472

7 simple tips to teach your child to handle money

Nine million four hundred sixty thousand one hundred forty one

Important life habits related to money are formed before the age of 7 years. Therefore, in order to protect the child from unnecessary expenses in adult life, it is important to teach him to save and right to treat money right now.

The website shares with you 7 correct ways that will help to develop a child's good habits.

No. 1. Tell us about the family budget

To tell the child about the money you already have 3-4 years, then at school age he will be able to dispose of them. It is important to do it on his tongue. Separate waste by color and tell us that blue is the rent, which is yellow to spend on food, and blue — on toys.

What I learned: the next time a child asks to store a new toy, you will be able to explain that the money is left only in a yellow circle, and blue will appear next month. Show your child that it can fail, gain more blue color and buy a larger toy.

No. 2. Do not buy from

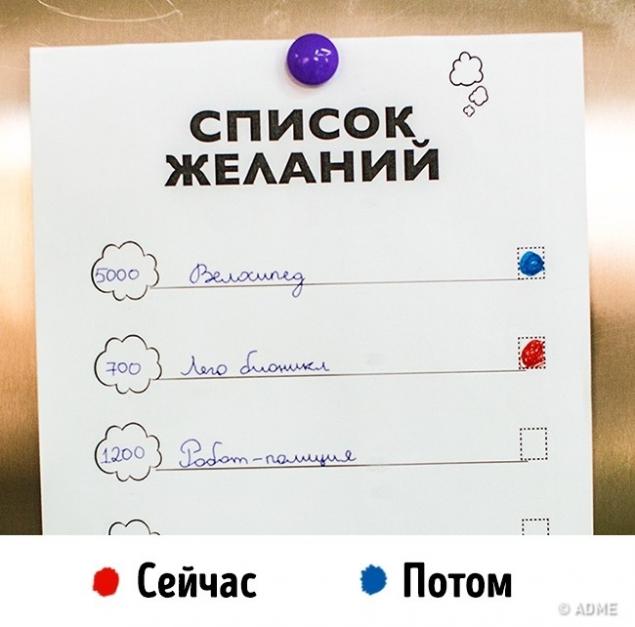

Bright Windows and shelves evoke a surge of emotion and makes the child to cry: "buy, buy, Buy!" Do not deny, and offer to bring a thing to the wish list. Wish to draw, write a name, a price and hang on the fridge. At the end of the month you can look at the list and pick one toy.

What I learned: the Kid will learn to think about each purchase and not to succumb to the spontaneous desires. This process will be interesting and informative.

No. 3. Let's pocket money

It is important not only to give the child pocket money, but also to teach them how to spend it, so they immediately went to the sweets and small things. For example, a child has 300 rubles. Tell him that he can buy them a little toy. But if you wait a month, you will help him and he will be able to buy a large.

What I learned: He will be able to plan their savings and future purchases.

No. 4. Break desire to prioritize

Children's desires are constantly changing. Today, I want one thing, tomorrow another. If things in the wish list a lot, break them by priority. Ask your child to highlight what I want now, and what in the future. If the thing is expensive, suggest to save up for it together using a piggy Bank.

What I learned: It develops important skills of planning and makes one think about future purchases.

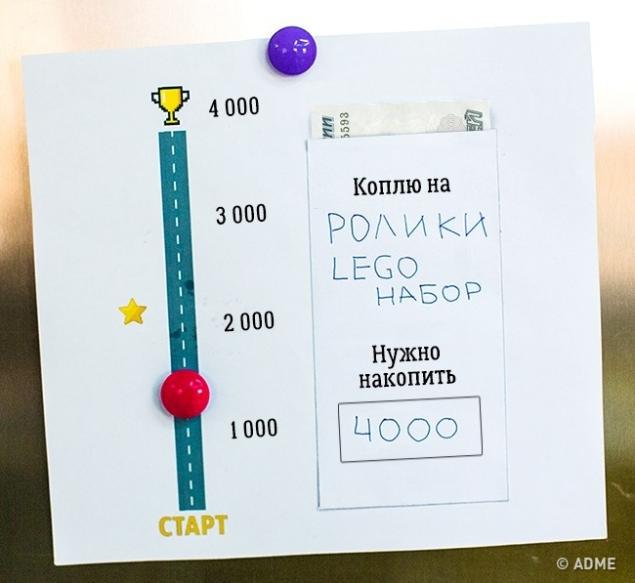

No. 5. Create piggy Bank

As the first piggy Bank is a glass, a plastic container or envelope. Place the piggy Bank stickers with the name of the future purchase and write how much you need to save. Let the child puts a part of pocket money and records, as put.

What I learned: Piggy Bank will teach your child to be patient, to be able to calculate and not to forget the cherished goal. If a child accumulates patiently — help him. For example, put each coin, add a bit on top.

No. 6. Do not pay children for their studies

"Get a good grade and get 100 rubles" — this method does not work. The child may decide that the assessment in mathematics is not 50 and as much as 500 rubles. In addition, this approach will make learning the production of money, not knowledge.

Add a little bit of cash in the Treasury only for big events: the end of the school year or win the swimming competition.

No. 7. Turn it into a game

If a child has a dream, but it costs a lot of money, make a plan and make the achievement of the goal in the game. Write the name of things, and next draw with your child a race track or a fabulous way. Hang the plan in a prominent place and celebrate every progress towards that goal.

What I learned: the Child learns to set goals and see the steps to achieve them. And the feeling of the game will help him to reach the end, to get the cherished thing and appreciate it.

via #image1415515

Important life habits related to money are formed before the age of 7 years. Therefore, in order to protect the child from unnecessary expenses in adult life, it is important to teach him to save and right to treat money right now.

The website shares with you 7 correct ways that will help to develop a child's good habits.

No. 1. Tell us about the family budget

To tell the child about the money you already have 3-4 years, then at school age he will be able to dispose of them. It is important to do it on his tongue. Separate waste by color and tell us that blue is the rent, which is yellow to spend on food, and blue — on toys.

What I learned: the next time a child asks to store a new toy, you will be able to explain that the money is left only in a yellow circle, and blue will appear next month. Show your child that it can fail, gain more blue color and buy a larger toy.

No. 2. Do not buy from

Bright Windows and shelves evoke a surge of emotion and makes the child to cry: "buy, buy, Buy!" Do not deny, and offer to bring a thing to the wish list. Wish to draw, write a name, a price and hang on the fridge. At the end of the month you can look at the list and pick one toy.

What I learned: the Kid will learn to think about each purchase and not to succumb to the spontaneous desires. This process will be interesting and informative.

No. 3. Let's pocket money

It is important not only to give the child pocket money, but also to teach them how to spend it, so they immediately went to the sweets and small things. For example, a child has 300 rubles. Tell him that he can buy them a little toy. But if you wait a month, you will help him and he will be able to buy a large.

What I learned: He will be able to plan their savings and future purchases.

No. 4. Break desire to prioritize

Children's desires are constantly changing. Today, I want one thing, tomorrow another. If things in the wish list a lot, break them by priority. Ask your child to highlight what I want now, and what in the future. If the thing is expensive, suggest to save up for it together using a piggy Bank.

What I learned: It develops important skills of planning and makes one think about future purchases.

No. 5. Create piggy Bank

As the first piggy Bank is a glass, a plastic container or envelope. Place the piggy Bank stickers with the name of the future purchase and write how much you need to save. Let the child puts a part of pocket money and records, as put.

What I learned: Piggy Bank will teach your child to be patient, to be able to calculate and not to forget the cherished goal. If a child accumulates patiently — help him. For example, put each coin, add a bit on top.

No. 6. Do not pay children for their studies

"Get a good grade and get 100 rubles" — this method does not work. The child may decide that the assessment in mathematics is not 50 and as much as 500 rubles. In addition, this approach will make learning the production of money, not knowledge.

Add a little bit of cash in the Treasury only for big events: the end of the school year or win the swimming competition.

No. 7. Turn it into a game

If a child has a dream, but it costs a lot of money, make a plan and make the achievement of the goal in the game. Write the name of things, and next draw with your child a race track or a fabulous way. Hang the plan in a prominent place and celebrate every progress towards that goal.

What I learned: the Child learns to set goals and see the steps to achieve them. And the feeling of the game will help him to reach the end, to get the cherished thing and appreciate it.

via #image1415515