442

Five ideas that give investment right now

Artem Inyutin co-Founder, head of investment areas TMT Investments

Even Silicon valley investors begin demanding with regard to start-UPS. The original idea does not guarantee the attraction of first investment, but if the project is in the right niche, the chances of funding increase dramatically.

In what area right now, it is best to run a startup? Which areas the investors consider the most promising? Who has more chances to be bought by a Corporation?

I see at least five areas for the future.

I. Sale by subscription.

The most promising segment of the cosmetics and personal care products. Examples of BirchBox and Glossybox demonstrate how successful you can be. BirchBox, the service of delivery of the goods for the house and sets of cosmetics for five years has grown into a company worth nearly $500 million.

The idea is simple — every woman loves cosmetics, perfumes and gifts. For a monthly subscription of $10-20 podistica BirchBox along with the order receives a gift box with samples of luxury cosmetics and perfumes. Business risks are minimal: first, gather pre-orders with payment, and only then is the purchase of goods (that is, almost no superfluous goods in a warehouse). Now BirchBox is a recognizable brand, and the company intends to produce its own line of cosmetics.

The European equivalent of BirchBox, Glossybox service, launched in 2011 and within a year attracted investment of $70 million Further development depends only on the imagination of the developers (boxes with gifts for men and children has already appeared). You can play with the filling: sell subscription, not only cosmetics, but also, for example, tea or chocolate.

II. FINTECH.

The idea of successful FINTECH-startups — to make the service worse than banks, only easier and cheaper. These criteria correspond, for example, was founded in 2011, TransferWise, which allows you to make local and international transfers without the involvement of banks and, therefore, without large commissions (price per transfer in the amount up to 200 Euro for 1 Euro) and losses from currency conversion.

For four years the cost of TransferWise at $1 billion (investment in the project exceeded $90 million). Another interesting example is Kabbage, who managed to put on the flow of lending to private entrepreneurs, bypassing the banking red tape with documents and approvals. Established in 2009 the company has already raised $600 million (interestingly, among investors and banks). I think very soon we will see a real boom in FINTECH startups. They have only one serious drawback — the capital intensity.

A focus on the B2C segment and, accordingly, require larger marketing budgets — otherwise customers about them do not know.

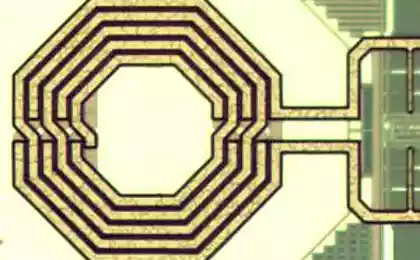

III. The Internet of things.

The Internet of things, of course, seriously change our lives. The market is still evolving, and many of the niches not yet occupied. I like everything connected with the service for smart home.

The most striking and interesting project in this area, in my opinion, is the Nest Labs — the intelligent remote controlled thermostat. Investment in this startup already has $80 million an Important feature of the Internet of things that interesting ideas here very quickly attract the attention of giants like Google, IBM, Microsoft, Cisco, or Samsung, who know how to combine advanced theory with their own technologies.

IV. Cloud-based B2B services.

Remote access to documents of companies from anywhere is changing the labour market. In the US, for example, more than 15% of employees did not attend office and work remotely. In the future, their share will only grow. Here are two examples of services that might contribute.

Birst is a cloud — based platform that can help any user who does not have special training, fast and simple to business intelligence. The project started in 2005, and today the investments have already exceeded $150 million. the Second example is a Looker, software for data mining. The project was launched only in 2011, but its cost is estimated in $173 million (the investment amounted to about $50 million).

V. Big Data.

The improvement of tools for processing large amounts of information will have a major impact on many industries — in particular, medicine. We are getting more information about the person, the history of its diseases, methods of treatment, and new technologies will allow in the future to cope with these volumes of information, to analyze, to use this information for timely diagnosis and treatment.

This is a very promising direction that will require the collaborative effort of software developers and research institutes. However, the first breakthrough projects in this area we probably will only see in ten years the laws of many countries impose a number of serious constraints in such studies. Less regulated region is developing rapidly.

A good example is Cloudera, which develops the solution based on Hadoop for data analysis the largest Internet websites in the world. In less than ten years, the startup has attracted more than $1 billion in Cloud service, Sumo Logic allows you to effectively process the log files of large volume. The system is easy to install, good massturbate (investment already exceeded $150 million). Information is projects that optimize its processing for a long time in the top. published

P. S. And remember, only by changing their consumption — together we change the world! © Join us at Facebook , Vkontakte, Odnoklassniki

Source: secretmag.ru/articles/2015/10/28/startups/

Even Silicon valley investors begin demanding with regard to start-UPS. The original idea does not guarantee the attraction of first investment, but if the project is in the right niche, the chances of funding increase dramatically.

In what area right now, it is best to run a startup? Which areas the investors consider the most promising? Who has more chances to be bought by a Corporation?

I see at least five areas for the future.

I. Sale by subscription.

The most promising segment of the cosmetics and personal care products. Examples of BirchBox and Glossybox demonstrate how successful you can be. BirchBox, the service of delivery of the goods for the house and sets of cosmetics for five years has grown into a company worth nearly $500 million.

The idea is simple — every woman loves cosmetics, perfumes and gifts. For a monthly subscription of $10-20 podistica BirchBox along with the order receives a gift box with samples of luxury cosmetics and perfumes. Business risks are minimal: first, gather pre-orders with payment, and only then is the purchase of goods (that is, almost no superfluous goods in a warehouse). Now BirchBox is a recognizable brand, and the company intends to produce its own line of cosmetics.

The European equivalent of BirchBox, Glossybox service, launched in 2011 and within a year attracted investment of $70 million Further development depends only on the imagination of the developers (boxes with gifts for men and children has already appeared). You can play with the filling: sell subscription, not only cosmetics, but also, for example, tea or chocolate.

II. FINTECH.

The idea of successful FINTECH-startups — to make the service worse than banks, only easier and cheaper. These criteria correspond, for example, was founded in 2011, TransferWise, which allows you to make local and international transfers without the involvement of banks and, therefore, without large commissions (price per transfer in the amount up to 200 Euro for 1 Euro) and losses from currency conversion.

For four years the cost of TransferWise at $1 billion (investment in the project exceeded $90 million). Another interesting example is Kabbage, who managed to put on the flow of lending to private entrepreneurs, bypassing the banking red tape with documents and approvals. Established in 2009 the company has already raised $600 million (interestingly, among investors and banks). I think very soon we will see a real boom in FINTECH startups. They have only one serious drawback — the capital intensity.

A focus on the B2C segment and, accordingly, require larger marketing budgets — otherwise customers about them do not know.

III. The Internet of things.

The Internet of things, of course, seriously change our lives. The market is still evolving, and many of the niches not yet occupied. I like everything connected with the service for smart home.

The most striking and interesting project in this area, in my opinion, is the Nest Labs — the intelligent remote controlled thermostat. Investment in this startup already has $80 million an Important feature of the Internet of things that interesting ideas here very quickly attract the attention of giants like Google, IBM, Microsoft, Cisco, or Samsung, who know how to combine advanced theory with their own technologies.

IV. Cloud-based B2B services.

Remote access to documents of companies from anywhere is changing the labour market. In the US, for example, more than 15% of employees did not attend office and work remotely. In the future, their share will only grow. Here are two examples of services that might contribute.

Birst is a cloud — based platform that can help any user who does not have special training, fast and simple to business intelligence. The project started in 2005, and today the investments have already exceeded $150 million. the Second example is a Looker, software for data mining. The project was launched only in 2011, but its cost is estimated in $173 million (the investment amounted to about $50 million).

V. Big Data.

The improvement of tools for processing large amounts of information will have a major impact on many industries — in particular, medicine. We are getting more information about the person, the history of its diseases, methods of treatment, and new technologies will allow in the future to cope with these volumes of information, to analyze, to use this information for timely diagnosis and treatment.

This is a very promising direction that will require the collaborative effort of software developers and research institutes. However, the first breakthrough projects in this area we probably will only see in ten years the laws of many countries impose a number of serious constraints in such studies. Less regulated region is developing rapidly.

A good example is Cloudera, which develops the solution based on Hadoop for data analysis the largest Internet websites in the world. In less than ten years, the startup has attracted more than $1 billion in Cloud service, Sumo Logic allows you to effectively process the log files of large volume. The system is easy to install, good massturbate (investment already exceeded $150 million). Information is projects that optimize its processing for a long time in the top. published

P. S. And remember, only by changing their consumption — together we change the world! © Join us at Facebook , Vkontakte, Odnoklassniki

Source: secretmag.ru/articles/2015/10/28/startups/

Ice cubes of herbal extracts for radiance of Your skin!

How to make a million by posting videos on YouTube