760

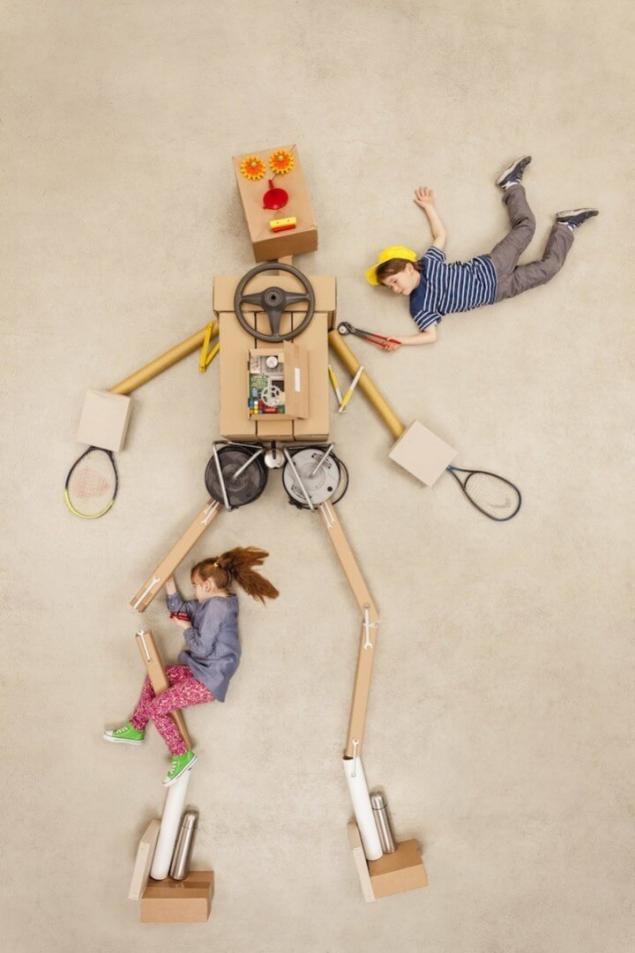

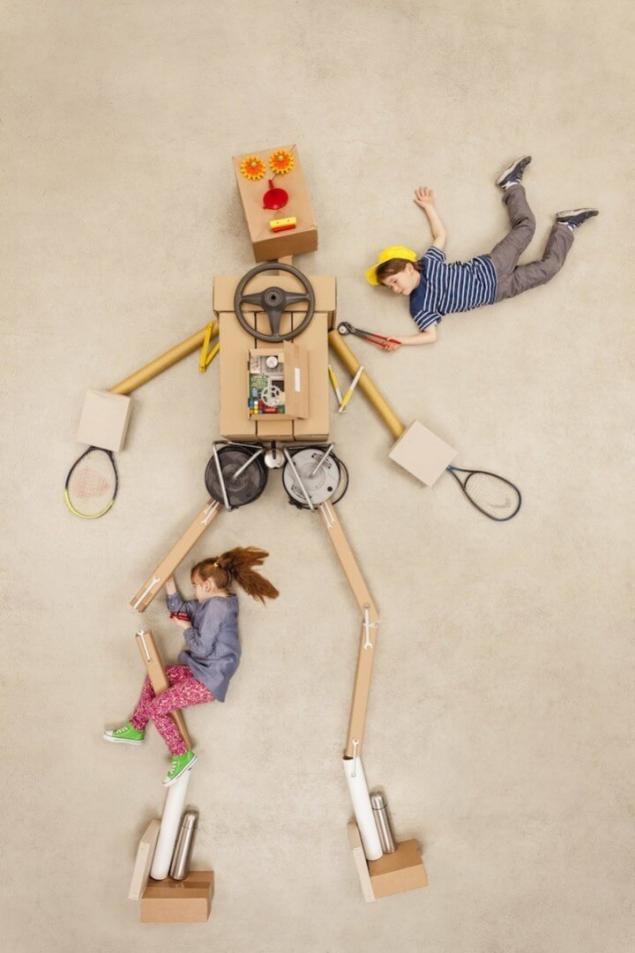

Make your children succeed

Jim Rogers - a billionaire and one of the most influential investors in the world. Together with George Soros, he founded the Quantum Fund. At the age of 37 years Rogers retired and began to travel (on account of his two trips around the world, one of them - on a motorcycle).

He currently lives with his family in Singapore, as confidence in the huge potential of the Asian markets. In his book «A Gift To My Children» (in our translation "Make your children succeed"), dedicated to his two daughters, Jim Rogers is divided by observations and experience in the investment and not only.

We recommend to take note of the lessons of the wise investor:

Success comes to those who are attentive to detail

The investor's work, as in life, are often determining exactly those things that most other people do not attach importance. Many mistakes are made because of the lack of effort to find and analyze information. Do not ignore the issues that cause visceral fear.

Learn the history and philosophy

By not reading it refers to the study of philosophy books and build logical structures, and the art of independent thinking, which will be helpful in understanding what is happening in the world and will not go on about dubious foreign interests. As the study of history, comes the understanding that the structure of the world is constantly changing and, therefore, changes in the next twenty or even ten years. For example, in the early twentieth century, the royal family of Great Britain and Germany were allies, and a few years later began to fight on opposing sides. Understanding history helps predict how events in one country affect others - such as coups and wars lead to an increase in raw material prices worldwide

. Read the media, but not particularly trust

The media can not rely on reliable sources of information or to express someone's selfish interests. It is therefore important to find and analyze the information in a variety of sources. Most people who are satisfied with only one point of view on things, easily manipulated.

Pay attention to the BRIC (generally accepted acronym for Brazil, Russia, India and China)

According to many investors these countries will lead the global economy in 2050. Among these countries, especially Jim Rogers identifies China and to some extent Brazil, and the others more skeptical. By analogy with the France of the 18th century, Britain the 19th century and the United States of the 20th century, the investor believes that China will own the 21st century. Despite the fact that many investors believed that China is absolutely unpromising investment place in the 1980 Jim Rogers felt it the potential and started to invest, what he does not regret in connection with the huge and growing economic, political and cultural influence exerted by this country right now. In view of some of the Chinese economy overheating Jim Rogers advised to invest in China during temporary downturns ( "hard landing»).

Learning foreign languages and, necessarily, the Chinese

Those who speak foreign languages, have a clear advantage, but from the standpoint of the investor it is also helps to study original documents and communicate with representatives of other countries, increasing the reliability of the information. Jim Rogers gives advice to all parents - make sure that children and grandchildren taught Chinese and English, as these languages, he predicted, will be the main languages of international communication. For their children, Jim Rogers hired a governess who speaks to them in Chinese.

Study the psychology, not to panic and emotions

In order to be a good investor and buy and sell at the right times is necessary, among other things, to understand the psychology. In the short term emotions and panic of market participants providing market ups and downs. Typically, the investor loses money when forgets about his observations and the position and give in to panic.

It is time women

In many Asian countries, such as China, India, Korea, which has always been the preferred birthday boys, girls are now in short supply. So, born in China 119 boys to 100 girls. Jim Rogers predicts that soon the Asian men face problems in search of his wife, while women require greater freedom, will get a better education, and it will open great prospects for professional growth.

No country can prosper by ignoring the law of supply and demand

The law of supply and demand - this is what you will see by opening the first pages of any textbook economics. All prices are changing under the influence of supply and demand, and any attempt to artificially control them sooner or later, out of breath.

Accept that everything is subject to change

Even if the changes you do not like them, refuse to accept them as silly as trying to resist the flow of a mountain river. Ability to adapt to change will help avoid unnecessary stress and open your eyes to new investment opportunities.

Often stereotypes do not correspond to reality

As an example, the situation in the early 1970s, when the stock US military-industrial complex companies have fallen sharply in price due to the reduction of state financing the defense sector, and opinion about a further fall in the value of shares has been distributed to investors and analysts. However, after the Vietnam War, which demonstrated that the army needed changes in public sector money, and stocks sector companies soared, in some cases, the cost has increased by 100 times were sent.

New - well forgotten old

Be on your guard, when all around shouting about something as unprecedented new and absolutely unique. Even the Internet, in fact, just one of the innovations, of which there were many in history. Despite the fact that even the newspaper Wall Street Journa announced at the end of 90th the beginning of the New Economy, a good example of what needs to be careful in assessing the role of new technologies is the collapse of the dot-com bubble in the early 2000s.

Learn your weaknesses and to admit mistakes

Often, even those who are considered professionals make mistakes. Much worse could be, if time does not admit that he chose the wrong course, and continue to give time and energy unpromising direction.

Take a closer look to what others disdain

You should not confuse what others consider your investment stupid, if you analyzed the available information and are confident of the contrary. Often it is these investments bring much more revenue. You can get rich by having the courage to buy what is currently no one can see the potential.

Vanity obscures reason

Yielding to vanity, it is very easy to quickly lose everything you have achieved. If a person or an entire state, for whatever reason, starts to believe that everything revolves around him, stopping to notice that actually happens, then losing its competitiveness in the near future.

The more you learn, the clearer will be the realization of how little you know. Understanding this will allow to separate confidence from self-confidence.

See the world with my own eyes, rather than relying only on the books and the opinions of others. The more you learn the world, the better to understand themselves.

He currently lives with his family in Singapore, as confidence in the huge potential of the Asian markets. In his book «A Gift To My Children» (in our translation "Make your children succeed"), dedicated to his two daughters, Jim Rogers is divided by observations and experience in the investment and not only.

We recommend to take note of the lessons of the wise investor:

Success comes to those who are attentive to detail

The investor's work, as in life, are often determining exactly those things that most other people do not attach importance. Many mistakes are made because of the lack of effort to find and analyze information. Do not ignore the issues that cause visceral fear.

Learn the history and philosophy

By not reading it refers to the study of philosophy books and build logical structures, and the art of independent thinking, which will be helpful in understanding what is happening in the world and will not go on about dubious foreign interests. As the study of history, comes the understanding that the structure of the world is constantly changing and, therefore, changes in the next twenty or even ten years. For example, in the early twentieth century, the royal family of Great Britain and Germany were allies, and a few years later began to fight on opposing sides. Understanding history helps predict how events in one country affect others - such as coups and wars lead to an increase in raw material prices worldwide

. Read the media, but not particularly trust

The media can not rely on reliable sources of information or to express someone's selfish interests. It is therefore important to find and analyze the information in a variety of sources. Most people who are satisfied with only one point of view on things, easily manipulated.

Pay attention to the BRIC (generally accepted acronym for Brazil, Russia, India and China)

According to many investors these countries will lead the global economy in 2050. Among these countries, especially Jim Rogers identifies China and to some extent Brazil, and the others more skeptical. By analogy with the France of the 18th century, Britain the 19th century and the United States of the 20th century, the investor believes that China will own the 21st century. Despite the fact that many investors believed that China is absolutely unpromising investment place in the 1980 Jim Rogers felt it the potential and started to invest, what he does not regret in connection with the huge and growing economic, political and cultural influence exerted by this country right now. In view of some of the Chinese economy overheating Jim Rogers advised to invest in China during temporary downturns ( "hard landing»).

Learning foreign languages and, necessarily, the Chinese

Those who speak foreign languages, have a clear advantage, but from the standpoint of the investor it is also helps to study original documents and communicate with representatives of other countries, increasing the reliability of the information. Jim Rogers gives advice to all parents - make sure that children and grandchildren taught Chinese and English, as these languages, he predicted, will be the main languages of international communication. For their children, Jim Rogers hired a governess who speaks to them in Chinese.

Study the psychology, not to panic and emotions

In order to be a good investor and buy and sell at the right times is necessary, among other things, to understand the psychology. In the short term emotions and panic of market participants providing market ups and downs. Typically, the investor loses money when forgets about his observations and the position and give in to panic.

It is time women

In many Asian countries, such as China, India, Korea, which has always been the preferred birthday boys, girls are now in short supply. So, born in China 119 boys to 100 girls. Jim Rogers predicts that soon the Asian men face problems in search of his wife, while women require greater freedom, will get a better education, and it will open great prospects for professional growth.

No country can prosper by ignoring the law of supply and demand

The law of supply and demand - this is what you will see by opening the first pages of any textbook economics. All prices are changing under the influence of supply and demand, and any attempt to artificially control them sooner or later, out of breath.

Accept that everything is subject to change

Even if the changes you do not like them, refuse to accept them as silly as trying to resist the flow of a mountain river. Ability to adapt to change will help avoid unnecessary stress and open your eyes to new investment opportunities.

Often stereotypes do not correspond to reality

As an example, the situation in the early 1970s, when the stock US military-industrial complex companies have fallen sharply in price due to the reduction of state financing the defense sector, and opinion about a further fall in the value of shares has been distributed to investors and analysts. However, after the Vietnam War, which demonstrated that the army needed changes in public sector money, and stocks sector companies soared, in some cases, the cost has increased by 100 times were sent.

New - well forgotten old

Be on your guard, when all around shouting about something as unprecedented new and absolutely unique. Even the Internet, in fact, just one of the innovations, of which there were many in history. Despite the fact that even the newspaper Wall Street Journa announced at the end of 90th the beginning of the New Economy, a good example of what needs to be careful in assessing the role of new technologies is the collapse of the dot-com bubble in the early 2000s.

Learn your weaknesses and to admit mistakes

Often, even those who are considered professionals make mistakes. Much worse could be, if time does not admit that he chose the wrong course, and continue to give time and energy unpromising direction.

Take a closer look to what others disdain

You should not confuse what others consider your investment stupid, if you analyzed the available information and are confident of the contrary. Often it is these investments bring much more revenue. You can get rich by having the courage to buy what is currently no one can see the potential.

Vanity obscures reason

Yielding to vanity, it is very easy to quickly lose everything you have achieved. If a person or an entire state, for whatever reason, starts to believe that everything revolves around him, stopping to notice that actually happens, then losing its competitiveness in the near future.

The more you learn, the clearer will be the realization of how little you know. Understanding this will allow to separate confidence from self-confidence.

See the world with my own eyes, rather than relying only on the books and the opinions of others. The more you learn the world, the better to understand themselves.