197

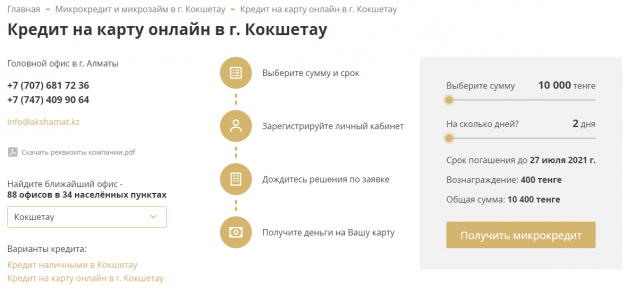

Urgent receipt of money for a card in Kokshetau without bureaucratic complications

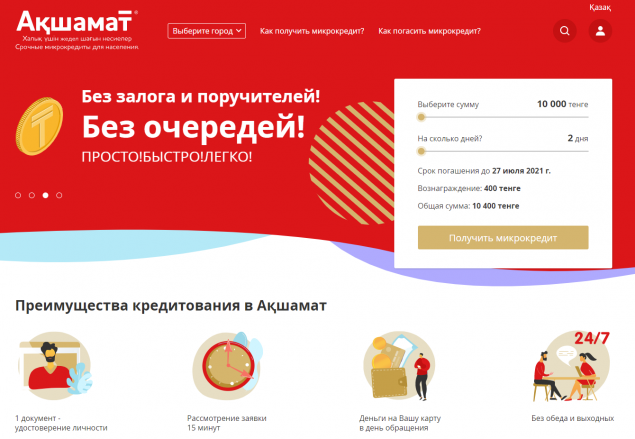

The vast majority of people sooner or later find themselves in a situation where urgently, for various reasons (for the purchase of medicines, repayment of debt for utilities, purchase of household or electronic equipment, etc.), need money. Attempts to borrow them in the bank do not always end successfully, and take a lot of time, it is often undesirable to contact relatives or acquaintances. The best option in this case is to obtain a microcredit, taking, for example, an online loan in Kokshetau from Akshamat, whose 84 branches operate daily in 32 cities, almost throughout Kazakhstan.

Quick loan processing

Among the main advantages of obtaining a microcredit, namely, the company "Akshamat" - the speed of its response to the appeal of a person who is temporarily in a difficult financial situation. After all, the application is considered within only 15 minutes, and the borrower receives money on his card on the day of applying to the company.

The advantages of solving the problem in this way are obvious. They consist, in addition to the exceptional speed of obtaining a loan, also in the absence of the need:

- spending time (and money if you have to get far enough and expensive transport) to leave the application;

- Standing (or sitting) in long queues;

- collecting a whole package of various certificates.

A loan in Kokshetau is issued by the company in a wide range of amounts - from 10 to 140 thousand tenge. Moreover, the size of the final payment the borrower can calculate independently on the site https://akshamat.kz/srochnye-dengi/, using a convenient calculator. This amount is directly dependent on the period (there are options from 2 to 15 days) for which the money is taken.

Microloan without proof of income

The company "Akshamat" promptly provides microcredit to the card to anyone aged 21 to 60 years, limited to providing them with:

- the original identity card;

- passport of a citizen of the Republic of Kazakhstan or a residence permit;

- Document of permanent employment.

Applying to Akshamat, which managed to win the trust of more than 91 thousand customers in the shortest possible time (since 2014), will help the borrower get a microloan on a short-term and absolutely transparent basis, promptly and according to a more flexible scheme than traditional banking, which will contribute to the citizen’s exit from a difficult financial situation.

Parimatch bonuses are distinguished by their attractiveness and benefits for the player

We eat Belarusian cheesecakes without sugar right on the beach, conscience does not torment