735

Gold, inflation and the global conspiracy: why not just print a lot of money

Three million seven hundred sixty four thousand two hundred ninety eight

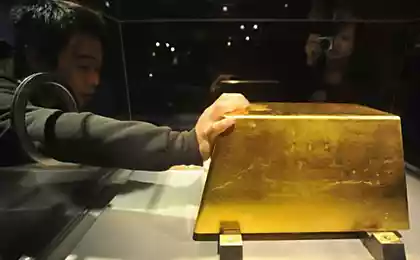

© Jeff Warnkin/Time.com

Unjustified increase in the quantity of money, unfortunately, does not make all rich. Many believe that the reason is lack of gold in the Treasury, the global dollar conspiracy or a mandatory increase of inflation as a consequence. T&P have collected the most common myths and people's opinions on this matter and asked the experts to explain what they mean and how plausible.

associate Professor of the Department of macroeconomics at new economic school (NES)"you can't print more money, because their number should not exceed the volume of gold reserves"currently, no country in the world, the amount of money not tied to gold reserves. This myth goes back to the gold standard — a monetary system in which each issued currency was in demand can be exchanged for an equivalent amount of gold. According to supporters of the gold standard, this system guarantees the stability of the economy, because Central banks can't print uncontrollably money, stimulating inflation. However, as history shows, the gold standard in certain periods was not protection from macroeconomic instability and its cause.

The most famous example — the great depression 1929-1939 years when the limited supply of gold and, consequently, insufficient money supply led to deflation, increasing the real debt burden on firms and individuals. This caused an increase in the number of bankruptcies, a banking crisis and eventually a significant rise in unemployment and falling living standards in the United States and Europe. Interestingly, similar problems (although in a much smaller scale) was observed in the United States in the 1890s that stimulated the emergence of a political movement of free silver, advocating for the abolition of the gold standard and the introduction of bimetallic standard. According to some historians, the events of that time reflected allegorically in the famous fairy tale by Frank Baum "the wonderful wizard of Oz". The opposite example is the "price revolution" — the episode of the European history of the XVI century, when a large influx of gold and silver to Spain of the newly discovered Mexico and Peru led to an increase in the money supply and increase the price level by the end of the XVI century in 2,5–4 times.

"The money supply must correspond to the total value of domestically produced goods and services. We don't have enough time to print more money"this statement has logic. The most important function of money — medium of exchange. Imagine the situation: I lecture in Economics and like to eat apples, the farmer, who these apples are, wants to buy a TV, but he absolutely does not need my lectures, and my neighbor just has the extra TV, but he is ready to trade him just for the delicious soup that cooks aunt Claudia, the same in turn, with pleasure would listen to my lectures. In the economy without money, to exchange took place, it is necessary the presence in one place of all four. However, if there are pieces of paper that everyone accepts as payment for goods and services, everything happens much faster and without the need of presence. Thus, paper money, not having themselves no intrinsic value, significantly reduce costs of exchange and thereby increase the welfare of all market participants.

It is clear that the larger the value of the goods and services produced in the economy, the more you need money to exchange them. However, the relationship here is not so direct, as described in the statement. Every ruble during the year may participate in more than one exchange and, accordingly, to conduct all transactions may need less money than the cost of existing goods and services. The speed at which each monetary unit participates in the exchange, also may vary over time in connection with the development of the financial sector, the emergence of new banking and financial instruments.

In addition, the money can act as a means of savings. If alternative, less liquid financial instruments have a low nominal rate of return, then we will lose if we save money in three-liter Bank or account in a commercial Bank, not in real estate or in Treasury bonds. But if we use the money as savings, then there is an additional demand on the money supply. The Central Bank can partially control the demand, driving the nominal interest rate. There are other reasons that create demand for money. For example, banks need more liquidity (money) during periods when companies pay taxes.

As a result, any market economy there is a need for money, which strongly depends on the value of produced goods and services. However, this demand also depends on other factors, and, therefore, the simple rule described in the statement does not work.

"Under the Charter of the IMF (and Russia — a member of the IMF), no state can print their own money beyond the amount of dollars in its reserves"In the modern versions of the Articles of agreement of the IMF such option. It has been modified by the second amendment in 1978, which gives member States the right to choose their own exchange rate regime. The IMF was created as part of the Bretton woods agreement in 1944, which established the two-level international monetary system: the gold price is rigidly fixed at 35 dollars per Troy ounce, the U.S. dollar freely exchanged for gold, and all the other participating countries had to maintain a stable exchange rate of their currencies to the US dollar (± 1%) with the help of currency interventions. But this system was unstable, and after a significant reduction in gold reserves during the 1968-1973 years, the U.S. refused to fix the price of gold and other countries to fix their currencies to the US dollar. After Jamaican international conference of 1973 such a two-tiered regime has ceased to exist de jure. However, a small number of countries today voluntarily use a currency Board, under which the monetary base (cash in circulation and reserves of commercial banks at the Central Bank) to one hundred percent needs to be provided reserves. As the Hong Kong dollar is strictly pegged to the U.S. dollar or Bulgarian Lev, fixed to the Euro.

"The amount of money depends on GDP, which does not allow us to print more"there's No technical limitation on the issuance (printing) of Fiat money (that is unsecured by anything except the state guarantees that they are legal tender in the country and will be accepted as payment of taxes and fees). The costs to issue paper money and coins is usually very small (for example, issue dollar notes today is the Federal reserve system of the United States at 4.9 per cent, and hundred-dollar bills — 12.3 cents). Moreover, the vast majority of Fiat money (in the US, about 90% of the money supply in Russia about 80%) do not have physical material (paper or metal), as it is an electronic record in the accounts of the Central Bank and commercial banks. Emission of electronic money is almost free.

However, taking decisions on monetary policy, and, consequently, relative to the amount of money in the economy, Central banks take into account the dynamics of GDP and other macroeconomic indicators (inflation, unemployment, growth rate of industrial production, exchange rate of the national currency and so on). This is due to two main reasons.

First, the most important objective of Central banks is to maintain low and stable inflation. We already know that the main function of money is its use as a medium of exchange, and the cost of all operations of exchange in the economy, as a rule, closely linked to production volume and GDP. Uncontrolled issuance of Fiat money eventually leads to inflation, because their greater number means greater demand for goods and services and their supply is limited production capacity of the economy (quantity and quality of workforce, amount of capital and land, the technological level and efficiency of public institutions) that monetary policy has no effect in the long term.

Secondly, all countries with a market economy is cyclic boom and recession. During a recession, GDP typically falls below the production possibilities of the economy, rising unemployment and underemployment, and businesses are not fully utilizing the available equipment. Using a soft monetary policy, printing more money, the Central Bank can stimulate demand for goods and services, and thus mitigate the negative effect of the recession on GDP and employment. Conversely, during the boom the economy grows too fast, the production has not kept pace with the growing demand, which eventually leads to inflation. In this case, the Central Bank could limit the supply and reduce the pressure of inflation using tight monetary policy, i.e. reducing monetary emission.

Sixty seven million seven hundred forty four thousand seven hundred ninety

"If we print money, increase inflation, depreciate wages, pensions, savings"Yes, the excess supply of money in the economy over that amount which is necessary to market participants for the exchange and for savings can lead to higher inflation. However, this happens not immediately and not always.

Firstly, businesses, shops, restaurants and so on change their prices slowly over time. This may be due to the cost of the release of new menus and catalogs, or print new price tags (imagine the cost of the supermarket, when you need to replace dozens or even hundreds of thousands of tags). Production costs are also rising gradually, as enterprises begin to buy and use new, more expensive batch materials. Salaries are also usually indexed and not changed every day. All this makes the price hard for several months, and even years.

Second, the additional effect of increasing the money supply on prices and production depends on the state of the economy at the moment. If the economy uses power fully, the additional demand would not significantly change the production of goods and services, as it will have to hire more workers, and they are almost there, or pay higher overtime wages to current employees. In addition, you will need new machines, equipment, production facilities and so on, and for their production, and installation requires considerable time. In the end, to meet the increased demand, businesses are forced to raise prices which causes inflation. If this money supply will be directed to imports, this will cause an increased demand for foreign currency and lead to exchange rate depreciation and therefore the cost of imports and more inflation.

On the other hand, if the economy is in a recession (that is, a large number of unemployed and production capacity of enterprises have not been fully used), the additional demand caused by the increase in the quantity of money is likely to increase output and reduce unemployment, while inflation will increase slightly. In other words, in such circumstances, monetary policy can mitigate the effects of the crisis without inflationary consequences.

"Enough money, just all of them are in the financial sector. So even if you print more of them, people do not feel"Really, the banking sector is an important part of the modern monetary system. Moreover, the bulk of the money used in the cash turnover is in the banking system and is created by commercial banks, not by issuing Central Bank. When we open a current account in a commercial Bank, we can use it to pay for goods and services (writing a check or paying by debit card). However, we usually do not spend all the money at once, and on average over the period on our account always has some amount. This gives the possibility of commercial banks to partially use our money for loans to other businesses or consumers. Entering into the loan, these businesses or consumers receive money into your current account that can be used to pay for goods and services. That is in addition to our initial money, the Bank creates an additional amount of money. This process can be repeated, as the Bank where you opened your current account, get a loan, also can do such an operation. However, the ability of commercial banks to create money is not endless and largely depend on the volume of the monetary base, i.e. money created by the Central Bank.

On the other hand, the claim that the population will not feel the effect of the issue of money, is erroneous. Yes, it is true that the money issued by the Central Bank usually will not go directly to companies and consumers and fall in the commercial banks, which, in turn, have the opportunity to increase lending to the real sector. The more liquidity flows into the banking system, the more affordable and accessible is a credit to enterprises and households (this is not always the case, about possible problems in the following paragraph). Accordingly, increasing the quantity of money in circulation and the demand for goods and services. If the economy is at full employment, this increase in demand will only lead to higher inflation. However, in a recession, so the soft monetary policy may mitigate the fall of output and reduce unemployment without strong inflationary effect.

"It is not necessary to print a lot of money because we spend and will have to give our children"In this statement there is a confusion between two different concepts: money and debt. In the modern economy, almost any debt (mortgage or consumer loan, the issuance of government bonds, or payment in the restaurant by credit card) is associated with money. However, debt is not money. We can borrow from a neighbor a bottle of vodka with the obligation to return it in a week, along with butterscotch as interest. In this case there is debt, but no money. Conversely, when we pay for a bottle of vodka in the store in rubles in cash, the payment involved money, but no debt arises for us or our children do not need to return this bottle to the store in a week or in 20 years.

When we spend money in the store or in the restaurant, they just change their owner, but do not disappear. Shop or restaurant will be able to use the ruble for the purchase of new semi-processed or for remuneration. The waiter from the restaurant will pay this ruble purchase of a bouquet of flowers for his girlfriend and so on. So the whole country will not be able to spend the money in circulation.

On the other hand, if our government borrows from other countries to pay current expenses, in 20 years the debt can be a serious burden for the budget, forcing the government to raise taxes, and our children pay for us. In this case, can really be the problem described in the statement, but it is not directly related to money or monetary policy.

"The United States was able to deceive all economic laws, printing money on the conveyor and there is not much suffering from inflation. All global economic processes revolve in dollars, without the dollar, everything will collapse. The demand balances the huge offer that is thrown does not stop operation of the printing press. You can not say about the ruble"In this statement there are several points that are worth paying attention to.

First, the US dollar really is the global reserve currency, but the impact on monetary policy and inflation in the United States are greatly exaggerated. The status of reserve currency means that Central banks and governments of other countries can hold this currency in large amounts as an official reserve and use it for international payments. According to the IMF, currently about 62% of official reserves in the world, the currency of which is known, is denominated in US dollars (this is about 3.8 trillion). Commercial banks, financial companies, enterprises and the population in other countries also have a considerable volume of dollars and dollar deposits. The status of a global reserve currency gives the US a slight advantage on the international capital markets associated with the ability to borrow debt at cheaper rates than those at which the United States lends to other countries (in the economic literature this is called the "exorbitant privilege"). Evaluations of this advantage vary and are highly dependent on the data used.

However, the status of global reserve currency has no significant impact on monetary policy of the States, which is focused on maintaining low and stable inflation, full employment and stability of the banking and financial system in the country. Of course, additional demand for US dollars as reserves (in the form of cash and deposits in Central and commercial banks of America) from other countries allows the Federal reserve to print more money. However, this additional demand is negligible compared to the demand for U.S. dollars in the country and, accordingly, has no serious influence on decisions in the sphere of monetary policy. Moreover, the fact that the US quite successfully cope with the task of maintaining low inflation and currency stability, allows their dollar to maintain its status as the global reserve currency. Any attempts of uncontrolled use of such benefits can lead to its loss.

Second, U.S. monetary policy in recent years is not contrary to economic laws. On the contrary, their clear understanding softened the consequences of the most serious since the great depression financial crisis of 2008. As I mentioned earlier, the money supply is created not only by the Central Bank in the form of emission of currency and the increase in commercial banks ' reserves accounts at the Central Bank, but largely by commercial banks in the process of lending to the real sector. After the financial crisis engulfed the US financial system in 2008, the lending process, banks sharply tightened. In conditions of high uncertainty and financial problems, banks significantly tightened the requirements to the debtors. In addition, in connection with the fall in the value of real estate and shares (which act as collateral for credit) has sharply increased the debt burden on the population and businesses, which led to a decline in demand for loans. The risk of a contraction in the money supply and aggregate demand, the Federal reserve has responded to unprecedented quantitative easing program related to the redemption of long-term securities (lowering the nominal interest rate virtually to the zero level was insufficient). This has led to a significant expansion of the monetary base (in the period from 2008 to 2014, it has increased 4.5 times). However, commercial banks are reluctant to increase lending to the economy, and all this additional issue has basically gone in the US economy or to other countries, and in reserves of us commercial banks in the accounts of the Federal reserve. From 2008 to 2014, the money supply (measured by M2 aggregate) increased by only half. For comparison, in Russia the monetary aggregate M2 over the same period increased more than twice. According to many economists, this unprecedented soft monetary policy has helped to support aggregate demand for goods and services and strongly mitigated the impact of financial crisis on the real economy.

And third, differences between the effectiveness of monetary policy in the United States and Russia is largely due to the structural differences of these two economies. Unlike USA, Russia is a more open economy — most of the goods we consume are imported. The prices of imported goods depend heavily on the exchange rate. The soft monetary policy (printing of money) usually leads to the depreciation of the national currency, and, consequently, to a rise in import prices and higher inflation. In addition, Russia, like other countries with developing markets exposed to currency crises. A sharp outflow of international capital or a significant drop in oil prices usually leads to the devaluation of the ruble and the decline in aggregate demand, output and employment. And there is a conflict between the objectives of monetary policy. On the one hand, the Bank of Russia seeks to bolster the ruble and maintain low inflation through tight monetary policy, that is, by raising interest rates and reducing money supply. On the other, there is a need to combat the recession using monetary policy. At the same time to achieve low inflation and a slight drop in output in such conditions is impossible. Therefore, in Russia and in other developing countries during crises, the inflation rate usually increases, and the Central banks of these countries often tighten the monetary policy. On the contrary, in many developed countries like USA, UK or Japan, during crises there is deflation and the Central banks of these countries print more money.

Source: theoryandpractice.ru

© Jeff Warnkin/Time.com

Unjustified increase in the quantity of money, unfortunately, does not make all rich. Many believe that the reason is lack of gold in the Treasury, the global dollar conspiracy or a mandatory increase of inflation as a consequence. T&P have collected the most common myths and people's opinions on this matter and asked the experts to explain what they mean and how plausible.

associate Professor of the Department of macroeconomics at new economic school (NES)"you can't print more money, because their number should not exceed the volume of gold reserves"currently, no country in the world, the amount of money not tied to gold reserves. This myth goes back to the gold standard — a monetary system in which each issued currency was in demand can be exchanged for an equivalent amount of gold. According to supporters of the gold standard, this system guarantees the stability of the economy, because Central banks can't print uncontrollably money, stimulating inflation. However, as history shows, the gold standard in certain periods was not protection from macroeconomic instability and its cause.

The most famous example — the great depression 1929-1939 years when the limited supply of gold and, consequently, insufficient money supply led to deflation, increasing the real debt burden on firms and individuals. This caused an increase in the number of bankruptcies, a banking crisis and eventually a significant rise in unemployment and falling living standards in the United States and Europe. Interestingly, similar problems (although in a much smaller scale) was observed in the United States in the 1890s that stimulated the emergence of a political movement of free silver, advocating for the abolition of the gold standard and the introduction of bimetallic standard. According to some historians, the events of that time reflected allegorically in the famous fairy tale by Frank Baum "the wonderful wizard of Oz". The opposite example is the "price revolution" — the episode of the European history of the XVI century, when a large influx of gold and silver to Spain of the newly discovered Mexico and Peru led to an increase in the money supply and increase the price level by the end of the XVI century in 2,5–4 times.

"The money supply must correspond to the total value of domestically produced goods and services. We don't have enough time to print more money"this statement has logic. The most important function of money — medium of exchange. Imagine the situation: I lecture in Economics and like to eat apples, the farmer, who these apples are, wants to buy a TV, but he absolutely does not need my lectures, and my neighbor just has the extra TV, but he is ready to trade him just for the delicious soup that cooks aunt Claudia, the same in turn, with pleasure would listen to my lectures. In the economy without money, to exchange took place, it is necessary the presence in one place of all four. However, if there are pieces of paper that everyone accepts as payment for goods and services, everything happens much faster and without the need of presence. Thus, paper money, not having themselves no intrinsic value, significantly reduce costs of exchange and thereby increase the welfare of all market participants.

It is clear that the larger the value of the goods and services produced in the economy, the more you need money to exchange them. However, the relationship here is not so direct, as described in the statement. Every ruble during the year may participate in more than one exchange and, accordingly, to conduct all transactions may need less money than the cost of existing goods and services. The speed at which each monetary unit participates in the exchange, also may vary over time in connection with the development of the financial sector, the emergence of new banking and financial instruments.

In addition, the money can act as a means of savings. If alternative, less liquid financial instruments have a low nominal rate of return, then we will lose if we save money in three-liter Bank or account in a commercial Bank, not in real estate or in Treasury bonds. But if we use the money as savings, then there is an additional demand on the money supply. The Central Bank can partially control the demand, driving the nominal interest rate. There are other reasons that create demand for money. For example, banks need more liquidity (money) during periods when companies pay taxes.

As a result, any market economy there is a need for money, which strongly depends on the value of produced goods and services. However, this demand also depends on other factors, and, therefore, the simple rule described in the statement does not work.

"Under the Charter of the IMF (and Russia — a member of the IMF), no state can print their own money beyond the amount of dollars in its reserves"In the modern versions of the Articles of agreement of the IMF such option. It has been modified by the second amendment in 1978, which gives member States the right to choose their own exchange rate regime. The IMF was created as part of the Bretton woods agreement in 1944, which established the two-level international monetary system: the gold price is rigidly fixed at 35 dollars per Troy ounce, the U.S. dollar freely exchanged for gold, and all the other participating countries had to maintain a stable exchange rate of their currencies to the US dollar (± 1%) with the help of currency interventions. But this system was unstable, and after a significant reduction in gold reserves during the 1968-1973 years, the U.S. refused to fix the price of gold and other countries to fix their currencies to the US dollar. After Jamaican international conference of 1973 such a two-tiered regime has ceased to exist de jure. However, a small number of countries today voluntarily use a currency Board, under which the monetary base (cash in circulation and reserves of commercial banks at the Central Bank) to one hundred percent needs to be provided reserves. As the Hong Kong dollar is strictly pegged to the U.S. dollar or Bulgarian Lev, fixed to the Euro.

"The amount of money depends on GDP, which does not allow us to print more"there's No technical limitation on the issuance (printing) of Fiat money (that is unsecured by anything except the state guarantees that they are legal tender in the country and will be accepted as payment of taxes and fees). The costs to issue paper money and coins is usually very small (for example, issue dollar notes today is the Federal reserve system of the United States at 4.9 per cent, and hundred-dollar bills — 12.3 cents). Moreover, the vast majority of Fiat money (in the US, about 90% of the money supply in Russia about 80%) do not have physical material (paper or metal), as it is an electronic record in the accounts of the Central Bank and commercial banks. Emission of electronic money is almost free.

However, taking decisions on monetary policy, and, consequently, relative to the amount of money in the economy, Central banks take into account the dynamics of GDP and other macroeconomic indicators (inflation, unemployment, growth rate of industrial production, exchange rate of the national currency and so on). This is due to two main reasons.

First, the most important objective of Central banks is to maintain low and stable inflation. We already know that the main function of money is its use as a medium of exchange, and the cost of all operations of exchange in the economy, as a rule, closely linked to production volume and GDP. Uncontrolled issuance of Fiat money eventually leads to inflation, because their greater number means greater demand for goods and services and their supply is limited production capacity of the economy (quantity and quality of workforce, amount of capital and land, the technological level and efficiency of public institutions) that monetary policy has no effect in the long term.

Secondly, all countries with a market economy is cyclic boom and recession. During a recession, GDP typically falls below the production possibilities of the economy, rising unemployment and underemployment, and businesses are not fully utilizing the available equipment. Using a soft monetary policy, printing more money, the Central Bank can stimulate demand for goods and services, and thus mitigate the negative effect of the recession on GDP and employment. Conversely, during the boom the economy grows too fast, the production has not kept pace with the growing demand, which eventually leads to inflation. In this case, the Central Bank could limit the supply and reduce the pressure of inflation using tight monetary policy, i.e. reducing monetary emission.

Sixty seven million seven hundred forty four thousand seven hundred ninety

"If we print money, increase inflation, depreciate wages, pensions, savings"Yes, the excess supply of money in the economy over that amount which is necessary to market participants for the exchange and for savings can lead to higher inflation. However, this happens not immediately and not always.

Firstly, businesses, shops, restaurants and so on change their prices slowly over time. This may be due to the cost of the release of new menus and catalogs, or print new price tags (imagine the cost of the supermarket, when you need to replace dozens or even hundreds of thousands of tags). Production costs are also rising gradually, as enterprises begin to buy and use new, more expensive batch materials. Salaries are also usually indexed and not changed every day. All this makes the price hard for several months, and even years.

Second, the additional effect of increasing the money supply on prices and production depends on the state of the economy at the moment. If the economy uses power fully, the additional demand would not significantly change the production of goods and services, as it will have to hire more workers, and they are almost there, or pay higher overtime wages to current employees. In addition, you will need new machines, equipment, production facilities and so on, and for their production, and installation requires considerable time. In the end, to meet the increased demand, businesses are forced to raise prices which causes inflation. If this money supply will be directed to imports, this will cause an increased demand for foreign currency and lead to exchange rate depreciation and therefore the cost of imports and more inflation.

On the other hand, if the economy is in a recession (that is, a large number of unemployed and production capacity of enterprises have not been fully used), the additional demand caused by the increase in the quantity of money is likely to increase output and reduce unemployment, while inflation will increase slightly. In other words, in such circumstances, monetary policy can mitigate the effects of the crisis without inflationary consequences.

"Enough money, just all of them are in the financial sector. So even if you print more of them, people do not feel"Really, the banking sector is an important part of the modern monetary system. Moreover, the bulk of the money used in the cash turnover is in the banking system and is created by commercial banks, not by issuing Central Bank. When we open a current account in a commercial Bank, we can use it to pay for goods and services (writing a check or paying by debit card). However, we usually do not spend all the money at once, and on average over the period on our account always has some amount. This gives the possibility of commercial banks to partially use our money for loans to other businesses or consumers. Entering into the loan, these businesses or consumers receive money into your current account that can be used to pay for goods and services. That is in addition to our initial money, the Bank creates an additional amount of money. This process can be repeated, as the Bank where you opened your current account, get a loan, also can do such an operation. However, the ability of commercial banks to create money is not endless and largely depend on the volume of the monetary base, i.e. money created by the Central Bank.

On the other hand, the claim that the population will not feel the effect of the issue of money, is erroneous. Yes, it is true that the money issued by the Central Bank usually will not go directly to companies and consumers and fall in the commercial banks, which, in turn, have the opportunity to increase lending to the real sector. The more liquidity flows into the banking system, the more affordable and accessible is a credit to enterprises and households (this is not always the case, about possible problems in the following paragraph). Accordingly, increasing the quantity of money in circulation and the demand for goods and services. If the economy is at full employment, this increase in demand will only lead to higher inflation. However, in a recession, so the soft monetary policy may mitigate the fall of output and reduce unemployment without strong inflationary effect.

"It is not necessary to print a lot of money because we spend and will have to give our children"In this statement there is a confusion between two different concepts: money and debt. In the modern economy, almost any debt (mortgage or consumer loan, the issuance of government bonds, or payment in the restaurant by credit card) is associated with money. However, debt is not money. We can borrow from a neighbor a bottle of vodka with the obligation to return it in a week, along with butterscotch as interest. In this case there is debt, but no money. Conversely, when we pay for a bottle of vodka in the store in rubles in cash, the payment involved money, but no debt arises for us or our children do not need to return this bottle to the store in a week or in 20 years.

When we spend money in the store or in the restaurant, they just change their owner, but do not disappear. Shop or restaurant will be able to use the ruble for the purchase of new semi-processed or for remuneration. The waiter from the restaurant will pay this ruble purchase of a bouquet of flowers for his girlfriend and so on. So the whole country will not be able to spend the money in circulation.

On the other hand, if our government borrows from other countries to pay current expenses, in 20 years the debt can be a serious burden for the budget, forcing the government to raise taxes, and our children pay for us. In this case, can really be the problem described in the statement, but it is not directly related to money or monetary policy.

"The United States was able to deceive all economic laws, printing money on the conveyor and there is not much suffering from inflation. All global economic processes revolve in dollars, without the dollar, everything will collapse. The demand balances the huge offer that is thrown does not stop operation of the printing press. You can not say about the ruble"In this statement there are several points that are worth paying attention to.

First, the US dollar really is the global reserve currency, but the impact on monetary policy and inflation in the United States are greatly exaggerated. The status of reserve currency means that Central banks and governments of other countries can hold this currency in large amounts as an official reserve and use it for international payments. According to the IMF, currently about 62% of official reserves in the world, the currency of which is known, is denominated in US dollars (this is about 3.8 trillion). Commercial banks, financial companies, enterprises and the population in other countries also have a considerable volume of dollars and dollar deposits. The status of a global reserve currency gives the US a slight advantage on the international capital markets associated with the ability to borrow debt at cheaper rates than those at which the United States lends to other countries (in the economic literature this is called the "exorbitant privilege"). Evaluations of this advantage vary and are highly dependent on the data used.

However, the status of global reserve currency has no significant impact on monetary policy of the States, which is focused on maintaining low and stable inflation, full employment and stability of the banking and financial system in the country. Of course, additional demand for US dollars as reserves (in the form of cash and deposits in Central and commercial banks of America) from other countries allows the Federal reserve to print more money. However, this additional demand is negligible compared to the demand for U.S. dollars in the country and, accordingly, has no serious influence on decisions in the sphere of monetary policy. Moreover, the fact that the US quite successfully cope with the task of maintaining low inflation and currency stability, allows their dollar to maintain its status as the global reserve currency. Any attempts of uncontrolled use of such benefits can lead to its loss.

Second, U.S. monetary policy in recent years is not contrary to economic laws. On the contrary, their clear understanding softened the consequences of the most serious since the great depression financial crisis of 2008. As I mentioned earlier, the money supply is created not only by the Central Bank in the form of emission of currency and the increase in commercial banks ' reserves accounts at the Central Bank, but largely by commercial banks in the process of lending to the real sector. After the financial crisis engulfed the US financial system in 2008, the lending process, banks sharply tightened. In conditions of high uncertainty and financial problems, banks significantly tightened the requirements to the debtors. In addition, in connection with the fall in the value of real estate and shares (which act as collateral for credit) has sharply increased the debt burden on the population and businesses, which led to a decline in demand for loans. The risk of a contraction in the money supply and aggregate demand, the Federal reserve has responded to unprecedented quantitative easing program related to the redemption of long-term securities (lowering the nominal interest rate virtually to the zero level was insufficient). This has led to a significant expansion of the monetary base (in the period from 2008 to 2014, it has increased 4.5 times). However, commercial banks are reluctant to increase lending to the economy, and all this additional issue has basically gone in the US economy or to other countries, and in reserves of us commercial banks in the accounts of the Federal reserve. From 2008 to 2014, the money supply (measured by M2 aggregate) increased by only half. For comparison, in Russia the monetary aggregate M2 over the same period increased more than twice. According to many economists, this unprecedented soft monetary policy has helped to support aggregate demand for goods and services and strongly mitigated the impact of financial crisis on the real economy.

And third, differences between the effectiveness of monetary policy in the United States and Russia is largely due to the structural differences of these two economies. Unlike USA, Russia is a more open economy — most of the goods we consume are imported. The prices of imported goods depend heavily on the exchange rate. The soft monetary policy (printing of money) usually leads to the depreciation of the national currency, and, consequently, to a rise in import prices and higher inflation. In addition, Russia, like other countries with developing markets exposed to currency crises. A sharp outflow of international capital or a significant drop in oil prices usually leads to the devaluation of the ruble and the decline in aggregate demand, output and employment. And there is a conflict between the objectives of monetary policy. On the one hand, the Bank of Russia seeks to bolster the ruble and maintain low inflation through tight monetary policy, that is, by raising interest rates and reducing money supply. On the other, there is a need to combat the recession using monetary policy. At the same time to achieve low inflation and a slight drop in output in such conditions is impossible. Therefore, in Russia and in other developing countries during crises, the inflation rate usually increases, and the Central banks of these countries often tighten the monetary policy. On the contrary, in many developed countries like USA, UK or Japan, during crises there is deflation and the Central banks of these countries print more money.

Source: theoryandpractice.ru

House on the island — the advantages of provincial life

Learn how to diversify Your menu with 3 dishes from fancy flours