166

Looking for a job with savings for 10 years ahead

Any savings at least slightly increase confidence in the future. Although psychologists do not approve of the idea of postponing anything until tomorrow. They say that this is not how we live our lives, but put it off for later. Today we will tell you how to save money and whether to work if you already have some savings.

For any earnings, experts advise to save 20% of wages. You should forget about this 20% and in no case encroach on them to save the planned amount. To successfully accumulate the desired amount, You need to set a goal.. If there is no goal, if you do not know what you are saving for, it will be much more difficult not to encroach on the piggy bank.

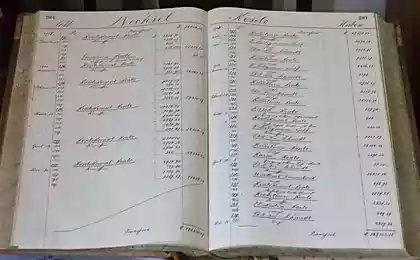

So, the goal is set, where to start? You have to start with cost accounting. For several months in a row write down all the expenses in a notebook. After some time, you will see a pattern in which you spend certain amounts on important and not very important purchases. Here, too, you can divide your salary in percentage ratio, do not deny yourself in pleasant little things.

The golden rule of budget planning is 50/20/30. It says that 50 percent of income should be spent on the necessary things: rent, food and other important things, without which you can not do. 20% of the income should be allocated to pay off debts or savings. 30% – be sure to spend on your loved one: care, entertainment, shopping. This rule is good because you can accumulate funds gradually and at the same time do not deny yourself in pleasant little things. Otherwise, what's all this about when once a month you can't get a massage or buy yourself that damn bag?

Here is the situation: a girl named Zhenya plans to resign from the post of secretary, over the years she managed to accumulate a decent amount. Now Zhenya does not know what to do. She was tired of working for her uncle, and she was sure that for a certain time she had enough accumulated funds not to work: “While I worked, I could afford annual trips abroad, while saving a little. I have enough money for 10 years alone. I don’t have a husband or children, should I get a job? ?

Answering the question of Zhenya is not easy, because it is up to her. But we can say for sure that money has the property of ending. Where does she see herself in 10 years, when she is 0? Can she take care of herself and find a new job? It is worth remembering that many professions have an expiration date - if you do not improve your skills, no one will hire you.

How is Zhenya going to manage the money? Money loves investment. The best thing you can invest in is yourself. If Zhenya goes to a massage therapist or seamstress course or learns languages, she will be able to earn money in the future. But if she spends all her savings on rest and pleasure, and this is not prohibited, then in the end the girl can remain at the broken trough. Especially if she is alone, she has no one to rely on. But the choice is up to Gene.

We must also remember that life never goes as planned. Every new day gives us a reason for joy and disappointment, and with it unplanned spending. Therefore, it is necessary to decide: if you do not want to be an employee, you will have to look for yourself and spend money on training. That's not a bad idea. But the question is, will you find yourself before you run out of money for education and food? Nobody wants to live from salary to salary, so it is very important to start planning your budget in time. What would you do if you were Zhenya?

For any earnings, experts advise to save 20% of wages. You should forget about this 20% and in no case encroach on them to save the planned amount. To successfully accumulate the desired amount, You need to set a goal.. If there is no goal, if you do not know what you are saving for, it will be much more difficult not to encroach on the piggy bank.

So, the goal is set, where to start? You have to start with cost accounting. For several months in a row write down all the expenses in a notebook. After some time, you will see a pattern in which you spend certain amounts on important and not very important purchases. Here, too, you can divide your salary in percentage ratio, do not deny yourself in pleasant little things.

The golden rule of budget planning is 50/20/30. It says that 50 percent of income should be spent on the necessary things: rent, food and other important things, without which you can not do. 20% of the income should be allocated to pay off debts or savings. 30% – be sure to spend on your loved one: care, entertainment, shopping. This rule is good because you can accumulate funds gradually and at the same time do not deny yourself in pleasant little things. Otherwise, what's all this about when once a month you can't get a massage or buy yourself that damn bag?

Here is the situation: a girl named Zhenya plans to resign from the post of secretary, over the years she managed to accumulate a decent amount. Now Zhenya does not know what to do. She was tired of working for her uncle, and she was sure that for a certain time she had enough accumulated funds not to work: “While I worked, I could afford annual trips abroad, while saving a little. I have enough money for 10 years alone. I don’t have a husband or children, should I get a job? ?

Answering the question of Zhenya is not easy, because it is up to her. But we can say for sure that money has the property of ending. Where does she see herself in 10 years, when she is 0? Can she take care of herself and find a new job? It is worth remembering that many professions have an expiration date - if you do not improve your skills, no one will hire you.

How is Zhenya going to manage the money? Money loves investment. The best thing you can invest in is yourself. If Zhenya goes to a massage therapist or seamstress course or learns languages, she will be able to earn money in the future. But if she spends all her savings on rest and pleasure, and this is not prohibited, then in the end the girl can remain at the broken trough. Especially if she is alone, she has no one to rely on. But the choice is up to Gene.

We must also remember that life never goes as planned. Every new day gives us a reason for joy and disappointment, and with it unplanned spending. Therefore, it is necessary to decide: if you do not want to be an employee, you will have to look for yourself and spend money on training. That's not a bad idea. But the question is, will you find yourself before you run out of money for education and food? Nobody wants to live from salary to salary, so it is very important to start planning your budget in time. What would you do if you were Zhenya?

My sister got married and went to live in Italy, we never dreamed of it.

Unscrupulous sister never helps mom, she at 64 years old she handles a huge garden