241

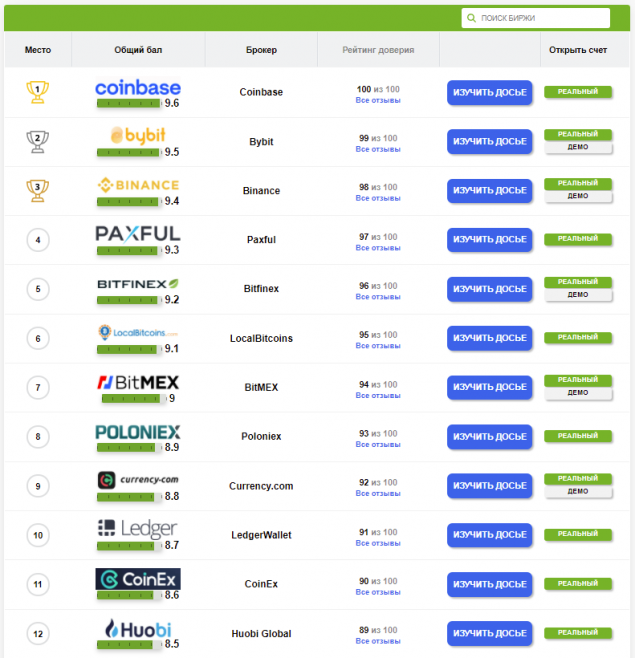

What are cryptocurrency exchanges and which are better?

A cryptocurrency exchange is a platform on which you can buy or sell cryptocurrency. One cryptocurrency can be exchanged for another on the stock exchange. For example, you can convert Bitcoin to Litecoin. You can also buy cryptocurrency using fiat currency such as the US dollar and the euro. Cryptocurrencies can also be converted back into fiat currency on an exchange, which you can withdraw to your regular bank account or leave cash in your account (to exchange for cryptocurrency later).

On cryptocurrency exchanges, only pairs of cryptocurrencies are listed, whereas fiat currency exchanges for cryptocurrency allow you to buy and sell cryptocurrency for dollars, pounds, euros and other fiat currencies. That is why it is important to study the rating of crypto exchanges and reviews of real users.

What are the types of cryptocurrency exchanges?

Cryptocurrency exchanges are divided into three categories:

- Centralized.

- Decentralized.

- Hybrids.

1. Centralized Exchanges (CEX)

Centralized exchanges, also known as traditional crypto exchanges, are much more popular than decentralized exchanges. Private companies own and operate the platforms on which such exchanges operate. These platforms run from a local or “central” server owned by a private company. As a result, centralized exchanges are more susceptible to several types of external security threats, such as hacking.

The advantages of centralized platforms include:

- Higher trading volume compared to decentralized exchanges.

- Allows transactions with fiat currency on cryptocurrency.

- High liquidity.

- Website functionality.

2. Decentralized Exchanges (DEX)

A decentralized exchange offers a cryptocurrency exchange that functions as an alternative to traditional centralized exchange. DEX is independent of the company or service in the management of the client’s assets. Instead, transactions or transactions are controlled by an automated process that operates without the presence of a central authority. Transactions are considered inter-client or peer-to-peer.

Using blockchain technology, DEXs are created to enable secure cryptocurrency trading without the need for a central figure. DEX platforms essentially act as a service that links trading transactions so that customers wishing to exchange tokens can do so. Most DEXs work using the Ethereum blockchain.

Advantages of decentralized platforms:

- Provides high security from hacking due to distributed nodes.

- Cannot be turned off by the government due to distributed global nodes.

- There's no central company.

3. A hybrid cryptocurrency exchange.

Hybrid crypto exchanges are exchanges that combine the positive features of centralized and decentralized exchanges. They eliminated the shortcomings of centralized and decentralized exchanges, combined the security and anonymity of decentralized exchanges, as well as the liquidity and usability of centralized exchanges.

With hybrid cryptocurrency exchanges, users have full control over their funds and are not required to transfer them to a custodian. Users can also trade their digital assets directly from their wallets, while investing tokens in a powerful smart contract.

He chose a woman with a child... Relationships that don’t have any good!

I only recognized this diva by her voice! That’s what everyone’s favorite 55-year-old singer is doing.