660

Mass eviction

The mortgage crisis that began in the United States since mid-2007, has turned into an economic, giving rise to a record drop in the indices on the major stock exchanges and billions in losses for big banks. In the III quarter of 2009, 937,840 owners of "mortgage" houses in the United States received notice from creditors on a possible or impending seizure of property on account of debts. Warning received 136 each homeowner, which is the highest quarterly results since 2005. Increasing the number of Americans who do not pay on time interest on loans, experts associated with high levels of unemployment.

Ordinary Americans of Elkhart, Indiana, tell their stories about how lost their homes and were on the street.

9 ph via bigpicture

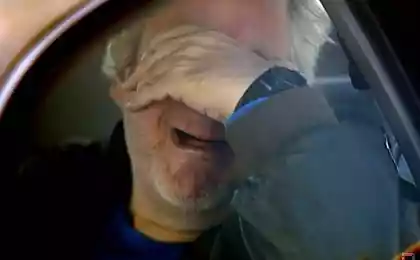

1. Among those who were evicted from their homes, which were disposed of by banks - Charles Funnell of Elkhart, Indiana. "I miss this house, really miss the life that I had," - she says. In this photo taken on September 25 Funnell looking at the house, which is called her for 18 years. After she was fired, and the last savings run out, she had lost the right to the house in 2007. After spending 30 years in the trade of residential vans, 52-year-old Funnell now works part-time in a pizza delivery car and lives in a van with his son and daughter in the house of his son. Looking back, Funnell said that could take a loan from relatives, if previously admitted their problems. She advises: "Do not be afraid to ask for help as soon as possible. Do not be shy". (James Cheng / msnbc.com)

2. The 42-year-old Terry Vavrek travels from his home, where lived for 8 years, since filed for bankruptcy and lost mortgage. Lost their jobs in January and received each month for unemployment benefits in the amount of $ 1,200, she quickly got into debt, because she had to pay the mortgage - $ 1,400 per month. Currently Vavrek and her daughter live with a friend. She has worked at the plant, which produces vehicles for H2 Hummers «General Motors». She hopes to regain its place as the company decided to sell the factory to a Chinese company. "I look forward to positive news about their work, as the company has signed a contract for the sale of the plant," - she says. She would change anything if I knew that all this would happen? "I would have made sure that I could buy back the house even without work", - she says. (James Cheng / msnbc.com)

3. Johnny Warren Brenda Carpenter and talk about their problems with the mortgage on his doorstep in Elkhart September 30th. They live in this house since 1998 and has always regularly paid until they are fired from their jobs - Warren after 17 years of work, Carpenter - after 20. They help local non-profit organization «La Casa», which helps them to reduce the fee for a mortgage. Carpenter says that they are all the time looking for work, but they refused because they "are not suitable for age." Carpenter advises not to miss payments for a house. "Make sure that the mortgage is paid in the first place", - she says. (James Cheng / msnbc.com)

4. Rebecca Kristner sits at his home in Elkhart, which lived 24 years old, and then lost. Each room living memories, she says, and "they can not pick them up." 55-year-old Kristner deprived of the right to property, quit his job a nurse, she left due to stress and the death of her husband. "His death has brought me a lot of emotional problems - she says. - And partly, I consulted with her shopping "- especially in credit. "Seek advice and help from the people, not the banks", - she says to those who have the same problems. (James Cheng / msnbc.com)

5. Roberto and Patricia Negret playing with his year-old son Roberto Jr. in the backyard of their home on September 17. 38-year-old Roberto wants to leave the house, because he can not pay the mortgage. He lost his job and was unemployed 10 months, but then returned to his job, but his salary was cut. "I do not earn as much as earned before," - he says. "I know I can not do it with the mortgage", - he said. They will move into an apartment as soon as it decides the mortgagee's right to property. (James Cheng / msnbc.com)

6. Bert Garcia sits on the steps of his home on September 22. She lost her job a year ago, and its accounts - especially health - began to accumulate. In late October, she found herself face to face with the deprivation of the right to the house. "I lost my job and health insurance," - says 39-year-old Garcia. This double blow to her pocket led to the fact that she would have to lose the house where she lived for five years. Mother with three children, she paid $ 1,600, trying to ask the mortgagee to change the loan, but that did not happen. Her advice: "Try to pay the mortgage in the first place. Because because of unpaid bills, you can lose everything, including your dreams. " (James Cheng / msnbc.com)

7. aspiring singer Rowena Gutier poses for a portrait in the backyard of his home in Elkhart. Lost work as a nurse and saw her mortgage payment went up by 13%, she was in the hospital because of a heart attack in June. She could lose the house if you do not find a job in the near future. On weekends, she sings, however, free of charge. She hopes that somebody will pay attention to her talent. "I comfort myself by singing", - she says. Gutier blames his situation agent mortgages and own carelessness. "I did not realize that the whole thing in a third party - she says the loan. - I thought about was that I landlady ... I was like a little girl at Disneyland. " (James Cheng / msnbc.com)

8. Janet Berrier stands at his home on September 23. She is ready to move out as soon as will be notified if it does not soften the terms of the mortgage. "I've already packed most of the things - she says. - In order not to waste time and have time to move out in time when it is needed. " Berrier took a mortgage in 2006 and said that he considered the interest held. Two years later, the monthly payment increased by $ 200, and at work, she lost her overtime pay for that good. "I can pay half the mortgage, - she said his bank. - And they said that this is not enough. " (James Cheng / msnbc.com)

9. Terry Gonon outside his home in Elkhart, where he and his family lived for 4 years, until they were deprived of the right to the property in March this year. He is a construction worker, but his working hours are not more than 10 per week. He and his wife and nine children live in a trailer in Bristol. Gonon paid $ 20 000 mortgage that they took 30 years, but then the payment increased by $ 400. The insurer refused to cover the house, and the lender has added to the amount of interest on the "force majeure" circumstances. 38-year-old says Gonon that used to work with people who know and trust. "Get a pledge from a local bank - he advises. - Do not go to a broker. " (James Cheng / msnbc.com)

Source:

Ordinary Americans of Elkhart, Indiana, tell their stories about how lost their homes and were on the street.

9 ph via bigpicture

1. Among those who were evicted from their homes, which were disposed of by banks - Charles Funnell of Elkhart, Indiana. "I miss this house, really miss the life that I had," - she says. In this photo taken on September 25 Funnell looking at the house, which is called her for 18 years. After she was fired, and the last savings run out, she had lost the right to the house in 2007. After spending 30 years in the trade of residential vans, 52-year-old Funnell now works part-time in a pizza delivery car and lives in a van with his son and daughter in the house of his son. Looking back, Funnell said that could take a loan from relatives, if previously admitted their problems. She advises: "Do not be afraid to ask for help as soon as possible. Do not be shy". (James Cheng / msnbc.com)

2. The 42-year-old Terry Vavrek travels from his home, where lived for 8 years, since filed for bankruptcy and lost mortgage. Lost their jobs in January and received each month for unemployment benefits in the amount of $ 1,200, she quickly got into debt, because she had to pay the mortgage - $ 1,400 per month. Currently Vavrek and her daughter live with a friend. She has worked at the plant, which produces vehicles for H2 Hummers «General Motors». She hopes to regain its place as the company decided to sell the factory to a Chinese company. "I look forward to positive news about their work, as the company has signed a contract for the sale of the plant," - she says. She would change anything if I knew that all this would happen? "I would have made sure that I could buy back the house even without work", - she says. (James Cheng / msnbc.com)

3. Johnny Warren Brenda Carpenter and talk about their problems with the mortgage on his doorstep in Elkhart September 30th. They live in this house since 1998 and has always regularly paid until they are fired from their jobs - Warren after 17 years of work, Carpenter - after 20. They help local non-profit organization «La Casa», which helps them to reduce the fee for a mortgage. Carpenter says that they are all the time looking for work, but they refused because they "are not suitable for age." Carpenter advises not to miss payments for a house. "Make sure that the mortgage is paid in the first place", - she says. (James Cheng / msnbc.com)

4. Rebecca Kristner sits at his home in Elkhart, which lived 24 years old, and then lost. Each room living memories, she says, and "they can not pick them up." 55-year-old Kristner deprived of the right to property, quit his job a nurse, she left due to stress and the death of her husband. "His death has brought me a lot of emotional problems - she says. - And partly, I consulted with her shopping "- especially in credit. "Seek advice and help from the people, not the banks", - she says to those who have the same problems. (James Cheng / msnbc.com)

5. Roberto and Patricia Negret playing with his year-old son Roberto Jr. in the backyard of their home on September 17. 38-year-old Roberto wants to leave the house, because he can not pay the mortgage. He lost his job and was unemployed 10 months, but then returned to his job, but his salary was cut. "I do not earn as much as earned before," - he says. "I know I can not do it with the mortgage", - he said. They will move into an apartment as soon as it decides the mortgagee's right to property. (James Cheng / msnbc.com)

6. Bert Garcia sits on the steps of his home on September 22. She lost her job a year ago, and its accounts - especially health - began to accumulate. In late October, she found herself face to face with the deprivation of the right to the house. "I lost my job and health insurance," - says 39-year-old Garcia. This double blow to her pocket led to the fact that she would have to lose the house where she lived for five years. Mother with three children, she paid $ 1,600, trying to ask the mortgagee to change the loan, but that did not happen. Her advice: "Try to pay the mortgage in the first place. Because because of unpaid bills, you can lose everything, including your dreams. " (James Cheng / msnbc.com)

7. aspiring singer Rowena Gutier poses for a portrait in the backyard of his home in Elkhart. Lost work as a nurse and saw her mortgage payment went up by 13%, she was in the hospital because of a heart attack in June. She could lose the house if you do not find a job in the near future. On weekends, she sings, however, free of charge. She hopes that somebody will pay attention to her talent. "I comfort myself by singing", - she says. Gutier blames his situation agent mortgages and own carelessness. "I did not realize that the whole thing in a third party - she says the loan. - I thought about was that I landlady ... I was like a little girl at Disneyland. " (James Cheng / msnbc.com)

8. Janet Berrier stands at his home on September 23. She is ready to move out as soon as will be notified if it does not soften the terms of the mortgage. "I've already packed most of the things - she says. - In order not to waste time and have time to move out in time when it is needed. " Berrier took a mortgage in 2006 and said that he considered the interest held. Two years later, the monthly payment increased by $ 200, and at work, she lost her overtime pay for that good. "I can pay half the mortgage, - she said his bank. - And they said that this is not enough. " (James Cheng / msnbc.com)

9. Terry Gonon outside his home in Elkhart, where he and his family lived for 4 years, until they were deprived of the right to the property in March this year. He is a construction worker, but his working hours are not more than 10 per week. He and his wife and nine children live in a trailer in Bristol. Gonon paid $ 20 000 mortgage that they took 30 years, but then the payment increased by $ 400. The insurer refused to cover the house, and the lender has added to the amount of interest on the "force majeure" circumstances. 38-year-old says Gonon that used to work with people who know and trust. "Get a pledge from a local bank - he advises. - Do not go to a broker. " (James Cheng / msnbc.com)

Source: