193

Getting an online loan at any time without taking credit history into account

Money has an amazing feature of fast spending. Previously, this rule applied only to cash, and now moved to financial means on a salary and even a credit card. How to get rid of financial difficulties? Where can I get the money? Asking for money from parents or acquaintances is not accepted now. Everyone lives to the best of their ability. The financial company Glavpotrebcredit will come to the rescue.

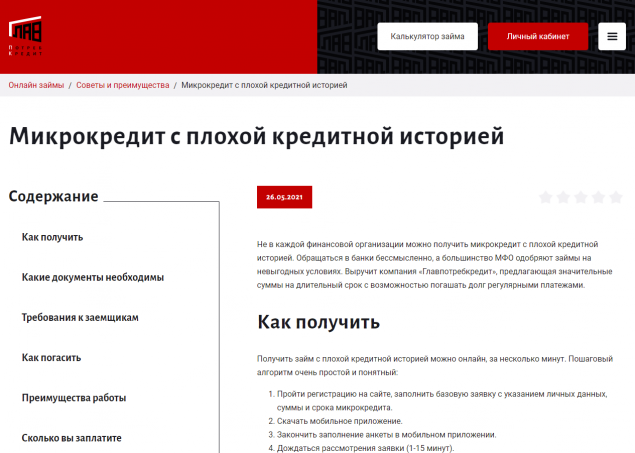

Reliable lender

MFIs and ICCs are created for the credit population. They are less demanding of consumers than banks. In a banking institution require the purity of credit history, confirmation of income, the presence of outpost property or guarantors. Glavpotrebloan issues a microloan with a bad credit history and does not make special claims. This does not mean that the microfinance organization does not have a scoring system of verification. It exists and it works. Only long-standing debts are not taken into account, and the system is built on new methods. Therefore, a person who in his youth got into the “black list” can count on obtaining a microloan.

Interest-free first loan

A distinctive feature of many MFIs is the first interest-free loan. It is issued for a small amount and a short period. The borrower will not pay anything for the loan. He needs to return the amount he received. This system is designed to attract customers. It is an effective mechanism for many people who are afraid to contact MFIs. But if the first transaction went well, they can turn to a familiar service for the second time. With a short loan term, the overpayment becomes almost invisible to the consumer. And he will use the services of the financial company in the future. At the same time, MFIs offer permanent discount promotions, other benefits.

Benefits of MFIs

Chief Consumer Credit works around the clock. Here you can get a loan on a bank card at any time of the day or night, which is an important factor. Sometimes money is required at night. Advantages of microfinance organization:

- fast registration of the application and receipt of money on the card;

- round-the-clock financing;

- issuing money without taking into account credit history and other requirements;

- the possibility of extending the contract in case of insolvency;

- frequent discounts, gifts;

- online service;

- daily markup, not exceeding 1%;

- confidentiality;

- Protection of passport and financial data.

How is an online loan issued?

You can get a microcredit from anywhere in the world with a working Internet. This requires a passport and a mobile phone. No other documents are required. A loan is made on the basis of an application. You need to provide information about yourself, your employment. Data on the place of residence and actual residence, education, family and children under 18 years old may be required. You may also need phone numbers from close people or acquaintances. Based on the data provided and its scoring verification system, a microloan is issued directly to the bank card at any time.

What not to do on St. Olga’s Day, July 24

What you need to know about loans, so as not to fall for the bait of unscrupulous scammers