707

Kredits.biz service helps in the optimal choice of MFIs for obtaining a loan

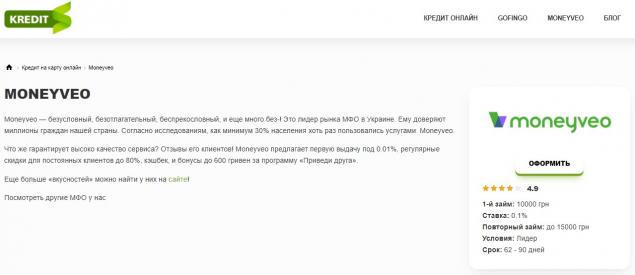

From financial difficulties, usually spontaneous, no one is guaranteed. And when a person in need of a certain amount (usually up to several thousand hryvnias) has a problem – where to get the urgently needed money, the service Kredits.biz will come to the rescue. Since ordinary banking institutions due to the duration of consideration of the application for a loan, as well as the possible refusal for a number of reasons, are not able to provide a loan online, the optimal solution is to apply to MFIs. And to choose the one that provides the most suitable conditions for a particular borrower, it is worth using the portal Kredits.biz, where all the necessary information about the largest microfinance organizations of the country is collected and professionally systematized. The undeniable advantages of this service are:

- round-the-clock and daily availability;

- availability in the catalog only verified MFIs of Ukraine;

- availability of a simple interface with the ability to select MFIs according to the requested parameters;

- the reliability of the information provided on the credit products offered by organizations;

- Possibility to apply for a credit card online directly on the company’s website.

Some MFIs, in addition to the passport and TIN, offer a potential borrower to fill out a short questionnaire indicating marital status, gender, type of activity, region of residence, etc.

639144

Any citizen of Ukraine, whose age exceeded the 18-year mark, can, using the services of Kredits.biz, choose the MFI that appeals to him on his terms and receive a transfer (within a few tens of minutes) to his bank card. The advantages of such a financial transaction are:

- providing a minimum package of documents, that is, only a passport of a citizen of Ukraine, as well as a TIN (in rare cases, an additional, easily filled out document is required);

- the possibility to use a simple credit calculator that excludes hidden payments;

- high (90%) probability of a positive decision on the application;

- a quick decision to transfer money to the borrower on his card;

- the right to renew the contract;

- the possibility of early repayment of debt;

- availability of a loyalty program and regular promotions for customers.

To get a loan to a card urgently using the service Kredits.biz comfortable and profitable, because, guided by the published on the site of the current rating of MFIs, the borrower has the opportunity to take a more thoughtful approach to the choice of a financial institution. Based on customer feedback and objective data on MFIs, the company determines its rating based on:

- service speed from the moment of filling in the application until the money arrives on the card;

- clarity and transparency of credit conditions;

- Loyalty to potential borrowers and regular customers.