508

Online loan on the card: convenience and speed of obtaining financial assistance

Advantages of online loan on the card

Quick access to financial assistance in the event of unexpected expenses or temporary shortages of funds was made possible by online loans on the card. This type of loan has gained immense popularity in recent years due to its convenience and affordability. Consider the main advantages of an online loan on the card.

- Convenience and simplicity of the process

You can get an online loan at any convenient time, without the need to visit a financial institution. All stages of loan processing are carried out online: filling out the application, providing the necessary documents and receiving funds to the card. This saves time and simplifies the procedure for obtaining a loan. - Quickness of approval and loan issuance

Online loans are usually considered within minutes or even seconds. Automated systems allow you to quickly check the applicant’s credit history and make a decision on issuing a loan. If the application is approved, the money can be transferred to the card instantly or within a few hours. - No complex requirements for the borrower.

Unlike traditional credit institutions, online loans on the card usually do not require an extensive list of documents and a complex procedure for checking the borrower. Only passport data and income information may be required to obtain a loan. This makes the loan process accessible to a wide range of potential borrowers.

2. How to get an online loan on the card?

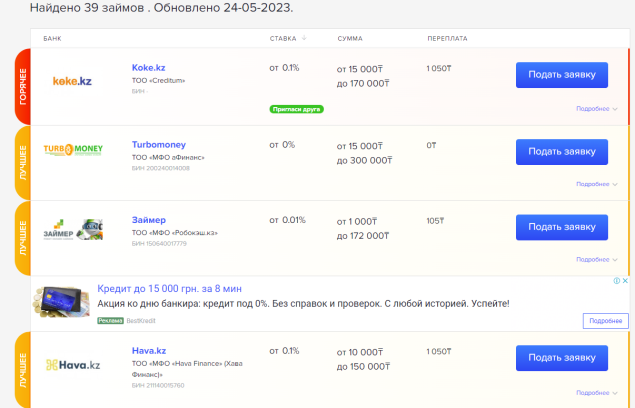

- Choosing a reliable lender

Before you apply for an online loan on a card, it is important to conduct research and choose a reliable lender. Make sure the company has positive reviews and a good reputation. Pay attention to the loan terms, interest rates and repayment terms. - Completing the application

After choosing a lender, fill out an online loan application. Specify the required amount and maturity. Personal data and income information may also be required. - Verification and approval of the application

The lender will process your application and check your credit history. If the application is approved, you will receive a notification of the decision. - Getting money on the card

Once the application is approved, the money will be transferred to your card. This usually happens instantly or within a few hours.

3. When should I apply for an online loan on the card?

- Urgent expenses

An online credit card loan can be useful in case of urgent expenses such as medical bills, car repairs or urgent purchases. Quick availability of funds allows you to quickly solve financial problems. - Lack of other sources of funding

If you do not have the opportunity to get a loan from a bank or from friends, an online loan to a card can be a way out of financial difficulty. However, you should remember your solvency and carefully evaluate your ability to repay the loan.

From weeds between the tiles in the country there is simply no salvation, all means go in the course

If you had to buy old and hard asparagus, do not rush to throw it away, just take a vegetable peel.