686

Who owns the Apple? Hidden masters of the world

Recently, the world was shaken with sensational news — the capitalization of the company "Bitten Apple" has exceeded$700 billion.

But that's not all:

"Investor and the main shareholder of Apple Carl Icahn has estimated value per share of the company in of $216, or $91 higher than their current value. According to Icahn, Apple's capitalization should reach $1.3 trillion" (RBC)

Eight million one hundred seventy eight thousand five hundred six

Leave the question of fairness of such fantastic value of the shares, and accept the fact that Apple — the world's largest company. Ask the simple but awkward question, who owns this company, at a cost equal to the budgets of several European countries put together?

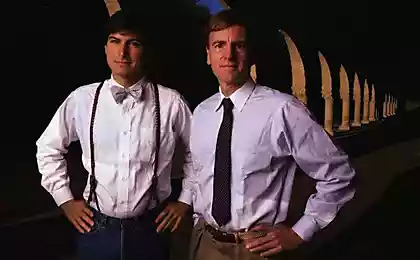

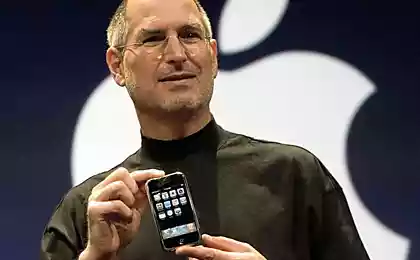

It would seem that the quote from RBC clearly indicate that a major shareholder Carl Icahn, eccentric miliarder, cynical shark, known raider and extortionist, kicker, and many more. In fact, he is most often mentioned in the media as a major shareholder and newsmaker. There is still Tim cook — Apple CEO (the one that the official gay), but it is the figure appointed by the shareholders, i.e. the owner is not in any way.

However, having carefully studied the situation, we find a surprising fact — billionaire Carl Icahn owns only 1(one) per cent of Apple shares. Of course, the cost of even one percent is a huge amount, but it's only one-hundredth part! Where's the rest? The question is not that hidden, but for example, the same RBC not only ignored, but openly falsified in the media.

Is it so difficult to open and it is the official data from the register of shareholders? Nothing could be simpler, and we can easily do this yourself:

The Vanguard Group, Inc. (The) 5.68 %

State Street Corporation 4.11 %

FMR, LLC 3.07 %

BlackRock Institutional Trust Company, N. A. 2.72 %

Bank of New York Mellon Corporation 1.42 %

Northern Trust Corporation 1.39 %

BlackRock Fund Advisors 1.21 %

Amazing. discovery, but Carl Icahn is not even in the top ten biggest shareholders of Apple! Who are these mysterious they the real owners?

In the first place the Vanguard Group — for the uninitiated reader, and for many economists the name is unfamiliar, although in any directory you can find the information that the company controls the assets as much as $ 2 trillion ( 2000 billion$). Three times more the cost of the same Apple! Here such prudes. In fact, the amount of assets under their control several times more, but we will examine later.

Before proceeding to further analysis of the shareholder structure and ownership should make a small digression.

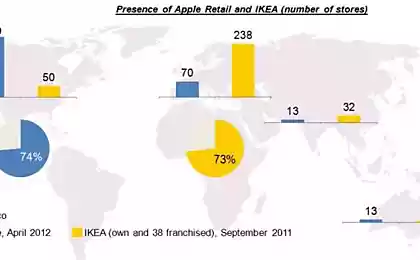

The ideals of democracy© and the picture to the media, which serves as a cover for the true owners, not very well with the fact that all of the world's largest companies belong to the same group of people. How to hide this obvious contradiction? It's very simple — it is necessary to create the appearance that the owners(shareholders) allegedly many and they are all "different".

Indeed, how can the "masters of the world" have a measly 5-6% of the shares? Yes, any liberal will laugh in your face if you tell him that. The fact that these "pathetic six percent" worth forty or fifty billion dollars does not bother anyone — with a modest pack is guaranteed to put your CEO is already a problem. For full control of the company with a turnover of hundreds of billions of dollars required to twenty percent — no more as rivals to collect a bag of more than 20% impossible ( it will cost under a hundred yds $).

And suddenly, some Chinese will buy as much as seven percent of shares and they will be able to fill in the largest American company?

"Not gonna happen!"— decided a long time ago, the real masters of the world, and err.

To understand how they exercised total control and kept the appearance of a lack of a host, we return to our list of shareholders. On the second place company :

State Street Corporation owns 4.11 %

And who are they, I ask a regular reader? And again we Google(yahoo) to help:

finance.yahoo.com/q/mh?s=STT+Major+Holders

And who are the largest shareholders he?

1.Massachusetts Financial Services Co ( canadian insurance company — who owns confusing)

2.Price (T. Rowe) Associates Inc — 7%

3.Vanguard Group (where the same without him!) — 6%

4. BlackRock ( before him, soon come the turn!) — 5%

Deeper look who is a shareholder at Price (T. Rowe) Associates Inc

and we see all the same friends: Vanguard and BlackRock( remember this name, it is often vstrechatsya, walking hand in hand with our main character)

finance.yahoo.com/q/mh?s=TRow+Major+Holders

That is exactly in the same manner monster Vangard controls and the second principal shareholder of the company Apple! Simple technique and ten percent of the shares of Apple already in his pocket. But that's not all!

In the first ten there are two offices with a similar name BlackRock &Blabla and the third time the name is mentioned in the BlackRock shareholders State Street. ( by the way at the Vanguard of such subsidiaries are dozens — okay, that is not the fact that we all their possessions will be able to calculate even approximately — even the largest)

Naturally, owners of BlackRock, we find all the same faces:

finance.yahoo.com/q/mh?s=BLK

Add another four percent and received 14% of all the shares of EPL holds one office — the Vanguard! And again, that's not all.

What else is there left among the straw owners Abluka?

FMR LLC (Fidelity Management and Research), Fidelity Investments similarly, we find exactly the identical names of the shareholders: Blackrock, Vanguard, State Street and so on.

That is, the Fidelity is again controlled by the Vanguard Group!

Total in the Bank "modest" 17%.

Actually, to issledovaniya makes no sense — all the other investors are about 1% or less.

Wonderful scheme of mutual ownership and cross-shareholding. And if some of the shareholders seem not related to Vanguard directly, its shareholders — precisely under their control, and even in the third iteration(level) will be the same.

That is, Vangard:

1. Officially, the main shareholder of Apple. For comparison, the same clown who publicly represents the largest shareholder of Apple — Carl Icahn has only 1% of the shares, five times less than this one package.

2. Vanguard also has major stakes in almost all the other companies that own large shares of Apple. But that is not enough!

3. Vanguard, not only owns the largest katami shares but also controls the company shareholders, paragraph 2. !!!

And finally, a quote from the blog of Tatyana Volkova in the subject:

About the octopus, a pyramid, and generally continued about Vanguard

Here's a picture emerged today of an investigation. The world's largest companies - banks Bank of America, JP Morgan, Citigroup, Wells Fargo, Goldman Sachs imagdop Stanley.

Look at who their largest shareholders. Bank of America: State Street Corporation, Vanguard Group, BlackRock, FMR (Fidelity), Paulson, JP Morgan, T. Rowe, Capital World Investors, AXA, Bank of NY, Mellon.

JP Morgan: State Street Corp., Vanguard Group, FMR, BlackRock, T. Rowe, AXA, Capital World Investor, Capital Research Global Investor, Northern Trust Corp. ivpc of Mellon.

Citigroup: State Street Corporation, Vanguard Group, BlackRock, Paulson, FMR, Capital World Investor, JP Morgan, Northern Trust Corporation, иFairhome Capital Mgmt, ivpc of NY Mellon.

Wells Fargo: Berkshire Hathaway, FMR, State Street, Vanguard Group, Capital World Investors, BlackRock, Wellington Mgmt, AXA, T. Rowe иDavis Selected Advisers.

Then check for yourself. The largest financial company fully controlled by ten institutional and/or Fund shareholders, which include a core of four companies that are present in all cases and at all decision-making: Vanguard, Fidelity, BlackRock and State Street. They all 'belong together', but if carefully to knock out the balance of the stakes, it turns out that in fact the Vanguard of all these controls from their partners and 'competitors', that is, Fidelity, BlackRock and State Street.

Now look at the 'tip of the iceberg'. That is, for a few, selected as the largest companies in various industries, controlled by this 'Big four', but upon closer examination — just Vanguard Corporation: Alcoa Inc. Altria Group Inc. American International Group Inc. AT&T Inc. Boeing Co., Caterpillar Inc. Coca-Cola Co., DuPont & Co., Exxon Mobil Corp., General Electric Co. General Motors Corporation, Hewlett-Packard Co. Home Depot Inc., Honeywell International Inc. Intel Corp. International Business Machines Corp., Johnson & Johnson, JP Morgan Chase & Co. McDonald's Corp. Merck & Co. Inc. Microsoft Corp., 3M Co., Pfizer Inc. Procter & Gamble Co. United Technologies Corp. Verizon Communications Inc. Wal-Mart Stores Inc. Time Warner, Walt Disney, Viacom, Rupert Murdoch''s News Corporation, CBS Corporation, NBC Universal... posted

P. S. And remember, just changing your mind — together we change the world! ©

Source: cont.ws/post/104575

But that's not all:

"Investor and the main shareholder of Apple Carl Icahn has estimated value per share of the company in of $216, or $91 higher than their current value. According to Icahn, Apple's capitalization should reach $1.3 trillion" (RBC)

Eight million one hundred seventy eight thousand five hundred six

Leave the question of fairness of such fantastic value of the shares, and accept the fact that Apple — the world's largest company. Ask the simple but awkward question, who owns this company, at a cost equal to the budgets of several European countries put together?

It would seem that the quote from RBC clearly indicate that a major shareholder Carl Icahn, eccentric miliarder, cynical shark, known raider and extortionist, kicker, and many more. In fact, he is most often mentioned in the media as a major shareholder and newsmaker. There is still Tim cook — Apple CEO (the one that the official gay), but it is the figure appointed by the shareholders, i.e. the owner is not in any way.

However, having carefully studied the situation, we find a surprising fact — billionaire Carl Icahn owns only 1(one) per cent of Apple shares. Of course, the cost of even one percent is a huge amount, but it's only one-hundredth part! Where's the rest? The question is not that hidden, but for example, the same RBC not only ignored, but openly falsified in the media.

Is it so difficult to open and it is the official data from the register of shareholders? Nothing could be simpler, and we can easily do this yourself:

The Vanguard Group, Inc. (The) 5.68 %

State Street Corporation 4.11 %

FMR, LLC 3.07 %

BlackRock Institutional Trust Company, N. A. 2.72 %

Bank of New York Mellon Corporation 1.42 %

Northern Trust Corporation 1.39 %

BlackRock Fund Advisors 1.21 %

Amazing. discovery, but Carl Icahn is not even in the top ten biggest shareholders of Apple! Who are these mysterious they the real owners?

In the first place the Vanguard Group — for the uninitiated reader, and for many economists the name is unfamiliar, although in any directory you can find the information that the company controls the assets as much as $ 2 trillion ( 2000 billion$). Three times more the cost of the same Apple! Here such prudes. In fact, the amount of assets under their control several times more, but we will examine later.

Before proceeding to further analysis of the shareholder structure and ownership should make a small digression.

The ideals of democracy© and the picture to the media, which serves as a cover for the true owners, not very well with the fact that all of the world's largest companies belong to the same group of people. How to hide this obvious contradiction? It's very simple — it is necessary to create the appearance that the owners(shareholders) allegedly many and they are all "different".

Indeed, how can the "masters of the world" have a measly 5-6% of the shares? Yes, any liberal will laugh in your face if you tell him that. The fact that these "pathetic six percent" worth forty or fifty billion dollars does not bother anyone — with a modest pack is guaranteed to put your CEO is already a problem. For full control of the company with a turnover of hundreds of billions of dollars required to twenty percent — no more as rivals to collect a bag of more than 20% impossible ( it will cost under a hundred yds $).

And suddenly, some Chinese will buy as much as seven percent of shares and they will be able to fill in the largest American company?

"Not gonna happen!"— decided a long time ago, the real masters of the world, and err.

To understand how they exercised total control and kept the appearance of a lack of a host, we return to our list of shareholders. On the second place company :

State Street Corporation owns 4.11 %

And who are they, I ask a regular reader? And again we Google(yahoo) to help:

finance.yahoo.com/q/mh?s=STT+Major+Holders

And who are the largest shareholders he?

1.Massachusetts Financial Services Co ( canadian insurance company — who owns confusing)

2.Price (T. Rowe) Associates Inc — 7%

3.Vanguard Group (where the same without him!) — 6%

4. BlackRock ( before him, soon come the turn!) — 5%

Deeper look who is a shareholder at Price (T. Rowe) Associates Inc

and we see all the same friends: Vanguard and BlackRock( remember this name, it is often vstrechatsya, walking hand in hand with our main character)

finance.yahoo.com/q/mh?s=TRow+Major+Holders

That is exactly in the same manner monster Vangard controls and the second principal shareholder of the company Apple! Simple technique and ten percent of the shares of Apple already in his pocket. But that's not all!

In the first ten there are two offices with a similar name BlackRock &Blabla and the third time the name is mentioned in the BlackRock shareholders State Street. ( by the way at the Vanguard of such subsidiaries are dozens — okay, that is not the fact that we all their possessions will be able to calculate even approximately — even the largest)

Naturally, owners of BlackRock, we find all the same faces:

finance.yahoo.com/q/mh?s=BLK

Add another four percent and received 14% of all the shares of EPL holds one office — the Vanguard! And again, that's not all.

What else is there left among the straw owners Abluka?

FMR LLC (Fidelity Management and Research), Fidelity Investments similarly, we find exactly the identical names of the shareholders: Blackrock, Vanguard, State Street and so on.

That is, the Fidelity is again controlled by the Vanguard Group!

Total in the Bank "modest" 17%.

Actually, to issledovaniya makes no sense — all the other investors are about 1% or less.

Wonderful scheme of mutual ownership and cross-shareholding. And if some of the shareholders seem not related to Vanguard directly, its shareholders — precisely under their control, and even in the third iteration(level) will be the same.

That is, Vangard:

1. Officially, the main shareholder of Apple. For comparison, the same clown who publicly represents the largest shareholder of Apple — Carl Icahn has only 1% of the shares, five times less than this one package.

2. Vanguard also has major stakes in almost all the other companies that own large shares of Apple. But that is not enough!

3. Vanguard, not only owns the largest katami shares but also controls the company shareholders, paragraph 2. !!!

And finally, a quote from the blog of Tatyana Volkova in the subject:

About the octopus, a pyramid, and generally continued about Vanguard

Here's a picture emerged today of an investigation. The world's largest companies - banks Bank of America, JP Morgan, Citigroup, Wells Fargo, Goldman Sachs imagdop Stanley.

Look at who their largest shareholders. Bank of America: State Street Corporation, Vanguard Group, BlackRock, FMR (Fidelity), Paulson, JP Morgan, T. Rowe, Capital World Investors, AXA, Bank of NY, Mellon.

JP Morgan: State Street Corp., Vanguard Group, FMR, BlackRock, T. Rowe, AXA, Capital World Investor, Capital Research Global Investor, Northern Trust Corp. ivpc of Mellon.

Citigroup: State Street Corporation, Vanguard Group, BlackRock, Paulson, FMR, Capital World Investor, JP Morgan, Northern Trust Corporation, иFairhome Capital Mgmt, ivpc of NY Mellon.

Wells Fargo: Berkshire Hathaway, FMR, State Street, Vanguard Group, Capital World Investors, BlackRock, Wellington Mgmt, AXA, T. Rowe иDavis Selected Advisers.

Then check for yourself. The largest financial company fully controlled by ten institutional and/or Fund shareholders, which include a core of four companies that are present in all cases and at all decision-making: Vanguard, Fidelity, BlackRock and State Street. They all 'belong together', but if carefully to knock out the balance of the stakes, it turns out that in fact the Vanguard of all these controls from their partners and 'competitors', that is, Fidelity, BlackRock and State Street.

Now look at the 'tip of the iceberg'. That is, for a few, selected as the largest companies in various industries, controlled by this 'Big four', but upon closer examination — just Vanguard Corporation: Alcoa Inc. Altria Group Inc. American International Group Inc. AT&T Inc. Boeing Co., Caterpillar Inc. Coca-Cola Co., DuPont & Co., Exxon Mobil Corp., General Electric Co. General Motors Corporation, Hewlett-Packard Co. Home Depot Inc., Honeywell International Inc. Intel Corp. International Business Machines Corp., Johnson & Johnson, JP Morgan Chase & Co. McDonald's Corp. Merck & Co. Inc. Microsoft Corp., 3M Co., Pfizer Inc. Procter & Gamble Co. United Technologies Corp. Verizon Communications Inc. Wal-Mart Stores Inc. Time Warner, Walt Disney, Viacom, Rupert Murdoch''s News Corporation, CBS Corporation, NBC Universal... posted

P. S. And remember, just changing your mind — together we change the world! ©

Source: cont.ws/post/104575