What is an IPO and why it is needed

In a network, you can often find stories about how the company went public and conducted IPO, which resulted in founding the business became billionaires. However, not everyone is aware of what amount of work behind this process of transition from private to public. Today we look at this process step by step.

What is IPO h4> When a company wants to offer its shares to the general public, it conducts IPO (Initial Public Offering - IPO). Accordingly, the status of the organization is changing - instead of private (shareholder can not be anyone) it becomes public (shareholder may be anyone).

A private company may be shareholders, but not so much, and such companies are faced with regulatory requirements, other than those that apply to the public. The process of preparing an IPO IPO) takes from several months to a year and cost the company quite substantial funds.

Why do companies conduct IPO h4> It's all about the money - the company wants to raise funds. After receiving the money can be used for business development or, for example, reinvestment in infrastructure.

Another plus is the availability of publicly traded shares of the company - to offer stock options to top managers, luring the best talent. In addition, shares may be used in the course of mergers and acquisitions, covering a portion of the payment - if you buy Facebook WhatsApp, messenger founders received a significant part of the $ 19 billion in shares of social network that is already out on the stock exchange. Contact with the world's largest stock exchange listing - NYSE or NASDAQ - it is simply prestigious.

First steps in preparation for the IPO h4> The company, which has gathered on the exchange, hires investment bank (or several banks), which will deal with the process of organizing IPO. Theoretically possible to organize trade their shares and own, but in practice so no one comes. Banks involved in organizing IPO, called underwriters.

After the bank hired - for example, Goldman Sachs and Morgan Stanley - between their representatives and the management company under negotiation in which the price is determined by the shares offered for purchase, their type, and the total amount of funds that are expected to attract.

After the agreement was signed between the company and the underwriter, the latter takes the investment memorandum to the regulatory authority in the country. In the United States - is the Securities Commission (SEC), and in Russia - Bank of Russia. This document provides detailed information about the proposal and the company - financial statements, biographies manual lists existing legal problems of the organization, the purpose of raising funds and opens a list of current shareholders. Then regulator verifies the information, and, if necessary, requests the additional data. If all information is correct, then the appointed date of IPO, underwriter and prepares all the financial data of the company.

What is the interest of underwriters h4> Investment banks to invest in the IPO and the organization "buy" shares of the company, before they finally get into the listing exchange. Banks earn on the difference between the price of the shares, which they have paid to IPO, and the price is set at the time of the start of trading. When an IPO exits promising company, the competition for the right to become banks anderraytorom its IPO can be very serious.

To generate interest in IPO underwriters often conduct an advertising campaign (Road Show), in which are collected before information on the financial performance of the company to prospective investors, and sometimes even in different parts of the world. Usually Road Show arranged for large investors. Often such investors offer to buy shares before the official auction - this process is called allocation.

The price of shares, Exchange h4> When approaching the date of IPO, the underwriter and the company issuing the stock exchange, negotiate the price of the shares. Figure may depend on many factors: the prospects of the company, the results of Road Show and the current market situation.

Similarly with the underwriters for the placement of large and promising companies compete and exchange, for which the occurrence of such a company in Listing means increasing overall liquidity and trading volumes. Also plays a role and prestige. In the case of such a popular company, representatives of stock exchanges appear before her guidance, explaining the pros placement on its site.

The purchase of shares at IPO h4> Private investors can not buy shares before the official start of trading. Often in the early days of trading shares of new companies fluctuate, so usually analysts advise not to rush with the transactions and wait until the price is established on a more or less stable.

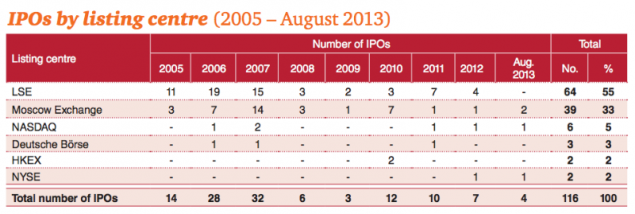

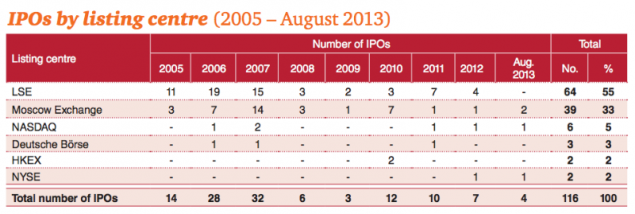

Why Russian companies to hold an IPO abroad h4> Recently, Russian companies started to show some activity and on the Moscow Stock Exchange ("Yandex» spent additional placement of shares, and "Rain", "Big City" and Slon.ru plans to merge the holding and exercise a > IPO). Nevertheless, most of the exchange activity of Russian companies going overseas.

That's what this bill's chief economist thinks ITinvest Sergei Egishyants :

All clear: capital in the West - and therefore there place their securities companies from around the world, including Russia. Recently gaining popularity IPO in China - because the local capital market also ballooned to generously scale, so to attract Chinese money sought by many.

Russian stocks western and eastern investors are in no hurry - for many reasons (protection of property rights are not enthusiastic, market capacity on smaller orders, etc.). Theoretically, of course, and in the Russian capital a lot, but that's only if you look formal, clearly the same as most of the free (!) Assets owned by big businessmen and some politicians, are not available in the accounts of the Savings Bank, and in the western offshore, Fund and Bank. In such circumstances, the behavior of Russian firms seeking accommodation in the West, it is quite natural. Blockquote>

Data Source: PWC i>

The pros and cons of the IPO h4> The fact of the IPO for the company usually positive, because it means that she has grown enough to qualify for raising capital in a similar way - resort to it only when you need to do a lot of money on large-scale expansion. In addition, public companies attract much more attention that it facilitates the process of hiring and marketing.

Among the disadvantages of IPO can be noted worse after going public attention to the company by the regulators - there are a large number of requirements of both the state and the stock exchanges themselves, which are companies listed on them, must fulfill. In particular it relates to the financial statements. In addition, the company's founders can not always immediately after the IPO to sell their shares and become millionaires, as this may reduce their rate and business capitalization.

Links Related Articles:

«Rain», Slon.ru and "Big City" united in the holding and conduct an IPO on the Moscow Stock Exchange «Yandex" will place its shares on the Moscow Stock Exchange Work in international markets through ITinvest How does the exchange trade in Russia

Source: habrahabr.ru/company/itinvest/blog/227383/