528

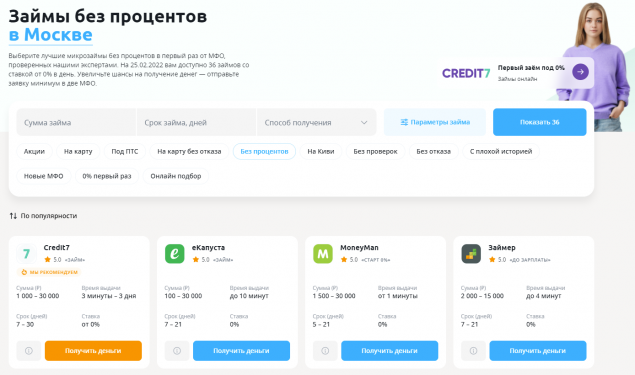

Is it worth dealing with microfinance organizations?

Almost anyone has the opportunity to get loans for a relatively short period and on favorable terms. Yes, once it was believed that in such cases the risks are quite large and exceed the possible benefits, but today this segment of the market has stabilized. There are leaders, that is, companies that offer transparent terms of cooperation to all users.

What You Need to Know About Short Term Loans

In order to stimulate user demand, a grace period is proposed. For example, you can borrow without interest for 30 days, which is very convenient. There are different conditions for a free test period, and the client can choose the most attractive option. By the way, you do not have to visit many sites, because there are special aggregators that save time. Features:

- Standard filters allow you to sort the entire number of offers by loan amount, term, methods of obtaining money.

- Among the methods of obtaining money are transfers to an account or card, to a virtual card, to a phone, to a bank account, even delivery by courier to the house and many other options.

- Yes, in most cases, you do not have to talk about very large amounts. As a rule, we are talking about several thousand or several tens of thousands of rubles.

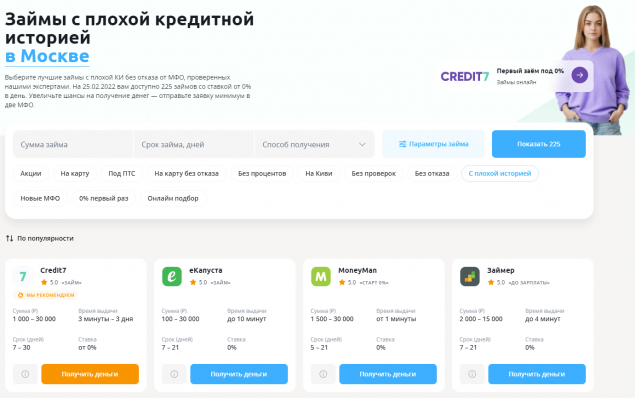

What you need to pay attention to when making a loan

It is worth considering a convenient repayment schedule in advance so as not to spoil your credit history. Although there are loans without a refusal with a bad credit history, but not all microfinance organizations offer this. In addition, the conditions for issuing money for bona fide payers may be more loyal. In addition,

- It is possible to get funds on PTS bail.

- It is necessary to specify in advance the nuances and possible force majeure circumstances that may arise. For example, if repayment on time suddenly proves impossible, then it is worthwhile to stipulate in advance the possibility of restructuring the debt.

- And yet, another possibility will be a good sign: to pay off the debt in advance, that is, ahead of the planned schedule.

Compliance with conditions

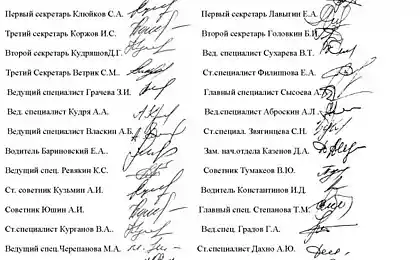

Solid financial and credit institutions or microfinance organizations attract customers not only with favorable terms. The confidentiality of any personal and payment data of the user is guaranteed. This information is not transferred to third parties and subsequently is not used to send advertising, impose any related services. If you evaluate what microfinance institutions offer, you can see that the conditions are basically similar. So, you need to be an adult, have identity documents with you and meet some other requirements.

For two months, some evil force lifted her husband at 5:30 in the morning, like a scout, he made his way into the kitchen and cooked breakfast.

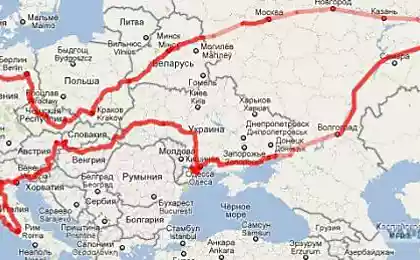

Get a profitable loan secured by real estate in Zaporozhye!