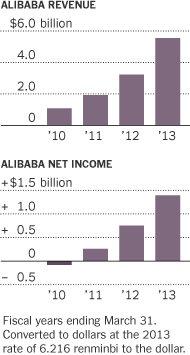

Chinese Internet giant Alibaba IPO chose the New York Stock Exchange (NYSE)

In the battle for the right to place the shares of the company Alibaba Group winner was the New York фондовая Exchange (NYSE).

The largest Chinese companies in the field of e-commerce Alibaba officially announced in обновленном The offering prospectus that it plans to list its shares on the New York Stock Exchange under the ticker symbol BABA.

For the NYSE this is a great victory, t. To. She competed with the stock exchange Nasdaq due to become the venue for IPO (IPO), which promises to be the largest in US history. Anonymous from reliable sources that the company's shares can start trading in the first half of August.

The founder of Alibaba Group Jack Ma i>

IPO of Alibaba IPO will be the largest among Internet companies that spend NYSE. Two years ago Facebook chose Nasdaq Stock Market as a platform for carrying out its IPO.

«We participated in the careful selection and scale of the stock exchanges, and we welcome Alibaba Group on the New York Stock Exchange, where she will join our network of leading global brands," - said the press spokeswoman Nasdaq: «Alibaba - impressive company, and we wish them success in their IPO ». blockquote> The two stock exchanges are constantly competing for promising IPO, for a good fee for listing and that is even more important for the prestige of big names of companies that can attract other Customer debut on the stock market.

According to Renaissance Capital, this year the share exchange Nasdaq fell most of the 142 conducted the IPO, which is approximately 57% of all placements. In part, this was because the market continues to maintain a leading position in the distribution of shares of biotechnology.

But the placement, for which ground was the NYSE this year earned more money. These transactions brought 18, 8 billion dollars, accounting for approximately 62 percent of all earned on money allocation.

Moreover, NYSE this year in the lead in the IPO technology companies: it floated 20 firms, while the Nasdaq chose 16. This damaged items Nasdaq, which has traditionally been a vehicle for technology stocks.

One of the major victories NYSE is also a public offering Twitter -One of the biggest IPO last year.

But at the same time the Nasdaq has managed to attract a number of Chinese Internet companies, including the operator's search engine Baidu and online retailer JDcom.

Nevertheless, in recent months, several people knowledgeable about the solutions Alibaba, said that the preference for NYSE.

Perhaps one of the factors that influenced the decision of the heads of Alibaba, was проваленное IPO Facebook, which was accompanied by delays in sales and anger investors. All this disrepute Nasdaq.

The reason that Alibaba has decided to conduct an IPO in the US is that both the American Stock Exchange is convenient to work with non-standard структурой corporate governance of Chinese retailer. The company Alibaba, there is the so-called partnership of 27 insiders who will nominate the majority of the board members.

This structure is not at all similar to the system of the two classes of shares in which some investors have preferred shares, giving more rights to vote. But this is far from the principle of "one share - one vote", which is followed by the Hong Kong Stock Exchange, the domestic market of Alibaba.

posts and related links:

What is IPO and why it is needed How-to: How to buy tech stocks on the example of "Yandex» As the economic news affecting the stock market Analytical materials about the stock market from the experts ITinvest

Source: habrahabr.ru/company/itinvest/blog/230977/