797

And prices are rising, the prices ...

This year has seen an unprecedented rise in prices for many goods, some of which have soared to such heights which were not recorded in the history of the world market. A record rise in prices for different categories of goods need to contribute to the world economy in metals and fuels on a background of dwindling stocks of these raw materials, adverse weather conditions and natural disasters, lower crop yields, as well as the activity of speculators on the world market.

12 ph + letter via fox-olegov

1. There is currently a trend of rapid growth in copper prices: November 11, the price of copper reached its peak level of 8903 and amounted to 36 US dollars per ton. The main reason for the increase in copper prices is a big demand for the metal used as a raw material in various industries (especially in the electrical and electronics). The main country-consumers of copper is China, which in recent years has dramatically increased the demand for commodities as a hedge against rising prices.

2. As always, the most reliable are investing in gold. Demand for gold is particularly high at the time of instability in the world economy. By the end of last week the price of an ounce of gold was US $ 1369.8.

3. It is very attractive for investment and platinum, which is due to a number of valuable properties is widely used in high-tech industries. November 4 saw a meteoric rise in prices for the metal. An ounce of platinum was worth $ 1787, 6, November 3 at its cost was $ 1707 5. But this is more than a five percent increase in the price of just 1 day!

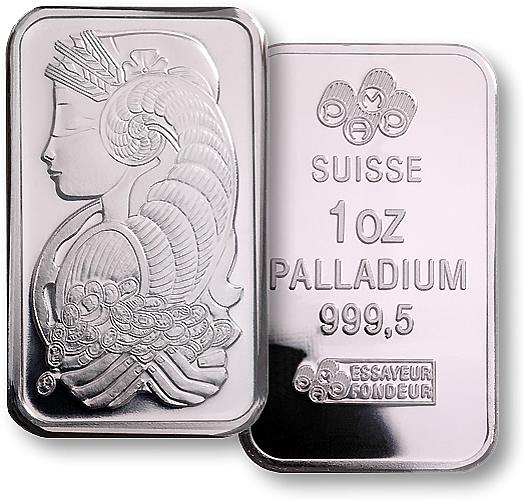

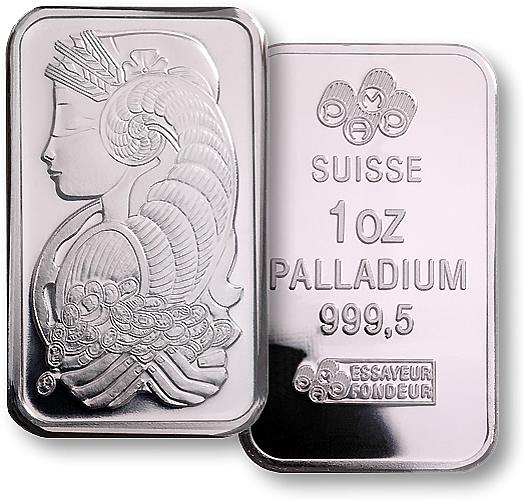

4. On November 3 also began a sharp rise in the price of palladium. It needed only one week to the palladium price increased by more than 10% and peaked in the price of November 11 ($ 713, 6 per troy ounce). One reason for this phenomenon is the growth in demand for palladium jewelery.

5. Adverse weather conditions, summer forest fires in Russia and the activity of speculators led to an unprecedented rise in prices for crops. In particular, the cost of wheat June increased by more than 50%. This is the steepest rise in its price since 1959.

6. Since the summer is constantly increasing in price, and corn. And according to forecasts by 2011, its cost will grow by 9%.

7. Global soybean prices also go up. Just last week the US soybean rose in price by $ 11 per ton, and the Argentine to $ 16 per ton.

8. The price of the sugar in November peaked, which was observed 30 years ago. It was caused by a sharp increase in demand for this product after reports of substantial losses of sugar cane harvest in Brazil.

9. There has been an unprecedented rise in cotton (more than 60% per year) because of the severe floods, drenched his plantation in Pakistan and China. For the first time in 15 years, the cost of a pound of cotton over $ 1. Of course, this is quite a negative impact on the prices of goods of light industry.

10. Dry weather reduced crops in Brazil, coffee and cocoa. And of course, this is reflected in the price of these products on the world market. Experts estimate that the growth in coffee prices this year has already exceeded 30%.

11. The price boom continues in the oil market. The causes are many. This depletion of the fuel and the increase in world demand for hydrocarbons and small spare capacity in the oil industry, the impact of speculators, etc.

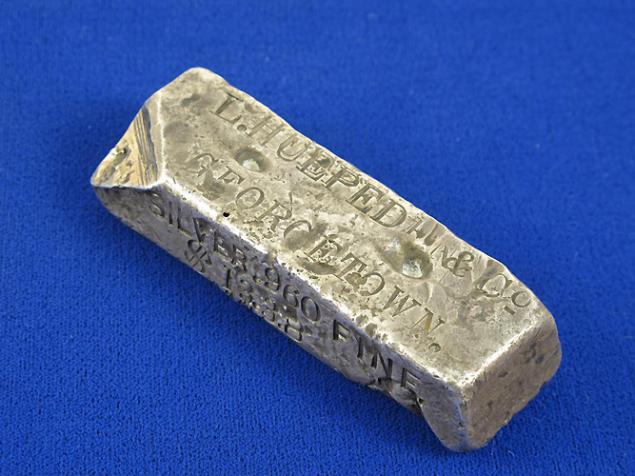

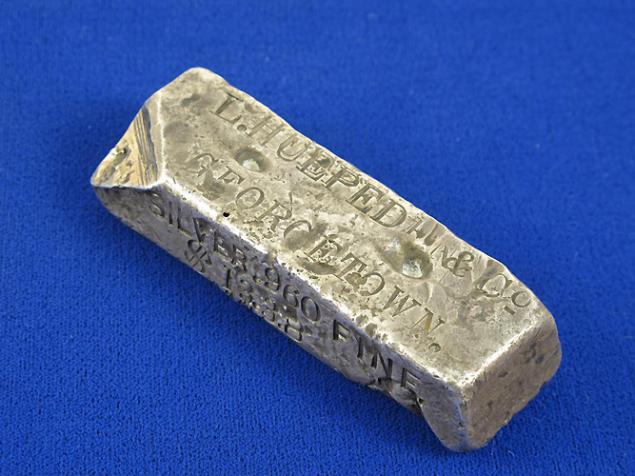

12. Since the beginning of the year the price of silver has increased by 80%. Only last month the increase in the price it was more than 20% of metal and 11 November was estimated at 27, 68 dollars per ounce. And this is not the limit is projected as the world's reserves are depleted of silver only, and the need for it (especially in industry) is growing steadily.

Source:

12 ph + letter via fox-olegov

1. There is currently a trend of rapid growth in copper prices: November 11, the price of copper reached its peak level of 8903 and amounted to 36 US dollars per ton. The main reason for the increase in copper prices is a big demand for the metal used as a raw material in various industries (especially in the electrical and electronics). The main country-consumers of copper is China, which in recent years has dramatically increased the demand for commodities as a hedge against rising prices.

2. As always, the most reliable are investing in gold. Demand for gold is particularly high at the time of instability in the world economy. By the end of last week the price of an ounce of gold was US $ 1369.8.

3. It is very attractive for investment and platinum, which is due to a number of valuable properties is widely used in high-tech industries. November 4 saw a meteoric rise in prices for the metal. An ounce of platinum was worth $ 1787, 6, November 3 at its cost was $ 1707 5. But this is more than a five percent increase in the price of just 1 day!

4. On November 3 also began a sharp rise in the price of palladium. It needed only one week to the palladium price increased by more than 10% and peaked in the price of November 11 ($ 713, 6 per troy ounce). One reason for this phenomenon is the growth in demand for palladium jewelery.

5. Adverse weather conditions, summer forest fires in Russia and the activity of speculators led to an unprecedented rise in prices for crops. In particular, the cost of wheat June increased by more than 50%. This is the steepest rise in its price since 1959.

6. Since the summer is constantly increasing in price, and corn. And according to forecasts by 2011, its cost will grow by 9%.

7. Global soybean prices also go up. Just last week the US soybean rose in price by $ 11 per ton, and the Argentine to $ 16 per ton.

8. The price of the sugar in November peaked, which was observed 30 years ago. It was caused by a sharp increase in demand for this product after reports of substantial losses of sugar cane harvest in Brazil.

9. There has been an unprecedented rise in cotton (more than 60% per year) because of the severe floods, drenched his plantation in Pakistan and China. For the first time in 15 years, the cost of a pound of cotton over $ 1. Of course, this is quite a negative impact on the prices of goods of light industry.

10. Dry weather reduced crops in Brazil, coffee and cocoa. And of course, this is reflected in the price of these products on the world market. Experts estimate that the growth in coffee prices this year has already exceeded 30%.

11. The price boom continues in the oil market. The causes are many. This depletion of the fuel and the increase in world demand for hydrocarbons and small spare capacity in the oil industry, the impact of speculators, etc.

12. Since the beginning of the year the price of silver has increased by 80%. Only last month the increase in the price it was more than 20% of metal and 11 November was estimated at 27, 68 dollars per ounce. And this is not the limit is projected as the world's reserves are depleted of silver only, and the need for it (especially in industry) is growing steadily.

Source: