197

How to choose the right microloan

How to choose the right microloan

For registration, they resort to the services of a microcredit or microfinance organization, but given the large list of proposals, it is easy to get confused. How do you decide which option will provide the most comfort for your situation? We offer to deal with all the main parameters in order.

Timing and limits on amounts

Each individual case has its own needs, so the amounts for micro loans online vary significantly. For basic expenses with small investments, 1,000-10,000 rubles are enough. For example, so much is taken for timely payment of utilities, urgent purchase of clothes. If you need to organize a small event, purchase equipment and other useful expenses, the amount is limited to 30,000 rubles. The large size of microloans is considered to be 50 000-100 000 rubles. Such money is suitable for making an expensive purchase, instead of a loan from a bank, for holidays abroad or treatment.

A number of points are worth considering:

- the period granted for return with interest;

- Small loans, as a rule, must be repaid within a short period (up to 1 month);

- return is important within the prescribed period under the contract, earlier payments are also not prohibited;

- Long-term microcredit involves a period of 6 months. Payments are required every month or once a week.

Loan processing time

How to choose a microloan and not make a mistake? All companies take into account the urgent need, so it does not require a long wait for issuance. The application is considered within 15 minutes, often the company’s employees cope in a shorter period of time, which takes 1-2 minutes. Also, there are no problems with the transfer of money, the process is necessarily carried out on the date of registration by the organization. If desired, you can contact online companies, in this case there is no reference to working hours, since the employee must process applications regardless of weekends, holidays, 24 hours a day.

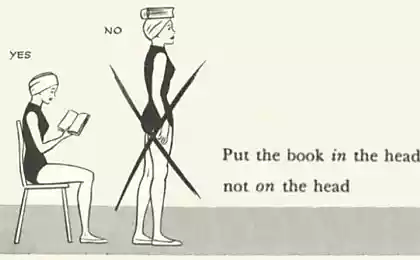

Requirements of organizations issuing funds

Banking institutions put forward much more restrictions, but the requirements of the ICC and IFC are much more modest, so applicants face refusal only in rare cases. If you compare loans with loans that require a lot of documents:

- Parsport.

- INN.

- SNILS.

- Certificate of salary for the last 6 months.

- Guarantors, etc., then only the original passport will be required to obtain a loan, it is not necessary to carry documents from work, to provide guarantors.

There are also no restrictions on the categories of borrowers, often funds are given to persons aged 18 to 20 years, than students and young people use. There are often proposals that apply to people of retirement age and the unemployed. Another option is business loans (legal entities or IP).

Outcomes

Based on the information presented, the selection of microloans is the simplest task, but here you will have to study the proposals presented. It is worth considering your needs, interest, payment terms, the availability of a suitable method of receipt. After that, it remains to choose a company that will suit all points.

The palmist did not take money for the session saw the love line on his hands

After such a soliak, the husband will kiss, the question with potatoes is no longer worth it.