1376

How to do accounting in online store

You have created an online store, now the question arises: how to get it work is not technically, but from the practical side. And the main question: how to organize the accounting and paperwork? And is there in this case any benefits? Another important question: can not knock out checks? Let's deal.

At the opening of its online store would be logical to sole proprietorship instead LLC. After all, it is most likely on the organization of small businesses. However, there are exceptions: some online stores as "grow", it becomes necessary to re-register the business and create a society. Tip: To start use IP USN (with the object "income" or "income minus expenses": figure out what is more profitable for you).

• Accepts costs

If a site created by third parties, then the costs for its services can be attributed to the cost of acquisition of exclusive rights to the program for electronic computers and databases provided by subparagraph 2.1 of paragraph 1 of Article 346.16 of the Tax Code. Note rights to the site should be documented. Spending on promotion online store can be accounted for in the cost of advertising. Such explanations are contained in the Letter of the Russian Finance Ministry on December 16, 2011 № 03-11-11 / 317.

Office of the Federal Tax Service for the city of Moscow in a letter dated December 16, 2011 № 20-14 / 2/122096 @ concluded that in order to take into account the created site as an intangible asset, the entrepreneur must have documents proving the existence of an intangible asset and the exclusive right to it. We are talking about patents, certificates and other security documents, the contract of assignment (purchase) of patent, trademark. The letter also made a reservation that if the production site is carried out on the basis of an agreement on the creation of a computer program providing transition to the customer exclusive rights to this software, and then in the accounting and tax accounting individual entrepreneur should recognize an intangible asset.

What system of taxation choose to work online store. Not a lot of options: Ba or USN. Why are two of them? Because UTII officials are not allowed to be used in the implementation of distance selling.

If the merchant does not have exclusive rights to the newly created software package and online advertising information posted on its activities, the cost of setting up the portal you need to consider how to spend on advertising, the base - 20 sub-paragraph 1 of Article 346.16 of the Tax Code. This explanation is contained, in particular, in the above letter from the Federal Tax Service.

• Accounting for the cost of shipping

Another important question is how to take into account the cost of courier delivery. The Ministry of Finance in a letter dated March 7, 2012 № 03-11-11 / 76 explained that if the cost of transportation services a customer has ordered goods included in the price of the product, and separate agreements will not be issued, then these activities can be considered part of the work in the field of remote sales of goods .

If courier services executed a separate contract and paid for will be charged in addition to the buyers, such activity is recognized independent, and hence its taxation should be managed separately from the operation of an online store.

Thus, delivery of goods, carried out as an independent work, using for this purpose the organization or employer no more than 20 vehicles, based on the standards of Chapter 26.3 of the Tax Code, can be translated into UTII.

• Options for tax

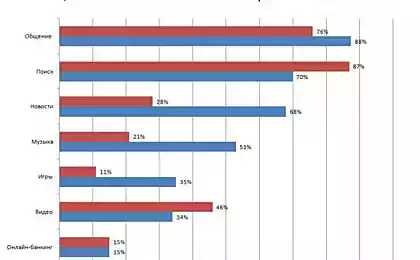

The important question: what system of taxation choose to work online store. Not a lot of options: Ba or USN. Why are two of them? Because UTII officials are not allowed to be used in the implementation of distance selling. We will understand why.

Russia's Finance Ministry in a letter dated March 21, 2012 № 03-11-11 / 94 made it clear that a retailer does not apply, in particular, the sale of goods on samples and catalogs is stationary distribution network (including in the form of mail (mail order trade), as well as through TV, telephone and computer networks).

Therefore, the activities of the network of traders does not apply to retail, and thus is not subject to taxation in the form of a single tax on imputed income.

• Cash - obligatory

How to take into account the cost of courier delivery? The Ministry of Finance explained that if the cost of transportation services is included in the price of the product, and separate agreements will not be issued, then these activities can be considered as part of the work in the field of distance selling.

Many who creates his own shop in the virtual space to think that checks in this case, you can not knock. But, as has been sounded above - activity on selling goods over the Internet can be translated into vmenenku, which means - you need to use a cash register is mandatory. How can knock out checks, if the orders come into the office first, and only then to deliver goods to customers who for various reasons can refuse to pay for the purchase?

The Letter UFNS the city of Moscow from September 27, 2012 № 20-14 / 091251 @ unambiguous conclusion: organizations and individual entrepreneurs in the implementation of trade through online retailers are obliged to use of cash registers and issue receipts when paying for goods buyers.

The law does not allow embossing checks, for example, in the office and deliver them together with the goods to the customer. Officials of the opinion that organizations and individual entrepreneurs who carry out courier services for pre-order with delivery of the goods to the specified address when the buyer cash payments required to apply mobile CCP. This recommendation is logical and convenient to both customers and the companies themselves.

Specialists of the Federal Tax Service of the city of Moscow in a letter dated May 11, 2012 № 20-14 / 041286 @ recalled that the non-issuance of cash receipt with cash payments is the reason for bringing the company to administrative liability in accordance with paragraph 2 of Article 14.5 of the Administrative Code.

• No cash

Despite the fact that, as already noted above, the use of the cash register in the online store must always be, yet there is one exception.

If cash payments from customers in payment for goods received from a site on the Internet are carried out with the use of payment cards through credit institutions (ie, "bank transfer"), then a trader there is no need to use the CCP, because the revenue in this case comes not in cash and to the account. This conclusion contains Letter Russian Finance Ministry of June 9, 2009 № 03-01-15 / 6-293 and repeatedly confirmed by a letter FTS, for example, on April 24, 2012 in Document No. № 17-26 / 037701 @.