1301

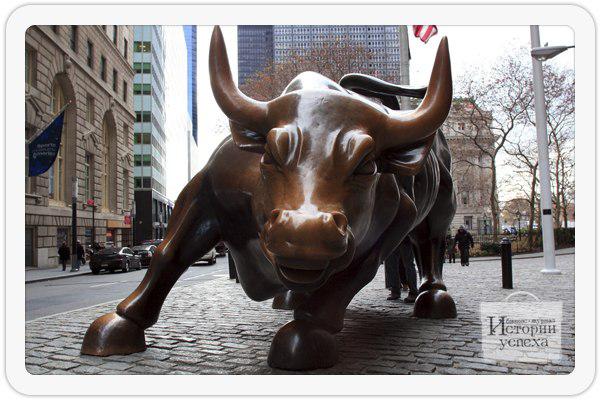

15 great ideas of investors and gurus of Wall Street

1. Warren Buffett, the guru investor wealth is estimated at $ 39 billion, "Price - this is what you pay. cost - this is what you get. It does not matter whether we're talking about promotions or socks, I prefer to buy a quality product at a time when it is undervalued ».

2. George Soros, the state - $ 22 billion, "I am rich because I know when it is not right. Simply put, I was able to survive because of their ability to recognize their own mistakes ».

3. David Rubenstein, an estimated fortune of $ 2, 8 billion, "Persist - do not choose" no "as an answer. If you are happy sitting in one place and not taking risks, you will be sitting at the same place the next 20 years & quot ;.

4. Ray Dalio, the state - $ 6, 5 billion, "It is the desire to objectively evaluate themselves and others most strongly differentiates people using their potential, from all the other & quot ;.

5. Eddie Lampert, the state - $ 3 billion: "The idea of foreboding is key when investing and business in general. You can not wait until the situation becomes apparent. Need to think - that's what others have done in certain circumstances. Tepe pb same under the new circumstances, it is necessary to understand what to do next? & Quot;

T. Boone Pickens 6, the state - $ 1 4 billion, "The older I get, the better I can see where to go. If you are going to hunt elephants, do not go astray for rabbits ".

7. Charlie Munger, the state - $ 1 billion, "If you look at our last 15 decisions, you will see a pretty mediocre achievements. There was no hyperactivity, but it becomes clear sea of patience. You should stick to his principles and possibilities, and when there is a chance, try to use it as much as possible ".

8. David Tepper, clean condition - $ 5 billion, "This company looks cheap, that company looks cheap, but the entire economy completely changes the essence of the matter. The main thing here - it's coming. Sometimes the hardest thing - it's just to do nothing ".

9. Benjamin Graham: "The individual investor should act consistently as an investor and inconsistent as a speculator. This means that he should be able to fairly judge each of their purchase and the price they pay. The assessment should be objective, reasonable, and its result should answer the question - whether the investor will receive more than paid & quot ;.

10. Lewis Bacon, pure state of $ 1, $ 4 billion, "If you are a speculator, you have to take the confusion and chaos & quot ;.

11. Paul Tudor Jones, a pure state $ 3, $ 2 billion, "the main thing of all - keep the situation under control, never think, always trade and protect their rear. As a result, the size does not matter & quot ;.

12. Bruce Kovner, a pure state $ 4, 3 billion: "I believe that new traders trade 3-5 times more than you need. Newcomers take on the risks of 5-10% when the percentage should be as low as 1-2% ".

13. Rene Rivkin, pure state of $ 346 million, "When you buy a stock, ask yourself, would you have bought the entire company as a whole?"

14. Peter Lynch, the pure state of $ 352 million, "I think the main thing - is to realize that for every action should the company, and the growth of the value of each share is worth only one real reason. Business operations varies from worse to better, and small companies become large ".

15. John Templeton, a pure state $ 20 billion, "The time of maximum pessimism is best for shopping. Time of maximum optimism is best suited for sales. "