668

22.06. The pension system as a hostage

< 1889.

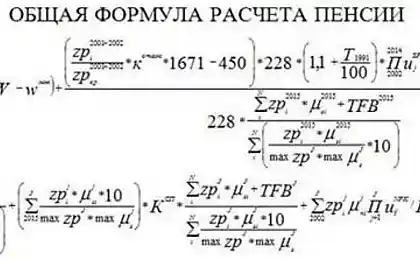

I want to say, sho If history teaches, it's what Shaw teaches nobody. Or almost none. And strongly characteristic proof - what happens with pension systems in most countries. Very developed - including. And even in the first place. It would seem, look through history. After all, when Guy Yulievich, peresekatel Rubicon and other water barriers, introduced (the first, probably in the world) war pensions system, it does not expect, how death is the cobblestones lie within a few hundred years hileyuschy budget Empire. Well, it was the first experience.

And when Germany in 1889 introduced the world's first system of pensions for age, no one imagined how much saliva will fly to address dozens of governments of its citizens in a hundred-odd years. Since the intentions were good - social and financial protection of citizens.

The rights to a pension in the new system based on contributions previously paid. Denmark (1891) and New Zealand (1898) introduced the pensioning system focused on targeted assistance to the poor. Here it is funded through general tax revenues.

In subsequent years, the majority of Western European countries formed the pension insurance system, focused on the German model; Anglo-Saxon countries (with the notable exception of the US) and the Nordic countries to a greater extent walked in the footsteps of Denmark and New Zealand. These systems solve different problems. The German has been focused on the preservation of the social status of working after retirement. Danish, subsequently introduced in England, -. On the poverty limit

In XX century, the gradual convergence of the pension systems of developed countries. Where they were based on insurance premiums (Germany), introduced a minimum pension guarantee, not dependent on previous contributions. In countries, the pension system is oriented to equal pensions funded from general revenues, budgets, canceled Control Means. In addition to a flat minimum pension introduced compulsory social insurance system (United Kingdom).

A characteristic feature of pension schemes - their political popularity in its infancy. This is understandable: retiring workers over the previous working life did not make full payments to those who provide them with pensions. They are net beneficiaries of the introduction of the pension system. The severity of the payment of pensions rests with the next generation of workers. However, for the young industrial society with limited share of older age groups, this does not cause serious political problems.

pension insurance system was introduced as a mechanism to ensure that the possibility of existence in the case of survival to age inoperable. In the United States at the time of its introduction, the majority of men over the age of 60 years were working. However, as is the case with many other major social innovation, she becomes a factor in reducing the level of employment in the retirement age. Among men aged 60 and older in 1900, 66% worked. In 1990, the figure was only 26%.

From 1950 to 1990 the age of retirement in most developed countries fell from 66 to 62 years. Factor participation in the workforce of persons aged 60-64 years in 1960 in Belgium, the Netherlands, France, exceeded 70%. By the mid-90s it was down to 20%.

Demographic projections suggest that in the period up to 2030 load of pensioners to working population developed countries is about double.

Since the beginning of the 1980s, when the crisis of pension systems has become apparent, the process of raising the retirement age (Germany, Greece, Italy, Portugal, UK), the minimum period of work required to obtain full pension (Germany, Greece, Italy), tightening conditions earlier pensioning (France, Germany). The ratio of the average pension to the salary was reduced by the introduction of more stringent indexing mechanisms (Austria, Finland, France, Germany, Greece, Italy, the Netherlands). There is a reduction of the period during which more long-term work includes increase in base future pension payments (Austria, Finland, France, Italy, the Netherlands, Portugal, United Kingdom), reduced pension benefits of employees in the public sector (Finland, Greece, Italy, Portugal).

And yet, in Germany payroll taxes make up 42% of its value, the public finances in a deep crisis. Germany can not lead the size of the budget deficit in line with the Maastricht criteria.

70-30 years ago, when the most developed countries of this world have formed their pension systems, it has a wide room for maneuver and could easily go the way of savings insurance, avoiding the occurrence of one of the most pressing economic and political problems faced by the end of XX - the beginning of XXI century.

Options? Chile - the country, the pension reform which marked the beginning of many years of debate on the desirability and feasibility of the transition to a funded pension insurance system. Here in 1970 the contribution rate of the distribution of the pension insurance system reached a high level and stimulate tax evasion. Since 1981, Chile switched to using a funded pension insurance system. Every employee contributes 10% of earnings on retirement savings account in his chosen fund. In addition, it was necessary to pay about 3% of earnings insurance in case of disability and loss of breadwinner, and to cover the administrative costs of the Fund. By the time of his retirement at the individual account accumulated amount provides an income in old age. By definition, the deficit of such a system is impossible

I want to say, sho If history teaches, it's what Shaw teaches nobody. Or almost none. And strongly characteristic proof - what happens with pension systems in most countries. Very developed - including. And even in the first place. It would seem, look through history. After all, when Guy Yulievich, peresekatel Rubicon and other water barriers, introduced (the first, probably in the world) war pensions system, it does not expect, how death is the cobblestones lie within a few hundred years hileyuschy budget Empire. Well, it was the first experience.

And when Germany in 1889 introduced the world's first system of pensions for age, no one imagined how much saliva will fly to address dozens of governments of its citizens in a hundred-odd years. Since the intentions were good - social and financial protection of citizens.

The rights to a pension in the new system based on contributions previously paid. Denmark (1891) and New Zealand (1898) introduced the pensioning system focused on targeted assistance to the poor. Here it is funded through general tax revenues.

In subsequent years, the majority of Western European countries formed the pension insurance system, focused on the German model; Anglo-Saxon countries (with the notable exception of the US) and the Nordic countries to a greater extent walked in the footsteps of Denmark and New Zealand. These systems solve different problems. The German has been focused on the preservation of the social status of working after retirement. Danish, subsequently introduced in England, -. On the poverty limit

In XX century, the gradual convergence of the pension systems of developed countries. Where they were based on insurance premiums (Germany), introduced a minimum pension guarantee, not dependent on previous contributions. In countries, the pension system is oriented to equal pensions funded from general revenues, budgets, canceled Control Means. In addition to a flat minimum pension introduced compulsory social insurance system (United Kingdom).

A characteristic feature of pension schemes - their political popularity in its infancy. This is understandable: retiring workers over the previous working life did not make full payments to those who provide them with pensions. They are net beneficiaries of the introduction of the pension system. The severity of the payment of pensions rests with the next generation of workers. However, for the young industrial society with limited share of older age groups, this does not cause serious political problems.

pension insurance system was introduced as a mechanism to ensure that the possibility of existence in the case of survival to age inoperable. In the United States at the time of its introduction, the majority of men over the age of 60 years were working. However, as is the case with many other major social innovation, she becomes a factor in reducing the level of employment in the retirement age. Among men aged 60 and older in 1900, 66% worked. In 1990, the figure was only 26%.

From 1950 to 1990 the age of retirement in most developed countries fell from 66 to 62 years. Factor participation in the workforce of persons aged 60-64 years in 1960 in Belgium, the Netherlands, France, exceeded 70%. By the mid-90s it was down to 20%.

Demographic projections suggest that in the period up to 2030 load of pensioners to working population developed countries is about double.

Since the beginning of the 1980s, when the crisis of pension systems has become apparent, the process of raising the retirement age (Germany, Greece, Italy, Portugal, UK), the minimum period of work required to obtain full pension (Germany, Greece, Italy), tightening conditions earlier pensioning (France, Germany). The ratio of the average pension to the salary was reduced by the introduction of more stringent indexing mechanisms (Austria, Finland, France, Germany, Greece, Italy, the Netherlands). There is a reduction of the period during which more long-term work includes increase in base future pension payments (Austria, Finland, France, Italy, the Netherlands, Portugal, United Kingdom), reduced pension benefits of employees in the public sector (Finland, Greece, Italy, Portugal).

And yet, in Germany payroll taxes make up 42% of its value, the public finances in a deep crisis. Germany can not lead the size of the budget deficit in line with the Maastricht criteria.

70-30 years ago, when the most developed countries of this world have formed their pension systems, it has a wide room for maneuver and could easily go the way of savings insurance, avoiding the occurrence of one of the most pressing economic and political problems faced by the end of XX - the beginning of XXI century.

Options? Chile - the country, the pension reform which marked the beginning of many years of debate on the desirability and feasibility of the transition to a funded pension insurance system. Here in 1970 the contribution rate of the distribution of the pension insurance system reached a high level and stimulate tax evasion. Since 1981, Chile switched to using a funded pension insurance system. Every employee contributes 10% of earnings on retirement savings account in his chosen fund. In addition, it was necessary to pay about 3% of earnings insurance in case of disability and loss of breadwinner, and to cover the administrative costs of the Fund. By the time of his retirement at the individual account accumulated amount provides an income in old age. By definition, the deficit of such a system is impossible

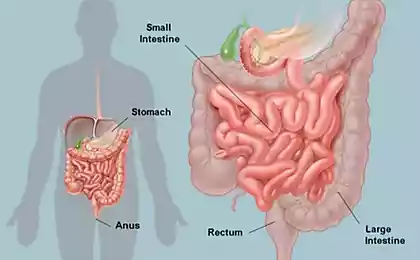

Dr. Walker: A quick and effective method of cleansing the body

In this hospital allowed cats and dogs to help their owners to recover