617

How to quickly get money on the card in Kazakhstan?

Fifty two million eight hundred fifteen thousand seven hundred eighty five

If you urgently needed to get the money on the card in Kazakhstan, for example, to make unexpected, but highly successful purchase, do not rush to the Bank. The best solution will be to apply to a microfinance organization. To become the owner of the microloan requires no more than an hour.

MFI – what is it?

Microfinance institutions or, for short, MFIs – financial institutions which are lending to citizens. Unlike conventional banks, they are:

If you never taken a microloan, you might want to read our step by step guide.

How to apply?

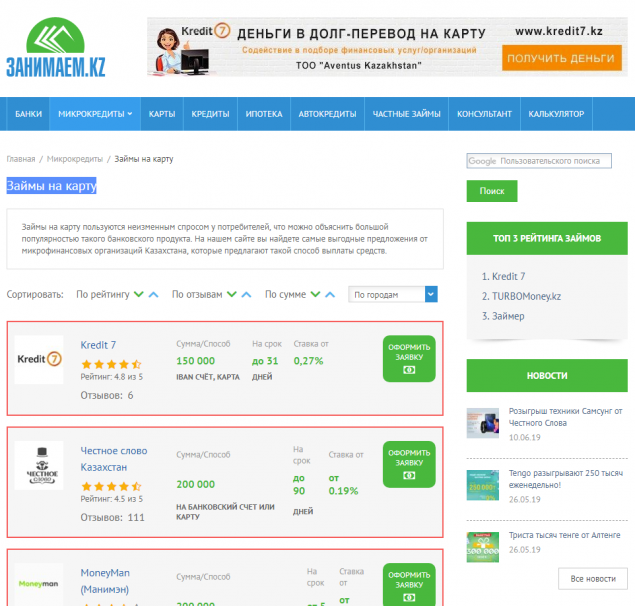

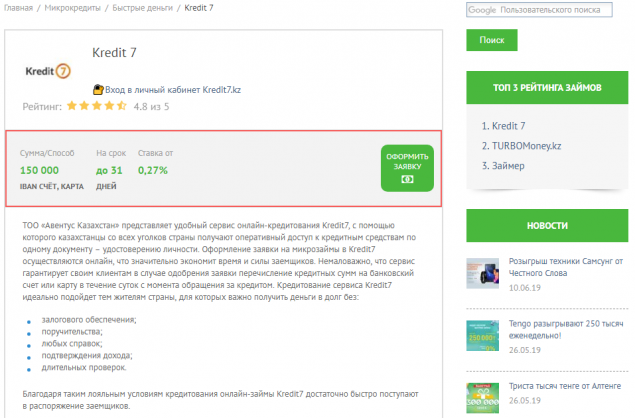

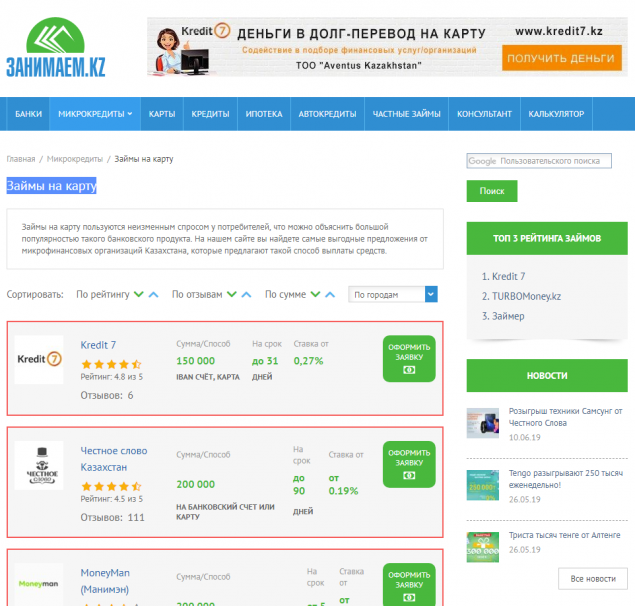

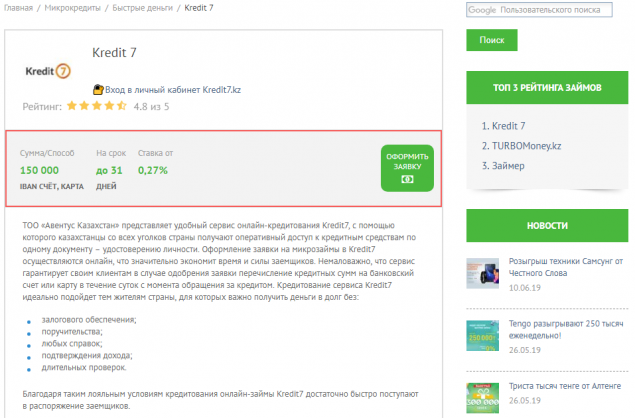

The first thing we recommend is to visit the service aggregator of offers from MFIs. Direct lending and the consideration of loan applications, these platforms do not do. However, their pages a quick and simple comparison of the microfinance environment.

Choose a MFI, given the credit limits, interest rates, the presence/absence of services the extension of the loan. Then:

After signing the documents (showing the code) you will get the money immediately – on the map.

If you urgently needed to get the money on the card in Kazakhstan, for example, to make unexpected, but highly successful purchase, do not rush to the Bank. The best solution will be to apply to a microfinance organization. To become the owner of the microloan requires no more than an hour.

MFI – what is it?

Microfinance institutions or, for short, MFIs – financial institutions which are lending to citizens. Unlike conventional banks, they are:

- Offer to make a loan and get the money all in remote mode. To leave your house or workplace to sign the contract or the provision of documents is not required. However, many MFIs provide microcredit in cash is through online offices;

- Do not require from the candidate for the loan of numerous documents, guarantors or collateral. All you need to do the borrower to provide details of the passport and tin;

- Give small amounts of money in a relatively short period. If you require a large amount of funds, you can apply several MFIs at the same time. Since the presence of open loans and even delinquency is not grounds for refusal of loan from the microfinance firms.

If you never taken a microloan, you might want to read our step by step guide.

How to apply?

The first thing we recommend is to visit the service aggregator of offers from MFIs. Direct lending and the consideration of loan applications, these platforms do not do. However, their pages a quick and simple comparison of the microfinance environment.

Choose a MFI, given the credit limits, interest rates, the presence/absence of services the extension of the loan. Then:

- On the main page of the website of the lender select the period and the amount of the loan. Please note: the amount of the overpayment that will show you the online calculator will be fully payable. No hidden commissions and payments in large and Mature MFIs no.

- Fill in the registration form. Usually you only need to specify passport data and INN, phone number, name and email.

- Confirm that you want to register by specifying the one-time code that come on the phone.

- Apply for the loan: the amount of information that you specify about yourself, there will be a large. Do not try to hide information or provide incorrect information will lead to failure.

- Verify the card (the account is temporarily locked minimum amount).

- Wait for a response from MFIs, it will be sent to you on the phone in the next 10-15 minutes (maximum wait time, usually not more than 30 minutes).

- If the answer is positive, you will need to confirm the cooperation by sending another SMS.

After signing the documents (showing the code) you will get the money immediately – on the map.

Where to choose cheap tickets, and how to save on their purchase?

Promo codes of popular shops and companies are now in one place