664

All in good time: the latest economy and business ideas that all ready

© Andrew B. Myers

Why modern financial sector, despite new technologies and numerous innovations, offers products and services brand does not meet the needs of most people? Columnist Huffington Post, April Rynn believes that we miss huge opportunities for business development, the economy and society that may adversely affect the market in the future. For successful economic development is necessary to ensure access of the majority of the population to appropriate financial services — in other words, you need to provide access to Finance. But historically, many financial services may be used only by the rich and wealthy, and the poor are excluded from the system.

Microfinance, but macroeffect

Microfinance is provision of small (micro) loans and savings products to people who are on the lower level of the economic pyramid. Clients of microfinance institutions are often called microentrepreneurs. Modern microfinance began in the 1970s when Mohammed Yunus began to provide small loans to the communities of poor women in Bangladesh. Today the system hundreds of millions saved from poverty of people. If you combine all microentrepreneurs, they will be a huge force in the global economy.

The era of commercial microfinance began in 2000-ies (Yunus received the Nobel prize in 2006). In October 2005 there was a company Kiva, which became the harbinger of the platforms P2P lending such as Lending Club and crowdfunding resources like Kickstarter. Today, Kiva helps to obtain loans totaling more than $ 1 billion to microentrepreneurs around the world. In countries like Congo, Kiva is the largest private lender.

Microfinance is efficient because it is based on trust and reputation and meets the needs of people excluded from the financial system. It allows low-income microentrepreneurs to refuse service sharks of the credit market and for the first time to save.

The money they can to send their children to school to secure a reserve capital for unforeseen situations, to improve the overall level of stability and sustainability.

The social impact of microfinance is enormous. Looking back, we can say that we saw the possibilities of commercial capital, which helps innovative tool to grow and develop. Of course, without commercial investment, microfinance would not be available for such a large number of people (in this case the repayment rate is still kept at a level close to 100%).

At the same time, microfinance is not a panacea. Often, the queries of the investors were placed in priority before the needs of microentrepreneurs. In some cases this has led to disastrous consequences: suicides of MFI clients, the massive defaults on loans, withdrawal from the market of some microfinance institutions.

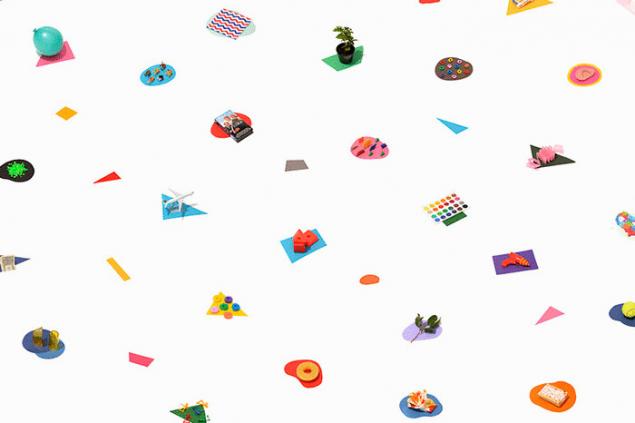

Bangladesh, Brooklyn, Berlin and deleteallitems now to the flourishing of the sharing economy, the sharing economy, which we observe today, to its new business model, based on the principle of "access above ownership" and underutilized assets. Today with unprecedented speed to develop a new social trading platform offering services from short term car rental (car sharing) and travel together (ridesharing) to sharing of all kinds of abilities and facilities. Many of these models are based on new technologies: in fact, we are creating a virtual platform to share in real life.

This process creates a completely new class of microentrepreneurs. It homeowners on Airbnb, drivers on Lyft, employers at TaskRabbit, teacher at Skillshare, couriers at Shyp, guides on AnyRoad, the owners of the cars on RelayRides and many others. Through these platforms they get an income, save money, ensure their well-being, entering the life of their community well, or make ends meet. The development of platforms for collaborative consumption is also based on trust and social capital, confirming the view that reputation matters more than a Bank account.

The popularity of micro-entrepreneurs an unexpected but not so surprising. According to organizations such as Freelancers Union, Intuit and others, by 2020, the US market is freelancers, that is, employees are not bound by contract with any organization, will be more than 40%. Thus, it is not simply a matter of collaborative consumption, is the main trend of the modern economy.

Some companies, such as Lyft (online platform for joint trips), actively seeking to expand its services and reach a wider community. Lyft allows its drivers (many of which were previously unemployed) to earn, but also seeks to extend its services to less affluent segments of the population through its Community Solutions initiative. However, neither Lyft nor other platforms for collaborative consumption may not provide financial services. The market is yet to fill this gap.

Example Etsy, P2P platform for trading Handicrafts, demonstrates how these new trends in the economy. Although Etsy is different from companies in the collaborative consumption because it is not based on sharing underutilized assets, numerous sellers on this online platform (more than one million worldwide) are a perfect example of micro-enterprises and the results of financial inclusion.

The majority of sellers on Etsy have no access to financial services to grow your business. Interestingly, they rarely need investment capital. They have no purpose and desire to expand your business, rather, they appreciate its P2P nature. This provides them the flexibility to do exactly what they like. Overall, it's the same as if a leading multinational Corporation (or a country) did not have financial instruments for development. Paradoxically, in this case such standard measures as providing access to capital of the small business Association (SBA), are not suitable. We need a new approach.

Companies such as Etsy and platforms of collaborative consumption act as economic bridges: they are able to smooth the transition to a new economic thinking, a new approach to work, family and position in society. Collaborative consumption is not going to solve world economic problems, as well as one microfinance may not reduce global poverty. However, this powerful and useful tool that was not there before and which should be developed.

Services, which are all waiting for

Modern micro-entrepreneurs, and society as a whole, can learn from the past experience of ensuring financial inclusion. Here are three main lessons from there:

— Micro-entrepreneurs in terms of joint consumption, lack of financial services;

— However, many who would actively participate in collaborative consumption, remain behind due to limited access to appropriate financial instruments;

The first two points represent a huge opportunity for financial institutions and entrepreneurs at both macro-and micro-level.

Kiva was in many ways a pioneer of the modern phenomenon of crowdfunding and P2P lending. She connected the ideas of Yunus (building trust and increasing the value of reputation and social capital) with innovative technologies that allow to access the Finance with the help of new tools (online lending platforms and mobile banking).

Unfortunately, while traditional players in the market restrict broad access to these innovations. For example, Barclay card allow wealthy clients to donate their money, but do not directly serve clients with low income. Here is a list of services that it was time to develop. The market for them is ready:

Services for tracking income, savings and investment for micro-entrepreneurs;

Tools for teaching financial literacy: a key element in development, which improves the impact of all ongoing transactions and services;

— Easy access credit card: a platform for collaborative consumption require participants to have a credit card, which eliminates from the game a large number of potential users.

Economy, labor market, General well-being of people and the role of Finance in the modern world are undergoing significant changes. The growth of micro-enterprises, by and large, represents a new economic force. To reveal its full potential, it is necessary to develop services that correspond to the new needs of people. Is the key to success in the era of all these changes and the ability to open the world in new ways.

Source: theoryandpractice.ru