492

The Euro is not working

Peter praet, chief economist and member of the Board of Directors of the ECB, presented to the public a presentation on what the regional economy the Euro has brought nothing but trouble.

Earlier this year, the ECB began the attraction of unprecedented generosity in the form of a quantitative easing programme worth 60 billion euros a month, and it was expected that it will continue until September 2016. Startled by what is happening in China, the European Central Bank said it may extend the expiration date.

Now Standard and Poor's warns or recommends — as you wish — that the ECB needs to double the amount of quantitative easing to 2.4 trillion euros and extend up to mid-2018. This requirement is not surprising: despite a program of the ECB and negative Deposit rates, the stock price fell sharply, and the German DAX index lost 23% in six months.

Here comes Peter praet, chief economist and member of the Board of Directors of the ECB. At the BVI Asset Management conference in Germany he presented a striking presentation by showing several graphs, one sadder than the other, which suggests that the region's economy, the Euro has brought nothing but trouble.

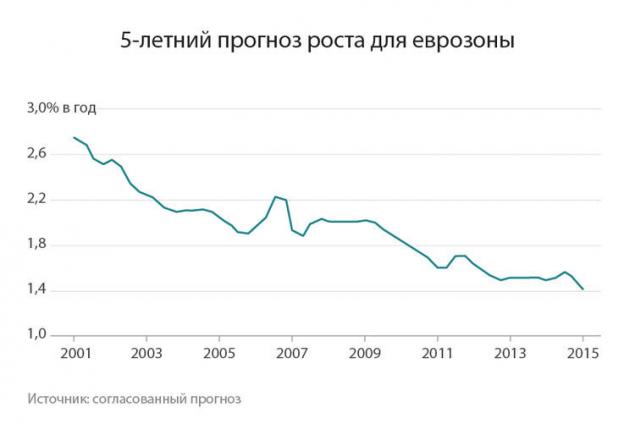

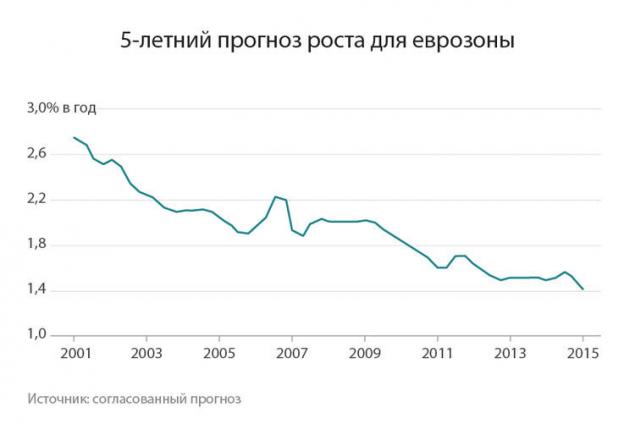

The following graph Prat shows how the expectations of economic growth for the next five years declined over a period of 15 years after the Euro:

And another picture in the genre of "hope versus reality": the growth, which economists expected from the private sector in October 2007. In the time available, no questions asked money were in abundance, even for Greece. And here's how that turned out — Greece mercy not illustrated in the figure, the corresponding curve would have broken this graph:

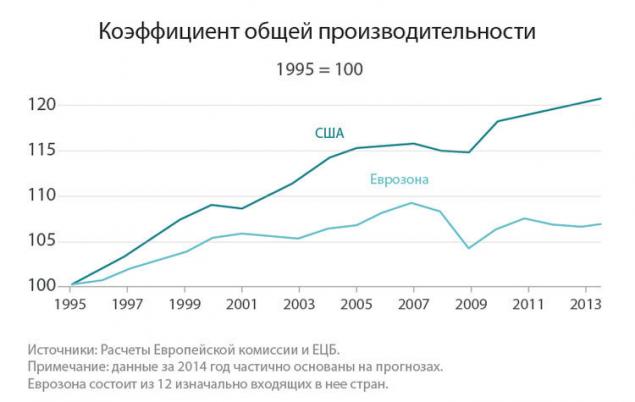

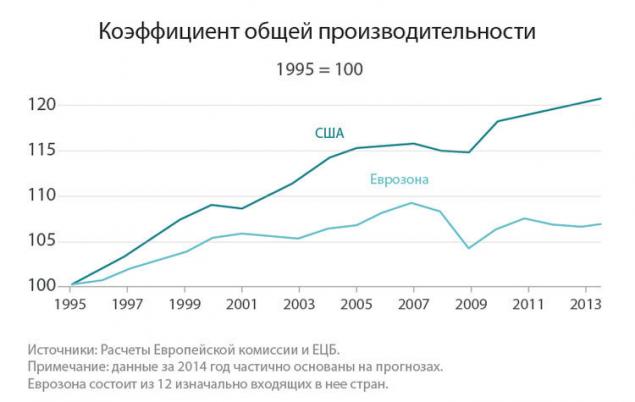

How deep is the current problem? Productivity growth suggests that the economy is dynamic in terms of technology, it is not in place. The following graph compares the performance in the US and the Eurozone over the past 20 years. The performance prior to the introduction of the Euro rose, but not as fast as in America. After entering the Euro, the growth stopped, and after the financial crisis, it has even decreased. Productivity in the Euro area lower than in 2007:

This is partly because a small investment in equipment. Despite the almost free loans and the abundance of liquidity, the company is not invested in productivity. In the newly formed Euro area and this figure was not so high, but in 2008, it just collapsed. Now investments are increasing gradually in Germany but in the Eurozone they are still on the decline. Let's see how deep failed Spain. Again, we are grateful that the chart is not Greece:

Bank credit to the private sector also fell sharply. What would banks do with their available liquidity, but in the form of loans outside the financial sector they do not produce. With one of the credit spectrum there was no demand for loans because the economy declined. On the other hand, those companies that loans were needed, the money is not received. In Spain the total volume of Bank loans began to decline in 2011, partly because bad loans were written off very slowly, and many of them still hang in the reporting of the banks and wait their fate.

The following graph, containing data for June 2015, it is shown that the volume of Bank loans rose slightly this year for the first time since 2011. Germany is limping, but is moving forward. Spain is still in the pit.

As a result, unemployment in some Eurozone countries has become an unavoidable catastrophe, and its figures reach 25% in Greece and 22% in Spain, and among young people it is twice these numbers. However, in Germany, Austria, Luxembourg and some other countries, unemployment is very low. Therefore, the average look much better than in "vulnerable countries" as the ECB calls Cyprus, Greece, Ireland, Spain, Italy, Portugal and Slovenia.

General unemployment remained in double digits. This area is now and France (10,5%). The masses of "discouraged workers", i.e. those who are willing to work, but after several years of trying to penetrate the head wall to stop searching for jobs, continue to grow:

And here is how the Eurozone was divided into two parts. On one side are countries that benefit from (relatively) hard currency; and on the other hand, countries like Greece, Spain, Italy and others, including France. The latter had always been the currency, as in banana republics, they often greatly devalued, to solve any of their fiscal and other problems, not getting rid of them actually. However, now that these countries can't devalue, they were "vulnerable". These two parts of the Eurozone are only removed from each other:

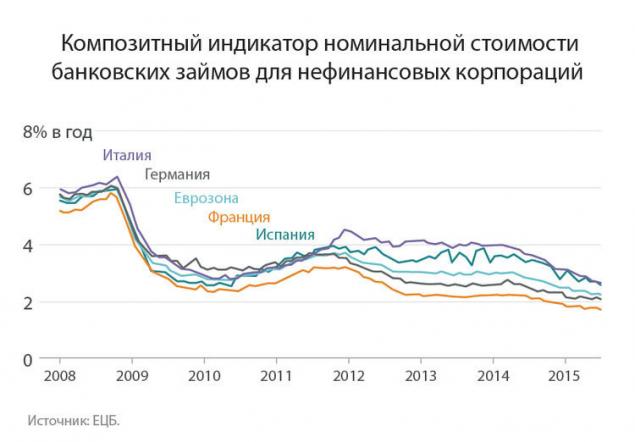

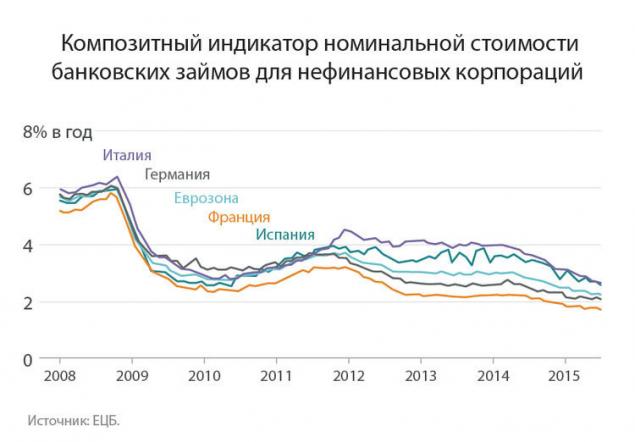

At the same time, the cost of Bank borrowing has never been lower than it is now. We expect that the ECB indicator of the total value of Bank borrowings based on interest rates on short - and long-term loans based on an average volume of new loans for 24 months until July 2015:

The volume of lending risk in "vulnerable countries" are now also at historic highs. In other words, attempts to twist the arms of banks to pour money into the economy, not hidden under the mattress, stopped, although lie under the mattress a huge amount. This graph is based on the "unbalanced sample" of the 32 Euro zone banks and shows the ratio of bad loans to the total volume.

These charts show that the Euro does not work in such different economic and political circumstances that "vulnerable countries" would feel better continuing to use their unreliable francs, Lira, pesos, etc., and that the devaluation and defaults of individual States as a whole would yield better results than the current circus paid for by the taxpayers activities redemption of debt and "strict economy." published

P. S. And remember, just changing your mind - together we change the world! ©

Join us in Facebook , Vkontakte, Odnoklassniki

Source: insider.pro/EN/article/47104/

Earlier this year, the ECB began the attraction of unprecedented generosity in the form of a quantitative easing programme worth 60 billion euros a month, and it was expected that it will continue until September 2016. Startled by what is happening in China, the European Central Bank said it may extend the expiration date.

Now Standard and Poor's warns or recommends — as you wish — that the ECB needs to double the amount of quantitative easing to 2.4 trillion euros and extend up to mid-2018. This requirement is not surprising: despite a program of the ECB and negative Deposit rates, the stock price fell sharply, and the German DAX index lost 23% in six months.

Here comes Peter praet, chief economist and member of the Board of Directors of the ECB. At the BVI Asset Management conference in Germany he presented a striking presentation by showing several graphs, one sadder than the other, which suggests that the region's economy, the Euro has brought nothing but trouble.

The following graph Prat shows how the expectations of economic growth for the next five years declined over a period of 15 years after the Euro:

And another picture in the genre of "hope versus reality": the growth, which economists expected from the private sector in October 2007. In the time available, no questions asked money were in abundance, even for Greece. And here's how that turned out — Greece mercy not illustrated in the figure, the corresponding curve would have broken this graph:

How deep is the current problem? Productivity growth suggests that the economy is dynamic in terms of technology, it is not in place. The following graph compares the performance in the US and the Eurozone over the past 20 years. The performance prior to the introduction of the Euro rose, but not as fast as in America. After entering the Euro, the growth stopped, and after the financial crisis, it has even decreased. Productivity in the Euro area lower than in 2007:

This is partly because a small investment in equipment. Despite the almost free loans and the abundance of liquidity, the company is not invested in productivity. In the newly formed Euro area and this figure was not so high, but in 2008, it just collapsed. Now investments are increasing gradually in Germany but in the Eurozone they are still on the decline. Let's see how deep failed Spain. Again, we are grateful that the chart is not Greece:

Bank credit to the private sector also fell sharply. What would banks do with their available liquidity, but in the form of loans outside the financial sector they do not produce. With one of the credit spectrum there was no demand for loans because the economy declined. On the other hand, those companies that loans were needed, the money is not received. In Spain the total volume of Bank loans began to decline in 2011, partly because bad loans were written off very slowly, and many of them still hang in the reporting of the banks and wait their fate.

The following graph, containing data for June 2015, it is shown that the volume of Bank loans rose slightly this year for the first time since 2011. Germany is limping, but is moving forward. Spain is still in the pit.

As a result, unemployment in some Eurozone countries has become an unavoidable catastrophe, and its figures reach 25% in Greece and 22% in Spain, and among young people it is twice these numbers. However, in Germany, Austria, Luxembourg and some other countries, unemployment is very low. Therefore, the average look much better than in "vulnerable countries" as the ECB calls Cyprus, Greece, Ireland, Spain, Italy, Portugal and Slovenia.

General unemployment remained in double digits. This area is now and France (10,5%). The masses of "discouraged workers", i.e. those who are willing to work, but after several years of trying to penetrate the head wall to stop searching for jobs, continue to grow:

And here is how the Eurozone was divided into two parts. On one side are countries that benefit from (relatively) hard currency; and on the other hand, countries like Greece, Spain, Italy and others, including France. The latter had always been the currency, as in banana republics, they often greatly devalued, to solve any of their fiscal and other problems, not getting rid of them actually. However, now that these countries can't devalue, they were "vulnerable". These two parts of the Eurozone are only removed from each other:

At the same time, the cost of Bank borrowing has never been lower than it is now. We expect that the ECB indicator of the total value of Bank borrowings based on interest rates on short - and long-term loans based on an average volume of new loans for 24 months until July 2015:

The volume of lending risk in "vulnerable countries" are now also at historic highs. In other words, attempts to twist the arms of banks to pour money into the economy, not hidden under the mattress, stopped, although lie under the mattress a huge amount. This graph is based on the "unbalanced sample" of the 32 Euro zone banks and shows the ratio of bad loans to the total volume.

These charts show that the Euro does not work in such different economic and political circumstances that "vulnerable countries" would feel better continuing to use their unreliable francs, Lira, pesos, etc., and that the devaluation and defaults of individual States as a whole would yield better results than the current circus paid for by the taxpayers activities redemption of debt and "strict economy." published

P. S. And remember, just changing your mind - together we change the world! ©

Join us in Facebook , Vkontakte, Odnoklassniki

Source: insider.pro/EN/article/47104/

As the struggle with waste in different cities around the world

The right blender — your faithful assistant in the kitchen