476

How to confirm expenses on a business trip

Many activities involve active business trips, during which the employee performs work in another city, and therefore has to live for several days in a hotel, spending money on transport and food. According to the law, the employer is obliged to compensate the costs incurred by the traveler during his work. However, for this, the costs must be necessarily justified, as evidenced by checks and some other documents.

The relevance of confirming your expenses on a business trip

It is most convenient to buy documents for living on doc-msk-1.com, because on the site it can be done quickly, easily and inexpensively. Most often, this is necessary if a person has lost/lost check documents as a result of various reasons.

According to the official letter of explanation from the Ministry of Finance No. 03-03-06/3/1456 of 15.01.2019, to compensate for travel expenses, a person must confirm them officially. In other words, all costs must be justified. Only in this case, the accountant will be able to make official compensation in accordance with the requirements of paragraph 252 of the Tax Code of the Russian Federation. According to the law, all expenses must be:

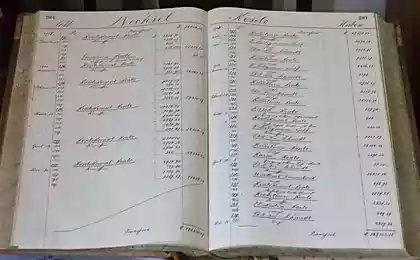

According to accounting and tax documents, travel expenses are made in the category "Other expenses", which are related to the sale and production of goods / services.

How expenses incurred on a business trip are confirmed

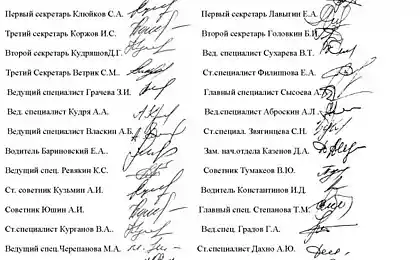

According to Art. 166 of the Labor Code of the Russian Federation, any business trip is an official trip of an employee to another city in order to fulfill an official assignment. For this purpose, an Order is developed for the enterprise, which indicates the place of business trip, duration, purpose and service assignment.

Upon returning from a working trip, the employee is obliged to appear in the accounting office within 3 days and submit an advance report, attaching official documents to it. They confirm the costs incurred during the trip. If the travel funds were issued before the trip, then after returning the accountant must check the target spending, checking with the submitted checks. The staff member is most often reimbursed for the following expenses:

Reimbursement of hotel costs

After returning from a business trip, the employee is compensated for the expenses incurred during his stay at the hotel. The only thing for this is that he must present a check confirming the expenses incurred. In case of loss of this document, accounting will be extremely difficult to compensate for the costs incurred, so such a document should be kept and presented to the accountant.

As you can see, you should approach the organization of a business trip very carefully, paying special attention to all daily allowances, as well as compensation for expenses incurred. Proper and competent design will avoid financial misunderstandings.

The relevance of confirming your expenses on a business trip

It is most convenient to buy documents for living on doc-msk-1.com, because on the site it can be done quickly, easily and inexpensively. Most often, this is necessary if a person has lost/lost check documents as a result of various reasons.

According to the official letter of explanation from the Ministry of Finance No. 03-03-06/3/1456 of 15.01.2019, to compensate for travel expenses, a person must confirm them officially. In other words, all costs must be justified. Only in this case, the accountant will be able to make official compensation in accordance with the requirements of paragraph 252 of the Tax Code of the Russian Federation. According to the law, all expenses must be:

- documented, that is to have the design in the form of official paper in exact accordance with the requirements of the Russian Federation;

- economically justified and expressed in monetary form;

- incurred in the course of work.

According to accounting and tax documents, travel expenses are made in the category "Other expenses", which are related to the sale and production of goods / services.

How expenses incurred on a business trip are confirmed

According to Art. 166 of the Labor Code of the Russian Federation, any business trip is an official trip of an employee to another city in order to fulfill an official assignment. For this purpose, an Order is developed for the enterprise, which indicates the place of business trip, duration, purpose and service assignment.

Upon returning from a working trip, the employee is obliged to appear in the accounting office within 3 days and submit an advance report, attaching official documents to it. They confirm the costs incurred during the trip. If the travel funds were issued before the trip, then after returning the accountant must check the target spending, checking with the submitted checks. The staff member is most often reimbursed for the following expenses:

- Pre-booking of tickets;

- public transport to the railway station or airport;

- the price of a ticket for a vehicle - plane, train;

- bed linen on the train;

- the amount of insurance payment according to compulsory insurance of passengers on transport.

Reimbursement of hotel costs

After returning from a business trip, the employee is compensated for the expenses incurred during his stay at the hotel. The only thing for this is that he must present a check confirming the expenses incurred. In case of loss of this document, accounting will be extremely difficult to compensate for the costs incurred, so such a document should be kept and presented to the accountant.

As you can see, you should approach the organization of a business trip very carefully, paying special attention to all daily allowances, as well as compensation for expenses incurred. Proper and competent design will avoid financial misunderstandings.

At the opening of the 1980 Olympics in Moscow, athletes depicted a living samovar, a traditional symbol of Russian hospitality.

What kind of salad a fast gypsy woman will treat guests at the festive table