613

Scammers Beware: 6 most common divorce, which believes every

Before you have a few fresh ways of stealing money from bank cards, which are becoming more and more popular in our country. Take a few minutes of your time and read this post. This will help you save your own security agents!

1. Con artists are represented employees of the bank

This fresh scheme of deception, which is gaining more popularity among fraudsters.

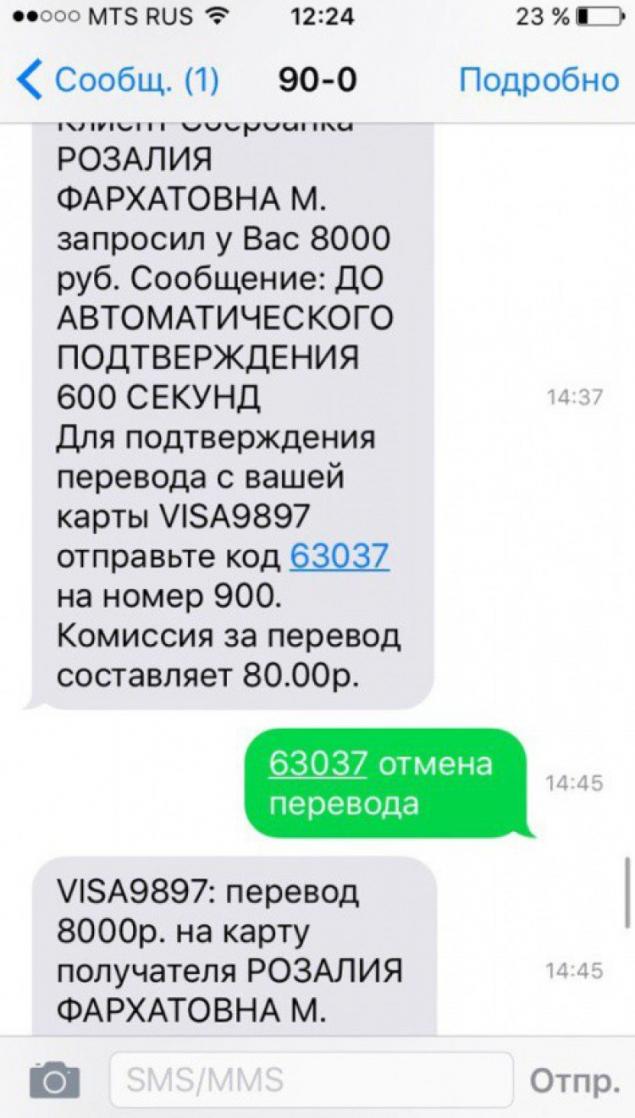

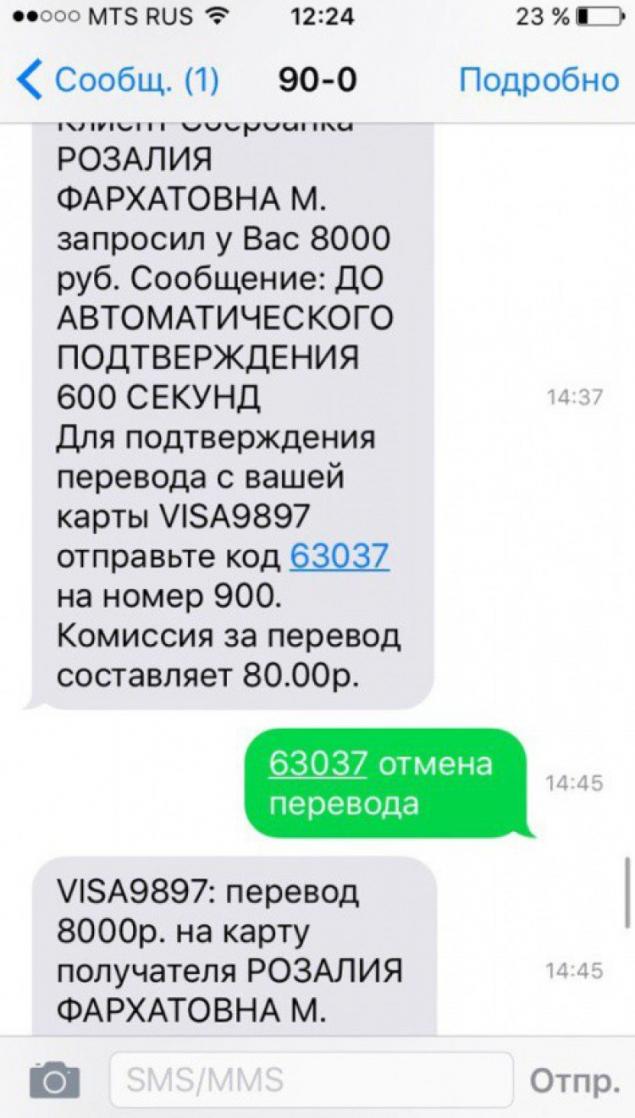

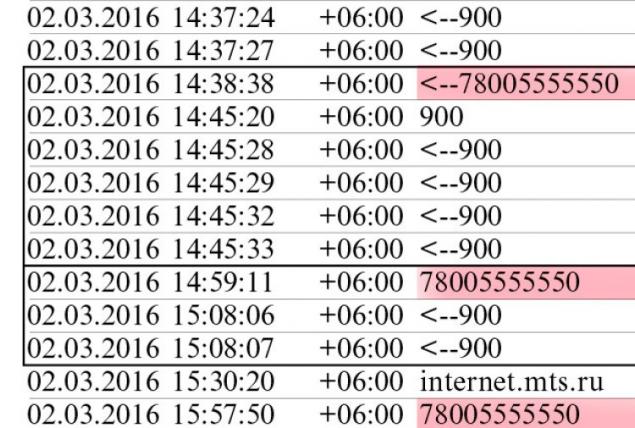

The man originally comes SMS with the number 900 (the Savings Bank of the service number), in which an unknown person asks him to translate a certain amount of money that will be charged to the account of the victim, if in reply send sent a digital code. Either the operation will be confirmed automatically after 600 seconds.

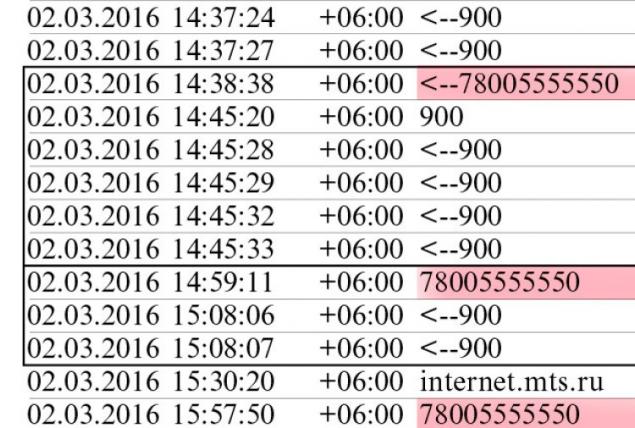

Man is naturally taken aback by such a desperate situation. And then the fun begins ... Suddenly a phone call from an official of Sberbank number (8-800-555-5550), at the other end a man who refers to the victim by name and said that his trying to fool crooks. And he, as a security specialist bank, must understand and help in this problem.

Further employee "Savings Bank" said that it is necessary to stay on the line, write a response to a message - code that there is provided, insert a space and the word - "cancel transfer". After that, the money, along with the security services of the bank specialist, disappear.

P.S. Asked if the fraudster call under the guise of Sberbank number can, so much so that on the return and call, and call detail has been specified exactly this number, the representatives of the cellular companies do not hide what is technologically possible to do.

2. Con artists are represented by bank employees. Another common scheme

Victim places the advertisement for the sale of any goods on one of the most popular websites ads and became a sight for fraudsters.

Calls buyer and says he is ready to buy the other thing. He further reported that he was in another city and is ready to make a payment on the card, and for the purchase of transport to send a courier company.

Victim fraudster sends his credit card number, as well as all passport information, as they need a transport company.

After some time, she receives a call from a number which all used to be trusted - 8-800-555-5550 (Sberbank official number)

. The voice: "Hello. I Sberbank security officer. On your account entered in the transfer amount (the amount of calls). Since the amount is large, it requires confirmation. You phone was sent SMS with a verification code. If you do call her, the sum is now added to your account. »

The victim believes the swindler and provides all the information, then all the money disappear from the map.

3. Fraud using a wireless terminal and contactless technology PayPass

Attackers shoot money from passengers using the wireless terminal through the clothes and bags wall. Through contactless PayPass technology cards with PIN-less, you can withdraw up to 1,000 Russian rubles.

Unfortunately, these thieves may well sweep the places of mass gatherings. To withdraw money from the account, it is sufficient to attach the device to a pocket or bag, readers of proximity cards operate at a distance of up to twenty centimeters, is not to get their problems.

contactless cards vulnerability can be reduced by using the "tin foil hat", more precisely, of the purse. Generally speaking, if you put the card in the foil package, special radioekranirovanny purse or metal box, it will be impossible to carry out the transaction.

And do not forget about the methods of fraud with bank cards, which have become classics. Here are some of them:

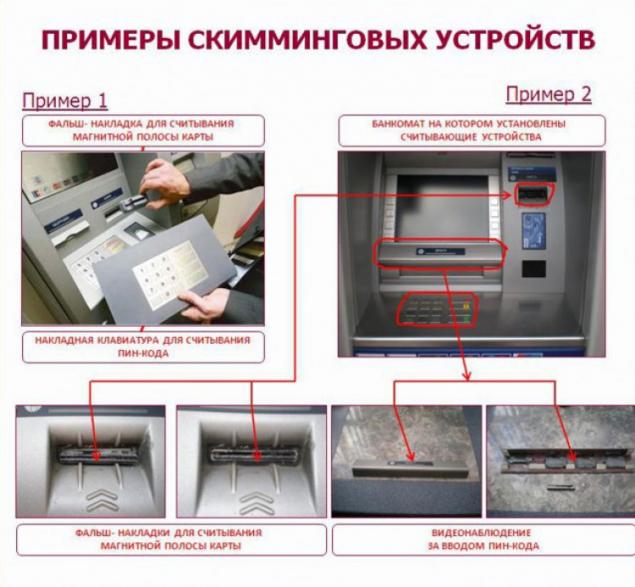

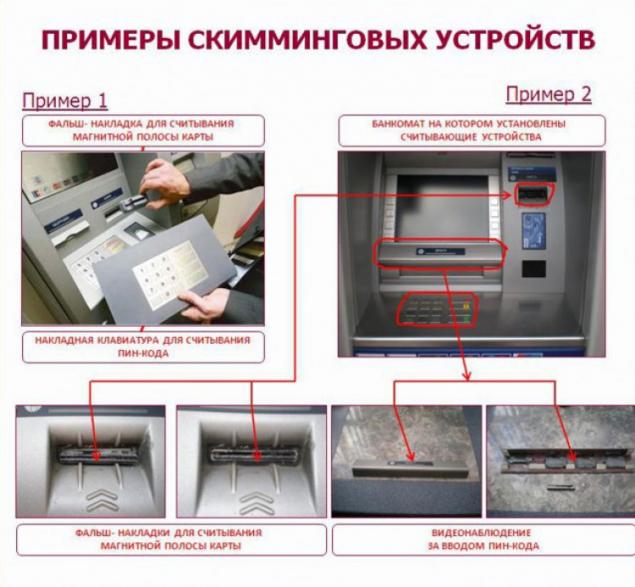

Skimming

This theft of card data using a special reader (skimmer). Attackers copy all the information from the magnetic stripe card (the name of the holder, card number, expiry date of its validity, the CVV and the CVC-code), learn the PIN code, you can use the mini-camera, or pads on the keyboard installed on the ATM. Becoming a victim of skimming can not only taking cash and paying for purchases in retail outlets.

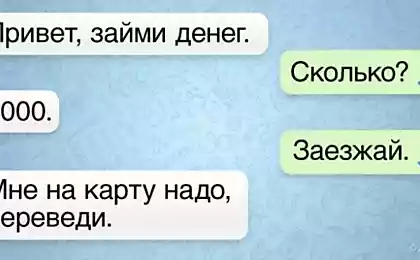

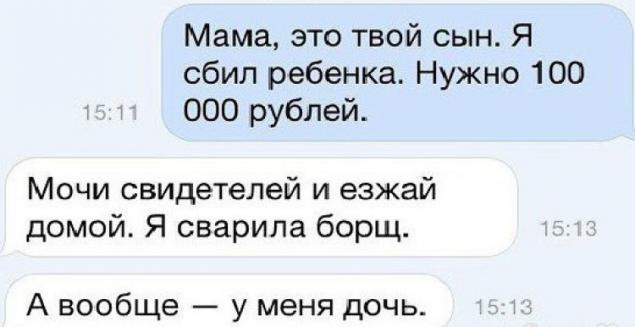

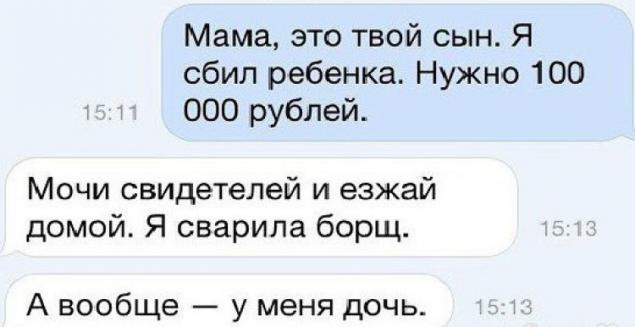

«Mom, I have a problem, do not call, translate money to this account»

Even if your child is sitting on the couch next to you, you are frightened, having received such a message. So it's parents arranged: they are worried about their children, and the reaction to a possible threat to them is very strong. And if your child is somewhere in the city? Simple, effective and brazen scheme using strong feelings and basic, fundamental instincts.

Phishing

Criminals create sites that are similar to the official web pages of credit institutions, which offer customers leave confidential information about yourself. Another option - delivery by mail or via SMS false messages from banks to provide card numbers

. After receiving this information, the scammers steal money with

cards

Loading ... Loading ...

Liked? Share with your friends!

Loading ... Loading ...

1. Con artists are represented employees of the bank

This fresh scheme of deception, which is gaining more popularity among fraudsters.

The man originally comes SMS with the number 900 (the Savings Bank of the service number), in which an unknown person asks him to translate a certain amount of money that will be charged to the account of the victim, if in reply send sent a digital code. Either the operation will be confirmed automatically after 600 seconds.

Man is naturally taken aback by such a desperate situation. And then the fun begins ... Suddenly a phone call from an official of Sberbank number (8-800-555-5550), at the other end a man who refers to the victim by name and said that his trying to fool crooks. And he, as a security specialist bank, must understand and help in this problem.

Further employee "Savings Bank" said that it is necessary to stay on the line, write a response to a message - code that there is provided, insert a space and the word - "cancel transfer". After that, the money, along with the security services of the bank specialist, disappear.

P.S. Asked if the fraudster call under the guise of Sberbank number can, so much so that on the return and call, and call detail has been specified exactly this number, the representatives of the cellular companies do not hide what is technologically possible to do.

2. Con artists are represented by bank employees. Another common scheme

Victim places the advertisement for the sale of any goods on one of the most popular websites ads and became a sight for fraudsters.

Calls buyer and says he is ready to buy the other thing. He further reported that he was in another city and is ready to make a payment on the card, and for the purchase of transport to send a courier company.

Victim fraudster sends his credit card number, as well as all passport information, as they need a transport company.

After some time, she receives a call from a number which all used to be trusted - 8-800-555-5550 (Sberbank official number)

. The voice: "Hello. I Sberbank security officer. On your account entered in the transfer amount (the amount of calls). Since the amount is large, it requires confirmation. You phone was sent SMS with a verification code. If you do call her, the sum is now added to your account. »

The victim believes the swindler and provides all the information, then all the money disappear from the map.

3. Fraud using a wireless terminal and contactless technology PayPass

Attackers shoot money from passengers using the wireless terminal through the clothes and bags wall. Through contactless PayPass technology cards with PIN-less, you can withdraw up to 1,000 Russian rubles.

Unfortunately, these thieves may well sweep the places of mass gatherings. To withdraw money from the account, it is sufficient to attach the device to a pocket or bag, readers of proximity cards operate at a distance of up to twenty centimeters, is not to get their problems.

contactless cards vulnerability can be reduced by using the "tin foil hat", more precisely, of the purse. Generally speaking, if you put the card in the foil package, special radioekranirovanny purse or metal box, it will be impossible to carry out the transaction.

And do not forget about the methods of fraud with bank cards, which have become classics. Here are some of them:

Skimming

This theft of card data using a special reader (skimmer). Attackers copy all the information from the magnetic stripe card (the name of the holder, card number, expiry date of its validity, the CVV and the CVC-code), learn the PIN code, you can use the mini-camera, or pads on the keyboard installed on the ATM. Becoming a victim of skimming can not only taking cash and paying for purchases in retail outlets.

«Mom, I have a problem, do not call, translate money to this account»

Even if your child is sitting on the couch next to you, you are frightened, having received such a message. So it's parents arranged: they are worried about their children, and the reaction to a possible threat to them is very strong. And if your child is somewhere in the city? Simple, effective and brazen scheme using strong feelings and basic, fundamental instincts.

Phishing

Criminals create sites that are similar to the official web pages of credit institutions, which offer customers leave confidential information about yourself. Another option - delivery by mail or via SMS false messages from banks to provide card numbers

. After receiving this information, the scammers steal money with

cards

Loading ... Loading ...

Liked? Share with your friends!

Loading ... Loading ...

30 evidence that each of us has an opinion about the comfort

25 touching evidence that children and animals can not live without each other