2562

Loan on a card: a convenient way to solve financial issues

Moneypanda.com: information portal about card loans and other microloans

Modern life often requires us to make quick and important decisions in the financial sector. There are situations when you need money right now, but contacting the bank takes too much time and it is not always possible to get approval for a loan. In such cases, a card loan comes to the rescue - a convenient and quick way to get money onto your bank card.

About our project Moneypanda.com

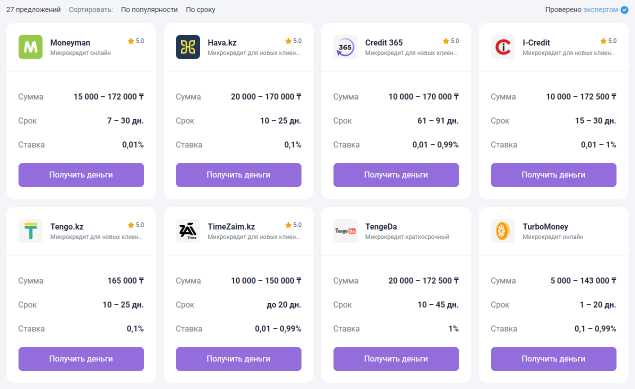

Today, there are many companies providing card loan services. However, choosing the right financial services provider can generally be a challenging task. That is why we want to introduce you to our project – Moneypanda.com.

Useful reviews of loan providers

On our website you will find detailed reviews of various companies providing credit cards. We will tell you about the capabilities of each provider, what conditions they offer, what requirements they set and what the features of the loan process are. We also provide information about rates, terms and amounts of loans, as well as ways to repay the debt.

Our goal is to provide information without promoting specific providers

It is important to note that our project does not intend to advertise specific financial service providers. We do not benchmark or seek to generate interest in the services of any particular provider. We only provide information about what is available on the market so that you can make your own decision about which card loan option is right for you.

Help in choosing the most suitable option

If you are facing financial difficulties or simply want to learn more about the possibilities of loans on a card, take a look at our website. Moneypanda.com will help you understand the variety of offers and choose the most profitable and convenient option for yourself. We are ready to provide you with all the necessary information and help you make the right choice!

Advantages of a loan on a card:

- Speed of receiving money to a bank card.

- Minimum requirements and documents for registration.

- Possibility to get a loan at any time of the day.

- Convenient ways to pay off debt.

How to choose a suitable loan on a card:

- Determine the required loan amount.

- Compare the conditions of different companies.

- Check loan rates and terms.

- Please pay attention to the requirements for borrowers.

- Choose the most profitable and convenient option.

Don't forget to read reviews from other customers and pay attention to the transparency of the terms.

In Soviet times, students were completely different, modern children do not understand.

How it happened that Toto Cutugno all his life bowed to his wife, but the child he gave birth to another