282

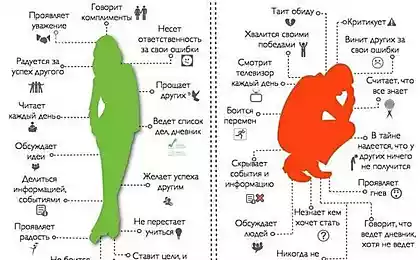

How to know if you are a fraudster

Fraudsters are able to get into the trust of even the most cautious, and trusting people are just a godsend for them. No matter what new schemes of deception appear, they can always be understood if you reason soberly.

Website I have collected in this post a few tips on how to determine what you are trying to cheat, and what to do so that nothing from scammers did not work.

Uninvited guest to you

- Step 1. Ask him how he knows your name or address.

- Step 2. Ask to show the documents confirming the position and the name by which he presented himself. Study them carefully.

- Step 3. Call the organization he introduced himself as an employee and ask if an employee was sent to you and what this is related to.

- Step 4. Ignore all calls to act immediately.

- Step 5. Read reviews about the company, its services or products on the Internet.

- Step 6. Ask about the payment methods for the service/goods offered.

Disturbing Signals If You Already Have a Deal

- Confidentiality. You are asked not to tell anyone about anything.

- The jackpot is just around the corner. Fraudsters encourage you in every possible way, drawing more and more money. Your denial of reality can extend this deception beyond common sense, as you will not want to admit that you have been fooled.

- Disappearance. When your patience runs out and you begin to suspect a fraudster of an insidious plan, he simply disappears. All channels of communication with him suddenly become inaccessible.

- Situation 1

ActionRemember if you have officially participated in any competitions. If not, do not respond to the message and delete it.

- Situation 2

Action: request security codes not even a bank employee, do not respond to SMS. Urgently call the bank that issued and servicing your card at the phone number indicated on the back of the card.

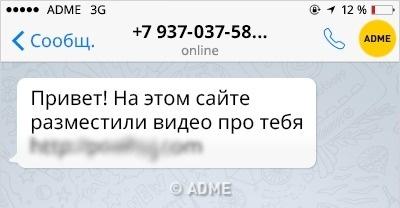

- Situation 3

Action: Don't follow the link. You will get a virus on your phone that will help scammers hack into your personal account in a mobile bank (if any) and steal money from bank accounts. It can also be an automatic subscription to paid services. Download any applications only in official stores, install and constantly update antivirus on your smartphone or tablet.

- Situation 4

Action: You can give the card number, which is its address. CVC code, card expiry date, name and surname of the holder are not required for transfers. But with this information, scammers will be able to withdraw money from your bank account.

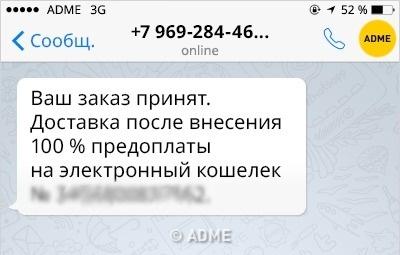

- Situation 5

Action: Learn how to deliver the goods. If among them there is no possibility of payment upon receipt, refuse to buy in this store.

- Situation 6

Action: Your friend's account may have been hacked. Try to contact him in another way. If this is not possible, start a conversation in messages, ask about something that only you and your friend can know.

- Situation 7

Action: Do not call unfamiliar cell numbers. They can be paid, you will lose money from your mobile account. Copy and type in the Internet search engine the first few sentences from the message. Fraudsters often use the same texts and schemes for many years. You will probably find reviews of people who have already been caught once.

Wikihow, Ministry of Internal Affairs RF

See also.

How to get out of a sinking car alive

How to get out of a falling elevator

via www.adme.ru/svoboda-sdelaj-sam/kak-vybratsya-zhivym-iz-padayuschego-lifta-1396865/

These children turned ordinary photos into masterpieces

8 gorgeous reasons to visit the Kamchatka Peninsula