743

In housing mortgages in Novy Urengoy: features and benefits

Eighty one million one hundred twenty five thousand nine hundred sixty five

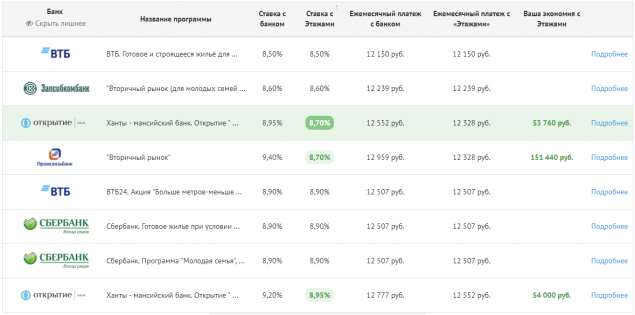

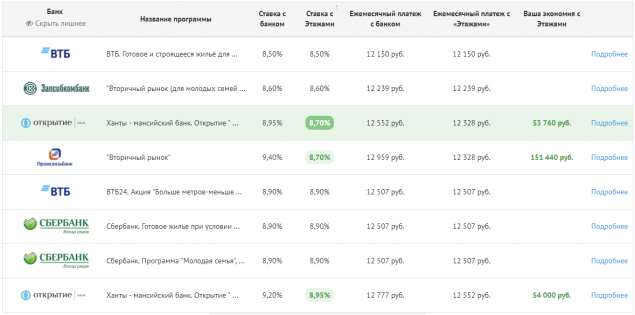

A home mortgage is one of the most popular varieties of lending. To save up to buy a home or apartment difficult. Sometimes a young family gets an apartment in the inheritance, sometimes the help of wealthy relatives. If the amount needed to purchase real estate, there is a solution: to buy an apartment in the mortgage. Official website Floors offers different types of mortgage programs in New Urengoy.

The features and benefits

So, a mortgage is a contract for a mortgage loan. Usually the word associated with the purchase of the apartment, but sometimes in the mortgage purchase a car or make other expensive purchases.

Dignity.

Types of payments

For all its popularity, the mortgage loans had to acquire myths and rumors about what exactly will have to pay. So, when buying a home mortgage you will experience such payments.

Requirements for the borrower

In essence, they are the same as Bank customer, who draws up the conventional loan. However, to use the loyal mortgage programs, you need to meet several additional requirements.

Features of the mortgage from the Builder

There are 2 options: the loan through a Bank affiliate of the developer or the conclusion of the loan agreement directly with the construction company. The advantages of mortgages, executed through the developer, are.

The conclusion of the loan contract with the construction company eliminates the need to turn to the Bank. Loan processing is fast, no documentation of income.

The procedure of repayment of the loan

He's no different than payments on a conventional loan. In the contract on a loan, prescribe the amount and timing of payments. Initially repaid monthly interest, and then the body of the loan.

Thus, the mortgage is the solution for those who need housing, but can not save the required amount. However, before doing loan, you need to objectively assess the solvency of the family. In any case, you will make a long regime of austerity and rigorous calculation of all available funds.

A home mortgage is one of the most popular varieties of lending. To save up to buy a home or apartment difficult. Sometimes a young family gets an apartment in the inheritance, sometimes the help of wealthy relatives. If the amount needed to purchase real estate, there is a solution: to buy an apartment in the mortgage. Official website Floors offers different types of mortgage programs in New Urengoy.

The features and benefits

So, a mortgage is a contract for a mortgage loan. Usually the word associated with the purchase of the apartment, but sometimes in the mortgage purchase a car or make other expensive purchases.

Dignity.

- The opportunity to buy an apartment immediately, not save for it a long time.

- The same repayment amount, allowing you to plan a family budget. You have the opportunity to take advantage of different mortgage programs, the appropriate level of income.

- No need for additional collateral.

Types of payments

For all its popularity, the mortgage loans had to acquire myths and rumors about what exactly will have to pay. So, when buying a home mortgage you will experience such payments.

- Commission payments for loans and its management.

- Interest rate.

- The insured amount.

- One-time payment for notary services, as well as the assessment of the independent expert (if the housing is acquired on the secondary market).

- All kinds of utility bills.

- The penalty for that loan is repaid ahead of schedule (if the contract has such a clause).

Requirements for the borrower

In essence, they are the same as Bank customer, who draws up the conventional loan. However, to use the loyal mortgage programs, you need to meet several additional requirements.

- The marriage officially registered.

- Age restrictions.

- Solvency documented.

- The document about the need to improve housing conditions.

Features of the mortgage from the Builder

There are 2 options: the loan through a Bank affiliate of the developer or the conclusion of the loan agreement directly with the construction company. The advantages of mortgages, executed through the developer, are.

- The ability to count on low interest on the loan.

- Assistance from the developer in collecting the necessary documents.

- More rapid consideration of the application.

The conclusion of the loan contract with the construction company eliminates the need to turn to the Bank. Loan processing is fast, no documentation of income.

The procedure of repayment of the loan

He's no different than payments on a conventional loan. In the contract on a loan, prescribe the amount and timing of payments. Initially repaid monthly interest, and then the body of the loan.

Thus, the mortgage is the solution for those who need housing, but can not save the required amount. However, before doing loan, you need to objectively assess the solvency of the family. In any case, you will make a long regime of austerity and rigorous calculation of all available funds.

Tamper for soil compaction and petrol shvonarezchiki from "the"

Specifics of the real estate market of Astana