344

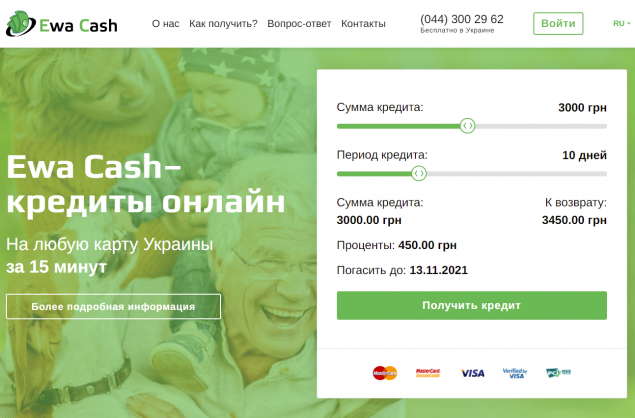

Quick loans to a card from the microfinance office Ewacash

In modern life, quite often there is an urgent need for a certain amount of funds. Turning to acquaintances and friends rarely leads to a positive result. A better option if you need money would be a 24-hour microloan. MFO Ewacash offers to get a microloan on favorable terms. Despite the relatively recent start of work, this office has managed to establish itself as a conscientious organization, which is also confirmed by a large number of positive reviews. She helped many clients who contacted us quickly receive the required amount on their card.

Advantages of MFOs over banking institutions

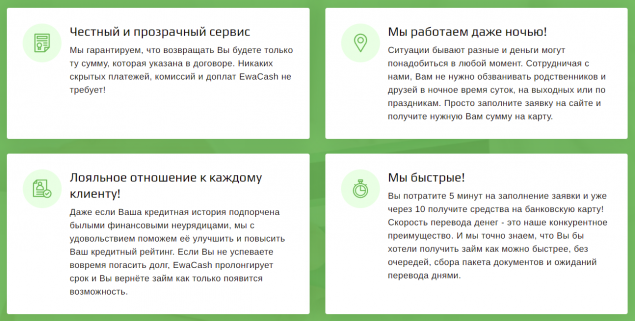

Like many modern microfinance organizations, Ewacash operates online. As a result, users will be able to submit an application without leaving home. This completely eliminates the need to visit ground offices. Thanks to round-the-clock work, borrowers can count on financial assistance at any time. In many ways, the popularity of modern microfinance offices is explained by their many advantages over the same banks. The defining advantages of these organizations include the following important points:

- A more loyal attitude towards borrowers - MFOs easily approve microloans for students, mothers on maternity leave and pensioners.

- Ease of application. Users can receive money without leaving home.

- Fast processing of applications. After the loan is approved, the money will be transferred to the specified account within 10-15 minutes.

- Work without holidays and weekends, the possibility of obtaining a microloan at any time of the day.

Features of MFO Ewacash

The microfinance organization Ewacash offers convenient functionality and all the tools for quickly completing an application. The website has a special calculator that will allow you to calculate the amount to be refunded in advance. To do this, you just need to indicate the desired loan size, as well as the repayment period. To receive a loan, new users must register and provide up-to-date information. This is followed by a card check, followed by consideration of the application. If approved, the money will be promptly transferred to the specified card. During the process of applying for a loan, users will be able to carefully read the terms of the agreement and get answers to all their questions. If necessary, borrowers can seek assistance from a technical support representative. The MFO manager will advise on issues and eliminate unclear points. A distinctive feature of this organization is its loyal attitude towards its clients. The latter can count on the following opportunities:

- high probability of approval;

- debt extension;

- convenience of loan repayment (online or through a terminal).

Nuances of choosing the optimal platform for trading

High-quality cotton bedding from the manufacturer Le Vele