458

Three lessons that can be learned after a Grand failure

Well-known American trader Jim Paul went from being a boy from a poor family in Kentucky, to the experienced investor who made his fortune on the Chicago Mercantile exchange. But his arrogance grew with his success. Eventually in 1983, the brokerage firm where he worked, fired him. His reputation was destroyed and he lost $1.6 million, $400 thousand of which he borrowed from friends.

The remainder of the decade, Gender was used to back in shape. In 1990, he worked in the research Department of Morgan Stanley Dean Witter & Co: the market transactions it is not allowed.

Then Paul wrote: "What I learned after he lost a million dollars", and then established his own company Marketfield Asset Management LLC. Here are three main lessons that Paul himself drew from this story.

1) You is your money. To others for sure

"When you lose your money, you very quickly realize that people identify you with them. Moreover, you usually evaluate yourself. You identify yourself with them. That's why to lose money so scary," writes the co — author of the book by Paul Brendan Moynihan.

So if you can lose in the near future a large sum of money, be prepared for the fact that you turn most of your friends and maybe even relatives. It will be a heavy blow.

So while you are all well, and you are at the peak of his career, especially not under a delusion concerning the devotion of your comrades. Most of them will leave you in the same moment when you lose your status and they will be known.

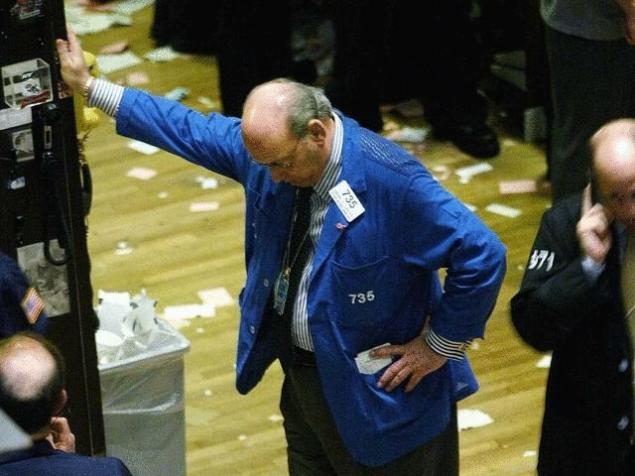

2. There is a difference between reasonable risk and gamble

If you want to build a career as an investor, you need to be prepared that not all your decisions will be successful. Nevertheless, you should never rely on chance. Even before the end of a deliberate decision better than the decision you took based on luck. Never risk money if you can't count more than half of the risks.

With gamblers dependence on risk is fundamentally different in nature.

"Card is just a disease. And if you have the money, then the chances are that you will get it, a lot. The lack of adrenaline will haunt you forever once you get rich," says Paul.

3. Never take decisions under emotional influence of the crowd

You are the man. It is therefore natural that occasionally you will be flooded with emotions. Just before every important decision always try to understand where the emotions you say, and cold calculation. And if emotions more, refuse the transaction.

Even worse to succumb to the General mood of their environment. The fact that thousands or even millions of people believe in something doesn't mean that they are right. Never make important decisions for themselves simply in order to maintain the trend. That's flawed logic. The chances that the crowd will be right, no higher than the chances that it will be the right man, alone in his judgment.

source: lifter.com.ua

Source: /users/1077

Academician Uglov — the truth and lies about the allowed drugs

Scraping massage gua Sha — an ancient Chinese technique of healing