627

"Coming Crisis buy gold, canned meat and cartridges

will be 2 Picchu and text

We are waiting for a financial cataclysm pohlesche Great Depression, I'm sure an expert stock analyst Stepan Demur.

Neither the United States nor Europe can not revive their economies. The debts are growing with each passing day. How will it all end? We decided to ask the famous stock analyst Stepan Demur.

His point of view different from the views of most economists. He emphasizes that an engineer-physicist, so, they say, makes his predictions based on exact numbers, not speculation. It seems it is time to buy in the store 20 cans of corned beef. Just in case.

In general, impressionable ladies reading this text is prohibited.

01.

"DEAD WORLD ECONOMY»

- Debts in developed countries are growing. What's over?

- The world economy is dead. Developed countries are not able to service their debts. In America, it has already exceeded $ 16 trillion. dollars. There calculation. Even if the US authorities will be taxable income of its citizens 100% deductible, they will not be able to serve - in fact pay - their duty. United States in the last 30 years living at the expense of lending. That was the main source of the development of civilization and progress. Now this scheme came to an end. And the only way out - default.

- Let's say America declare itself bankrupt. What then?

- Implemented the principle of "Everyone to whom we must forgive." But it's hard. Because of all the political leaders of some owners - the banks. Who are the owners of banks - God knows. There is a second option would be to devalue the currency. For example, 10 times. If you do, the debt burden will fall on the order. It's simple: your debt is denominated in dollars of old, and what you produce - new dollars. But each of these paths is unacceptable from a political and social point of view. It's too dangerous.

- Is the present situation it was impossible to calculate? After all, smart people in the same bank and the government sit mathematical models calculated ...

- It is useless. Modern economics to real life to do. In October this year, even in the US Federal Reserve System (the analog of our central bank) admitted that their models - this is an empty exercise in mathematics. For example, why do they have to pump up the economy with money and to keep lending rates near zero? According to their models in a year and a half it was to happen to double-digit inflation and the growth of production and consumption. Neither one nor the other, we do not see. Prices are not rising, jobs are not created, production falls. In fact, over two years, the world economy was injected about $ 30 trillion. This is half of the global GDP. But to no avail. Because the money is settled in the banks and the real economy have not reached.

- What's in this gigantic economic machine gone wrong?

- There is an opinion, saying that we have moved to a new level. We have a post-industrial society and a new economy, blah blah blah. But what is it in fact? This is when you get the basic income not from the production of anything, and from the revaluation of assets. Let's say you have a flat. You go to the bank and say: I want to take under her credit. The bank gives you $ 100. After a year or two at the expense of growth of the price it has cost $ 200. You go to the bank and say, give me another $ 100. And the bank gives, because it is now worth so much. What are you doing? Take that money and spend. Of course, asset prices are rising again. But at some point the market is collapsing. Your apartment is worth the same $ 100, but you need to order more. I always remember the example of Japan, where real estate prices there fell from 1990 to 1996 by 80% and still have not risen. Something similar is now going to happen in all countries.

"Oil prices fall SEVERAL TIMES»

- The crisis can not be avoided?

- No, and it will be worse than the Great Depression. Because imbalances much more. Hardest hit Russia and China, Saudi Arabia. We'll be back on the level of welfare in the 60 - 70s of the last century.

- And what will happen in Russia, you can be more specific?

- Now everything is in our economy is dependent on oil prices. In the coming years it will fall to $ 35 - 40. While it does not, because the global economy has pumped liquidity. She goes to the stock and commodity markets. But this can not continue indefinitely. Problems in the real sector have already begun. Soon citizens and businesses do not cmogut to service their debts. Again, all will collapse - no matter how much money you have or printed.

- Why are we so vulnerable? After all, a lot of the other economies that are also engaged in the export of resources ...

- We are fundamentally different from them. For example, from the same Australia. We are not export-oriented model, and raw material economy of the colony. No more. Private industry is killed. Agriculture began to rise to his feet, but soon it will finish the WTO. There is only a pipe in which oil and gas are pumped. Oil dollars are spent on the purchase of imported goods, US government bonds, as well as officials from the country's output. Remember where we were and where China in terms of development in 1987? And let's compare right now. Two very big differences.

"Accumulate the money and live without debt»

- You are such nightmares are telling that it is time to dig a bunker in the country and products to add ... What are we supposed to do?

- All right say. Buy stew, ammunition, drugs and weapons. I'm not kidding.

- Is it all so hard to be?

- Special forces of Great Britain and Switzerland are preparing for an influx of refugees from Europe. Make a report on the impact of the crisis, social unrest and riots. Most affected developing countries. We're not rich live, and will live even worse.

- What is the best advice to give to our readers?

- Save money and live without debt. The main rule - to live below their capabilities, not to show off. I never understood how you can, with a salary of 60 - 70 thousand rubles to buy himself a new "Mercedes» ?!

- Well, the money amassed. But what stash something to keep?

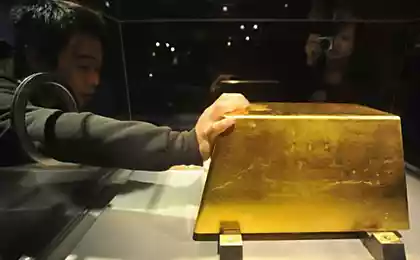

- In gold. That is, in the physical metal. Coins, scrap gold, bullion. Stocks and bonds - a piece of paper, that is nothing. They do not have to buy. The same thing - with the ruble. We should get rid of him. Trace his story at least the past 25 years. How many times it has depreciated in 90 years? That's right!

- A better than gold?

- In 2008, growing only a dollar and gold. But if you look at the statistics, the US dollar since 1913 has lost 98% of purchasing power, and gold - no. Plus gold is that it has also a function of the commodity.

Rising inflation - is also becoming more expensive precious metals. And when the crisis, the gold rises because it is the equivalent of money. Personally, I keep my family capital in gold. And in this way coming in, let's say, some smart people I know.

PERSONAL

Stepan Demur. He was born in 1967. All the dashing 90's lived in America. MIPT graduate students went to receive additional education. And remain in the United States until the early 2000s. "Eat like - he explains. - That went to trade on the American Stock Exchange. " In the late 90s he was head of research at one of Chicago's largest investment companies. And well he studied how the transatlantic economy. In the 2000s he returned to Russia. "The money earned. It was time to get married. And an American I have never liked - said Demur correspondent "KP" when they are at the end of the interview overturned a pair of glasses of whiskey. - Just imagine, the one I told during a visit that the United States won World War II! »

Other opinions

"In 99, 9% of the prophecy come true»

- Of course, the crisis, which happened in 2008, not yet dissolved. It is somewhat similar to what it was in the 70s of the last century. Then the economy began to recover only 10 years later - said Vasily Solodkov, director of the Banking Institute of Higher School of Economics. - In my opinion, the US debt default will not be exact. Especially as the dollar remains the world's reserve currency, and Americans continue to borrow money on the international market. Especially in the US there have been positive changes. They have become closely involved in the problem of the budget deficit and reduce public debt.

Sudden catastrophic events in the coming years will not be exact. Possible unless the exit of Greece from the euro zone and sufficiently serious acceleration of inflation. But the crisis always comes suddenly. And in what form and where it will happen, it is very difficult to predict. Economic science is strong hindsight. And at 99, 9% of the prophecies of the crisis do not come true.

As for the savings ... If we had not bought gold in 1913, and in 1977, it is still in negative territory would be, and if at the end of 2008, is in the black. So it all depends on the choice of the date. But pre-buy-no one knows.

source

02.Birzhevoy analyst Stepan Demur.

thank you did not break the post

Source:

We are waiting for a financial cataclysm pohlesche Great Depression, I'm sure an expert stock analyst Stepan Demur.

Neither the United States nor Europe can not revive their economies. The debts are growing with each passing day. How will it all end? We decided to ask the famous stock analyst Stepan Demur.

His point of view different from the views of most economists. He emphasizes that an engineer-physicist, so, they say, makes his predictions based on exact numbers, not speculation. It seems it is time to buy in the store 20 cans of corned beef. Just in case.

In general, impressionable ladies reading this text is prohibited.

01.

"DEAD WORLD ECONOMY»

- Debts in developed countries are growing. What's over?

- The world economy is dead. Developed countries are not able to service their debts. In America, it has already exceeded $ 16 trillion. dollars. There calculation. Even if the US authorities will be taxable income of its citizens 100% deductible, they will not be able to serve - in fact pay - their duty. United States in the last 30 years living at the expense of lending. That was the main source of the development of civilization and progress. Now this scheme came to an end. And the only way out - default.

- Let's say America declare itself bankrupt. What then?

- Implemented the principle of "Everyone to whom we must forgive." But it's hard. Because of all the political leaders of some owners - the banks. Who are the owners of banks - God knows. There is a second option would be to devalue the currency. For example, 10 times. If you do, the debt burden will fall on the order. It's simple: your debt is denominated in dollars of old, and what you produce - new dollars. But each of these paths is unacceptable from a political and social point of view. It's too dangerous.

- Is the present situation it was impossible to calculate? After all, smart people in the same bank and the government sit mathematical models calculated ...

- It is useless. Modern economics to real life to do. In October this year, even in the US Federal Reserve System (the analog of our central bank) admitted that their models - this is an empty exercise in mathematics. For example, why do they have to pump up the economy with money and to keep lending rates near zero? According to their models in a year and a half it was to happen to double-digit inflation and the growth of production and consumption. Neither one nor the other, we do not see. Prices are not rising, jobs are not created, production falls. In fact, over two years, the world economy was injected about $ 30 trillion. This is half of the global GDP. But to no avail. Because the money is settled in the banks and the real economy have not reached.

- What's in this gigantic economic machine gone wrong?

- There is an opinion, saying that we have moved to a new level. We have a post-industrial society and a new economy, blah blah blah. But what is it in fact? This is when you get the basic income not from the production of anything, and from the revaluation of assets. Let's say you have a flat. You go to the bank and say: I want to take under her credit. The bank gives you $ 100. After a year or two at the expense of growth of the price it has cost $ 200. You go to the bank and say, give me another $ 100. And the bank gives, because it is now worth so much. What are you doing? Take that money and spend. Of course, asset prices are rising again. But at some point the market is collapsing. Your apartment is worth the same $ 100, but you need to order more. I always remember the example of Japan, where real estate prices there fell from 1990 to 1996 by 80% and still have not risen. Something similar is now going to happen in all countries.

"Oil prices fall SEVERAL TIMES»

- The crisis can not be avoided?

- No, and it will be worse than the Great Depression. Because imbalances much more. Hardest hit Russia and China, Saudi Arabia. We'll be back on the level of welfare in the 60 - 70s of the last century.

- And what will happen in Russia, you can be more specific?

- Now everything is in our economy is dependent on oil prices. In the coming years it will fall to $ 35 - 40. While it does not, because the global economy has pumped liquidity. She goes to the stock and commodity markets. But this can not continue indefinitely. Problems in the real sector have already begun. Soon citizens and businesses do not cmogut to service their debts. Again, all will collapse - no matter how much money you have or printed.

- Why are we so vulnerable? After all, a lot of the other economies that are also engaged in the export of resources ...

- We are fundamentally different from them. For example, from the same Australia. We are not export-oriented model, and raw material economy of the colony. No more. Private industry is killed. Agriculture began to rise to his feet, but soon it will finish the WTO. There is only a pipe in which oil and gas are pumped. Oil dollars are spent on the purchase of imported goods, US government bonds, as well as officials from the country's output. Remember where we were and where China in terms of development in 1987? And let's compare right now. Two very big differences.

"Accumulate the money and live without debt»

- You are such nightmares are telling that it is time to dig a bunker in the country and products to add ... What are we supposed to do?

- All right say. Buy stew, ammunition, drugs and weapons. I'm not kidding.

- Is it all so hard to be?

- Special forces of Great Britain and Switzerland are preparing for an influx of refugees from Europe. Make a report on the impact of the crisis, social unrest and riots. Most affected developing countries. We're not rich live, and will live even worse.

- What is the best advice to give to our readers?

- Save money and live without debt. The main rule - to live below their capabilities, not to show off. I never understood how you can, with a salary of 60 - 70 thousand rubles to buy himself a new "Mercedes» ?!

- Well, the money amassed. But what stash something to keep?

- In gold. That is, in the physical metal. Coins, scrap gold, bullion. Stocks and bonds - a piece of paper, that is nothing. They do not have to buy. The same thing - with the ruble. We should get rid of him. Trace his story at least the past 25 years. How many times it has depreciated in 90 years? That's right!

- A better than gold?

- In 2008, growing only a dollar and gold. But if you look at the statistics, the US dollar since 1913 has lost 98% of purchasing power, and gold - no. Plus gold is that it has also a function of the commodity.

Rising inflation - is also becoming more expensive precious metals. And when the crisis, the gold rises because it is the equivalent of money. Personally, I keep my family capital in gold. And in this way coming in, let's say, some smart people I know.

PERSONAL

Stepan Demur. He was born in 1967. All the dashing 90's lived in America. MIPT graduate students went to receive additional education. And remain in the United States until the early 2000s. "Eat like - he explains. - That went to trade on the American Stock Exchange. " In the late 90s he was head of research at one of Chicago's largest investment companies. And well he studied how the transatlantic economy. In the 2000s he returned to Russia. "The money earned. It was time to get married. And an American I have never liked - said Demur correspondent "KP" when they are at the end of the interview overturned a pair of glasses of whiskey. - Just imagine, the one I told during a visit that the United States won World War II! »

Other opinions

"In 99, 9% of the prophecy come true»

- Of course, the crisis, which happened in 2008, not yet dissolved. It is somewhat similar to what it was in the 70s of the last century. Then the economy began to recover only 10 years later - said Vasily Solodkov, director of the Banking Institute of Higher School of Economics. - In my opinion, the US debt default will not be exact. Especially as the dollar remains the world's reserve currency, and Americans continue to borrow money on the international market. Especially in the US there have been positive changes. They have become closely involved in the problem of the budget deficit and reduce public debt.

Sudden catastrophic events in the coming years will not be exact. Possible unless the exit of Greece from the euro zone and sufficiently serious acceleration of inflation. But the crisis always comes suddenly. And in what form and where it will happen, it is very difficult to predict. Economic science is strong hindsight. And at 99, 9% of the prophecies of the crisis do not come true.

As for the savings ... If we had not bought gold in 1913, and in 1977, it is still in negative territory would be, and if at the end of 2008, is in the black. So it all depends on the choice of the date. But pre-buy-no one knows.

source

02.Birzhevoy analyst Stepan Demur.

thank you did not break the post

Source: