703

How to protect yourself from skimming

It happens like this: you are in an unfamiliar place with no money. See lane ATM. Withdraw cash. A few weeks later comes a TEXT: someone in Cape town also takes money from your card.

You call the Bank, block the card, but the money has already been withdrawn. Return them or not — depends on the Bank. Have to deal and to waste time. You may have to call the police in Cape town.

This is called skimming: crooks stealing your card details, then make a duplicate and cashing out the money. The danger lies right here:

To steal the contents of the card, the fraudsters need to copy two things: the magnetic stripe on the card and the PIN code. To do this, they have in the Arsenal.

Skimmer. Is a homemade card reader magnetic tape. The scammers attach it to the card reader of the ATM. Sometimes the skimmer is disguised so well that to recognize it is not even a Bank employee.

Hidden camera. The scammers attach them to the ATM or hiding somewhere near. Miniature camera aimed at the ATM keypad and record how customers enter the PIN code. To distinguish the camera is challenging because it puts them and the Bank's security service.

Keyboard invoice. Fraudsters installed on the ATM, a fake keypad over the original. Fake remembers everything you type and sends pressing real keys. ATM responds as usual, so difficult to notice the substitution. Then criminals took the pad, transcribe the recording and learn the PIN.

How to understand that the ATM openbare how to insert the card, view the ATM. Look for suspicious signs.

Overlays on the card slot. If installed on the ATM skimmer, the card first passes through a special reader, and then enters into a normal card reader. Check this lining on the slit, which is inserted into the map.

If the ATM card is trim (semi-transparent piece of plastic), try to swing or rotate it. Real will be tightly attached to the ATM. Fake backlash, moves and wobbles.

Usually scammers mounted spy device for a few hours, because they are afraid of inspections of the inspectors. So they use simple methods of fastening — tape, glue, honestly.

Often scammers leave a trace of cracks, glue stains and chips. It is better not to use ATM, a card reader which looks like someone poked it with a screwdriver or poured glue.

False panel and black dots. Scammers make fake panels, mount them on the camcorder, and then quickly attached to the ATM: the dispenser of money, under the hood or under the screen. There are cases where the camera was hidden in a stand for the brochures of the same Bank.

Feel free to study the surface of the ATM. Touch panel. Usually the fake keep bad. If something wobbles, examine the item closer.

Bad signal — if on a level surface, was found a miniature cavity, which from afar looks like a black dot. Take a look: perhaps it is a peephole camera.

Convex or different in tone keyboard. The Scam is not always possible to paint fake spare parts in the color of the ATM. The mismatch in color and tone is easy to notice.

Most often pseudo-keyboard glue stick or double sided sticky tape. Therefore, when the set of keys there is a small gap. Pad like is pulled away from the ATM.

If the keyboard has a different texture, bulges or wobbles, try to pry it with your fingernail. If the ATM is attacked by fraudsters, under the panel you will see the real keyboard.

If the ATM is old, chipped and worn panels, and the keyboard looks like new, is also a bad sign. Can not be that banks have changed the keyboard separately from the housing ATM.

How to choose bancomats the skimmers you can never face, if you follow a few rules.

No: unfamiliar ATMs. Try to withdraw money from one ATM. Ideally, if you remember, how it looks (especially the keyboard and the card slot).

No: outdoor ATMs. There fraudsters it is easier to install reader or use the camera as you enter your PIN.

No: ATMs in dark places. Even if the ATM is indoors, lack of light is bad. Can not ignore suspicious items. If there is no choice, turn on the flashlight on my phone and inspect the ATM.

Yes: anti-skimming cover. Banks are fighting card fraud. For example, put on ATMs anti-skimmers does — a special protective lining that make it difficult to attach the reader.

The irony is that the first anti-skimmers does was very similar to the skimmers. People are confused, so today the anti-skimmers does make of transparent plastic. This helps the customer see inside the card slot no scanners, wires and circuit boards.

However, scammers have learned to mask the skimmers under the anti-skimmers does. There will the same recipe — feel free to move the tray before you enter the map.

Yes: the ATMs inside the offices. They are better guarded and more often checking the security of banks. Besides, offices are always a lot of ATMs: skimmers are pasted each — too expensive for fraudsters. At the same time, criminals sometimes deliberately attacked the office, because people think that they are in no danger.

Yes: "wings" for the keyboard. Such ATMs are difficult to install fake keypads and almost completely exclude the possibility of entry of the PIN on a hidden camera.

Yes: ATMs jitterati. Jitter is a pad on the tray, which causes the card to vibrate when you enter. If the ATM equipped with jitter, it is likely that the crooks will pass it by: "shake" will not allow them to correctly copy the magnetic strip on the card. Without this, the whole scheme becomes meaningless.

However, with jitterati there are problems. First, most of the ATMs they are not. Secondly, to understand that the ATM is jitter, not until you insert the card. But you can first test the unfamiliar ATM with some discount card. If it vibrates when you enter, then the ATM safe.

To test the ATM is an extra step, but it can save you a thousand rubles, and five, and fifty. Remember that the map data got to the fraudsters, once you are infected with ATM.

Caution: the ATM in the office or the Mall. The skimmers are harder to get to them. But there are cases where crooks have bribed the guards, and those were written in-house surveillance at the ATM. Then the video was passed on to fraudsters, and they watched the pins. Always cover the keypad with your hand.

Caution: the locks at the entrance to the Bank. Many banks have branches with a magnetic closure. There you can enter using any card with a magnetic strip. Sometimes scammers put skimmers directly into the castle. To combat this just go on the discount card.

Sometimes crooks hang on the outside lock the keyboard to enter the PIN code. Here, too, is simple: if you are required to enter something, that's for sure scammers, and desperate. Banks will never ask you to enter a PIN code at the entrance to the office.

Caution: tourist areas abroad. When we travel, we don't know how to look ATMs of foreign banks, so to cheat us easier. These scammers are. Be careful, especially in Asia: Asian skimming kung-fu knows no equal.

How to protect moneyCover your hand with your free hand when entering the PIN. Sometimes criminals don't put cameras and overhead keyboard, and just hire people to spy, as you enter your PIN.

Go to the chipped card. The presence of the chip will not protect you 100%. Chip really hard to copy. But it reads ATM, and in Russia not all ATMs can do it. The crooks know where to find the ATMs of the old sample and make cash on the magnetic strip. Chips lower the risk, but they cannot reduce it to zero.

Connect SMS-Bank. Connect SMS of all transactions on the account to quickly respond to the sudden cancellation. It will not help if cash will be at night or if you turned off the phone.

Put the limits. Limit in the Internet Bank the cash.Scammers will not be able to withdraw the whole amount at one time.

In Internet banking this is done like this:

1. Select the drop-down list to the right of the name of the account, and then click the "Limits"

2. Put a limit: for example, 5000 rubles. This means that no one can remove from the card more than 5000 rubles in one day

What to do if you caught skimming bancomate take false details, not ukreplyaya them and do not draw attention to himself. If it happens during the day and inside the branch, locate a Bank employee and calmly tell him about the suspicion. If it happens on the street or at night, take things and go away from the ATM. You can follow from the car or on foot — walk away from persecution. Make sure that tail. Then call the Bank that owns the ATM, and in paints describe everything that happened to you. If you notice a skimmer after I inserted the card, leave it in the ATM. Call your Bank and lock it, but then when I'm in a safe place. How to look скиммеры

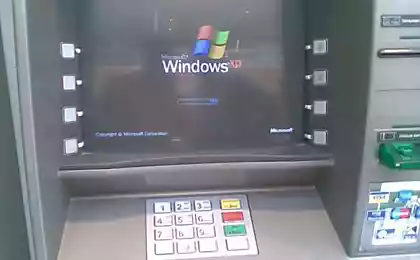

Skimmer, which was disguised as defies any skimming attacks

Arsenal prepared by the fraudster: false keyboard and a skimmer

Conventional skimmer-pad

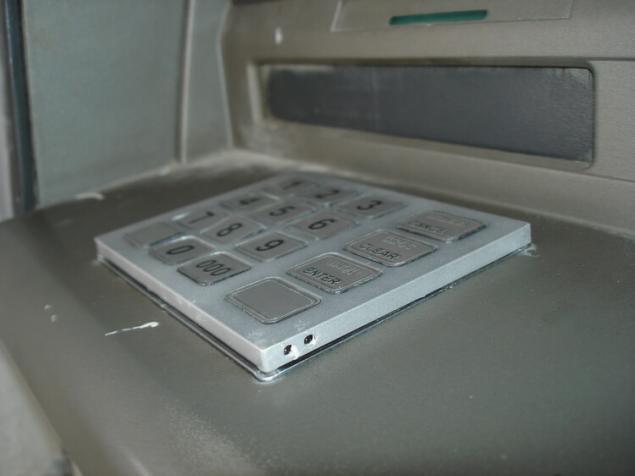

A similar device, but its obviously stuck in a hurry

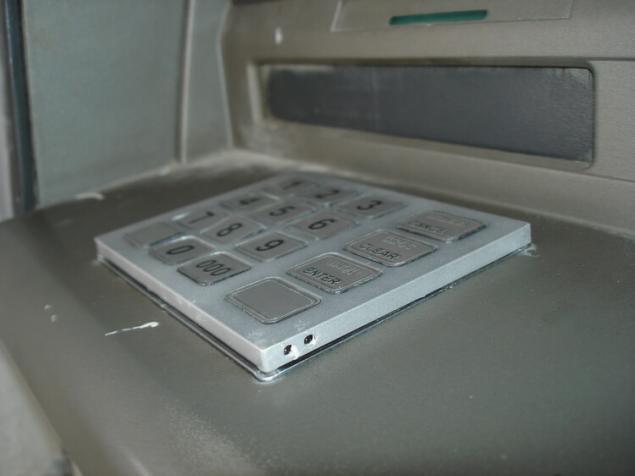

False keyboard

Another skimmer that looks like defies any skimming attacks. By the way, it is hidden and camera

Here the camera is mounted in a blank panel

ATM with a skimmer and without. Guess where the hidden camera

published

P. S. And remember, only by changing their consumption — together we change the world! ©

Join us in Facebook , Vkontakte, Odnoklassniki

Source: journal.tinkoff.ru/skimming/

You call the Bank, block the card, but the money has already been withdrawn. Return them or not — depends on the Bank. Have to deal and to waste time. You may have to call the police in Cape town.

This is called skimming: crooks stealing your card details, then make a duplicate and cashing out the money. The danger lies right here:

To steal the contents of the card, the fraudsters need to copy two things: the magnetic stripe on the card and the PIN code. To do this, they have in the Arsenal.

Skimmer. Is a homemade card reader magnetic tape. The scammers attach it to the card reader of the ATM. Sometimes the skimmer is disguised so well that to recognize it is not even a Bank employee.

Hidden camera. The scammers attach them to the ATM or hiding somewhere near. Miniature camera aimed at the ATM keypad and record how customers enter the PIN code. To distinguish the camera is challenging because it puts them and the Bank's security service.

Keyboard invoice. Fraudsters installed on the ATM, a fake keypad over the original. Fake remembers everything you type and sends pressing real keys. ATM responds as usual, so difficult to notice the substitution. Then criminals took the pad, transcribe the recording and learn the PIN.

How to understand that the ATM openbare how to insert the card, view the ATM. Look for suspicious signs.

Overlays on the card slot. If installed on the ATM skimmer, the card first passes through a special reader, and then enters into a normal card reader. Check this lining on the slit, which is inserted into the map.

If the ATM card is trim (semi-transparent piece of plastic), try to swing or rotate it. Real will be tightly attached to the ATM. Fake backlash, moves and wobbles.

Usually scammers mounted spy device for a few hours, because they are afraid of inspections of the inspectors. So they use simple methods of fastening — tape, glue, honestly.

Often scammers leave a trace of cracks, glue stains and chips. It is better not to use ATM, a card reader which looks like someone poked it with a screwdriver or poured glue.

False panel and black dots. Scammers make fake panels, mount them on the camcorder, and then quickly attached to the ATM: the dispenser of money, under the hood or under the screen. There are cases where the camera was hidden in a stand for the brochures of the same Bank.

Feel free to study the surface of the ATM. Touch panel. Usually the fake keep bad. If something wobbles, examine the item closer.

Bad signal — if on a level surface, was found a miniature cavity, which from afar looks like a black dot. Take a look: perhaps it is a peephole camera.

Convex or different in tone keyboard. The Scam is not always possible to paint fake spare parts in the color of the ATM. The mismatch in color and tone is easy to notice.

Most often pseudo-keyboard glue stick or double sided sticky tape. Therefore, when the set of keys there is a small gap. Pad like is pulled away from the ATM.

If the keyboard has a different texture, bulges or wobbles, try to pry it with your fingernail. If the ATM is attacked by fraudsters, under the panel you will see the real keyboard.

If the ATM is old, chipped and worn panels, and the keyboard looks like new, is also a bad sign. Can not be that banks have changed the keyboard separately from the housing ATM.

How to choose bancomats the skimmers you can never face, if you follow a few rules.

No: unfamiliar ATMs. Try to withdraw money from one ATM. Ideally, if you remember, how it looks (especially the keyboard and the card slot).

No: outdoor ATMs. There fraudsters it is easier to install reader or use the camera as you enter your PIN.

No: ATMs in dark places. Even if the ATM is indoors, lack of light is bad. Can not ignore suspicious items. If there is no choice, turn on the flashlight on my phone and inspect the ATM.

Yes: anti-skimming cover. Banks are fighting card fraud. For example, put on ATMs anti-skimmers does — a special protective lining that make it difficult to attach the reader.

The irony is that the first anti-skimmers does was very similar to the skimmers. People are confused, so today the anti-skimmers does make of transparent plastic. This helps the customer see inside the card slot no scanners, wires and circuit boards.

However, scammers have learned to mask the skimmers under the anti-skimmers does. There will the same recipe — feel free to move the tray before you enter the map.

Yes: the ATMs inside the offices. They are better guarded and more often checking the security of banks. Besides, offices are always a lot of ATMs: skimmers are pasted each — too expensive for fraudsters. At the same time, criminals sometimes deliberately attacked the office, because people think that they are in no danger.

Yes: "wings" for the keyboard. Such ATMs are difficult to install fake keypads and almost completely exclude the possibility of entry of the PIN on a hidden camera.

Yes: ATMs jitterati. Jitter is a pad on the tray, which causes the card to vibrate when you enter. If the ATM equipped with jitter, it is likely that the crooks will pass it by: "shake" will not allow them to correctly copy the magnetic strip on the card. Without this, the whole scheme becomes meaningless.

However, with jitterati there are problems. First, most of the ATMs they are not. Secondly, to understand that the ATM is jitter, not until you insert the card. But you can first test the unfamiliar ATM with some discount card. If it vibrates when you enter, then the ATM safe.

To test the ATM is an extra step, but it can save you a thousand rubles, and five, and fifty. Remember that the map data got to the fraudsters, once you are infected with ATM.

Caution: the ATM in the office or the Mall. The skimmers are harder to get to them. But there are cases where crooks have bribed the guards, and those were written in-house surveillance at the ATM. Then the video was passed on to fraudsters, and they watched the pins. Always cover the keypad with your hand.

Caution: the locks at the entrance to the Bank. Many banks have branches with a magnetic closure. There you can enter using any card with a magnetic strip. Sometimes scammers put skimmers directly into the castle. To combat this just go on the discount card.

Sometimes crooks hang on the outside lock the keyboard to enter the PIN code. Here, too, is simple: if you are required to enter something, that's for sure scammers, and desperate. Banks will never ask you to enter a PIN code at the entrance to the office.

Caution: tourist areas abroad. When we travel, we don't know how to look ATMs of foreign banks, so to cheat us easier. These scammers are. Be careful, especially in Asia: Asian skimming kung-fu knows no equal.

How to protect moneyCover your hand with your free hand when entering the PIN. Sometimes criminals don't put cameras and overhead keyboard, and just hire people to spy, as you enter your PIN.

Go to the chipped card. The presence of the chip will not protect you 100%. Chip really hard to copy. But it reads ATM, and in Russia not all ATMs can do it. The crooks know where to find the ATMs of the old sample and make cash on the magnetic strip. Chips lower the risk, but they cannot reduce it to zero.

Connect SMS-Bank. Connect SMS of all transactions on the account to quickly respond to the sudden cancellation. It will not help if cash will be at night or if you turned off the phone.

Put the limits. Limit in the Internet Bank the cash.Scammers will not be able to withdraw the whole amount at one time.

In Internet banking this is done like this:

1. Select the drop-down list to the right of the name of the account, and then click the "Limits"

2. Put a limit: for example, 5000 rubles. This means that no one can remove from the card more than 5000 rubles in one day

What to do if you caught skimming bancomate take false details, not ukreplyaya them and do not draw attention to himself. If it happens during the day and inside the branch, locate a Bank employee and calmly tell him about the suspicion. If it happens on the street or at night, take things and go away from the ATM. You can follow from the car or on foot — walk away from persecution. Make sure that tail. Then call the Bank that owns the ATM, and in paints describe everything that happened to you. If you notice a skimmer after I inserted the card, leave it in the ATM. Call your Bank and lock it, but then when I'm in a safe place. How to look скиммеры

Skimmer, which was disguised as defies any skimming attacks

Arsenal prepared by the fraudster: false keyboard and a skimmer

Conventional skimmer-pad

A similar device, but its obviously stuck in a hurry

False keyboard

Another skimmer that looks like defies any skimming attacks. By the way, it is hidden and camera

Here the camera is mounted in a blank panel

ATM with a skimmer and without. Guess where the hidden camera

published

P. S. And remember, only by changing their consumption — together we change the world! ©

Join us in Facebook , Vkontakte, Odnoklassniki

Source: journal.tinkoff.ru/skimming/

12 Signs You Need to Add More Fat to Your Diet

A simple calendar that will make your life meaningful