1459

Gold bullion from the United States contain tungsten!

Very similar to what a private bank "Fed" (Federal Reserve) has managed to steal nearly all the gold from the US Treasury. And now they are trying to shut the mouths of all the loud and prevent investigation of this crime ...

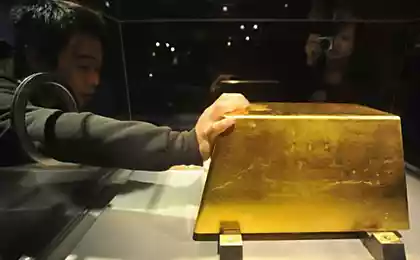

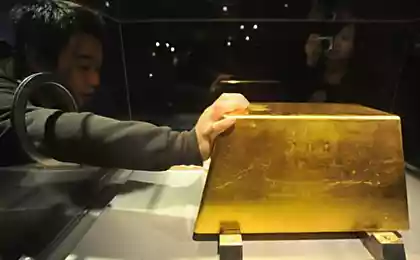

In October 2009, the US Treasury from the store, located at Fort Knox, went to China a party of gold bullion. Countries regularly shipped and get gold to pay off debts and even out the balance of trade. Most of the world's gold is exchanged and stored in depositories under the supervision of a special organization - the Association of London Bullion Market (London Bullion Market Association - LBMA).

When the party was received, the Chinese government ordered a special audit of purity and weight of gold bullion, as China - the largest foreign holder of US Treasury securities. Chinese officials were shocked when it turned out that the bars were fake. The party consisted of bars of tungsten coated with a thin layer of real gold. These proven "gold" bars were manufactured in the USA and kept in Fort Knox for many years.

The Chinese government immediately launched an investigation and make a statement which alluded to the machinations of the American government. The registration number of the party bars indicate that the fake ingots were obtained from the banks of the Federal Reserve during the Clinton administration. It was then commissioned by the Federal Reserve bankers were produced anywhere from 1, 3 to 1, 5 million of tungsten bars weighing 400 ounces. 640,000 of these tungsten tiles were covered with gold and sent to Fort Knox, where they remain to this day.

According to the Chinese investigation, the balance of these 1, 3-1, 5 million of tungsten bars weighing 400 ounces and was covered with gold and then sold on the international market. Not only that, the gold reserves of the United States got a fake gold, but the world market was also deceived by the bankers of the Federal Reserve, and the Clintons. The value of gold Clinton scam is neither more nor less - $ 600 billion.

An article in the "New York Post" on February 2, 2004, entitled "The district attorney is investigating the actions of the head of the New York Mercantile Exchange," pointed out that the gold scam Clinton come to the attention of American officials. Article written by Jennifer Anderson, reported that "the highest official of the New York Mercantile Exchange is under investigation conducted by the district attorney in Manhattan. Sources close to the exchange said that last week, Stuart Smith, senior vice president of operations at the exchange, the district prosecutor's office was searched. Details of the investigation were not disclosed, but a spokeswoman said the exchanges that it was not related to any stock exchange transactions. She declined to comment further, saying only that the charges have not been filed. A spokeswoman for the district attorney's office in Manhattan, also declined to comment ... »

Office of the Senior Vice President of Operations of the New York Mercantile Exchange (NYMEX), this is the place where you would go to find the reports [registration number and origin] for each gold bullion ever physically passes through stock transactions. They are obliged to keep records of each ingot. These accurate reports would indicate the origin of all physical gold, have hit the market, and therefore would reveal how much gold has appeared on the stock exchange is not of gold mining companies, simply because the amount of gold that came from "smelters" undoubtedly would exceed the number of physically produced American precious metal.

Why tungsten was used?

To print counterfeit money, you should have a special paper, or notes can be easily identified Spetspribor, which are widely used by banks and trading companies. Similarly, if you are going to rig the gold bullion, you should make sure that they had the properties and the weight of the gold.

The problem of good manufacturing forged ingot is that gold has a very high density, denser than lead almost doubled in two and a half times as dense as steel. You usually do not notice this because small gold rings, etc. weigh too little to make a difference in the density became obvious, but if you ever were holding a bar of gold, you might feel it's absolutely unmistakable: a gold bar is very, very difficult.

Standard gold bar trading between banks, known as the "London bullion reliable supply» («London good delivery bar»), weighs 400 ounces (more than 33 pounds) (about 12, 5 kg, translator's note), has the size of a small book in paperback. An ingot steel of the same size would weigh only 13, 5 lbs.

There are very few metals that have the same greater density as gold and, with two exceptions, they are more expensive than it. The first exception - depleted uranium, which is cheap, if you - the government, but it is very difficult to achieve for privateers. In addition, it is radioactive, which can also be a problem.

The second exception - tungsten. Tungsten - much cheaper than gold, but the density had almost the same difference - three tenths. The main differences - different color, and a lot of great toughness. Pure gold is relatively soft metal, you can scratch it with your fingernail.

Classy forged "gold" bullion should be fully consistent with this color, hardness, density, chemical, and physical properties. To do so, you must have a tungsten preform with dimensions of less than 1/8 inch (in all three dimensions) than the gold bar, then put on it a layer of real gold thickness of 1/16 inch. In the hands of such an ingot I would feel like this. On it would be stamped sample, chemical analysis showed to the gold and he would weigh exactly the same as a real gold bar weighs.

Today, the Fort Knox is still kept the "gold" bars Clinton, and even today they continue to spread throughout the world as the gold is circulated between countries to pay debts and to settle the so-called balance of trade.

Involuntarily the question arises: why Hillary Clinton took up the work of the Secretary of State?

Why not? Nobody is going to intervene or to question the actions of the Secretary of State of the United States. Why take the blows and the fire of criticism as president, when you can travel the world using US taxpayer dollars?

Carry any contraband gold and anything from the United States, using the diplomatic plane free. Move real gold stolen anywhere around the world. Be the first to be informed of any investigation in relation to the manufacture and distribution of fake gold and then immediately kill this investigation.

If you ever wanted to become a big mafia boss, the Secretary of State - is a job where you need to keep track of your syndicate. Do you think Richard Nixon's criminal ...

Fed admitted: "Gold we have».

The following dialogue between Congressman Ron Paul (R-TX) and a representative of the Fed's Scott Alvarez leaves no shadow of doubt that the Federal Reserve no gold for the US dollar. Most people who use alternative news sources, suspected it before, but now it's - fact.

The Federal Reserve does not own any gold at all. We do not own gold from 1934, so we did not participate in any transactions with gold ...

That reflected on our balance sheet - a gold certificates ... Until 1934, the Federal Reserve held the gold. We passed it, according to the law, the Treasury, and received in return the gold certificates. The relationship between the Federal Reserve, the US Treasury, and these non-tradable gold certificates are not clear, but goldnews.com tried to explain what is really happening:

In any case, we can analyze the main facts and come to certain conclusions:

1. The widespread perception that the Fed owns gold - is false. The investigation of this representation - misconception that the Fed downplays gold holdings on its balance sheet, reporting only gold certificates at the statutory price 42, $ 22. US gold stock, multiplied by the market price of gold, the Fed does not actually belong to, except that if the Treasury would default, but in this case, not everything is clear. Fed really owns the debt to total, $ 11, 1 billion, and it has a small chance to rise significantly in price if the Treasury revalue its gold and continue the practice begun by the law on modifications Nominal value.

2. The fact that the Fed has neither gold nor claims any gold, means that the dollar lacks any provision, apart from the building and equipment of the Fed's. Dollars are worth a lot less than most people think, and the Fed, with all his skill, much more helpless in the use of assets and conducting monetary policy in general. In general, the explanation of Álvarez enhances confidence in the high dollar value of gold.

An interesting prospect, and if this is true, then we can assume that the purchasing power of the dollar in terms of gold, much smaller than commonly thought, actually close to zero.

Our currency is not only not backed by gold, but in the case of the dollar, "Meltdown", only the assets that provide the world's reserve currency will remain worthless toxic mortgages purchased by the Federal Government in recent years from the insolvent banking institutions.

The only thing holding the dollar at this point is confidence in the market. When it is gone, everything else will go with it ...

Source: ru-an.info

In October 2009, the US Treasury from the store, located at Fort Knox, went to China a party of gold bullion. Countries regularly shipped and get gold to pay off debts and even out the balance of trade. Most of the world's gold is exchanged and stored in depositories under the supervision of a special organization - the Association of London Bullion Market (London Bullion Market Association - LBMA).

When the party was received, the Chinese government ordered a special audit of purity and weight of gold bullion, as China - the largest foreign holder of US Treasury securities. Chinese officials were shocked when it turned out that the bars were fake. The party consisted of bars of tungsten coated with a thin layer of real gold. These proven "gold" bars were manufactured in the USA and kept in Fort Knox for many years.

The Chinese government immediately launched an investigation and make a statement which alluded to the machinations of the American government. The registration number of the party bars indicate that the fake ingots were obtained from the banks of the Federal Reserve during the Clinton administration. It was then commissioned by the Federal Reserve bankers were produced anywhere from 1, 3 to 1, 5 million of tungsten bars weighing 400 ounces. 640,000 of these tungsten tiles were covered with gold and sent to Fort Knox, where they remain to this day.

According to the Chinese investigation, the balance of these 1, 3-1, 5 million of tungsten bars weighing 400 ounces and was covered with gold and then sold on the international market. Not only that, the gold reserves of the United States got a fake gold, but the world market was also deceived by the bankers of the Federal Reserve, and the Clintons. The value of gold Clinton scam is neither more nor less - $ 600 billion.

An article in the "New York Post" on February 2, 2004, entitled "The district attorney is investigating the actions of the head of the New York Mercantile Exchange," pointed out that the gold scam Clinton come to the attention of American officials. Article written by Jennifer Anderson, reported that "the highest official of the New York Mercantile Exchange is under investigation conducted by the district attorney in Manhattan. Sources close to the exchange said that last week, Stuart Smith, senior vice president of operations at the exchange, the district prosecutor's office was searched. Details of the investigation were not disclosed, but a spokeswoman said the exchanges that it was not related to any stock exchange transactions. She declined to comment further, saying only that the charges have not been filed. A spokeswoman for the district attorney's office in Manhattan, also declined to comment ... »

Office of the Senior Vice President of Operations of the New York Mercantile Exchange (NYMEX), this is the place where you would go to find the reports [registration number and origin] for each gold bullion ever physically passes through stock transactions. They are obliged to keep records of each ingot. These accurate reports would indicate the origin of all physical gold, have hit the market, and therefore would reveal how much gold has appeared on the stock exchange is not of gold mining companies, simply because the amount of gold that came from "smelters" undoubtedly would exceed the number of physically produced American precious metal.

Why tungsten was used?

To print counterfeit money, you should have a special paper, or notes can be easily identified Spetspribor, which are widely used by banks and trading companies. Similarly, if you are going to rig the gold bullion, you should make sure that they had the properties and the weight of the gold.

The problem of good manufacturing forged ingot is that gold has a very high density, denser than lead almost doubled in two and a half times as dense as steel. You usually do not notice this because small gold rings, etc. weigh too little to make a difference in the density became obvious, but if you ever were holding a bar of gold, you might feel it's absolutely unmistakable: a gold bar is very, very difficult.

Standard gold bar trading between banks, known as the "London bullion reliable supply» («London good delivery bar»), weighs 400 ounces (more than 33 pounds) (about 12, 5 kg, translator's note), has the size of a small book in paperback. An ingot steel of the same size would weigh only 13, 5 lbs.

There are very few metals that have the same greater density as gold and, with two exceptions, they are more expensive than it. The first exception - depleted uranium, which is cheap, if you - the government, but it is very difficult to achieve for privateers. In addition, it is radioactive, which can also be a problem.

The second exception - tungsten. Tungsten - much cheaper than gold, but the density had almost the same difference - three tenths. The main differences - different color, and a lot of great toughness. Pure gold is relatively soft metal, you can scratch it with your fingernail.

Classy forged "gold" bullion should be fully consistent with this color, hardness, density, chemical, and physical properties. To do so, you must have a tungsten preform with dimensions of less than 1/8 inch (in all three dimensions) than the gold bar, then put on it a layer of real gold thickness of 1/16 inch. In the hands of such an ingot I would feel like this. On it would be stamped sample, chemical analysis showed to the gold and he would weigh exactly the same as a real gold bar weighs.

Today, the Fort Knox is still kept the "gold" bars Clinton, and even today they continue to spread throughout the world as the gold is circulated between countries to pay debts and to settle the so-called balance of trade.

Involuntarily the question arises: why Hillary Clinton took up the work of the Secretary of State?

Why not? Nobody is going to intervene or to question the actions of the Secretary of State of the United States. Why take the blows and the fire of criticism as president, when you can travel the world using US taxpayer dollars?

Carry any contraband gold and anything from the United States, using the diplomatic plane free. Move real gold stolen anywhere around the world. Be the first to be informed of any investigation in relation to the manufacture and distribution of fake gold and then immediately kill this investigation.

If you ever wanted to become a big mafia boss, the Secretary of State - is a job where you need to keep track of your syndicate. Do you think Richard Nixon's criminal ...

Fed admitted: "Gold we have».

The following dialogue between Congressman Ron Paul (R-TX) and a representative of the Fed's Scott Alvarez leaves no shadow of doubt that the Federal Reserve no gold for the US dollar. Most people who use alternative news sources, suspected it before, but now it's - fact.

The Federal Reserve does not own any gold at all. We do not own gold from 1934, so we did not participate in any transactions with gold ...

That reflected on our balance sheet - a gold certificates ... Until 1934, the Federal Reserve held the gold. We passed it, according to the law, the Treasury, and received in return the gold certificates. The relationship between the Federal Reserve, the US Treasury, and these non-tradable gold certificates are not clear, but goldnews.com tried to explain what is really happening:

In any case, we can analyze the main facts and come to certain conclusions:

1. The widespread perception that the Fed owns gold - is false. The investigation of this representation - misconception that the Fed downplays gold holdings on its balance sheet, reporting only gold certificates at the statutory price 42, $ 22. US gold stock, multiplied by the market price of gold, the Fed does not actually belong to, except that if the Treasury would default, but in this case, not everything is clear. Fed really owns the debt to total, $ 11, 1 billion, and it has a small chance to rise significantly in price if the Treasury revalue its gold and continue the practice begun by the law on modifications Nominal value.

2. The fact that the Fed has neither gold nor claims any gold, means that the dollar lacks any provision, apart from the building and equipment of the Fed's. Dollars are worth a lot less than most people think, and the Fed, with all his skill, much more helpless in the use of assets and conducting monetary policy in general. In general, the explanation of Álvarez enhances confidence in the high dollar value of gold.

An interesting prospect, and if this is true, then we can assume that the purchasing power of the dollar in terms of gold, much smaller than commonly thought, actually close to zero.

Our currency is not only not backed by gold, but in the case of the dollar, "Meltdown", only the assets that provide the world's reserve currency will remain worthless toxic mortgages purchased by the Federal Government in recent years from the insolvent banking institutions.

The only thing holding the dollar at this point is confidence in the market. When it is gone, everything else will go with it ...

Source: ru-an.info