1591

Consumer loans in Russia

Russians drowned consumer credits. The central bank predicts a mass defaulted citizens from the crisis, over-indebtedness of the population. Olesya Gerasimenko tried to find out why the Russian people take out loans, paying no attention to 900% per annum, and that they are going to pay for purchased in duty cars and laptops.

In October 2011, in the Kemerovo region miner Maksim Smirnov got in the bank "Trust" loan of 300 thousand. Rub. In them, he bought a car - a used "Honda". But in the cars he understood well: from a foreign car was broken engine, it had to be repaired, not buy her expensive items and then sell almost twice cheaper. Without a car Smirnov did not want to live, I took another 200 thousand. Sberbank and bought a used white "Toyota" - and was back on the market for auto parts, and then sold the car cheaper than bought. For loans to the time accrued interest. After New 2013 Smirnov came home to fellow "Trust", ask why the bank stopped payment. Smirnov explained that the delayed payment for the first time, because I resigned from the mine where withhold wages, and learns from the bus driver getting 10 thousand. rub. per month. The bank said that the "Trust" can sue him in court, he said that the minimum payment on the 29th of January is 37 thousand. Rub., And left. Let them do what they want, but they will not give up the car, his wife said Smirnov. In April 2013th, in spite of two years of payments Smirnov remained one should just "trust" 330 thousand. Rub. In May, he went to work as a driver for a private illegal cut. Shortly before that, he took a third loan to Alfa Bank, bought a modest 99-th model "Lada". In this car on May 26 on the first day of work in the private section, and found him with a knife sticking in his throat. The investigation concluded that the man committed suicide because of debts.

His wife Natalia findings of the investigation do not believe: he did not care about credit, because for 13 years of their life together has not been a day without them, so why is now. Especially in the day of death, they did not fight, and the eve of the planned how to plant a vegetable garden and will repair the car. Smirnov sitting with friends in the hall storey village house and looks at me with curiosity. I was late for an appointment for four hours, I went to the airport by bus Novokuznetsk, then took a taxi, but the street where Prokopyevsk lived a widow and her four sons who knew neither the taxi driver nor the Manager, nor the navigator. While looking, I had time to notice that the small mining town orgy of advertising credit from formal banking programs to pawnshops and unknown agencies express "Money in debt for 15 minutes without guarantors and documents." Probluzhdav hour ravines, I went to the village and now, out of breath, I ask, how to ride them. And nothing says Natalya, sons of the same as you are now, in the morning go to the highway on the school bus, though, he did not back luck, they get on the chaise. Smirnova Leafs credit agreements: "I get five thousand rubles, loan me no one will, so I was not even in any bank. He himself decided where and how much to take. " After the death of her husband she had to read all the papers to understand the INN, BIKah and insurance. "So many papers, and all of them need to read ... Now, look, it is written that it is a voluntary agreement and collective life insurance. "I agree to participate in the program of voluntary collective life insurance, as described in the contract of voluntary group life insurance cardholders, hereinafter, referred to as group insurance program" ... Why repeat four times? I already do not understand anything. " Guarantor on any of the loans has not been, but in the same agreement the bank "Trust" stipulates that in case of death of the borrower to pay his heirs. Returning from school heirs at the time the three of us with serious faces digging a flower bed next to the barn, and the fourth - three years - climbed to her mother on her knees and sad sniffs: he in the morning and the temperature of the nozzle. I ask: "Do you consider how much cost you at least one credit?" "Husband worked all loans. How long have we lived with him, we took a lot of credit. And the kitchen, and a TV, a washing machine and new furniture, for repair, but usually all paid "- said Smirnov. Agrees with her her sister in law, "Because of their loans output was taken deliberately, sometimes quenched in advance." However, it turns out that often quenched with other loans more. The mine Smirnov paid 30 thousand. Rubles., Says his wife, one a month for loans paid 24 thousand. In-law nodded: "Yes, because we all live, the whole city. All the people I know, there are loans. "

According to the National Bureau of Credit Histories, the volume of loans to households over the past two years has almost doubled - 8 8 trillion rubles. in July of 2013. Who is in the portfolios of Russian banks, according to the Central Bank, 426, 6 billion rubles. problem of retail loans (they are considered to be loans for which payments are overdue by 90 days or more). In January-May, their volume increased by 92 billion rubles. against 50 billion increase over the past year. Total outstanding loans to 34 million people live - is 45% of the economically active population. People who have never faced by banks in the country is low. According to the Central Bank, 66 million Russians at least once took out a loan, while creditworthy segment of the population - about 80 million people. On June 1, 2013, every tenth Russian borrower had to issue over more than five credits per year and the proportion of Russians increased by 52%. In some regions, the proportion of the economically active population that received loans is close to 100%. This Chelyabinsk, Sverdlovsk region, Bashkiria, the Khabarovsk Territory and the Kemerovo region, where the family lives Smirnov. Research bureau full of depressing terms like "mass defaulted," "solvency crisis" and "lending".

Hunting, which take consumer credits in the regions can be called a disaster worse than heroin - the money are the most powerful drug. While searching for the heroes of this article, I did not ask to interview people who have taken loans for business development, treatment or mortgages: those reasons to go into debt more seriously than the new iPhone. But in the second month of the search characters it seemed that the worst debt piling healthy people who have everything in life is not so bad. My questions about the choice of bank and savings percentage is not met understanding. The parties are not perceived as an expensive loan product, someone's business, financial services or bondage. Most of the borrowers, especially those from small towns or villages are potrebkreditovaniya as assistance from the state, seeing them as something like the Soviet mutual aid funds, only vaguely aware as arranged and that there are banks. "I want to live well, and the like began to turn, when suddenly ..." - their main complaint. The majority are not driven by considerations of economic expediency and the desire to live as good neighbors, and better than you can afford. Many can not fend off aggressive, intrusive advertising "easy money". Seriously affects young TV: in the big cities it is fashionable to give away, the province still have breakfast, lunch, supper and spends weekends watching reality shows and soap operas. In the only cafe in the city of Kalach, that a five-hour bus ride from Voronezh, the song "All Moscow shines all Moscow burns" all visitors to look "Dom-2". I listen to the story of 25-year-old boy who wanted to show his girlfriend that took place as the man told her that work, and the forged certificate of wages and permanent employment to obtain loans. In May, he was found in the woods of his native village in a locked car and a hose from the exhaust pipe inside. His brother does not believe that it was a suicide, and said that he contacted with "bad people." But he recognizes that how much is actually his brother was debt and credit cards, the family learned only after his death. Back at the hotel, I turn on the TV. On the heroine of the series explains the investigator: "You will want to live normally, get dressed and shoed decently - not yet on the go."

The lure of life beyond their means so strong that the Russians are not afraid of high interest rates on loans, while the Europeans refuse to buy anything on credit with a surcharge of 5-6%, considering them to predatory. Rules like not borrow in excess of the monthly salary of her husband, or to take only one loan, the monthly payment for which no more than 30% of the basic income, I have not heard of any one family. But it brought together dozens of other stories. Wachter from Ekaterinburg took a loan of 300 thousand. Rub. son to the wedding because the bride insisted that everything was "as people" and "beautiful, like on TV." Two months after the holiday's father lost his job, the bank is now paying nothing. In Tomsk, the teacher of foreign languages has decided to sell a kidney to pay off the loan for the car and the repairs in the apartment. Written off by mail to the alleged ill music teacher, her husband said that he was going on a business trip, and flew to a clinic in Germany. After the operation of the customer has said that she does not have the promised € 40 thousand. The donor returned to Tomsk to unpaid loans and without the kidneys. Who he is treated by a psychiatrist and trying to win money. In the Kirov for the second time housewife decided to become a surrogate mother to take a loan for a new car and her husband build a cottage. Her neighbor in the ward also gave birth to a baby for another family: it was necessary to pay the credit taken for breast enlargement surgery.

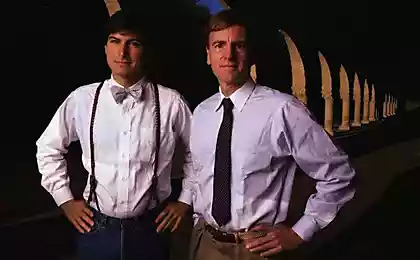

Millions of people in Russia are forced to live on credit before the credit

Millions of people in Russia are forced to live on credit before the credit

Photo: Pavel Lisitsyn, Kommersant

Most of the heroes refuse to call her real name and tell when the recorder: ashamed to admit himself bankrupt, ashamed to remember "consumer fuse" ashamed to answer "no" to the question "Ever consider how much cost you a loan for a new washing machine?" His anger and frustration they are transferred to the government. "It was a job with a salary of thirty thousand, scored loans. Currently there are no jobs, their homes no, sold almost all, the only income - allowance 1000 rubles. a month, a child of two years. Credit to pay nothing, and the state is on the side of the banks. Why all the high talk about the highest status of the family unless the banks of the more expensive than any other values? "," The state drive people into debt, handing out loans left and right! "" But the government can not hear us, we will be poorer, the easier we operate. Problems Blacks owners did not sway ... "" For the state and officials, we "tax cattle." Naturally, they will support the banks "," You're to introduce serfdom, and all debtors to issue the ownership of banks. The authorities do not care what decent people commit suicide, "" Our government can forgive the debts of Algeria to help, for example, in Iceland or in the same bankers, and its people - is difficult for them and is not necessary. I believe it is necessary to unite and declare themselves "," Where are these podevalis Raskolnikovs? Who can find a justice on these bloodsuckers ?! "- this is the most correct of thousands of posts on the forums about consumer lending.

Since 2010, the authors of these complaints are waiting for the law on bankruptcy of physical, which the State Duma will consider in the fall. However, preparing for the second reading of the bill will facilitate the life is not all borrowers. Because of recent amendments it implies that a bankrupt can declare himself a man whose duty starts from 300 thousand. Rub. In the first case was 50 thousand., Then bankruptcy could be more than two million Russians. In addition, initiation of bankruptcy proceedings the debtor will have to be spent for the services of a financial manager, and that's at least 10 thousand. Rub. per month. The same amount he is obliged to deposit with the court has the direction of the bankruptcy petition. From the text of the new version of the law has disappeared list of what can not be seized and described police officers, there was only a reference to the Code of Civil Procedure. According to it, the debtor can not take away the only housing, land, which is his private home, garden, kettle, pots, shoes, blankets and other items of a personal life, except for jewelry and luxury goods; tools needed for the job, livestock, poultry, rabbits and bees will leave too. Do not take away from home food and money totaling 30 thousand. Rub., The fuel needed for cooking the family of the debtor, as well as prizes and state decorations. Confiscated and to be auctioned may be flat, if it is bought in the mortgage, car and household appliances. Physical bankruptcy process can last up to two years, so that the costs would almost certainly will be comparable to the amount of debt.

While the law even in such unflattering debtors form is not accepted, you can negotiate with the banks through the financial ombudsman. This position exists in Russia only three years, and few of the debtors knows about it. The law on this institution, too, the State Duma has not yet been adopted, although it was expected that this will happen in the spring session. Now the financial responsibilities of the Ombudsman takes the head of the Association of Russian Banks Garegin Tosunyan. Its activity consists in the negotiations between the agreed to cooperate with the authorized banks and debtors. Refer to the Ombudsman may be any natural person indebted to no more than 500 thousand. Rub. and sudivsheesya with the bank. The Financial Ombudsman Service is free for all citizens. Legally banks are not obliged to carry out the decisions of the Commissioner, and the whole work is based on diplomacy. Since 2010, the Ombudsman received almost 12 thousand. Grievances. "Most of the applications we receive on debt restructuring, lower interest rates and the abolition of fines - says Tosunyan.- elderly often write on notebook sheet, by hand - this is especially hard to read. 80% manage to resolve the conflict. It is important that banks are treated like human beings to the problem, rather than formally, sweeping aside all the words "too many speculators." It happens that the crooks are turning, but it happens sometimes that we literally dragged people out of the loop. "

How many suicides happening in Russia because of the credit, no one believes. Moreover, there is no official statistics on the sale of their own bodies, cases of fraud or attempted suicide because of debts to banks. This summer in Novgorod carried a sentence of 30-year-old Olga Kirov (surname izmenena.- "Authority"), the trial of which is more like a textbook example of how economics and sociology, as it reflects the key socio-economic problems of Russia in recent years.

October 27, 2012 Olga Kirov went with her daughter to the country. Nastya's birthday, she was nine years old. Houses on their site was not there, Olga his civil husband only planned to build, but not enough money. While it was possible to roast barbecue and spend the night in the summer shed. In his arrival and he went Kirov has got for a daughter, took the blade and slashed himself on the wrists. And then in the throat. When Nastia started screaming Kirov grabbed a knife and hit him eight times in the neck of the child. Unable to finish the job, she reached for the cell phone and called her mother in Novgorod. The family called an ambulance, the two Kirov survived. The court found that the Kirov attempt on the life of his daughter, being irresponsible, and in June 2013 she was sentenced to five years in a penal colony. Nastia lost a lot of blood for a long time was in the hospital, where her grandmother took custody of. Because now it is intersected by tracheal re-learning to speak. The court found that the Kirov mired in debt on consumer loans and that even the land on which his mother tried to kill herself and her daughter, was bought on credit.

Kirov worked as a laboratory assistant in a construction company, received 18 thousand. Rub. per month, and for several years, one after another took the so-called quick loans for daily expenses. Most of these organizations use the format of the loan "to pay", for which the rate - about 1, 5-2, 5% per day. In terms of the year it will be 600-900%. Loan approve only one passport or its photocopy. Eight thousand rubles for two years turned 100 000 rubles. To open such a company to provide the money in debt, simply register a legal entity, a notification procedure to apply to the Federal Service for Financial Markets. And if the financial transactions performed by banks are monitored by the authorities, the agencies in microloans to distribute money under the frenzied interest, such claims are absent. Despite the fact that these firms have taken in people often disappear outstanding microloans to pay off, because their value is already incorporated a risk of default. "Seven thousand loan to LLC" Novmikrofinans "ten thousand at the Center for financial support, seven thousand in the company" Fast Money "80 thousand. Rub.