226

What is Tilt in Trading: Understanding and Managing Emotions in Trading

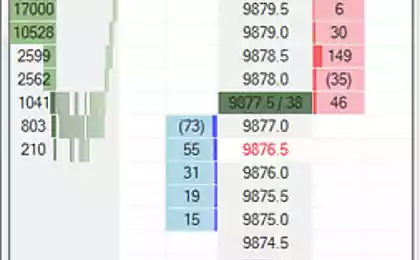

Trading is a rather risky and unstable way of earning money, which requires not only special knowledge and experience, but also the ability to remain calm in the most unpredictable situations. Excessive emotionality prevents the trader from making the right decisions, which can lead to significant financial losses. The condition of a person in which he cannot control his actions is called a tilt in trading. Let's take a closer look.

77360.

Source: Trading.biz

What is a tilt in trading?

Tilt is a state in which a person cannot control himself and commits rash actions. Tilt is divided into active when a trader hastily closes trades, and passive, which is characterized by inaction and inability to make decisions.

The state is manifested by emotional arousal, a person becomes overly aggressive, cannot rationally assess the situation and choose the right strategy. All this affects the effectiveness of trading and leads to losses.

What is dangerous tilt in trading:

There is also another type of tilt that is associated with positive emotions. After successful completion of a major transaction or a series of profitable trading operations, the trader falls into a state of euphoria and takes unjustified risks. The consequences can be disappointing, because both negative and positive emotions interfere with sober thinking and making good decisions.

Causes of tilt in trading

The reasons that lead to the appearance of a tilt in traders can be divided into two categories:

Source: Trading.biz

2. Market. They are caused by unpredictable situations that occur in the financial market, because of which the chosen strategy does not bring results. The loss of funds negatively affects the condition of the trader, because of which he makes the wrong decisions.

Most often, a tilt in trading occurs due to psychological reasons, when a trader is guided by emotions when making decisions. He acts intuitively, does not take into account technical analysis, does not take into account risks, uses other people’s strategies and hopes for luck. Trading for such a person is a gamble, which affects earnings. A tilt also occurs if a trader:

How to recognize a tilt in trading?

As a rule, a trader falls into a tilt when he cannot control the situation. A person may not notice himself that he acts recklessly and takes excessive risks, it seems to him that he acts adequately to the current situation. Having already received a negative experience and dealing with errors, the trader understands that this was the tilt. How to recognize an unstable state to prevent excessive financial losses?

Source: Trading.biz

It is indicated by the following signs:

How to deal with a tilt in trading?

Tilts mainly depend on the emotionality and susceptibility of the trader in relation to unpredictable situations. How to act if you are caught in a tilt:

For this purpose, an economic calendar is used, where all important events that affect quotes are noted. If a trader follows changes in the market, he feels more confident and less susceptible to emotions.

Source: Trading.biz

The best economic calendar in real time shows events and important news, which allows you to be aware of the changes taking place. This will help to predict the behavior of quotes and calculate their further actions.

The calendar is presented in the form of a table, where financial events are published in real time with the release time and preliminary forecast. Experts recommend that you regularly consult the economic calendar, as news and data are constantly updated. In addition to this tool, you can also use other technical analysis services, which are free of charge on trading.biz.

Useful tips to prevent tilt in trading

Source: Trading.biz

4. Do not trade in an unstable emotional state. When making deals, do not be distracted by household problems, experiences, extraneous thoughts. If you can not focus on trading, you can take a break.

5. Develop discipline. To succeed in trading, you need to systematically learn, work with technical analysis tools, develop and test strategies. With experience and understanding of the market, there will come a permanent income.

6. Use automated risk management services. For trading, various tools are offered that analyze transactions before trading, calculate possible profit and loss.

Every trader in his practice faces situations where emotions take over. In such moments, it is difficult to make the right decisions, which leads to losses in trading. You need to learn to recognize the tilt, switch, relax, analyze your condition.

The use of working strategies and tools for trading will help predict changes in advance and calculate risks. The trader will feel more confident, which means that his actions will be balanced and rational.

- How does the tilt manifest?

- How dangerous is he?

- What factors can provoke it;

- How to prevent an emotional breakdown;

- How to get out of an unstable state.

77360.

Source: Trading.biz

What is a tilt in trading?

Tilt is a state in which a person cannot control himself and commits rash actions. Tilt is divided into active when a trader hastily closes trades, and passive, which is characterized by inaction and inability to make decisions.

The state is manifested by emotional arousal, a person becomes overly aggressive, cannot rationally assess the situation and choose the right strategy. All this affects the effectiveness of trading and leads to losses.

What is dangerous tilt in trading:

- Emotions get out of control and do not allow you to make informed decisions.

- a trader in an excited state makes rash actions;

- Mistakes lead to financial losses, which causes retaliatory aggression.

- The trader may prematurely close the transaction and lose part of the funds;

- In the future, the habit of emotionally reacting to unforeseen situations during trading is developed.

There is also another type of tilt that is associated with positive emotions. After successful completion of a major transaction or a series of profitable trading operations, the trader falls into a state of euphoria and takes unjustified risks. The consequences can be disappointing, because both negative and positive emotions interfere with sober thinking and making good decisions.

Causes of tilt in trading

The reasons that lead to the appearance of a tilt in traders can be divided into two categories:

- Psychological. This is due to excessive emotional sensitivity. People with a penchant for excitement are more prone to tilt, as well as uncertainty and fatigue, which lead to errors in trading.

Source: Trading.biz

2. Market. They are caused by unpredictable situations that occur in the financial market, because of which the chosen strategy does not bring results. The loss of funds negatively affects the condition of the trader, because of which he makes the wrong decisions.

Most often, a tilt in trading occurs due to psychological reasons, when a trader is guided by emotions when making decisions. He acts intuitively, does not take into account technical analysis, does not take into account risks, uses other people’s strategies and hopes for luck. Trading for such a person is a gamble, which affects earnings. A tilt also occurs if a trader:

- Fear of losing a deposit, because of uncertainty, makes incorrect decisions;

- wants to compensate for losses or lost profits, which pushes on rash actions;

- He doubts the correctness of his actions, blames himself for past mistakes.

- is in a depressed state;

- Inattentively examines the indicators, because of which closes the deal ahead of time.

How to recognize a tilt in trading?

As a rule, a trader falls into a tilt when he cannot control the situation. A person may not notice himself that he acts recklessly and takes excessive risks, it seems to him that he acts adequately to the current situation. Having already received a negative experience and dealing with errors, the trader understands that this was the tilt. How to recognize an unstable state to prevent excessive financial losses?

Source: Trading.biz

It is indicated by the following signs:

- The trader rashly increases the volume of transactions. This is possible after successful transactions, when excitement increases and you want to quickly increase capital. At the same time, risks increase, so in case of failure, the loss will be tangible.

- Exceeding the level of risk that does not correspond to the deposit. If a trader unnecessarily risks and uses large amounts, this may also indicate a tilt.

- Leverage trading. Using maximum leverage to build positions can lead to an unstable emotional state in the event of a mistake.

- Tightening. The trader pushes back the stop losses and waits for the price to turn in the right direction. If the correction continues, its losses increase.

How to deal with a tilt in trading?

Tilts mainly depend on the emotionality and susceptibility of the trader in relation to unpredictable situations. How to act if you are caught in a tilt:

- Take a 30-minute break. You can walk, play sports to switch and reduce the degree of emotions.

- Change the situation periodically. Rest, go about your business, so as not to think about trading.

- Talk to other traders. On the forums you can communicate with like-minded people and throw out emotions.

- Analyze the situation. Try to understand the situation that led to an emotional outburst. This will help to stabilize the condition faster and prevent similar mistakes in the future.

For this purpose, an economic calendar is used, where all important events that affect quotes are noted. If a trader follows changes in the market, he feels more confident and less susceptible to emotions.

Source: Trading.biz

The best economic calendar in real time shows events and important news, which allows you to be aware of the changes taking place. This will help to predict the behavior of quotes and calculate their further actions.

The calendar is presented in the form of a table, where financial events are published in real time with the release time and preliminary forecast. Experts recommend that you regularly consult the economic calendar, as news and data are constantly updated. In addition to this tool, you can also use other technical analysis services, which are free of charge on trading.biz.

Useful tips to prevent tilt in trading

- Set a daily risk threshold. Calculate about 5% of the deposit so that in case of failure financial losses are minimal. This will prevent you from falling into despair and control the situation.

- Choose a strategy and follow the plan. A trader must have a proven working strategy that is profitable. Act according to a given algorithm, not intuition.

- Record the transaction information. To analyze the results of trading, it is recommended to keep a diary. Enter information about each trade and record your emotions at different stages of trading.

Source: Trading.biz

4. Do not trade in an unstable emotional state. When making deals, do not be distracted by household problems, experiences, extraneous thoughts. If you can not focus on trading, you can take a break.

5. Develop discipline. To succeed in trading, you need to systematically learn, work with technical analysis tools, develop and test strategies. With experience and understanding of the market, there will come a permanent income.

6. Use automated risk management services. For trading, various tools are offered that analyze transactions before trading, calculate possible profit and loss.

Every trader in his practice faces situations where emotions take over. In such moments, it is difficult to make the right decisions, which leads to losses in trading. You need to learn to recognize the tilt, switch, relax, analyze your condition.

The use of working strategies and tools for trading will help predict changes in advance and calculate risks. The trader will feel more confident, which means that his actions will be balanced and rational.

When Svetlana Ivanovna started talking about the funded program, I could not even think how it would end.

Why strange, but kind Alexander Lenkov himself sewed clothes for his wife and daughter, a difficult fate