239

How to cheat foreigners in Europe

First, briefly (for those who love quickly and on the job): You have made a purchase and want to pay with a card. They're handing you a terminal. The amount in euros is visible at the terminal. You insert a card, enter a PIN. The terminal connects to the bank, after which a certain amount in rubles or dollars is displayed on the screen, and below two buttons: “OK” and “EUR”. If the terminal is still in your hands, always press “EUR”! Below explain why, for now just trust that it will save you 3 to 10 percent of the purchase price.

It happens that the seller immediately takes the terminal back. In that case, it makes sense to say, "In euro, please." After payment, check again the copy of the receipt for payment by card: the amount on it must be in euros.

Now long and detailed:

Many of us have confidence that if you pay with a card for a purchase of 100 rubles, then exactly 100 rubles will be written off from the card, and not a penny more. Generally speaking, it is. The very idea of plastic cards implies that the cardholder should not overpay for their purchases, otherwise everyone would only use cash.

Wait, how do banks, Visa and Mastercard make money? And they make money mainly on the seller. With each transaction on the card, the store or cafe pays about a couple of percent for acquiring, and with small amounts it happens more if the bank has set a minimum commission threshold.

In general, banks take their share from sellers, and your bank, of course, it is beneficial that you pay with a card everywhere. Many of them are even willing to share their commission with us in the form of cashback, miles and bonuses, as long as we pay through them more often, and less often directly – in cash.

But are sellers happy with this state of affairs? Of course not! And in addition to the banal “do not accept cards”, they find a lot of ways to reduce money losses, but avoid losing customers:

Accept cards only when the purchase amount is above a certain threshold, say 5 or 10 euros.

Accept only local cards issued within the country. In many countries, only international transactions are made through the Visa and Mastercard, and local payments are made domestically, with less or no fees. As a result, the outlet will be more profitable if it is paid with a local card, not a foreign one. Therefore, many shops and gas stations in Portugal, for example, or the Netherlands, accept only local cards, and this is logical.

But then there is a new topic of how to make foreign cards not just profitable, but super profitable: currency conversion on the side of the acquiring bank at a knowingly inflated rate.

What's the trick? Let's say I pay a check for 100 euros at the store. My account is in rubles, for example. Who will convert these 100 euros into rubles to debit them from my account? My bank usually does that. And I know how much I'm losing on this. If I pay with, say, a card of Alfa-Bank, then the conversion will take place at their internal rate, that is, with a loss of about two percent against the Central Bank. That’s a lot for me, so I started using euro accounts at Alpha to avoid this conversion altogether. For rubles, I got a map of “Maize” where the conversion is strictly at the exchange rate of the Central Bank, without additional commissions. It is very convenient and profitable to pay from a ruble account any foreign currency purchases. I recommend it, by the way. But I got distracted. What if the conversion happens not in my bank, but on the side of the outlet, or rather, its acquiring bank? Then the exchange of euros for rubles will take place at the rate of a bank unknown to me. Do you think it's profitable? Of course not! Losses on such conversion reach up to 10 (ten!) percent of the amount. It could not be profitable, not for this they tried not to save us our penny, but on the contrary, it is relatively honest to appropriate it. I have never seen a single case where I have been offered a normal course, with losses ranging from a few percent to ten percent or more. Conclusion: All this is divorce and profanation.

The sad thing is that now this technology has literally conquered Europe, and not only souvenir shops for tourists use it, but more than serious companies: hypermarkets, gas station chains, hotels, airlines. . .

I once brought to a frank conversation an employee of the rental office, who wrote off 150 euros in rubles. Well, like a Russian card, so rubles. The fact that I have an account in euros does not concern them. You should ask. And it turned out that they wrote off rubles at their exchange rate, and Alfa Bank then transferred these rubles back to euros, as a result, two conversions, and minus ten euros for nothing. Well, I, of course, let's talk to her heart-to-heart, and as a result, she admitted that they (attention!) the management told them to do this always, without even asking customers. Can you guess why? And because the acquiring bank for this office makes more favorable conditions for commission on those operations that are carried out with conversion at the acquirer rate.

I suspect that this applies to almost all offices where bank cards are accepted. Having such different conditions, they are tempted to save commission at the expense of the client. Some do not give in to it, and honestly conduct operations in euros. Some convert without demand. And many offer customers to decide for themselves, still half of the customers decide in favor of the seller out of ignorance. Well, you know now, don't you?

Specific examples? Please!

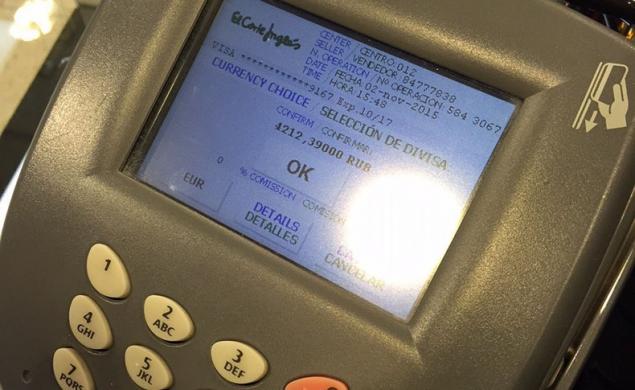

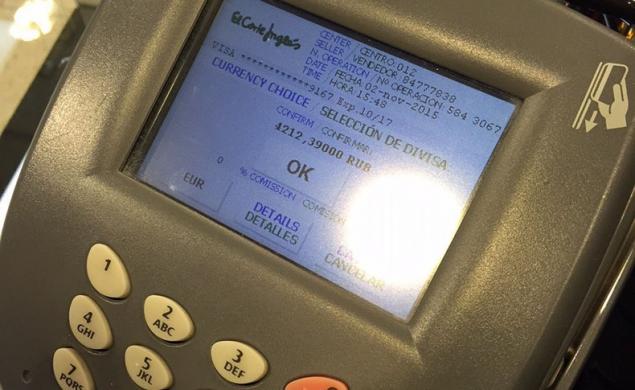

Here, for example, in the top photo was the terminal of the famous network in Spain El Corte Ingles. They wanted to charge me 4212.39 rubles for a purchase of 57 euros. Their rate is 73.90. Central Bank's rate is 70.75. 5 percent loss.

Keep going. You know Ryanair? Did you notice that as soon as you enter your card details, the cost of tickets magically turns from euros into dollars? This is also the same conversion. They see that the card is not European, so they convert the amount into bucks. Why not in rubles? Why in dollars? Don't you care? I dare say that they do not care what to convert into – the main thing is that the conversion operation itself took place, Ryanair earns an additional 7%. And there you need to manage to find this tick to pay tickets in euros. Few people find it.

And here's the ATM for you. I'm asking him to give me 100 euros. I enter the amount, enter the PIN, and then they offer me the deal of the century: write off from my card not 100 euros in euros, but 7682 rubles. At 70.14, yeah. How much percentage does it get? Ten? Holy shit. Denial!

Conclusions:

If you in Europe at the time of payment with a card offer instead of euros payment in rubles or dollars - feel free to refuse. You can not even double-check the courses, I assure you, no matter how greedy your bank was, it will still convert more profitable at times.

If you suddenly see in the check not the euro, but something else, then this is a reason for investigation. In the case of a large sum (as was the case with those 150 euros), I simply ask to cancel the operation to pay in cash. They can easily do this even if it has been approved. It is easier to score on small checks, of course, but it is still a shame, especially when asked to do it in euros. To someone I say ay-yay-yay, and somewhere I just leave: silently, but without a tip.

Even if you’re debited in euros, you’re still likely to lose one to two percent on your bank conversion. This is no longer a horror-horror, but you can also avoid: either start an account in euros or a corn card. I have been using it for six months, checked everything, fantastic, but it really works as stated - exactly at the exchange rate of the Central Bank.

Author: Oleg Radul P.S. And remember, just by changing our consumption, we change the world together! © Join us on Facebook , VKontakte, Odnoklassniki

Source: www.facebook.com/notes/%D0%BE%D0%BB%D0%B5%D0%B3-%D1%80%D0%B0%B0%B4%D1%83%D0%BB/%D0%BA%D0%D0%B0%B0%D0%B0%B4%D1%83%D0%B0%D0%B0%B0%D1%8E%D1%82-%D0%B0%B0%D0%D0%D0%D0%B0%D0%D0%D0%D%D1%D1%81%D1%D1%D1%D1%81%D1%D1%D1%82%D0%D0%D1%D1%D1%D1%81%D0%D1%D1%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D1%81%D0%D0%B0%D0%D0%B0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D%D%D0%D0%D%D0%D0%D%D

It happens that the seller immediately takes the terminal back. In that case, it makes sense to say, "In euro, please." After payment, check again the copy of the receipt for payment by card: the amount on it must be in euros.

Now long and detailed:

Many of us have confidence that if you pay with a card for a purchase of 100 rubles, then exactly 100 rubles will be written off from the card, and not a penny more. Generally speaking, it is. The very idea of plastic cards implies that the cardholder should not overpay for their purchases, otherwise everyone would only use cash.

Wait, how do banks, Visa and Mastercard make money? And they make money mainly on the seller. With each transaction on the card, the store or cafe pays about a couple of percent for acquiring, and with small amounts it happens more if the bank has set a minimum commission threshold.

In general, banks take their share from sellers, and your bank, of course, it is beneficial that you pay with a card everywhere. Many of them are even willing to share their commission with us in the form of cashback, miles and bonuses, as long as we pay through them more often, and less often directly – in cash.

But are sellers happy with this state of affairs? Of course not! And in addition to the banal “do not accept cards”, they find a lot of ways to reduce money losses, but avoid losing customers:

Accept cards only when the purchase amount is above a certain threshold, say 5 or 10 euros.

Accept only local cards issued within the country. In many countries, only international transactions are made through the Visa and Mastercard, and local payments are made domestically, with less or no fees. As a result, the outlet will be more profitable if it is paid with a local card, not a foreign one. Therefore, many shops and gas stations in Portugal, for example, or the Netherlands, accept only local cards, and this is logical.

But then there is a new topic of how to make foreign cards not just profitable, but super profitable: currency conversion on the side of the acquiring bank at a knowingly inflated rate.

What's the trick? Let's say I pay a check for 100 euros at the store. My account is in rubles, for example. Who will convert these 100 euros into rubles to debit them from my account? My bank usually does that. And I know how much I'm losing on this. If I pay with, say, a card of Alfa-Bank, then the conversion will take place at their internal rate, that is, with a loss of about two percent against the Central Bank. That’s a lot for me, so I started using euro accounts at Alpha to avoid this conversion altogether. For rubles, I got a map of “Maize” where the conversion is strictly at the exchange rate of the Central Bank, without additional commissions. It is very convenient and profitable to pay from a ruble account any foreign currency purchases. I recommend it, by the way. But I got distracted. What if the conversion happens not in my bank, but on the side of the outlet, or rather, its acquiring bank? Then the exchange of euros for rubles will take place at the rate of a bank unknown to me. Do you think it's profitable? Of course not! Losses on such conversion reach up to 10 (ten!) percent of the amount. It could not be profitable, not for this they tried not to save us our penny, but on the contrary, it is relatively honest to appropriate it. I have never seen a single case where I have been offered a normal course, with losses ranging from a few percent to ten percent or more. Conclusion: All this is divorce and profanation.

The sad thing is that now this technology has literally conquered Europe, and not only souvenir shops for tourists use it, but more than serious companies: hypermarkets, gas station chains, hotels, airlines. . .

I once brought to a frank conversation an employee of the rental office, who wrote off 150 euros in rubles. Well, like a Russian card, so rubles. The fact that I have an account in euros does not concern them. You should ask. And it turned out that they wrote off rubles at their exchange rate, and Alfa Bank then transferred these rubles back to euros, as a result, two conversions, and minus ten euros for nothing. Well, I, of course, let's talk to her heart-to-heart, and as a result, she admitted that they (attention!) the management told them to do this always, without even asking customers. Can you guess why? And because the acquiring bank for this office makes more favorable conditions for commission on those operations that are carried out with conversion at the acquirer rate.

I suspect that this applies to almost all offices where bank cards are accepted. Having such different conditions, they are tempted to save commission at the expense of the client. Some do not give in to it, and honestly conduct operations in euros. Some convert without demand. And many offer customers to decide for themselves, still half of the customers decide in favor of the seller out of ignorance. Well, you know now, don't you?

Specific examples? Please!

Here, for example, in the top photo was the terminal of the famous network in Spain El Corte Ingles. They wanted to charge me 4212.39 rubles for a purchase of 57 euros. Their rate is 73.90. Central Bank's rate is 70.75. 5 percent loss.

Keep going. You know Ryanair? Did you notice that as soon as you enter your card details, the cost of tickets magically turns from euros into dollars? This is also the same conversion. They see that the card is not European, so they convert the amount into bucks. Why not in rubles? Why in dollars? Don't you care? I dare say that they do not care what to convert into – the main thing is that the conversion operation itself took place, Ryanair earns an additional 7%. And there you need to manage to find this tick to pay tickets in euros. Few people find it.

And here's the ATM for you. I'm asking him to give me 100 euros. I enter the amount, enter the PIN, and then they offer me the deal of the century: write off from my card not 100 euros in euros, but 7682 rubles. At 70.14, yeah. How much percentage does it get? Ten? Holy shit. Denial!

Conclusions:

If you in Europe at the time of payment with a card offer instead of euros payment in rubles or dollars - feel free to refuse. You can not even double-check the courses, I assure you, no matter how greedy your bank was, it will still convert more profitable at times.

If you suddenly see in the check not the euro, but something else, then this is a reason for investigation. In the case of a large sum (as was the case with those 150 euros), I simply ask to cancel the operation to pay in cash. They can easily do this even if it has been approved. It is easier to score on small checks, of course, but it is still a shame, especially when asked to do it in euros. To someone I say ay-yay-yay, and somewhere I just leave: silently, but without a tip.

Even if you’re debited in euros, you’re still likely to lose one to two percent on your bank conversion. This is no longer a horror-horror, but you can also avoid: either start an account in euros or a corn card. I have been using it for six months, checked everything, fantastic, but it really works as stated - exactly at the exchange rate of the Central Bank.

Author: Oleg Radul P.S. And remember, just by changing our consumption, we change the world together! © Join us on Facebook , VKontakte, Odnoklassniki

Source: www.facebook.com/notes/%D0%BE%D0%BB%D0%B5%D0%B3-%D1%80%D0%B0%B0%B4%D1%83%D0%BB/%D0%BA%D0%D0%B0%B0%D0%B0%B4%D1%83%D0%B0%D0%B0%B0%D1%8E%D1%82-%D0%B0%B0%D0%D0%D0%D0%B0%D0%D0%D0%D%D1%D1%81%D1%D1%D1%D1%81%D1%D1%D1%82%D0%D0%D1%D1%D1%D1%81%D0%D1%D1%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D1%81%D0%D0%B0%D0%D0%B0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D0%D%D%D0%D0%D%D0%D0%D%D