760

The Americans fell massively depressed

Center for Public Opinion Research at Michigan State University monitors the attitudes and views of Americans about the economy of the country with the 50-ies of the last century. On Friday, he issued the latest estimates of the index of consumer sentiment, thereby causing a real shock. Americans have more than a quarter century did not relate to the situation with great pessimism than today.

And as shown by a recent survey research center Pew, the number of Americans who believe that they are better off today than they were five years ago, has fallen to its lowest level ever in '44 surveys. In such a gloomy mood of respondents wonder the following: by the usual standards, the economy is showing very good results - at least not yet. In particular, the official unemployment rate is 5, 1 percent, though rising, but by historical standards, is quite low.

However, the economic mood is worse today than in 1992, when the average unemployment rate was equal to 7, 5 percent.

Why the pessimism?

The gloomy mood is partly a reflection of the fact that the actual position of the Americans is much worse than his present. The official unemployment rate may be, and low, but the proportion of Americans in the active working age who are out of work (which is not the same thing), is at a historic high. Gross domestic product increased but the average family income, adjusted for inflation today is lower than in 2000.

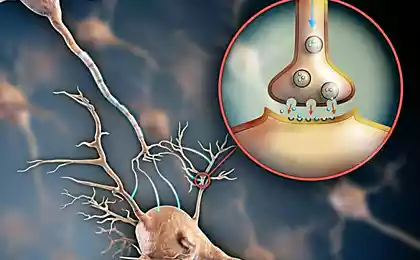

In addition, the opinions on the current state of the economy has a strong impact and the attitude of society to larger developments and trends.

When Ronald Reagan (Ronald Reagan) asked the question made famous "You live better than four years ago?", It sounded like the right answer, "Yes." In 1980, the average family income adjusted for inflation was higher than in 1976. But queues at gas stations and inflation exceeding 10 percent, people create the impression that everything is crumbling.

Conversely, when Reagan proclaimed "Morning in America", unemployment was at a historic high. But people were willing to listen to upbeat statements, as they felt that the economic storm passed.

More recently, the economic recession of 2001 confidence in the economy is high enough, it may be because people like to see in this recession just a temporary glitch after a strong boom in the 90s.

The main reason for our today's pessimism is that the new working Americans the boom never seen. Indicators to combat unemployment and create new jobs in the period of economic growth after 2001 were just miserable by the standards of the Clinton era. And wages barely kept pace with inflation. At the same time, corporate profits and revenues small elite grew very strongly, causing a strong impact on economic growth, which for the rest in the general table there were only crumbs.

Now the boom that was not just burst. It is quite clear that the Americans have lost faith in the prospect of returning to this well-being.

I would also say that they have lost faith in the integrity of our economic institutions.

At the beginning of this decade, when powerful corporate scandals broke - Enron, WorldCom, and so on, I thought that corruption in big business will be an important issue for politicians.

That has not happened, partly due to the fact that our march to the war led to the change of the main theme, and partly because the Americans were not ready to treat deeply negative to the system that has given us a strong economic growth in the previous decade.

But I get the impression that the crisis mortgage lending shows how the financial titans operate dishonest money, and how not to achieve much success executives receive gifts worth hundreds of millions of dollars, has revived the feeling that all is not well in the state of our economy. < br />

And this feeling is applied to the general pessimism.

The question now is: can the next administration end this ailing America?

Some causes of poor economic performance, there has been since 2000, to eliminate the administration is likely to fail.

Raw materials in the 90s it was cheap, but in the coming years due to the rise of China and other economies that are at a stage of growth, the world will experience increasing difficulties with the supply of oil, copper and so on. And this will happen regardless of the fact that the new president will do.

However, the revival of regulatory measures capable of restoring confidence in the financial system. Return to the accounting policies of the working class will ensure the growth of wages. A competition policy - not to be confused with the policies of big business all that he desires - will help to restore American leadership in information technology.

In other words, to strengthen our declining confidence you can do a lot.

However, this will not happen if the next president does not understand what is going wrong today. And looking at today's contenders, you know that such confidence we have.