646

Japanese beer Kirin wants to become the all-Russian brand

Japanese beer wants to become a national brand

The exclusive distributor of Japanese brewer Kirin «Nord Winds Distribution" (NVD) is going in the next two to three years to bring its products to the federal level: now the company is working on the formation of nationwide distribution system flagship brand Kirin - Kirin Ichiban. Sales of the brand NVD plans to annually increase by half. The company explains such promising forecasts transfer of beer in licensed segment and, accordingly, in a more affordable price range. Increase sales through local production - a standard for the development of the logic of the beer market, however, as experts note, the Japanese brand will remain a niche.

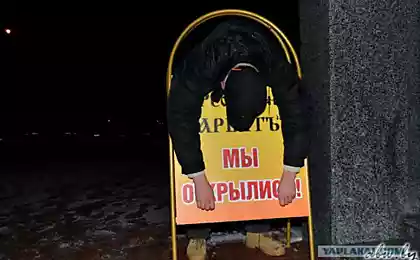

Theme: "Mass sumoshestvie and office hara-Kirin." Case Japanese beer Kirin Ichiban from R & I GROUP in Russia

Japanese Kirin beer sold in Russia since 2000. Last year, the European division of Kirin Brewery Company Limited in Europe - Kirin Europe GmbH - signed a license agreement with Kirin NVD for production in Russia. Now it uses the company's plant in Kaliningrad, AIT, which is part of Heineken Russia. According to brand manager of Kirin NVD Sergei Biryukov, the translation of beer in licensed segment will significantly reduce the price on the shelf with 70 rubles. (for a bottle of 0, 33 l) to 32 rubles. and to make beer more affordable. The high price of imported beers and enjoyed the geography of its sales, the lion's share of which are in Moscow and St. Petersburg. Now "Nord Winds Distribution" is actively expanding distribution of beer Kirin Ichiban and entering new markets, to then cover the whole of Russia. "The main driver of Japanese beer segment - the growing popularity of Japanese cuisine in Russia. In the next five years we intend to increase annual sales of Kirin Ichiban beer for at least 15 thousand. Hl ", - told RBC daily director of marketing NVD Edward Astapov.

Members of the beer market is not surprised by the plans Kirin: license segment increase capacity and affordability when compared with imported. "Now the market is increasingly growing two segments: super premium and discount, the latter, with a few exceptions such as domestic beer" Tinkoff "is just one of the licensed beer" - said the head of the press service of the company SUN InBev Alex Shavenzov. According to the director of public relations of Heineken Russia Anna Meleshina along the way proposed by Kirin, at one time held all the big foreign companies on the Russian market. "Imported beer is not competitive on price compared to licensing, so the big companies buy local plants or place orders for production in Russia," - said Ms. Meleshina.

Analyst IK "Finam" Sergey Phylchenkov believes that, in order to increase sales, the distributor must be prepared for additional costs for advertising and marketing, but in any case count on the tangible market share of the company is not: "In 2006, the Russian beer market was 968 million dal. By 2008, the market could reach 1.15 billion given. Thus, the company, if the implements its plans, it will take about 0, 03% in real terms - a negligible figure. " However, as noted by market participants, before the distributor can not be challenged to create a massive demand. Japanese beer is perceived as a niche product, so most likely the company will actively work with the selected target audience.

ANNA RYABOV

via rbcdaily.ru

The exclusive distributor of Japanese brewer Kirin «Nord Winds Distribution" (NVD) is going in the next two to three years to bring its products to the federal level: now the company is working on the formation of nationwide distribution system flagship brand Kirin - Kirin Ichiban. Sales of the brand NVD plans to annually increase by half. The company explains such promising forecasts transfer of beer in licensed segment and, accordingly, in a more affordable price range. Increase sales through local production - a standard for the development of the logic of the beer market, however, as experts note, the Japanese brand will remain a niche.

Theme: "Mass sumoshestvie and office hara-Kirin." Case Japanese beer Kirin Ichiban from R & I GROUP in Russia

Japanese Kirin beer sold in Russia since 2000. Last year, the European division of Kirin Brewery Company Limited in Europe - Kirin Europe GmbH - signed a license agreement with Kirin NVD for production in Russia. Now it uses the company's plant in Kaliningrad, AIT, which is part of Heineken Russia. According to brand manager of Kirin NVD Sergei Biryukov, the translation of beer in licensed segment will significantly reduce the price on the shelf with 70 rubles. (for a bottle of 0, 33 l) to 32 rubles. and to make beer more affordable. The high price of imported beers and enjoyed the geography of its sales, the lion's share of which are in Moscow and St. Petersburg. Now "Nord Winds Distribution" is actively expanding distribution of beer Kirin Ichiban and entering new markets, to then cover the whole of Russia. "The main driver of Japanese beer segment - the growing popularity of Japanese cuisine in Russia. In the next five years we intend to increase annual sales of Kirin Ichiban beer for at least 15 thousand. Hl ", - told RBC daily director of marketing NVD Edward Astapov.

Members of the beer market is not surprised by the plans Kirin: license segment increase capacity and affordability when compared with imported. "Now the market is increasingly growing two segments: super premium and discount, the latter, with a few exceptions such as domestic beer" Tinkoff "is just one of the licensed beer" - said the head of the press service of the company SUN InBev Alex Shavenzov. According to the director of public relations of Heineken Russia Anna Meleshina along the way proposed by Kirin, at one time held all the big foreign companies on the Russian market. "Imported beer is not competitive on price compared to licensing, so the big companies buy local plants or place orders for production in Russia," - said Ms. Meleshina.

Analyst IK "Finam" Sergey Phylchenkov believes that, in order to increase sales, the distributor must be prepared for additional costs for advertising and marketing, but in any case count on the tangible market share of the company is not: "In 2006, the Russian beer market was 968 million dal. By 2008, the market could reach 1.15 billion given. Thus, the company, if the implements its plans, it will take about 0, 03% in real terms - a negligible figure. " However, as noted by market participants, before the distributor can not be challenged to create a massive demand. Japanese beer is perceived as a niche product, so most likely the company will actively work with the selected target audience.

ANNA RYABOV

via rbcdaily.ru

In Russia, HUMMER began advertising format BTL

Outdoor advertising translated into meters. Deputies proposed new amendments to the bill