595

The economy: Alexander Auzan explains why some people live bad and others good

Economy has always sought explanations for why some people live bad and others good. In the second half of the XX century became louder sound explanation: the fundamental cause of differences in the level of development is the difference in institutions. The author of this theory was Nobel laureate Douglas North, who received the award for what he explained: innovation, economies of scale, education, capital accumulation are not causes of growth, they are growth. The power of social tensions is the starting point of economic science? It starts from Adam. From Adam Smith and his work "an inquiry into the nature and causes of the wealth of Nations." The questions that Smith tried to answer, passed through 250 years of subsequent history — and in the end of XX century, in 1998, one of the most remarkable institutional economists Mancur Olson released a wonderful book called "the rise and decline of Nations" is about the stagnation and institutional sclerosis.

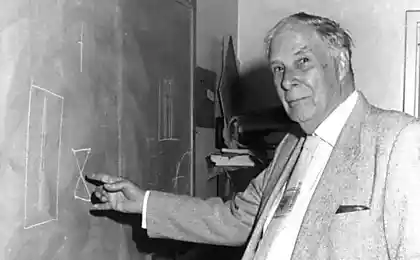

Now we have a pretty good picture of the world. People live longer in countries that better develop its economy. Are the world leaders in North America and Europe. In the tail chain of the global results is Africa. Do we understand why this is happening? One of the largest of minds, now alive, Douglas North, the author of the theory of institutional change, received the Nobel prize for her, said everything what I was looking for as the cause of success, is a reason not to. This is the growth. When you say innovation, economies of scale, education, capital accumulation is not really a factor. This is "pieces of growth" is part of it. And the reason is the differences in institutions. Let's look at how the rules work — on the football example. In 1994, a Caribbean tournament where the final is played in Barbados and Costa Rica. The rules state: "you need to Win with difference of 2 goals. In the event of a tie in regular time is assigned to additional. The game into extra time goes up to the first goal. Goal scored in extra time counted for two." On 83 minutes, Costa Rica wins back one ball. The score became 2:1 in favor of Barbados even though Barbados. As you begin to think I make the team? Barbados immediately scored an own goal to extra time, the team of Costa Rica is trying to score the ball, and defenders to protect the gates of the Barbados Costa Rica from attacking Costa Rica. So are institutions!

In Seoul and surrounding areas is home to approximately 26 million people and the capital of DPRK — Pyongyang — 3.26 m. Now the larger example. On the screen you see the night satellite images — North and South Korea. Glowing, fully lit part is the Republic of Korea. Quite a dark part is the Korean people's Democratic Republic. As you can see, one climate, one history, one culture (though now saying it's two different cultures). But the reason for the difference is obvious — it is not the climate and habits of the population. It is nothing like the rules — or institutions.

After this discovery it seemed possible to move in almost any direction. It became possible to explain not only the property, but nesobstvennoi — what is called externalities (external effects). It has been possible to explain the phenomena of crime and law enforcement, we have begun another way to understand the history and that history is possible and impossible. In this sense the economy is the explanation of how in General economic understanding came to the idea of institutions and to the theorem of Coase changed the idea about a variety of industries in this world.

The meaning of the Coase theorem is: "If transaction costs are zero, then the final allocation of resources efficiently regardless of the initial distribution of property rights". If this world was not transaction costs, friction, communication between people, as you have done, as it would be. No matter how you placed the resources, they automatically would come into balance. But it does not develop in a social vacuum would work, but social vacuum does not exist. Nesobstvennoi and the tragedy of the Commons the Result of the opening of transaction costs was the discovery of the concept of nesobstvennoi. It turned out that a significant part of the objects in this world is free access. Example: unlicensed software. This object came out from under the real control of the owner. While everyone recognizes that conditional Microsoft has some rights on these programs. And this applies not only to intangible objects. Bench in the city garden, which reads: "People, I love you!" — this is also an example of nesobstvennoi. Bench — the object of municipal ownership: that is, has an owner that sets the mode of use of the bench, but he is not able to support this mode of use. And it turns out that with changes in technology and legal environment, we have more, fewer property is outside of any property.

What is the history of ownership in Russia over the past two decades? 90 years, the order: all carry bags from the barn — privatization. All have and slept on the road. Zero years: all the carry bags in the barn — nationalization. All have and slept on the road. The question is not where are the question — how much riprap. This is the mode nesobstvennoi. Each of the possible modes of ownership necessary, because otherwise nothing will be done and will have to use state coercion: the police fasten to each computer and to have it forced on taxes. But each of the modes of ownership has advantages and disadvantages.

Private property is the most expensive system of ownership. She requires everything to be inventoried, described below worked the judicial system and the enforcement of judgments. It is expensive. I have a feeling that we have created all the institutions that could such a system serve. But with the state property either. It has its advantages: very easy to mobilize resources, so it can overcome various restrictions in the form of agreements. But they have their own problem: there is no owner who is not the official owner? Not a citizen? Not even the amount of citizens. So in this case, it is necessary to consider large threat of theft, and to have perfect control and Supervisory service, internal inspection. For this reason I also do not feel that we have it built. So when drag the bags in the barn or from a barn, a significant part of the turnover occurs in the free access mode, when we cannot obtain the expected effect of the nationalization or privatization. We are greatly underpaid — because transaction costs are positive. And in order to reduce this frictional force we need to build a pretty expensive institutions.

The easiest way to build communal property. We may not see it as communal property are usually formed where there is some misfortune or disaster. About it also a little bad writing, because there are so-called "tragedy of the Commons" — when all the benefits from the use of the resource appropriates the individual, and the expenses are allocated to the community. And there is such a thing as overuse of resources. Even more serious consequences relate to what is called external effects. For economic theory the problem of external effects was the main throughout the twentieth century: things fall out of the economy and someone accidentally bring profits, some losses, and it is unclear how to manage it. In the early twentieth century Arnold pigou proposed a solution that comes to mind for many: that we need to ban or tax negative effects. But Ronald Coase and his theorem has drastically changed ideas about what is good and what is bad. When the factory is prohibited to emit smoke is good? For those who breathe this smoke, Yes. And for those who work in the factory. Coase says that the damage is vzaimovezhlivy character. For the economy it does not matter whether the factory to pay because she smokes or people will pay the factory for the opportunity to get some air. It is important that such compensation occurred.

Inhibitions negative effects don't always work. You can ban Smoking, or check on the ring road, but we understand that at the same time it will be damage. You can redistribute money, imposing taxes on the car. But you must ensure that the money reaches someone the damage.

For example, in 2011 the state-owned company once again was not ready to move to Euro-4 standard, while private companies were ready for it. As this issue was resolved? It was decided to raise the excise tax on gasoline at 2 rubles with the new year, those who remain in the Euro-3 and no increase for those who goes to Euro-4. This was done in order to expensive gasoline was cheaper, and cheap gasoline were more expensive.

You can also create markets. The largest, in my opinion, the simulated market is the trade of quotas for emissions of hydrocarbons, i.e. the Kyoto Protocol. The paradox is that one of the authors of this system Danilov-Danilyan accuses Coase that in his theorem, he found that internalized can be only what can be economically counted. But this is incorrect. Coase only opened a frictional force in the economy, and is further made possible the modeling of quasirandom. Why inefficient institutions still exist? And how with the help of the Coase theorem it is possible to go beyond the economy? Gary Becker developed the theory called "Theory of crime and punishment". No doubt he had read Dostoevsky, but inspired primarily famous phrase Vyazemsky that in Russia the severity of laws kompensiruet by not having their performance. He formulated the function of expected utility of the individual from offense. This formula was followed by many important insights. It turned out that because crime-fighting is costly, it is optimal to have a non-zero level of crime. Crime will never be destroyed, said the economists, because the costs for the capture and destruction of the last offender will be prohibitively high. Will have to abandon the hospitals, vaccinations, and so forth to close the last case, and for a short while.

The second conclusion: that there is the severity of punishment and probability of punishment, it turns out that any law-enforcement apparatus will be "skewed". When we look at transaction costs state, then think about what is easier: to change a measure of punishment or to find the real criminal? The answer is obvious. States are therefore very reluctant to change the measure of restraint (in both directions). This applies to the actions instead of the police operation, cheaper apply army: tanks surrounded the neighborhood and started shooting at the terrorists. It is much cheaper than to hold the police operation. So law enforcement always need to control. Third conclusion: between the imposition of sentence for a particular crime and the reaction to it is the time lag. It turned out that the economic concept of elasticity applies to the crimes. There are inelastic crimes (for example, make them addicts, because I can not commit). Also interesting question: does it make sense for the death penalty? It turned out that the economists have settled it. First American economist Ehrlich has created a model that proved the efficacy of the death penalty (death penalty each constrains about 15 kills). Europe was surprised and started more research. It turned out that the graphs of the killings in Hong Kong, where the death penalty is not and Singapore, where it is about the same. So the murder rate is not determined by the death penalty. It turned out that in the model of Ehrlich are not considered transaction costs: the court can make a mistake. And it's two mistakes: punishing the innocent or the guilty nakazanie. To correct judicial error in the case of the death penalty impossible. In addition, the court may not only be wrong, but act deliberately dishonest. Killing innocent can carry a political meaning. What is the legal system more effective? For the economy — Anglo-Saxon case law. The continental system assumes that the legislator can foresee all situations. But the legislator also partially rational and are prone to opportunistic behavior: that is, the fewer decisions are taken in advance, the more effective the system. Hence, economists believe that it is good to have a common law system: a conflict — there was a judicial decision, not a conflict — there are no special regulations.

Why inefficient institutions survive? 50 years ago there was a popular theory of convergence. It said that soon all States will be more or less similar, because institutions compete as goods and survive the most effective. They will align the country. This theory is now considered refuted. The world is not convergence, but divergence. Countries increasingly diverge among themselves.

It proved scholar Angus Maddison. Statistics as a science of 200 years, but only in 1991, and Maddison for the first time had the idea to put together all the data for 180 years in a single table. It turned out that there are two paths of development of the country, let's call them "trajectory a and trajectory B". Moreover, only 25 countries is the "path A", and all the rest — on a trajectory "B". Let's say, "A" is the escape velocity, and "B" first. Russia certainly pursues the path "B", and it's such a jagged trajectory: Russia periodically jumps to "A" level, and then moving out. Apparently, there are forces of gravity that keep the country. Apparently, it is the bad institutions and the bad institutions do not perish and remain. The problem is the rut In 1985 opened an interesting effect, explain why in engineering new solutions are sometimes discarded, and the wrong decisions are fixed for many years. This so-called phenomenon of QWERTY. This arrangement of keys is not very convenient according to have appeared in 60-th — 70-th years of the ergonomics, but it is still used. How it appeared? "Qwerty" is the name of the English company, produced in the late nineteenth century typewriters. The company is long gone, typewriters — almost too. QWERTY left, because everyone in this world has long been customized for this system. Another example: it is proved that the width of the Russian Railways — the most optimal. But the whole world moves on it because of the huge costs. The QWERTY phenomenon shows how the technique secured an inefficient solution, but with the institutions all the same.

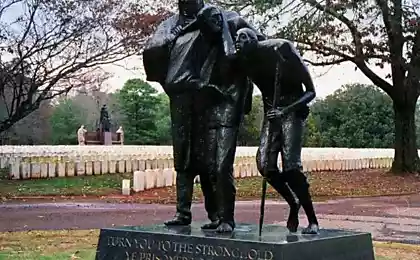

Douglass North in 1993 received the Nobel prize for the theory of institutional change. The statistics of Maddison confirmed what I said North. He proved that on the same principle as the QWERTY phenomenon in the countries of entrenched inefficient institutions. He showed this by the example of England and Spain in the XVI century were leaders in the world, but in the nineteenth century, radically dispersed, and Spain still can not catch up with England. This price is a random solution of the XVI century. Question about taxes in England fell into the hands of Parliament, and in Spain remained in the hands of the king. In the end, England had formed the budget more efficiently, and Spain in convulsions and the price of civil wars and revolutions is trying to move on from the "path B" in "trajectory". The same can be said about our country. Why have some countries managed to change the trajectory and not the other? The book, which will be discussed, in 2009, transformed the world. This scandalous book. It was written by three people, each of whom in the industry changed the world. This is the economist Douglas North, a historian John Marshall scientist Barry Weingast. In Russia it is issued by the Gaidar Institute and published under the title "Violence and social orders". It is absolutely brash subtitle: "Conceptual framework for interpreting recorded human history".

This study of three countries: the U.S., Britain and France about how they managed to get into a "trajectory". Very difficult, because it turned out that all is not as written in the textbooks. It turned out that there are only 3 rules, so-called "threshold conditions". Following them, the country 50 years after the adoption of these conditions are beyond the "path A". What are these rules?

"Violence and social orders" Barry Weingast, John Wallis, Douglass North — the Elite first needs to set rules for myself and then for others.

We need to build de-identified organizations that will survive their creators.

— The means of violence should be monitored collectively. In the countries of the "path B", all tend, on the contrary. Now this is the most fashionable hypothesis is born from the application of second and third derivatives of the Coase theorem to history. And it only strokes, only the main direction, but the story is now understood differently. It turns out that there are forces of gravity, it appears, there is probably a threshold condition of phase transitions. Perfection is impossible, diversity is real.

Source: theoryandpractice.ru