746

In reality, how many will cost Flat 3, 000, 000, take out a mortgage for 10 years?

Many look to the book - see fig. We saw an advertisement, for example 16%, and think, buy 3 + Leman Bank 500 thousand and all ... And there it was))

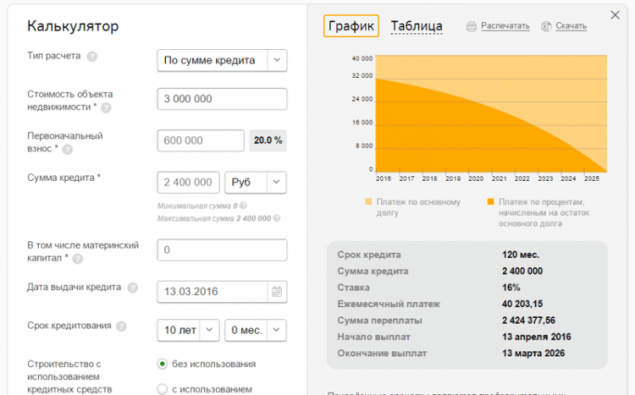

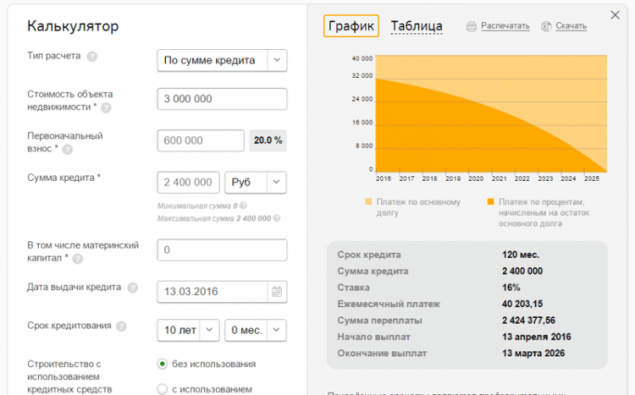

Go to the Savings Bank's website. Open the calculator to calculate the cost of mortgage ready жилье.

www.sberbank.ru/ru/person/credits/home/buying_complete_house

Ставим Apartment price - 3,000,000 rubles

We machine exposes the minimum down payment of 600,000 rubles.

so take out a mortgage 2.400.000 rubles.

The term of 10 years.

Category borrower - the general conditions

. Sex male. We put the age of 28 years, the income of 100,000 rubles.

3 people in the family (for example, we are a young family with a child)

This is what we get. The rate of 16% per annum, the overpayment 101% !!

Monthly payment 40,203 rubles!

And then many thought works and what I risk? B>

I'm living in a rented apartment, pay for it 20,000 rubles (I'm not on the capital prices) and then will pay 40, but to live in his apartment. And if it does not - the bank will sell an apartment, and I will return the money paid on the mortgage ...

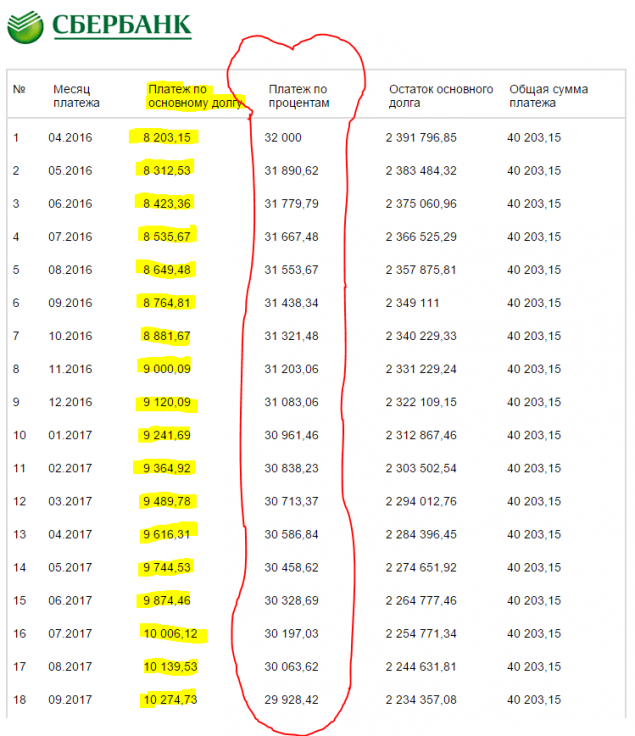

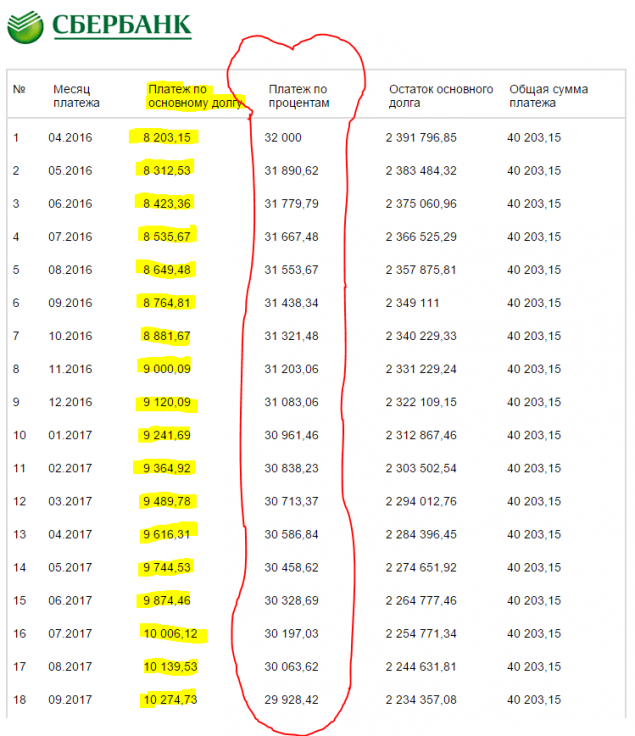

Not a bit of it. pay attention to the schedule of payments ...

According to the schedule it can be seen that you are paying at the beginning %%, and only then extinguish their debts.

oluchaetsya that the first, say, 5 years, you pay 746,778, 06 from 2.400.000 ...

Or just ~ 31%

And here's another interesting thing. B>

If you are successful, always on schedule to pay the mortgage for 10 years, then in fact it turns out that every month the loan you had cost 20,203 rubles

That is, you pay for the very apartment 2 400 000 rubles, and the use of credit has 2,424,377 rubles.

I wish you earn enough to not have to take out a mortgage. B>

Loading ... Loading ...

Liked? Share with your friends!

Loading ... Loading ...

Go to the Savings Bank's website. Open the calculator to calculate the cost of mortgage ready жилье.

www.sberbank.ru/ru/person/credits/home/buying_complete_house

Ставим Apartment price - 3,000,000 rubles

We machine exposes the minimum down payment of 600,000 rubles.

so take out a mortgage 2.400.000 rubles.

The term of 10 years.

Category borrower - the general conditions

. Sex male. We put the age of 28 years, the income of 100,000 rubles.

3 people in the family (for example, we are a young family with a child)

This is what we get. The rate of 16% per annum, the overpayment 101% !!

Monthly payment 40,203 rubles!

And then many thought works and what I risk? B>

I'm living in a rented apartment, pay for it 20,000 rubles (I'm not on the capital prices) and then will pay 40, but to live in his apartment. And if it does not - the bank will sell an apartment, and I will return the money paid on the mortgage ...

Not a bit of it. pay attention to the schedule of payments ...

According to the schedule it can be seen that you are paying at the beginning %%, and only then extinguish their debts.

oluchaetsya that the first, say, 5 years, you pay 746,778, 06 from 2.400.000 ...

Or just ~ 31%

And here's another interesting thing. B>

If you are successful, always on schedule to pay the mortgage for 10 years, then in fact it turns out that every month the loan you had cost 20,203 rubles

That is, you pay for the very apartment 2 400 000 rubles, and the use of credit has 2,424,377 rubles.

I wish you earn enough to not have to take out a mortgage. B>

Loading ... Loading ...

Liked? Share with your friends!

Loading ... Loading ...

73-year-old grandmother-Bodibildersha knows how to be successful in sports and in Love

This Bear waiting for their liberation for 30 years