

There is an opportunity to reduce costs, but we buy insurance with a maximum coverage of civil liability of $ 500, 000 dollars for the insurance case.

13. Medications - about $ 100 a month.

These include contraceptives.

14. Insurance Medical semyu- at $ 500 per month.

15. Disability Insurance - $ 136

If you become disabled, pays a certain amount (such as $ 800 per month) for the rest of his life.

16. Life insurance - $ 60 a month

If a breadwinner dies, the insurance helps to balance the financial problems to remain. 3 insurance policies totaling $ 1.3 million. In addition to work on feature complimentary insurance, about $ 600, 000. However, insurance against work stop action after leaving work.

17 Insurance semyu- eye on the $ 10.

Pays $ 200 per year for each on glasses or lenses kontakntye.

18. Insurance dental family - $ 120

Shipping basic dental expenses.

19. The cost of a garden the child - $ 800.

The training program at a local school for 2 year olds, is worth $ 40 dollars a day. School free.

Total, almost mandatory costs per month - $ 2671

Not quite mandatory spending, without which you can do if you need

20. Mowing the lawn - $ 120

Every two weeks, a person comes and mows the lawn. $ 60 at a time.

21. Delivery of prepared food - $ 428

Wife own food orders delivered to work five days a week. twice daily.

22. Expenses for the dog - around $ 450 per month.

The dog every day a man came to walk it - $ 75 per week or $ 300 a month. About once a month the dog wash and shear - $ 60. Then, the dog has a medical insurance - $ 500 per year. Well, the cost of food, medicines, vaccinations, check-ups, toys, clothes, somewhere another $ 500 a year.

23. Expenses for house cleaning - $ 200 per month

Every two weeks, the housekeeper comes and cleans the house, washing clothes, ironing, and so on. It costs $ 100 a day.

24. Spending on restaurants - about $ 400 a month.

Restaurants that level in which we walk are about $ 100- $ 150 for two people, or $ 200 if the child.

25. Expenditure on entertainment - $ 250 per month on average.

Tickets for the theater, ballet, opera, cinema, sports events and so on.

26. travel costs - $ 500 per month, on average.

There is of course difficult to paint, as these costs are very irregular and very different cost. Then, free flights we usually gets for miles, which we have accumulated a lot. But about $ 6,000 a year. For example, a trip of 10 days in Spain, cost about $ 4,000. A trip to New York for a week was worth $ 2,000.

27. Spending on clothes - $ 400 per month

Of course, not every month. When 0, a $ 2,000 when a time at the sale.

28. Gifts to charities and political organizations $ 200

Approximately 2,500 per year, rounded and averaged.

29. Contribution to various savings funds (pension, health and education) - $ 4,000 a month.

Total, it is not mandatory costs per month - $ 7148

Summarize family expenses:

Required - $ 2998

Almost Bound - $ 2671

Not really required - $ 7148

Total: $ 12817

Well, all that remains after the payment of these expenses, you can already spend on life and the loved ones.

Source: skystream7.livejournal.com