1775

Hunters wolves from Wall Street. Part 1

38,436,870

The adaptation of the book by Michael Lewis, "Quick boys» h4>

The adaptation of the book by Michael Lewis, "Quick boys» h4>

Photo: from left to right: Rob Park, Brad Katsuyama, Ronan Ryan i>

Before the collapse of the US financial system in 2008, Brad Katsuyama (Brad Katsuyama) could assure itself that does not bear any responsibility this system. Brad worked at the Royal Bank of Canada (Royal Bank of Canada, RBC). Royal Bank was the fifth largest bank in North America, but no one on Wall Street did not take it into account.

It was a quiet, respectable place - in the near future, everyone will know that his staff were able to resist the temptation to provide customers with unsecured loans or plunge them into the hands of ignorant investors. But the managers of the bank never thought - in those rare moments when they do what ever wondered - how retardation worked RBC. Katsuyama bosses sent him to New York from Toronto in 2002, when he was 23 years old - it was done in the framework of the "big bang", designed to bring in players RBC Wall Street. The sad truth is that this bank there and no one heard. "Canadians are constantly saying," We too often give their money to the Americans, "- says Katsuyama. "What they do not realize is that Americans have to pay, because nobody wants to work for RBC. RBC - this empty space ».

Before coming to the program of development of the banking Katsuyama never seriously thought about working on Wall Street and lives in New York. For him, it was the first lesson on the development of the American lifestyle, and he immediately put Brad stumped - so much of New York was different from that to which Katsuyama used in Canada. "It was all in abundance," - he says. "For the year living in New York, I met more boors, than in all previous life in Canada. People are living beyond their means, they did not get out of debt. This shocked me the most. Debts were understood to Canada unnatural. Long considered evil ».

In the first years of work on Wall Street Katsuyama first traded shares of energy companies the US and then the securities of IT companies. As a result, he was invited to lead a group of traders in the Royal Bank of Canada - about 20 people. In the trading room RBC rule existed "idiots-no-take" (in fact, among the staff is generally wore more colorful name): if someone came into the RBC in search of work, and it turns out that this is a typical habits " moron with Wall Street », it would not hired, regardless of how much money he had promised to bring to the company. In a corporate environment even existed a special term: «RBC-compliant." Although Katsuyama found him terrifyingly Canadian, he, Brad, was also «RBC-compatible." Katsuyama believed that the best way to manage people - is to convince them that your influence positive impact on their career development. And he believed that the only way to convince subordinates in this - really contribute to their career development.

Problems had started by the end of 2006, after RBC for $ 100 million acquired the US company Carlin Financial, specializing in electronic trading. According Katsuyama, the entire transaction occurs with excessive haste - his leadership has acquired Canadian firm, not really knowing almost nothing about most Carlin Financial, nor about electronic auction. Things started to take an alarming turn. Katsuyama found that works side by side with a group of American traders who last thing fits into the framework of the corporate culture RBC. On the first day after the merger Katsuyama received a call from an employee worried that whispered into the phone: "We here at the office walks some guy in suspenders and a baseball bat." This guy turned executive director Carlin Financial, Jeremy Frommer, who was anything but not «RBC-compatible." Returning to his alma mater, the University at Albany, years later, to give a speech about the secret of his success, told a group of students Frommer business courses: "It is important not just fly first class - I have to know that all my friends while flying in the" Savings ».

Moved into offices Carlin NY RBC employees soon had to attend a meeting at which Frommer ready to explain to one and all that-on-the-business-going-to-stock-markets. At the meeting Frommer stood in front of a flat monitor hanging on the wall. "He gets up and says that now trade on the stock market - it's a matter of speed" - says Katsuyama. "And then says," I'm going to show you how fast our system works. " Next to him sits a guy with a keyboard. Frommer's team "Enter order!" The guy presses Enter. And the order appears on the screen. Frommer prodozhaet: "See! See how fast !!! "The guy just did something that has entered from the keyboard notation shares, after which it will be displayed on the screen, just as if you just typed text. "And then he continues:" Come again! "And the guy again presses Enter. And all nod. It was 5 pm. The market is already closed; shares nothing happened. But Frommer simply glowed with the thought: "Oh my God, look, this is happening in real time!»

Katsuyama not believe his eyes. He thought the guy from whom we have just bought our new trading platform, or does not understand that his demonstration of technical achievements - this is complete nonsense, or, worse, believes that we are not able to understand it.

Almost at the same time , when in the life of Brad Katsuyama invaded Carlin Financial, the US stock market began to behave strangely. Before RBC bought it from, if I may say, a work of art from the world of electronic trading, computers Katsuyama worked exactly as it was intended. And then they stopped. Previously, if Brad had seen on the screen, that 10,000 shares of Intel are sold at a price of $ 22, it is understood that these may buy ten thousand shares of Intel at $ 22 apiece. He had only to press a button. However, pressing the spring of 2007, he did not suspect that the deal will evaporate into nowhere. Over seven years of work at the stock exchange, he was sure that can look at the monitor and see the current state of the market. Now, what he saw on the screen was a fiction.

Work in such conditions could not Katsuyama. Its main, trader task was acting as an intermediary between investors who want to buy or sell large amounts of shares and markets operate on a smaller securities. That is to say, the investor wants to sell a block of three million shares of Intel, as the market there is a need only one million: in this case, Katsuyama redeem the entire unit from the investor to sell a million immediately and the next few hours to spin, like a squirrel in a wheel to attach the other two. But, not knowing the real needs of the market, Katsuyama could not put a price on a large block of securities - and now, no matter what happens on the screen of his monitor, enthusiasm to continue working Brad became smaller.

By June 2007, the problem has grown so that to ignore it no longer had any opportunity. Before that Katsuyama did the same as most other people are having problems with the computer, he turned to support. Support staff did the same as they do always and everywhere, decided that Katsuyama somewhere he screwed up by mistake. "First of all, these guys started talking about the" human factor "- says Brad. "As if the traders - a gathering of village idiot."

Building in Secaucus, New Jersey - House for servers IEX i>

Katsuyama resented so active that caused the tech support developers, the guys who came in after the absorption of RBC Carlin. "They said that all of this because I'm in New York, and the stock market - in New Jersey, and my data on the market obsolete" - says Katsuyama. "Then they were given that this is so because the market in addition we sell thousands of people. Like, I'm not the only one who is trying to do something with the shares. And there are different events. And any news out ».

If everything is as you say, he asked them Katsuyama, why market data cease to be true only when he Katsuyama, trying to get access to them? For more convincing Brad made developers stand behind him, staring at the monitor. "I said," Look carefully. I want to buy 100,000 shares of AMD. I want to pay $ 15 per share. Now there are 100,000 shares of AMD at this price - 10,000 on the exchange BATS, 35,000 on the New York Stock 30 000 for Nasdaq, and 25 000 for Direct Edge - all seen on the screen. So now we sit down and we will look very carefully at the screen, and I put a finger to press Enter. And when I'm going to count to five out loud ... »

"Once ...

Two ... See, nothing happens.

Three ... Still on fifteen dollars ...

Four ... No movement in the markets ... »

"Five." Then I pressed the Enter and - bam! - All gone to the dogs. All offery gone, and the market price immediately rose ».

Katsuyama turned to developers: "It seems I have these" different events. " And "any news" - is also, apparently, I ».

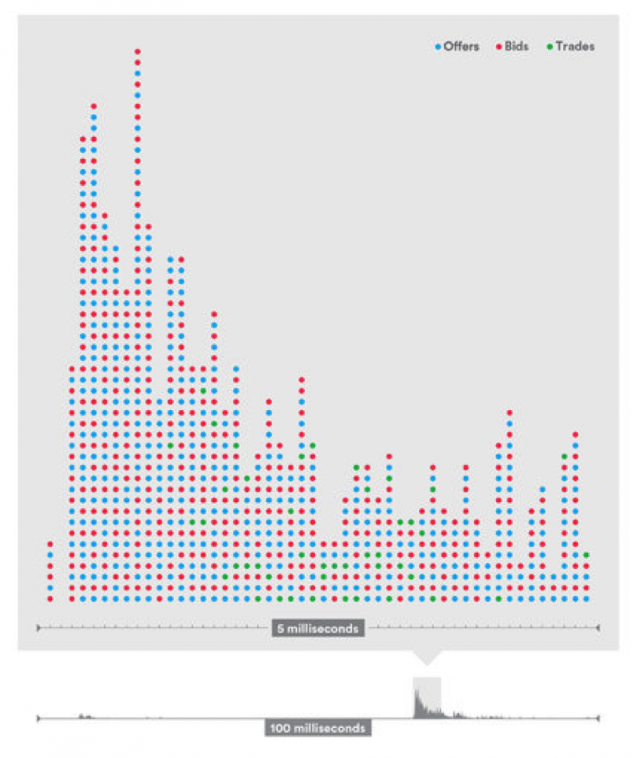

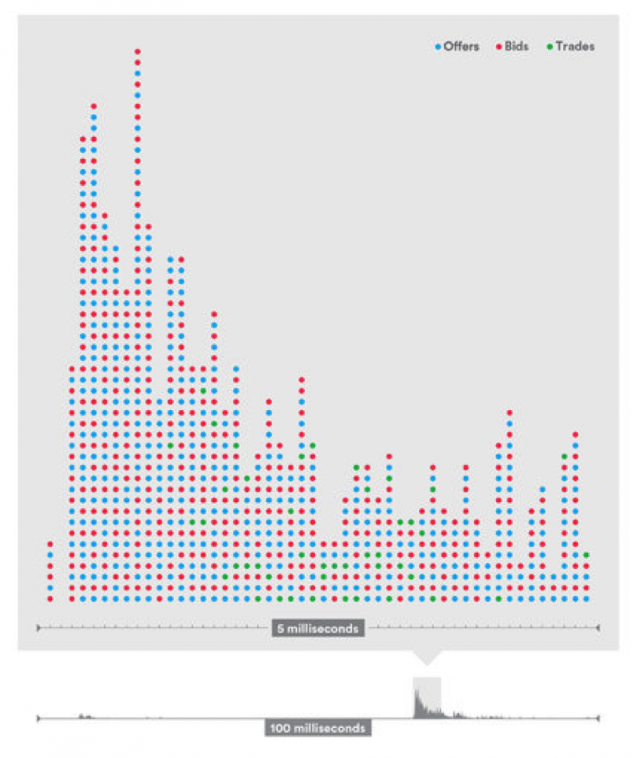

While you blink

High Frequency Trading - a discrete process, it is formed by the "mikrotolchkov." The bottom line of this chart - the stock market activity includes actions with General Electric shares within 100 milliseconds (0, 1 second) at 12:44 pm December 19, 2013. Grey block - pyatimillisekundnoe window during which the shares GE actively bought and sold - in this time were conducted 44 operations with shares. I>

On it they have not found the answer. Katsuyama suggested that the culprit was the installation of the software company Carlin. "As soon as the problem with the market data escalates, I began to realize that my real headache were their nightmarish technologies».

But the more he talked with investors from Wall Street, the clearer it became that they are faced with the same problems. A close friend of Brad's shares traded at a large hedge fund SAC Capital in Stamford, Connecticut, the famous (and in the near future - the infamous) that was always one step ahead of the US stock market. Katsuyama reasoned that if someone knew more about the market it, it was one of SAC Capital. One spring morning he boarded the train to Stamford and spent all day watching the bids on his friend. And it turned out that despite the fact that his friend has used software from Goldman Sachs and Morgan Stanley, he was faced with the same problem, and that RBC - by clicking on the button in an attempt to buy stocks, it appears that the market ran far ahead. "When I saw this guy sells and how he stays out in the cold, I realized that this is not only my problem. My headache was the headache of the whole market. And then I thought, "Oh wow, how serious it».

[ Continued translation adaptation of the book by Michael Lewis, "faster than boys', written by him for the New York Times, should i> - approx. pens.]

Source: habrahabr.ru/company/itinvest/blog/218975/

Condoleezza Rice, the former head of the US State Department, joined the board of directors Dropbox

As I earned $ 500K in machine learning and high-frequency trading - Part 1