920

The state will pay for the citizens of familiarity with the stock market

One of the tasks of the state in the economy is to increase liquidity, including the stock market. One obvious way to do this - to attract the exchange of people who have not worked on it, but possess suitable for such activities income.

Naturally, you should take care of the newcomers, giving them the opportunity to get into the stock market without the risk of financial loss. On January 1, 2015 in Russia there was a tool for beginners - individual investment account (IMS). < a>

What is it and for whom h4> MIS - a brokerage account, which gives its owner the right to individual tax benefits of two different types (of which below). On IIS, you can make any amount of money to 400 thousand rubles, the funds must be in the account for at least three years.

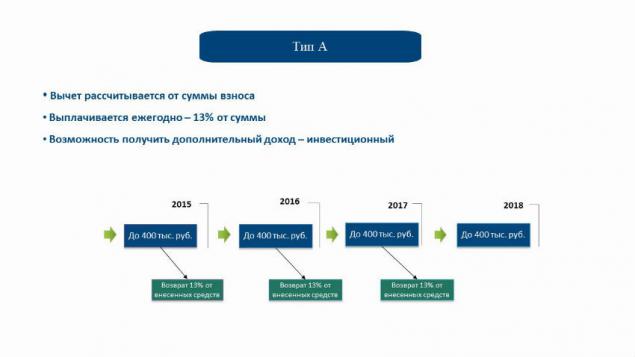

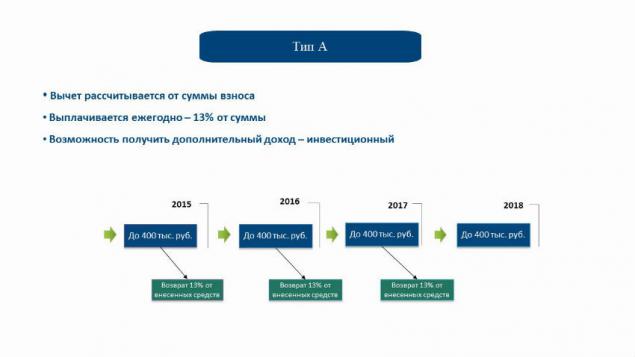

The privilege of the first type - a tax deduction of 13% of the amount paid - for people who are not going to try yourself in the role of an active investor, and just want to keep their money not "at home under the pillow."

It works like this - if the person in 2015 will make the account, for example, 400 thousand rubles, then it will return a tax deduction in the amount of 52 thousand. Rubles (13%) for this year. Money can be made even in December and in January to receive a deduction.

In fact, the government just pays citizens for the opening of accounts for the stock market kind of scholarship - while nobody really commits to perform some operations on the stock exchange. At the same time there is no ban on investment - you can use the money from the MIS for trading on the stock exchange, receive profit from this and, in addition, also be entitled to a tax deduction.

The privilege of the second type is designed for those people who do not just put money in the IMS, but also actively using them for investments in bonds, securities, currencies and other financial instruments (no restrictions on where to invest, no).

In this case, if the income from transactions for the three years exceeds 100% of the original deposited to the account, the money shall be exempt from having to pay income tax (when running on exchange with the "usual" brokerage accounts to pay taxes always).

An important point - to determine the type of the desired benefits (tax deduction or exemption from income tax) can not immediately, but even at the end of the third year of account. The investor simply weighs the pros and cons and communicate its decision to the broker, which leads him IMS (to open such an account in ITinvest need to fill order online ).

What is more profitable for beginners h4> It all depends on the situation of a particular person - if he does not want to "bother" with active investments (or afraid of losing money) and looking for a way to put some of their savings, then it is logical to use the right to tax deduction.

However, there is downside is that after receiving a deduction for the first year, the money should hang "on the account for another two years, otherwise the resulting deduction will have to return. It may be possible for the second year to make extra money and get a deduction even with them (these "new" money will be virtually frozen until the end of the third year of account), and in the third year to repeat the procedure.

If for example, we assume that each year paid 400 thousand rubles (the maximum possible amount), it turns out that for three years just to IMS builds up to 1 million 200 thousand. - Remove them without losing the right to deduct it will be possible only at the end of the third year . In today's rapidly changing economic environment, such conditions do not suit everyone.

There are other variants of the conservative use of IMS. One of them - buy currency at the exchange at more favorable rate than the one that offer exchangers (and without a huge between the purchase and sale) or an investment in shares of Russian (example - « Yandex ») and foreign (< a href = "http://habrahabr.ru/company/itinvest/blog/244913/"> Apple, Google, Facebook ) companies. Entitled to a tax deduction is retained.

Another option, which can be compared with a deposit in the bank - it's an investment in bonds (OFZ). The owner of an investment account can buy these bonds for the full amount of your account, on the basis of income received in the form of bond yields (currently 15%) plus the same tax deduction of 13% - an unprecedented level of profitability for banks.

Risks with OFZ not outweigh the risks of storage deposit in the bank. Income derived from them is guaranteed by the state. The circumstances in which the state can not meet such commitments - is the default, in which problems arise and the banking system of the country (with implications for household deposits).

In addition, some financial companies that conduct activities and as a broker, and have their own bank accounts offer different combinations of MIS and conventional deposits in the bank. For example, you can create an account IMS, get a deduction of 13%, and the next two years, this account will be equated to an ordinary deposit (with appropriate interest), but will not be able to withdraw money before the end of the third year of storage facilities.

For more information about IIS and use cases of this account can be found in our video:

Total h4> Investment accounts - is not some purely Russian innovation. These instruments stimulate investment activity have long been used throughout the world, for example in the US there are individual retirement accounts IRA (opened more than 15 million accounts) in the UK - Individual Savings Accounts SIA, in Canada - tax-free savings accounts TSFA.

As a result, the West is familiar with the stock market a large number of quite ordinary people, for whom speculation on the stock exchange are not the main occupation. However, they know that for conservation and enhancement of Finance, there are other tools other than banks - asset diversification helpful at all times.

Now the opportunity without undue risk to deal with the device of the stock market and acquire new knowledge (plus receive for such studies "scholarship" in the amount of 13% of the state) appeared among the Russians.

Source: geektimes.ru/company/itinvest/blog/246972/

Ultrasound returned memory in mice with Alzheimer's disease

Evernote for Android has adopted Material Design by Google