1136

Where and how to meet investors

© David Schwen

For serious relationship: where and how to meet with investors

Investors did not meet on the street — the owner is necessary not just to draw attention to themselves, but to show that his project is promising, but the team is trustworthy. How to make a good first impression, tell the entrepreneurs and investors themselves.

Sergei Nosyrev, co-founder of the service for modelling interiors Planner 5D

We have all been just: we met my investor at a roundtable, which was hosted by his incubator — approval and proposal received from investment in day of demonstration of their project.

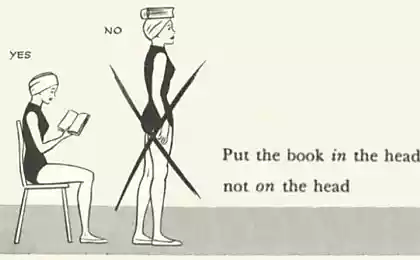

To the investor it is better to say little and show a lot — preferably a prototype, or at least their past achievements if they will help in the implementation of the future project. Not exactly necessary to say that in a year you will recoup the investment and make a million dollars. A competent investor will see the potential in the product or technology after your presentation, your fancy and useless numbers are not interesting.

Vitaly Obernikhin, co-founder and CEO of search application IT professionals Hiring Amazing

We were looking for for the project "smart money". For us, this means that the investor must have the competencies at the time we had. It was important for us that the investor was given the project enough attention; act calmly, if, say, the development of the new version on track or if you need to make fundamental changes; the investor helped to open doors and strongly promoted the project among other investors and clients.

In our pool of investors consists of companies and people who meet these criteria. To find these investors, we had to scour almost the entire market of venture capital and "angel" capital of the CIS and to meet a huge number of people. Sergei Dmitrichenko (co-founder of Amazing Hiring) conducted a full due diligence of people and companies that would like to invest in Amazing Hiring. For this, we found start-UPS with which our investors worked. We learned how organized the process of communication between projects and investors, was asked about the positive and potentially risky aspects of the relationship and understand whether we will arrange the quality and quantity of smart money, offered each investor. As a result, our investors really help us in the framework of their competencies.

Alex Aylarov, co-founder and CEO of online service calls Zingaya

With most of our investors we met at events for startups and then some time talking, talking about the development of the company. We visited a lot of different funds, but for the first round, we in the end their help was not needed.

In General, in Russia many investors calling themselves the venture, are not. They try to minimize risks for themselves, making them more similar to ordinary investors. They either do not invest or are trying to lower the rating to get a higher percentage for smaller attachments.

Sergey Shalaev, co-owner and CEO of service recommendations Surfingbird

I think the investor is best to start with their friends, colleagues, classmates. This is how we found our first investment: our former colleague, Pierrick introduced us to their friends who invested in our project first money.

Speaking about funds here, perhaps it is worth noting that the team needs to be ready for such a step like raising the investment round, and is able to live without the founders a couple of months, as the round will take care of their focus and energy.

Arkady Moreinis, business angel

All investors are different, and the universal answer to this question is no. Personally at me all is very simple: by mail I do not accept, because tired of reading absolutely meaningless letters. At the seed stage, which I do, some papers and business plans don't really matter. Not yet checked the main idea, draw the business plan makes no sense. Because the business plan in its classical form is, relatively speaking, a multi-page description of the project and plans for the next five years for making money.

At the initial stage of the project, such plan to paint unrealistic. You need only a certain contingent financial model "on the napkin": how much will be spent on customer acquisition, how much and on what will earn the average check, the overhead. So I meet with people in person — every Tuesday from 14.00 to coworking "Good Republic". The most important thing is to look at the person, talk to him and understand what he wants and can. Probably to meet with me easier than with somebody else: I have a fixed time and place.

From my point of view, there are two of the biggest mistakes that startups make.

The first is "I have an idea, but its implementation and sale of I need people." In this case, the question arises: what do you have? Important point: people should not come up with the idea, and with a team, willing and able to implement the first version of any came to mind ideas. With a man without a team for me to talk about.

Second is when "I have an idea what I can do to get investment?" From this I was just shaking. This suggests that initially the man in the head porridge. I much better perceive the flow "we have an idea how we make money?" The purpose of the people who come to me should not be getting money, and getting advice on how to earn money. People come to seed investors, or as they call them business angels, mainly for the "vtupuyu" get the money.

They come for the normal advice, partnership participation in the management of the project at the initial stage. Of course, I invest in projects, but one of the main goals of a business angel — save money at the start of the project. This means that the cool, professional business angel is someone who can help the project team to achieve goals for their own money with minimal losses. Funds work with projects on other stages and, accordingly, provide other investment.

If these two problems there, everything else is discussed: not all people are experienced and understand the nuances, so many things you can humanly be discussed in the process. The field of activity of projects that interest me, any where in some way involved in IT and Internet. I believe if these areas are involved in the channels of communication and sales, the project has a chance to scale.

Vitaly Polekhin, head of the investors club at the Moscow school of management SKOLKOVO

I rarely respond to a mass mailing, especially when you see the open copy of the mail addresses of other investors, or feel in the text notes of copy-paste. Not afraid of losing a good project, because for me it's an indicator of the inability to reach the right audience.

Don't like it when already at the stage of communication persistence and commitment to their idea turns into obstinacy and stubbornness, in spite of objective data. For me it is an indicator of inflexibility, and at startup there is still so much pivots — things never go according to plan.

To the question "Where will the money?" want to hear the answer "Well, first, we would like to start paying his salary". The entrepreneur must understand that the money for the project are primarily the responsibility and difficult choices that change and limiting its life by several years. Stories about the founders of the company living in the office in sleeping bags and eating instant noodles, is the truth. But steep start up the cars with the trendy coworking — tales.

Don't like stars-singles. A startup is a team game. Therefore, despite the unique qualities of the founder, if he couldn't convince the future success of the company of others, the project is not destined for a great future.

If from the beginning the author of the project tries to wriggle and avoid answering awkward questions or simply misleading, and sometimes seemingly only embellishes — it's better not to continue communication.

Ilya Breyman, CEO at Talent Equity Ventures

Budding entrepreneurs need to do first to make MVP, test, refute or confirm hypotheses, to demonstrate results, indicating that the hypothesis was correct. At this stage, usually the investor does not need — you can turn to friends and relatives, use credit cards and personal savings. At the stage of "I have an idea and presentation" to allow yourself to attract other people's money can only entrepreneurs with proven experience (preferably both successful and failed).

When really need money for the development of the project, you can go to investors with a focus on the stage, with experience, knowledge and network in your industry with the specific technological and business competencies, and more. It is therefore very important to collect information about investors to see them as not only a sack of money as real people with interests, knowledge and experience to tailor your pitch for them, to know the answer to the question "besides money, what we can do for you?" In addition, it is important to know what the investor's risk appetite, the range of investments it attracts, which is already in the portfolio of the investor.

In markets where there is more competition for the money and considerably more startups than investors, it is better to be represented than to go to the investor from the street. To obtain better performance from someone the investor trusts, other successful entrepreneurs, co-investors, partners, etc. This is not a guarantee of receiving investment, but significantly increases the chances of success.

What's to tell? In the presentation, which usually begins with the introduction, it is important to briefly explain the essence of the business, describe your achievements in figures, the amount requested, together with an assessment, which involved a round analysis of the competitive environment and industry development plans — why you need money, information about the team, including mentors. You can talk about the defensibility of the project — that is, about the competitive advantages of the project and the barriers to entry of competitors (patents, unique knowledge, contacts, contracts and partnerships, speed to market, etc.).

The presentation should be concise, readable and contain only relevant information, which is enough for making decision in the format of "interested/not interested in further chat". To a presentation to make, it is better to spend time getting feedback from people who know how the investors think.

At the meeting, you can tell us more about the business model, show the results achieved, to give a reasonable forecast for financial and business indicators to answer questions of the investor, but most importantly — listen carefully, including criticism. Sometimes the criticism just better not to answer, and to note what is causing the issues, and to offer back to the investor with the answers after a more detailed study. It is clear that the investor expects you to be "material," but that relates primarily to facts, which are based on assumptions (about competitors, about regulation, about the industry), and there is no doubt about the predictions. Confidence and stubbornness are two very different things.

You should not ask to sign a confidentiality agreement. First, active venture capitalists won't sign as they are crossed by hundreds and even thousands of projects and sign every NDA is ineffective and expensive. Secondly, decent investors care about their reputation, they have a different business. If there is concern that the idea used in the interests of other portfolio companies — it is not necessary to communicate with the investors who invested in direct competitors. In the end, no NDA to sign, and sediment from mistrust will remain.

Source: theoryandpractice.ru